Question

(i) Non-current assets: During the year Jones PLC manufactured an item of plant for its own use. The direct materials and labour were 3 million

(i) Non-current assets: During the year Jones PLC manufactured an item of plant for its own use. The direct materials and labour were 3 million and 4 million respectively. Production overheads are 75% of direct labour cost. These manufacturing costs are included in the relevant expense items in the trial balance. The plant was completed and put into immediate use on 1 April 2019.

All plant and equipment is depreciated at 20% per annum using the reducing balance method with time apportionment in the year of acquisition.

The directors decided to revalue the property (which was acquired on the 1 October 2014) in line with recent increases in market values. On 1 October 2018 an independent surveyor

5

valued the property at 48 million, which the directors have accepted. The property was being amortised over an original life of 20 years which has not changed. Jones PLC does not make a transfer to retained earnings in respect of excess amortisation. The revaluation gain will create a deferred tax liability (see note (iv)).

All depreciation and amortisation is charged to cost of sales. No depreciation or amortisation has yet been charged on any non-current assets for the year ended 30 September 2019.

(ii) Administrative expenses: On 15 August 2019, Jones PLC paid a dividend of 0.10p per share in issue. This has been included in administrative expenses.

(iii) Inventory: The inventory at 30 September 2019 was valued at 56.6 million.

(iv) Tax provisions: A provision for income tax for the year ended 30 September 2019 of 24.3 million is required. At 30 September 2019, the tax base of Jones PLCs net assets was 15 million less than their carrying amounts. This excludes the effects of the revaluation of the leased property. The income tax rate of Jones PLC is 30%.

Required:

(a) Prepare the statement of profit or loss and other comprehensive income for Jones PLC for the year ended 30 September 2019.

(b) Prepare the statement of financial position for Jones PLC as at 30 September 2019. Note: A statement of changes in equity is not required.

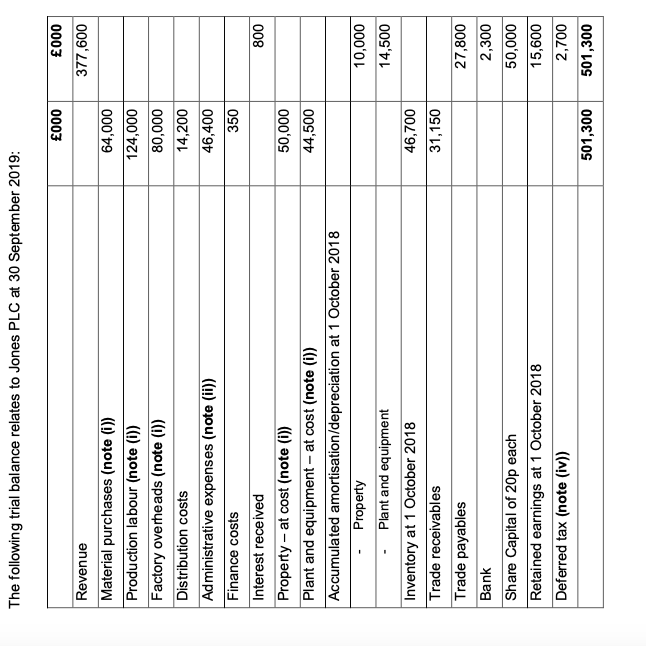

The following trial balance relates to Jones PLC at 30 September 2019: 000 000 377,600 64,000 124,000 80,000 14,200 46,400 350 800 50,000 44,500 Revenue Material purchases (note (i)) Production labour (note (i)) Factory overheads (note (i)) Distribution costs Administrative expenses (note (ii)) Finance costs Interest received Property - at cost (note (i)) Plant and equipment - at cost (note (i)) Accumulated amortisation/depreciation at 1 October 2018 Property Plant and equipment Inventory at 1 October 2018 Trade receivables Trade payables Bank Share Capital of 20p each Retained earnings at 1 October 2018 Deferred tax (note (iv)) 10,000 14,500 46,700 31,150 27,800 2,300 50,000 15,600 2,700 501,300 501,300Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started