I need the work shown for questions 2-4 and then 5-9 answered. Thank you!

I need the work shown for questions 2-4 and then 5-9 answered. Thank you!

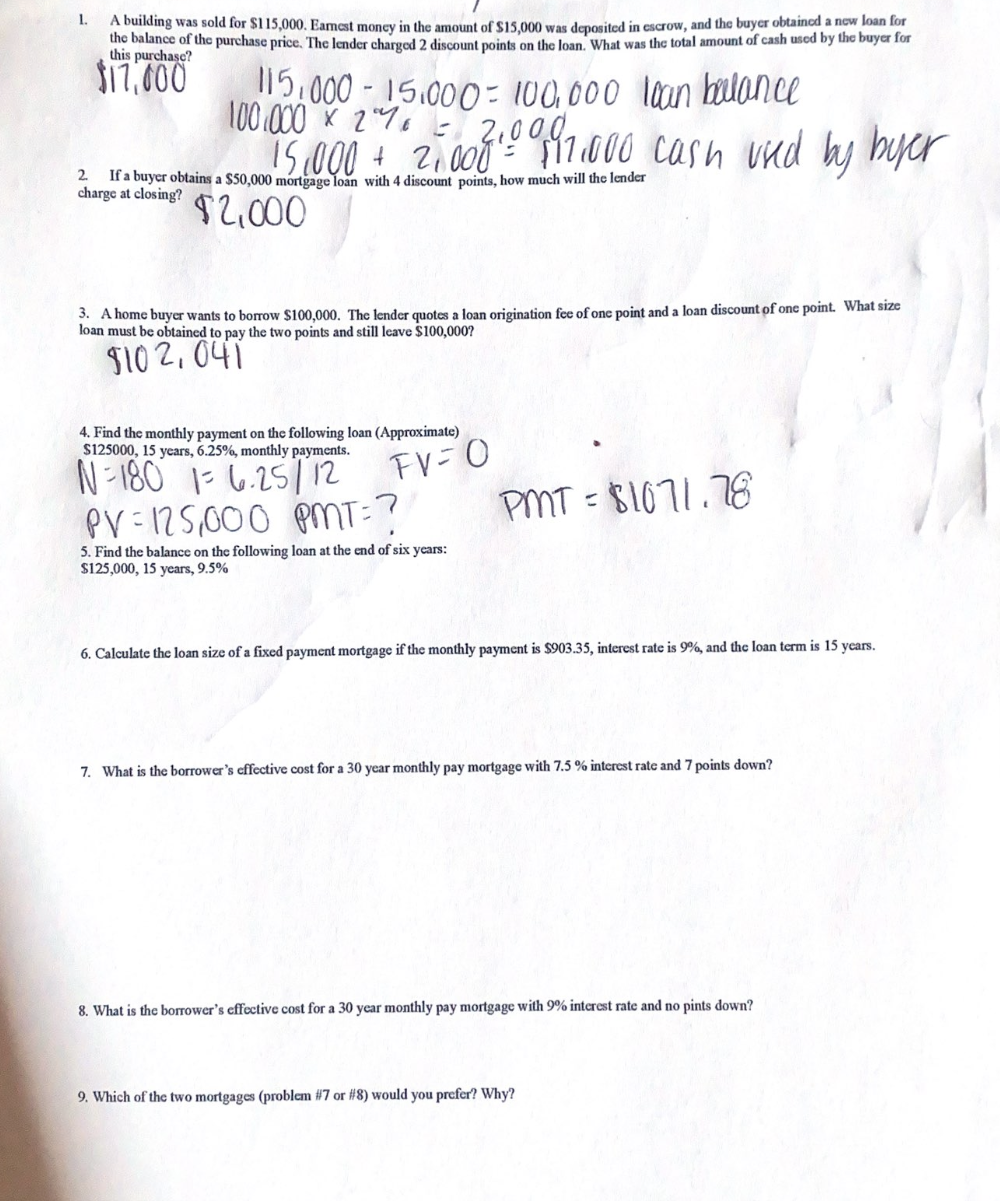

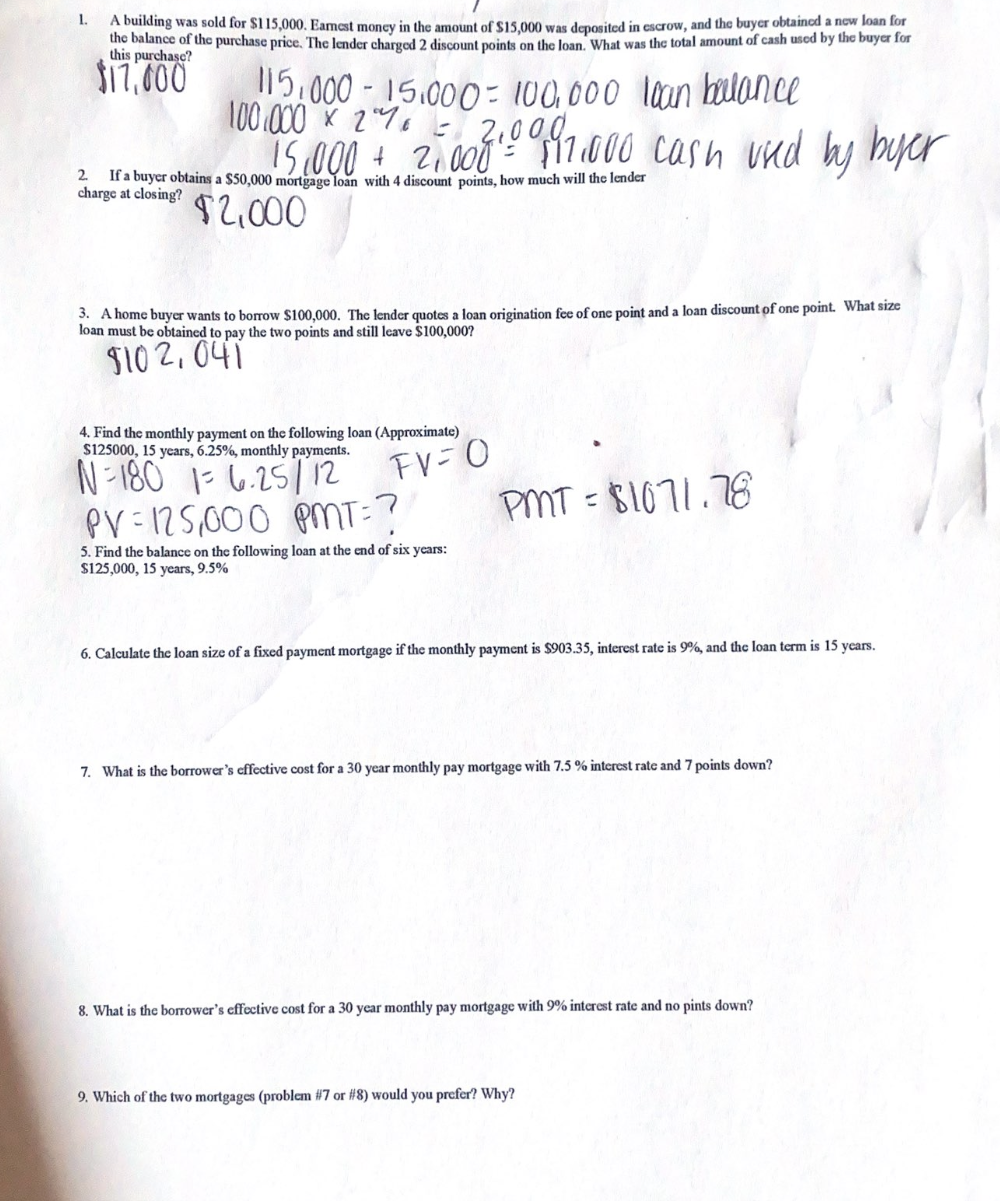

1. A building was sold for $115,000. Eamest money in the amount of $15,000 was deposited in escrow, and the buyer obtained a new loan for the balance of the purchase price. The lender charged 2 discount points on the loan. What was the total amount of cash used by the buyer for this purchase? charge at closing? $21000 3. A home buyer wants to borrow $100,000. The lender quotes a loan origination fee of one point and a loan discount of one point. What size loan must be obtained to pay the two points and still leave $100,000 ? 9102,041 4. Find the monthly payment on the following loan (Approximate) 5. Find the balance on the following loan at the end of six years: $125,000,15 years, 9.5% 6. Calculate the loan size of a fixed payment mortgage if the monthly payment is $903.35, interest rate is 9%, and the loan term is 15 years. 7. What is the borrower's effective cost for a 30 year monthly pay mortgage with 7.5% interest rate and 7 points down? 8. What is the borrower's effective cost for a 30 year monthly pay mortgage with 9% interest rate and no pints down? 9. Which of the two mortgages (problem #7 or #8 ) would you prefer? Why? 1. A building was sold for $115,000. Eamest money in the amount of $15,000 was deposited in escrow, and the buyer obtained a new loan for the balance of the purchase price. The lender charged 2 discount points on the loan. What was the total amount of cash used by the buyer for this purchase? charge at closing? $21000 3. A home buyer wants to borrow $100,000. The lender quotes a loan origination fee of one point and a loan discount of one point. What size loan must be obtained to pay the two points and still leave $100,000 ? 9102,041 4. Find the monthly payment on the following loan (Approximate) 5. Find the balance on the following loan at the end of six years: $125,000,15 years, 9.5% 6. Calculate the loan size of a fixed payment mortgage if the monthly payment is $903.35, interest rate is 9%, and the loan term is 15 years. 7. What is the borrower's effective cost for a 30 year monthly pay mortgage with 7.5% interest rate and 7 points down? 8. What is the borrower's effective cost for a 30 year monthly pay mortgage with 9% interest rate and no pints down? 9. Which of the two mortgages (problem #7 or #8 ) would you prefer? Why

I need the work shown for questions 2-4 and then 5-9 answered. Thank you!

I need the work shown for questions 2-4 and then 5-9 answered. Thank you!