Answered step by step

Verified Expert Solution

Question

1 Approved Answer

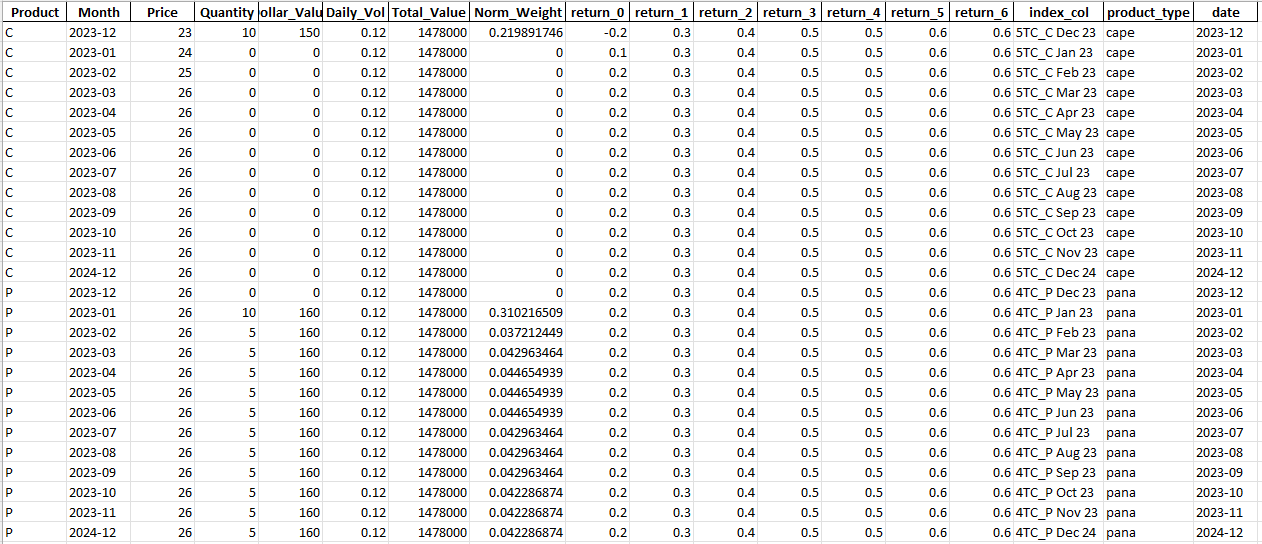

I need to calculate the component VaR with this data using the norm _ weight for the portfolio weight and the return series for the

I need to calculate the component VaR with this data using the normweight for the portfolio weight and the return series for the returns of each security. This is a sample dummy data so it only contains return to return the real dataset will contain return to return The component VaR is defined as:

dollar component VaR $VaR NZalpha sigma sum of i NZalpha wicovmatrix wsigma where NZ is the normal distribution and Z score and alpha is at level, w is the weight, i is at ith security. sigma is the volatility.

please give the solution in Python. Thank youtableProductMonth,Price,tableQuantity ollarValu,DailyVol,TotalValue,NormWeight,returnreturnreturnreturnreturnreturnreturnindexcol,producttype,dateCTCC Dec cape,CTCC Jan cape,CTCC Feb cape,CTCC Mar cape,CTCCApr cape,CTCC May cape,CTCC Jun cape,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started