Answered step by step

Verified Expert Solution

Question

1 Approved Answer

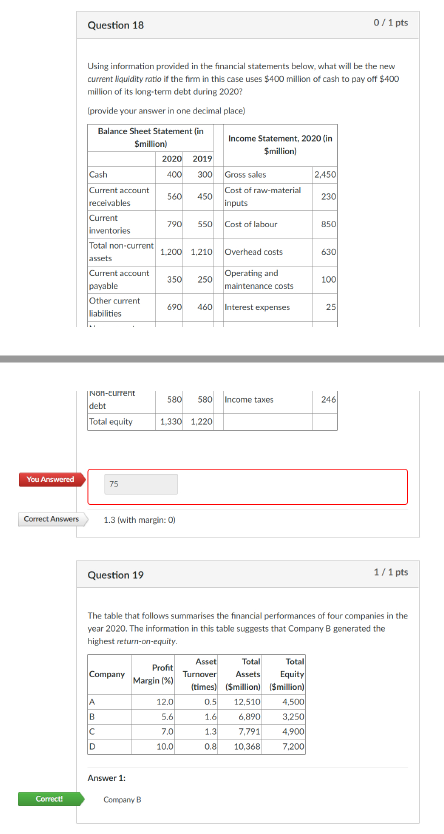

I need the solutions. Thank you Question 18 0/1 pts Using information provided in the financial statements below, what will be the new current liquidity

I need the solutions. Thank you

Question 18 0/1 pts Using information provided in the financial statements below, what will be the new current liquidity ratio if the firm in this case uses $400 million of cash to pay off $400 million of its long-term debt during 2020? (provide your answer in one decimal place) Balance Sheet Statement in Smillion) Income Statement, 2020 (in $million 2020 2019 Cash 400 300 Gross salles 2.450 Current account Cost of raw material 560 450 receivables 230 Current 790 550 Cost of labour 850 inventories Total non current 1.200 1.210 Overhead costs 630 assets Current account 350 250 Operating and 1001 payable maintenance costs Other current 690 liabilities 460 Interest expenses inputs 25 580 580 Income taxes 246 NON-Current debt Total equity 1.330 1.220 You Answered 75 Correct Answers 1.3 (with margin: 0) Question 19 1/1 pts The table that follows summarises the financial performances of four companies in the year 2020. The information in this table suggests that Company B generated the highest return-on-equity. Company Profit Margin (%) A Asset Total Total Turnover Assets Equity (times) ($million $million) 0.5 12,510 4,500 1.6 6,890 3,250 1.3 7,791 4,900 0.8 10,368 7.200 12.0 5.6 7.0 10.0 B D Answer 1: Correct! Company BStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started