Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I would like to know why are the dividends received for available-for-sale securities and the realized gain on the sale of land already included in

I would like to know why are the dividends received for available-for-sale securities and the realized gain on the sale of land already included in net income?

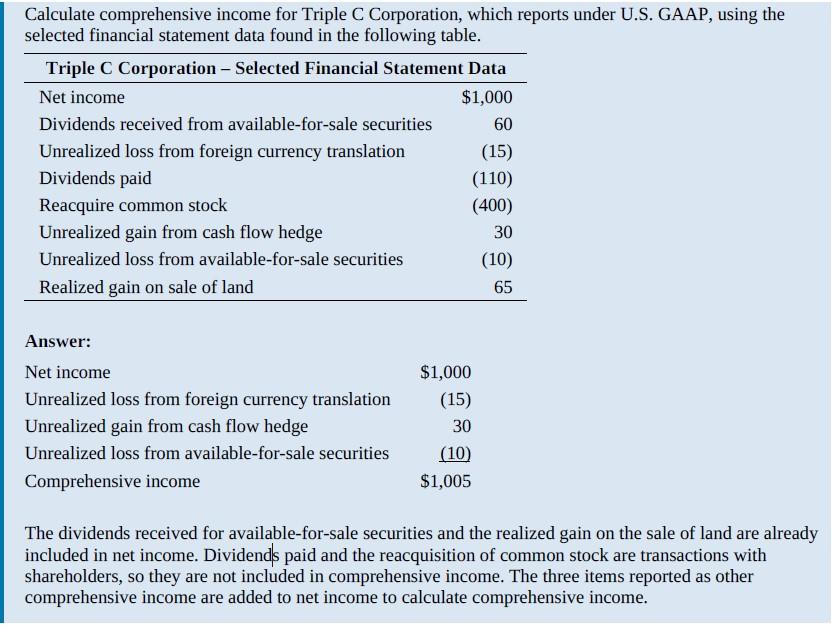

60 Calculate comprehensive income for Triple C Corporation, which reports under U.S. GAAP, using the selected financial statement data found in the following table. Triple C Corporation - Selected Financial Statement Data Net income $1,000 Dividends received from available-for-sale securities Unrealized loss from foreign currency translation (15) Dividends paid (110) Reacquire common stock (400) Unrealized gain from cash flow hedge 30 Unrealized loss from available-for-sale securities (10) Realized gain on sale of land 65 $1,000 (15) Answer: Net income Unrealized loss from foreign currency translation Unrealized gain from cash flow hedge Unrealized loss from available-for-sale securities Comprehensive income 30 (10) $1,005 The dividends received for available-for-sale securities and the realized gain on the sale of land are already included in net income. Dividends paid and the reacquisition of common stock are transactions with shareholders, so they are not included in comprehensive income. The three items reported as other comprehensive income are added to net income to calculate comprehensive incomeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started