Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need to understand the journal entries. Are they corect? Please explain to me with calculations how to arrive at the figures, given in the

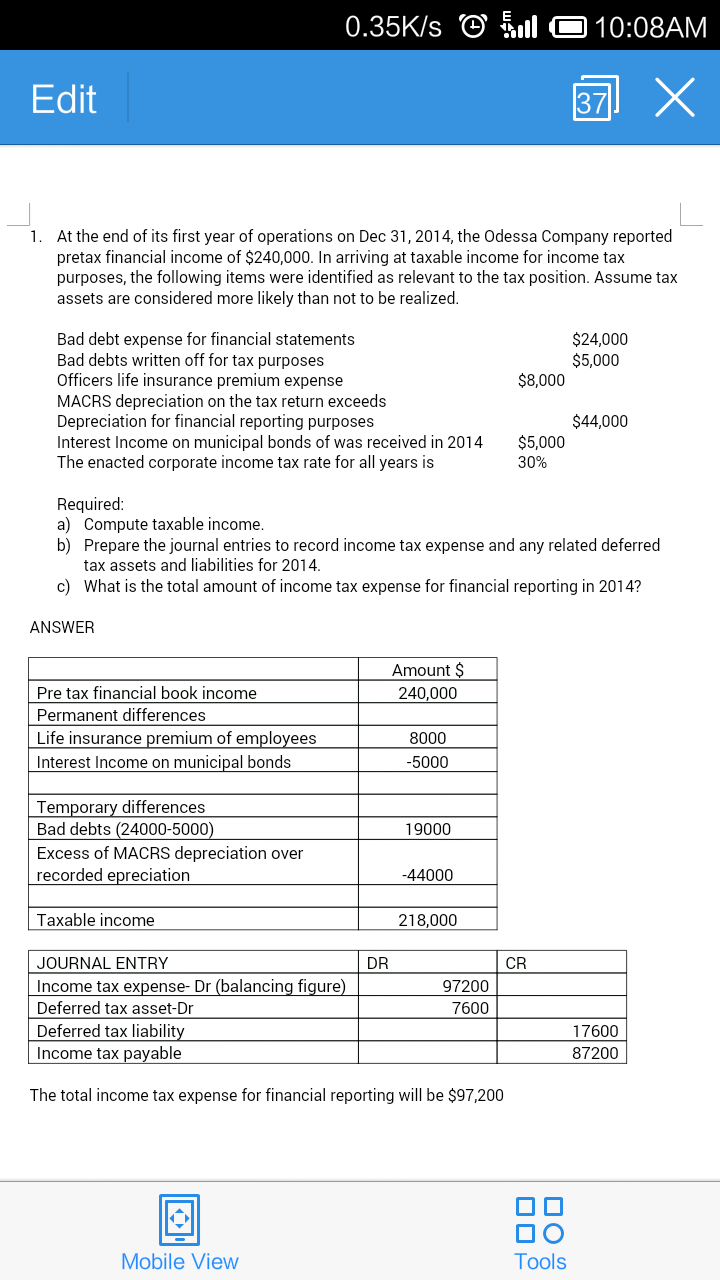

I need to understand the journal entries. Are they corect? Please explain to me with calculations how to arrive at the figures, given in the answer.

0.35K/s ( 0:08AM Edit 37 X At the end of its first year of operations on Dec 31, 2014, the Odessa Company reported pretax financial income of $240,000. In arriving at taxable income for income tax purposes, the following items were identified as relevant to the tax position. Assume tax assets are considered more likely than not to be realized 1. $24,000 $5,000 Bad debt expense for financial statements Bad debts written off for tax purposes Officers life insurance premium expense MACRS depreciation on the tax return exceeds Depreciation for financial reporting purposes Interest Income on municipal bonds of was received in 2014 The enacted corporate income tax rate for all years is $8,000 $44,000 $5,000 30% Required a) Compute taxable income b) Prepare the journal entries to record income tax expense and any related deferred tax assets and liabilities for 2014 What is the total amount of income tax expense for financial reporting in 2014? c) ANSWER Amount $ 240,000 Pre tax financial book income Permanent differences Life insurance premium of employees Interest Income on municipal bonds 8000 -5000 Temporary differences Bad debts (24000-5000 Excess of MACRS depreciation over recorded epreciation 19000 -44000 Taxable income 218,000 DR CR JOURNAL ENTRY Income tax expense- Dr (balancing figure Deferred tax asset-Dr Deferred tax liabilit Income tax payable 97200 7600 17600 87200 The total income tax expense for financial reporting will be $97,200 Mobile View ToolsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started