Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need to know how to do the calculation by hand. Cannot put into an Excel spreadsheet. Problems 3 and 4 Objective: Incremental Rate of

I need to know how to do the calculation by hand. Cannot put into an Excel spreadsheet.

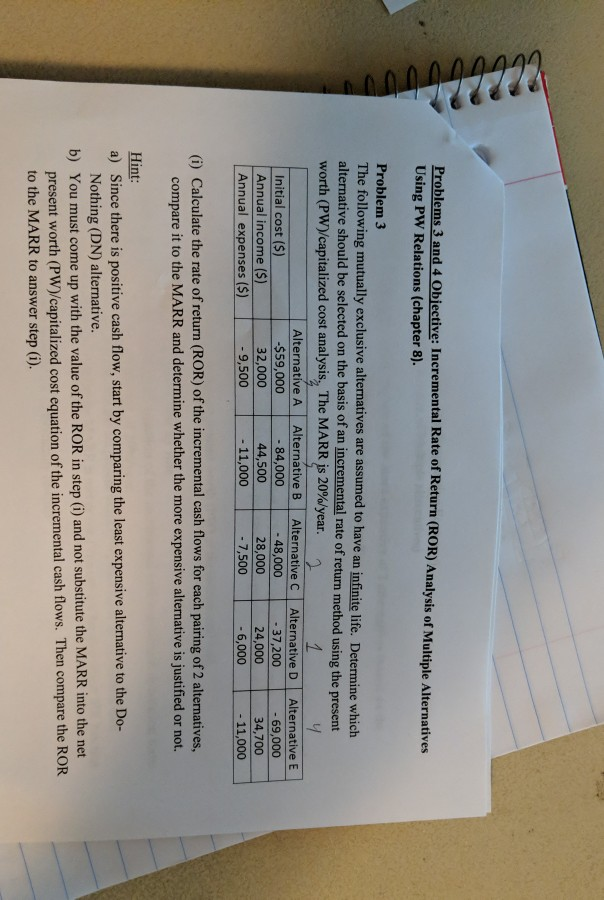

Problems 3 and 4 Objective: Incremental Rate of Return (ROR) Analysis of Multiple Alternatives Using PW Relations (chapter 8). Problem 3 The following mutually exclusive alternatives are assumed to have an infinite life. Determine which alternative should be selected on the basis of an incremental rate of return method using the present worth (PW)/capitalized cost analysis, The MARR is 20%/year. y Alternative A Alternative B Alternative C Alternative D Alternative E Initial cost ($) -$59,000 - 84,000 - 48,000 - 37,200 - 69,000 Annual income ($) 32,000 44,500 28,000 24,000 34,700 Annual expenses ($) - 9,500 - 11,000 - 7,500 - 6,000 - 11,000 1 (i) Calculate the rate of return (ROR) of the incremental cash flows for each pairing of 2 alternatives, compare it to the MARR and determine whether the more expensive alternative is justified or not. Hint: a) Since there is positive cash flow, start by comparing the least expensive alternative to the Do- Nothing (DN) alternative. b) You must come up with the value of the ROR in step (i) and not substitute the MARR into the net present worth (PW)/capitalized cost equation of the incremental cash flows. Then compare the ROR to the MARR to answer step (i). Problems 3 and 4 Objective: Incremental Rate of Return (ROR) Analysis of Multiple Alternatives Using PW Relations (chapter 8). Problem 3 The following mutually exclusive alternatives are assumed to have an infinite life. Determine which alternative should be selected on the basis of an incremental rate of return method using the present worth (PW)/capitalized cost analysis, The MARR is 20%/year. y Alternative A Alternative B Alternative C Alternative D Alternative E Initial cost ($) -$59,000 - 84,000 - 48,000 - 37,200 - 69,000 Annual income ($) 32,000 44,500 28,000 24,000 34,700 Annual expenses ($) - 9,500 - 11,000 - 7,500 - 6,000 - 11,000 1 (i) Calculate the rate of return (ROR) of the incremental cash flows for each pairing of 2 alternatives, compare it to the MARR and determine whether the more expensive alternative is justified or not. Hint: a) Since there is positive cash flow, start by comparing the least expensive alternative to the Do- Nothing (DN) alternative. b) You must come up with the value of the ROR in step (i) and not substitute the MARR into the net present worth (PW)/capitalized cost equation of the incremental cash flows. Then compare the ROR to the MARR to answer step (i)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started