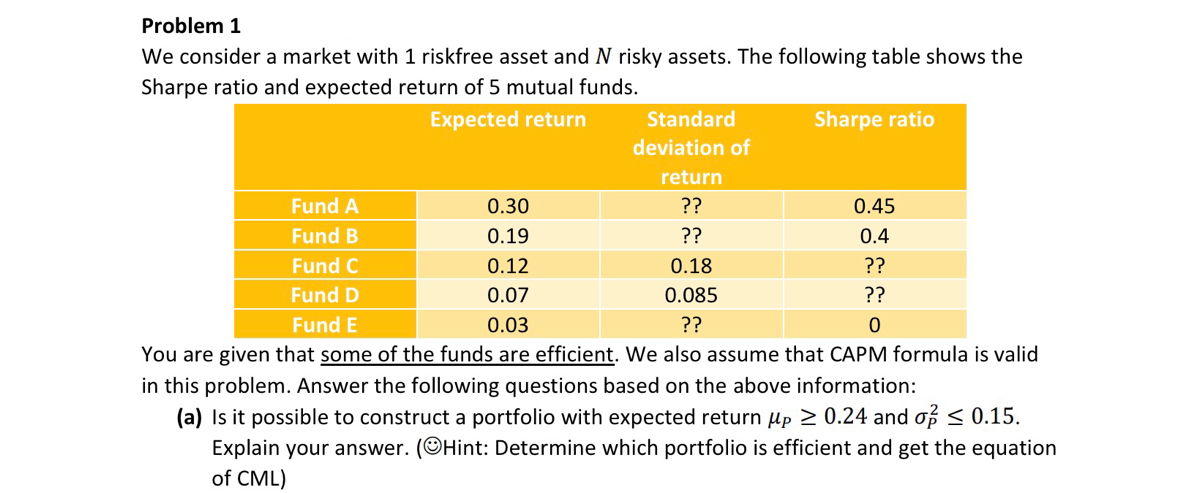

Problem 1 We consider a market with 1 riskfree asset and N risky assets. The following table shows the Sharpe ratio and expected return

Problem 1 We consider a market with 1 riskfree asset and N risky assets. The following table shows the Sharpe ratio and expected return of 5 mutual funds. Expected return Standard deviation of return ?? ?? 0.18 0.085 ?? Sharpe ratio Fund A 0.30 Fund B 0.19 Fund C 0.12 Fund D 0.07 Fund E 0.03 You are given that some of the funds are efficient. We also assume that CAPM formula is valid in this problem. Answer the following questions based on the above information: (a) Is it possible to construct a portfolio with expected return p 0.24 and of 0.15. Explain your answer. (Hint: Determine which portfolio is efficient and get the equation of CML) 0.45 0.4 ?? ?? 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started