Question: i need the work done by hand, not excel so please show work thank you Five years ago, Thomas Martin installed production machinery that had

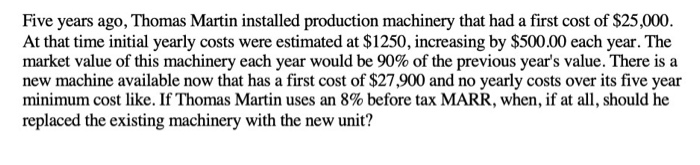

Five years ago, Thomas Martin installed production machinery that had a first cost of $25,000. At that time initial yearly costs were estimated at $1250, increasing by $500.00 each year. The market value of this machinery each year would be 90% of the previous year's value. There is a new machine available now that has a first cost of $27,900 and no yearly costs over its five year minimum cost like. If Thomas Martin uses an 8% before tax MARR, when, if at all, should he replaced the existing machinery with the new unit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts