Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need with thing problem thank you that's all the information that I have I send why you keep asking for more clarification I send

I need with thing problem thank you

that's all the information that I have I send

why you keep asking for more clarification I send what I have

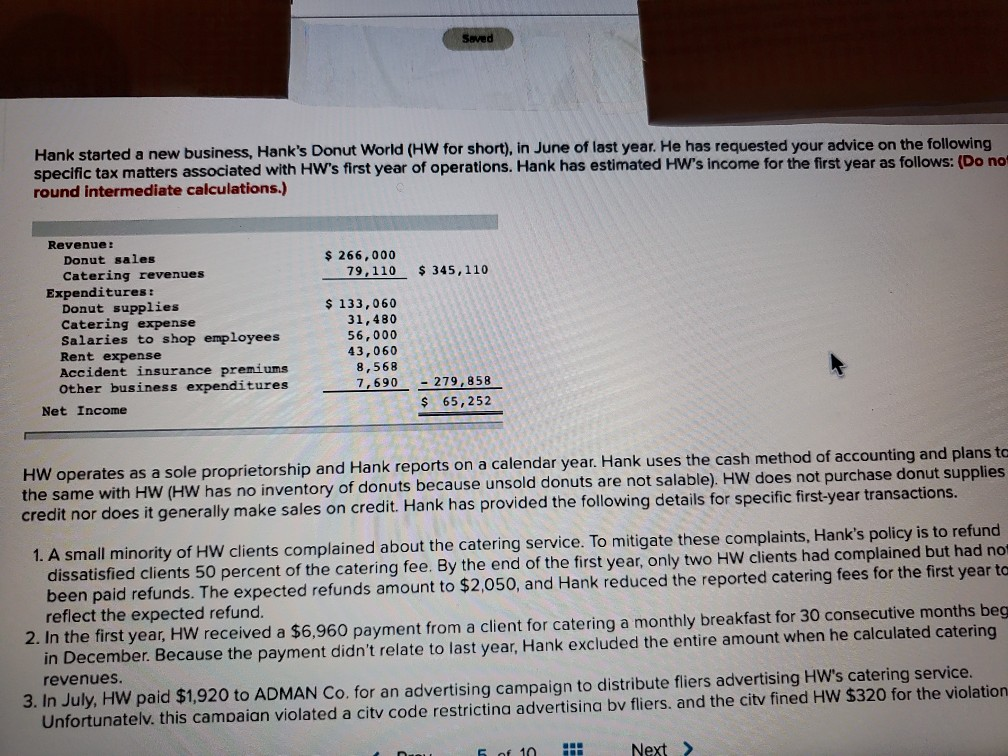

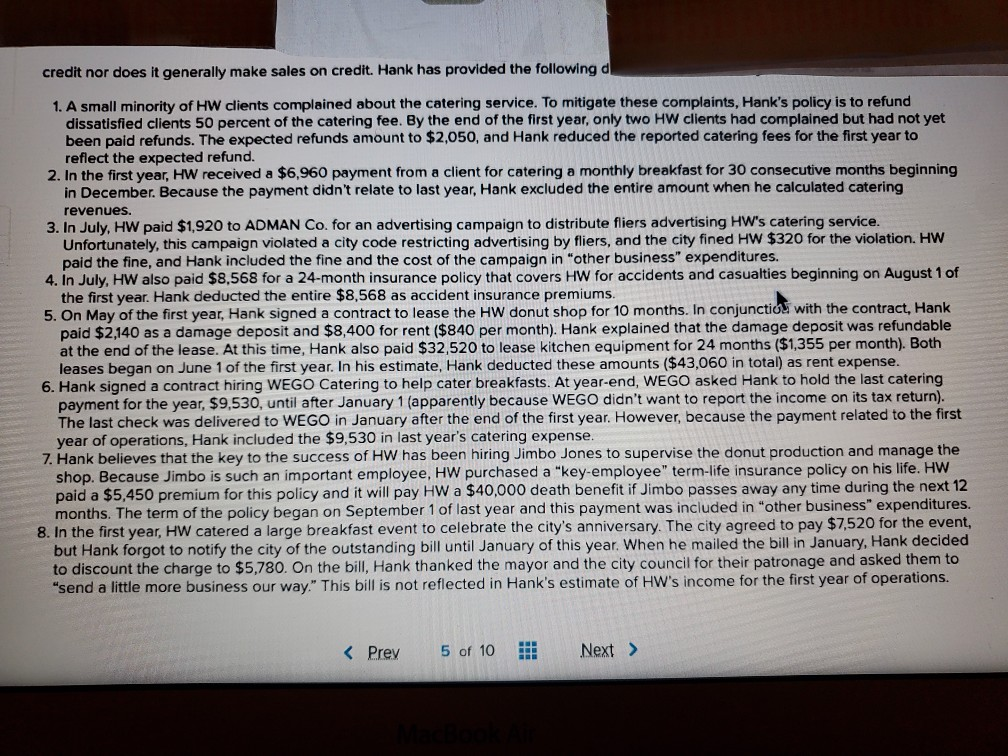

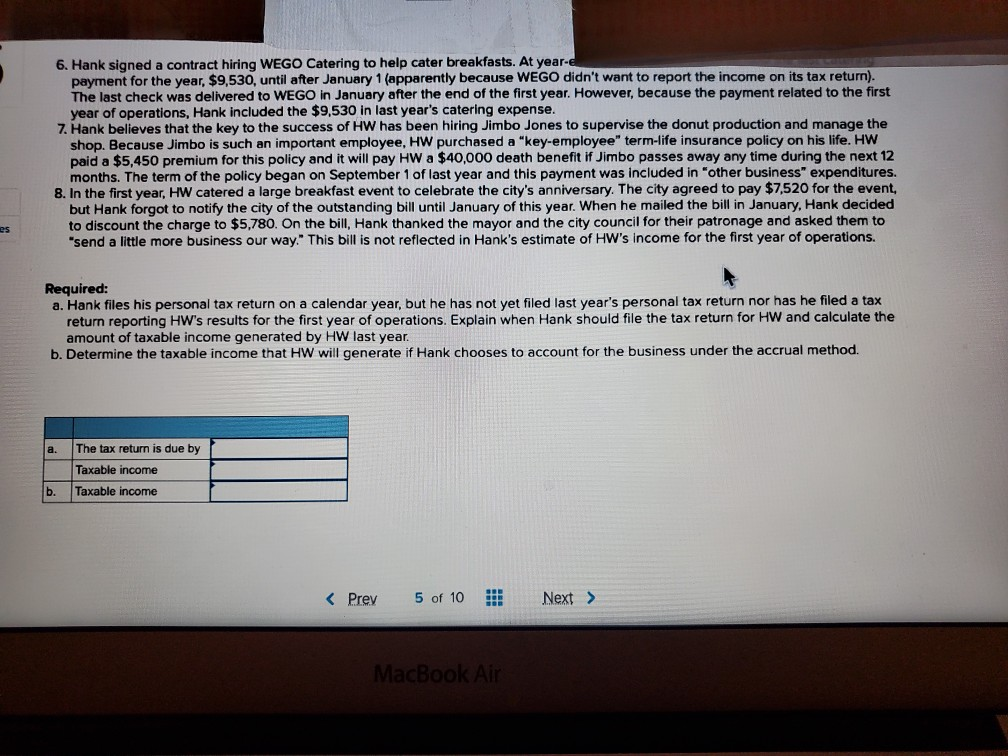

Hank started a new business, Hank's Donut World (HW for short), in June of last year. He has requested your advice on the following specific tax matters associated with HW's first year of operations. Hank has estimated HW's income for the first year as follows: (Do nc round intermediate calculations.) $ 266,000 79,110 $ 345,110 Revenue: Donut sales Catering revenues Expenditures: Donut supplies Catering expense Salaries to shop employees Rent expense Accident insurance premiums Other business expenditures Net Income $ 133,060 31,480 56,000 43,060 8,568 7,690 - 279.85R $ 65,252 HW operates as a sole proprietorship and Hank reports on a calendar year. Hank uses the cash method of accounting and plans to the same with HW (HW has no inventory of donuts because unsold donuts are not salable). HW does not purchase donut supplies credit nor does it generally make sales on credit. Hank has provided the following details for specific first-year transactions. 1. A small minority of HW clients complained about the catering service. To mitigate these complaints, Hank's policy is to refund dissatisfied clients 50 percent of the catering fee. By the end of the first year, only two HW clients had complained but had no been paid refunds. The expected refunds amount to $2,050, and Hank reduced the reported catering fees for the first year to reflect the expected refund. 2. In the first year, HW received a $6,960 payment from a client for catering a monthly breakfast for 30 consecutive months beg in December. Because the payment didn't relate to last year, Hank excluded the entire amount when he calculated catering revenues. 3. In July, HW paid $1,920 to ADMAN Co. for an advertising campaign to distribute fliers advertising HW's catering service. Unfortunatelv. this campaian violated a city code restricting advertising by fliers, and the city fined HW $320 for the violation E 10 Next > 6. Hank signed a contract hiring WEGO Catering to help cater breakfasts. At year-e payment for the year, $9,530, until after January 1 (apparently because WEGO didn't want to report the income on its tax return). The last check was delivered to WEGO in January after the end of the first year. However, because the payment related to the first year of operations, Hank included the $9,530 in last year's catering expense. 7. Hank believes that the key to the success of HW has been hiring Jimbo Jones to supervise the donut production and manage the shop. Because Jimbo is such an important employee, HW purchased a "key-employee" term-life insurance policy on his life. HW paid a $5,450 premium for this policy and it will pay HW a $40,000 death benefit if Jimbo passes away any time during the next 12 months. The term of the policy began on September 1 of last year and this payment was included in other business" expenditures. 8. In the first year, HW catered a large breakfast event to celebrate the city's anniversary. The city agreed to pay $7,520 for the event, but Hank forgot to notify the city of the outstanding bill until January of this year. When he mailed the bill in January, Hank decided to discount the charge to $5,780. On the bill, Hank thanked the mayor and the city council for their patronage and asked them to "send a little more business our way." This bill is not reflected in Hank's estimate of HW's income for the first year of operations. Required: a. Hank files his personal tax return on a calendar year, but he has not yet filed last year's personal tax return nor has he filed a tax return reporting HW's results for the first year of operations. Explain when Hank should file the tax return for HW and calculate the amount of taxable income generated by HW last year. b. Determine the taxable income that HW will generate if Hank chooses to account for the business under the accrual method. The tax return is due by Taxable income Taxable income Hank started a new business, Hank's Donut World (HW for short), in June of last year. He has requested your advice on the following specific tax matters associated with HW's first year of operations. Hank has estimated HW's income for the first year as follows: (Do nc round intermediate calculations.) $ 266,000 79,110 $ 345,110 Revenue: Donut sales Catering revenues Expenditures: Donut supplies Catering expense Salaries to shop employees Rent expense Accident insurance premiums Other business expenditures Net Income $ 133,060 31,480 56,000 43,060 8,568 7,690 - 279.85R $ 65,252 HW operates as a sole proprietorship and Hank reports on a calendar year. Hank uses the cash method of accounting and plans to the same with HW (HW has no inventory of donuts because unsold donuts are not salable). HW does not purchase donut supplies credit nor does it generally make sales on credit. Hank has provided the following details for specific first-year transactions. 1. A small minority of HW clients complained about the catering service. To mitigate these complaints, Hank's policy is to refund dissatisfied clients 50 percent of the catering fee. By the end of the first year, only two HW clients had complained but had no been paid refunds. The expected refunds amount to $2,050, and Hank reduced the reported catering fees for the first year to reflect the expected refund. 2. In the first year, HW received a $6,960 payment from a client for catering a monthly breakfast for 30 consecutive months beg in December. Because the payment didn't relate to last year, Hank excluded the entire amount when he calculated catering revenues. 3. In July, HW paid $1,920 to ADMAN Co. for an advertising campaign to distribute fliers advertising HW's catering service. Unfortunatelv. this campaian violated a city code restricting advertising by fliers, and the city fined HW $320 for the violation E 10 Next > 6. Hank signed a contract hiring WEGO Catering to help cater breakfasts. At year-e payment for the year, $9,530, until after January 1 (apparently because WEGO didn't want to report the income on its tax return). The last check was delivered to WEGO in January after the end of the first year. However, because the payment related to the first year of operations, Hank included the $9,530 in last year's catering expense. 7. Hank believes that the key to the success of HW has been hiring Jimbo Jones to supervise the donut production and manage the shop. Because Jimbo is such an important employee, HW purchased a "key-employee" term-life insurance policy on his life. HW paid a $5,450 premium for this policy and it will pay HW a $40,000 death benefit if Jimbo passes away any time during the next 12 months. The term of the policy began on September 1 of last year and this payment was included in other business" expenditures. 8. In the first year, HW catered a large breakfast event to celebrate the city's anniversary. The city agreed to pay $7,520 for the event, but Hank forgot to notify the city of the outstanding bill until January of this year. When he mailed the bill in January, Hank decided to discount the charge to $5,780. On the bill, Hank thanked the mayor and the city council for their patronage and asked them to "send a little more business our way." This bill is not reflected in Hank's estimate of HW's income for the first year of operations. Required: a. Hank files his personal tax return on a calendar year, but he has not yet filed last year's personal tax return nor has he filed a tax return reporting HW's results for the first year of operations. Explain when Hank should file the tax return for HW and calculate the amount of taxable income generated by HW last year. b. Determine the taxable income that HW will generate if Hank chooses to account for the business under the accrual method. The tax return is due by Taxable income Taxable incomeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started