Answered step by step

Verified Expert Solution

Question

1 Approved Answer

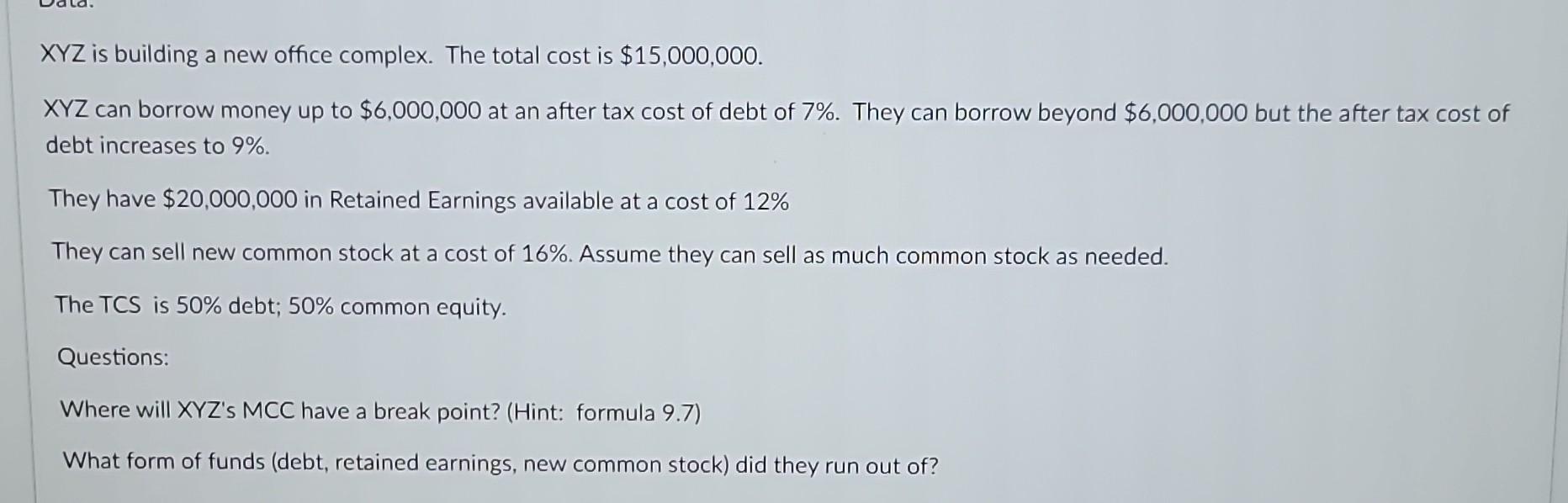

I need this question answered using one or more of the following equations: NPV = CF(PVIFAr,t) - CFo or IRR = 0 = CF(PVIFAr,t) -

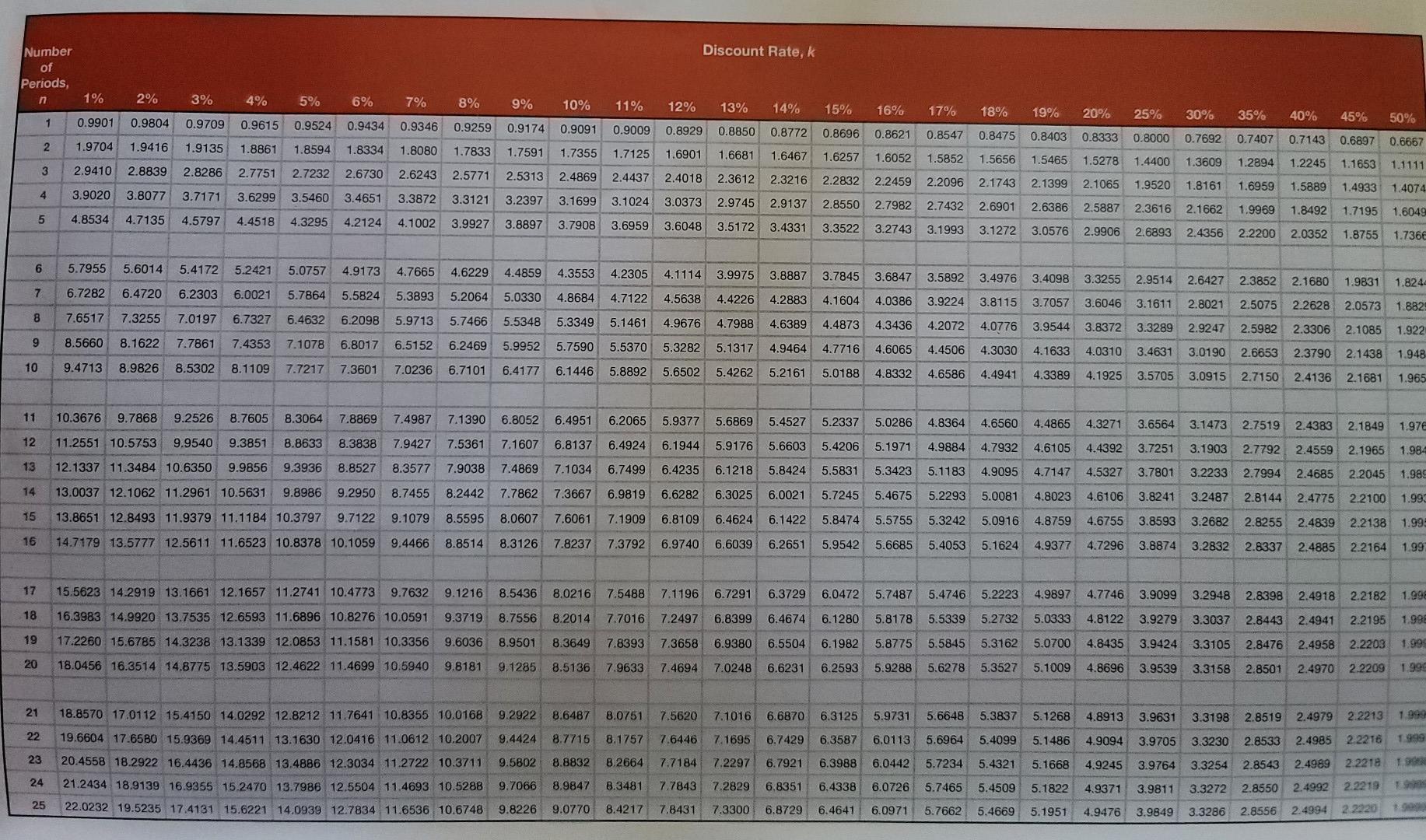

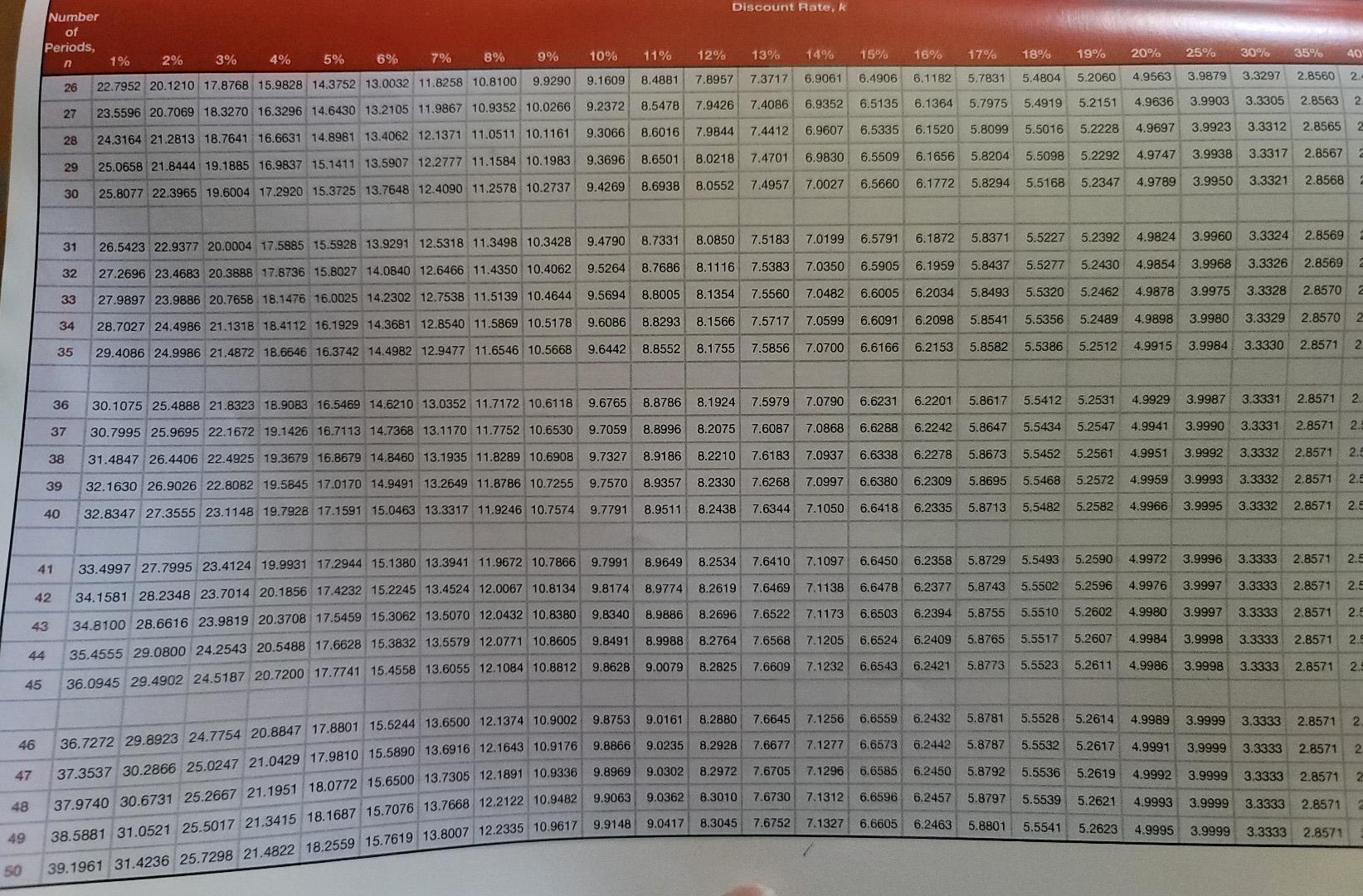

I need this question answered using one or more of the following equations: NPV = CF(PVIFAr,t) - CFo or IRR = 0 = CF(PVIFAr,t) - CFo or the equation for WACC

The needed tables have been provided.

\\( X Y Z \\) is building a new office complex. The total cost is \\( \\$ 15,000,000 \\). \\( X Y Z \\) can borrow money up to \\( \\$ 6,000,000 \\) at an after tax cost of debt of \7. They can borrow beyond \\( \\$ 6,000,000 \\) but the after tax cost of debt increases to \9. They have \\( \\$ 20,000,000 \\) in Retained Earnings available at a cost of \12 They can sell new common stock at a cost of \16. Assume they can sell as much common stock as needed. The TCS is \50 debt; \50 common equity. Questions: Where will XYZ's MCC have a break point? (Hint: formula 9.7) What form of funds (debt, retained earnings, new common stock) did they run out of? \\( X Y Z \\) is building a new office complex. The total cost is \\( \\$ 15,000,000 \\). \\( X Y Z \\) can borrow money up to \\( \\$ 6,000,000 \\) at an after tax cost of debt of \7. They can borrow beyond \\( \\$ 6,000,000 \\) but the after tax cost of debt increases to \9. They have \\( \\$ 20,000,000 \\) in Retained Earnings available at a cost of \12 They can sell new common stock at a cost of \16. Assume they can sell as much common stock as needed. The TCS is \50 debt; \50 common equity. Questions: Where will XYZ's MCC have a break point? (Hint: formula 9.7) What form of funds (debt, retained earnings, new common stock) did they run out ofStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started