Question

The management accountant for Giada's Book Store has prepared the following income statement for the most current year: Cookbook Travel Book Classics Total Sales $60,000

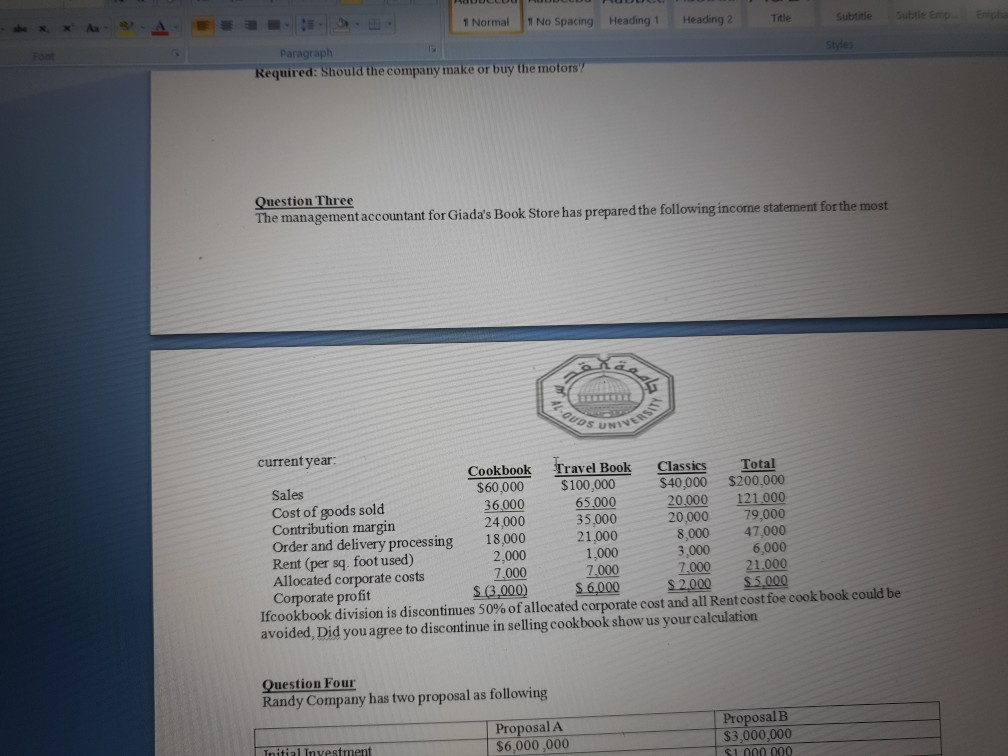

The management accountant for Giada's Book Store has prepared the following income statement for the most current year: Cookbook Travel Book Classics Total Sales $60,000 $100,000 $40,000 $200,000 Cost of goods sold 36,000 65,000 20,000 121,000 Contribution margin 24,000 35,000 20,000 79,000 Order and delivery processing 18,000 21,000 8,000 47,000 Rent (per sq. foot used) 2,000 1,000 3,000 6,000 Allocated corporate costs 7,000 7,000 7,000 21,000 Corporate profit $ (3,000) $ 6,000 $ 2,000 $ 5,000 If cookbook division is discontinues 50% of allocated corporate cost and all Rent cost foe cook book could be avoided, Did you agree to discontinue in selling cookbook show us your calculation

1 Normal 11 No Spacing Heading 1 Heading 2 Title Subtitle Paragraph Required: Should the company make or buy the motors Question Three The management accountant for Giada's Book Store has prepared the following income statement for the most KOUDS UNIVERSUS current year: Cookbook Travel Book Classics Total Sales $60,000 $100,000 $40.000 $200.000 Cost of goods sold 36.000 65.000 20.000 121.000 Contribution margin 24,000 35.000 20,000 79,000 Order and delivery processing 18,000 21.000 8,000 47,000 Rent (per sq. foot used) 2,000 1.000 3,000 6,000 Allocated corporate costs 7,000 7.000 7.000 21,000 Corporate profit $ (3,000) $ 6,000 $ 2.000 S5.000 Ifcookbook division is discontinues 50% of allocated corporate cost and all Rentcost foe cook book could be avoided. Did you agree to discontinue in selling cookbook show us your calculation Question Four Randy Company has two proposal as following Proposal A $6,000,000 Proposal B $3,000,000 1 S1000 000 Initial InvestmentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started