Answered step by step

Verified Expert Solution

Question

1 Approved Answer

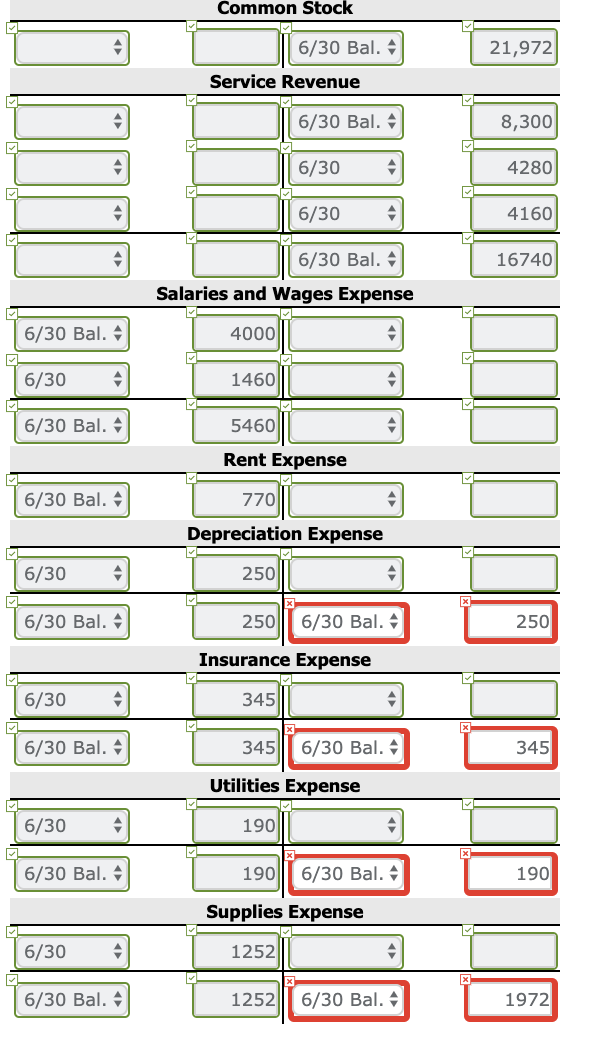

I only need help with the squares outlined in RED. *The question that says the answer is partially correct* Problem 4-02A Len Jason started his

I only need help with the squares outlined in RED. *The question that says the answer is partially correct*

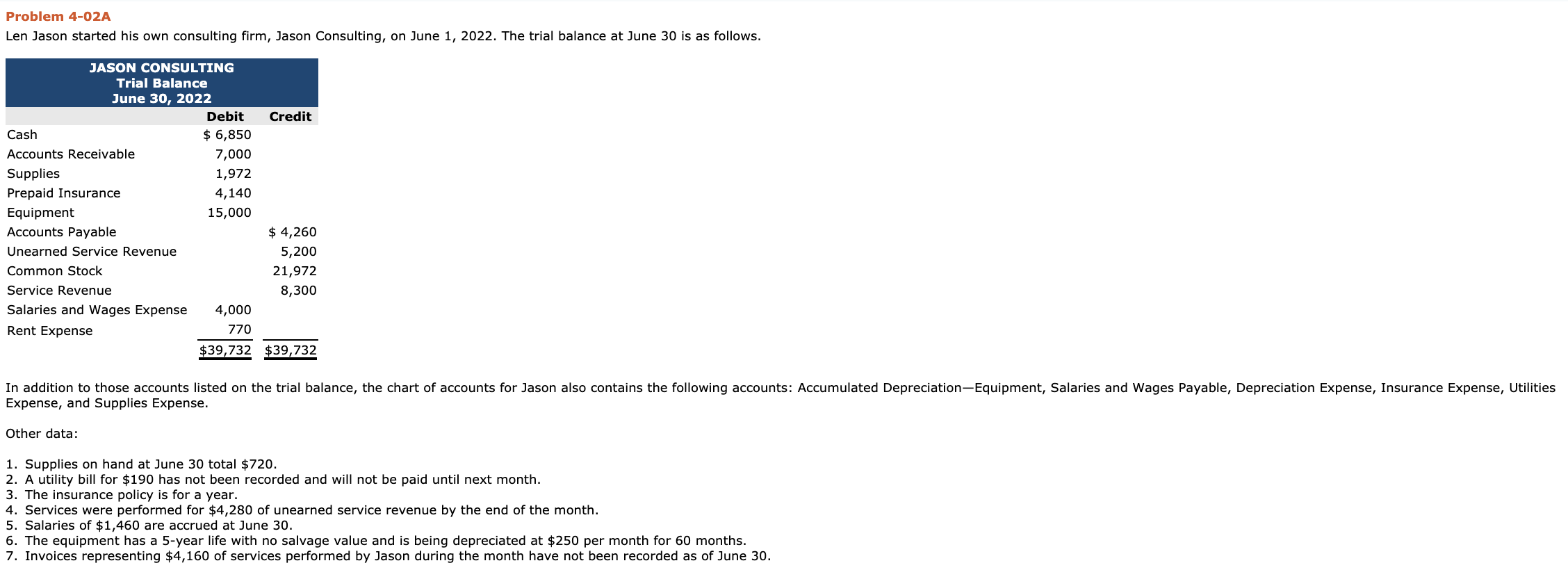

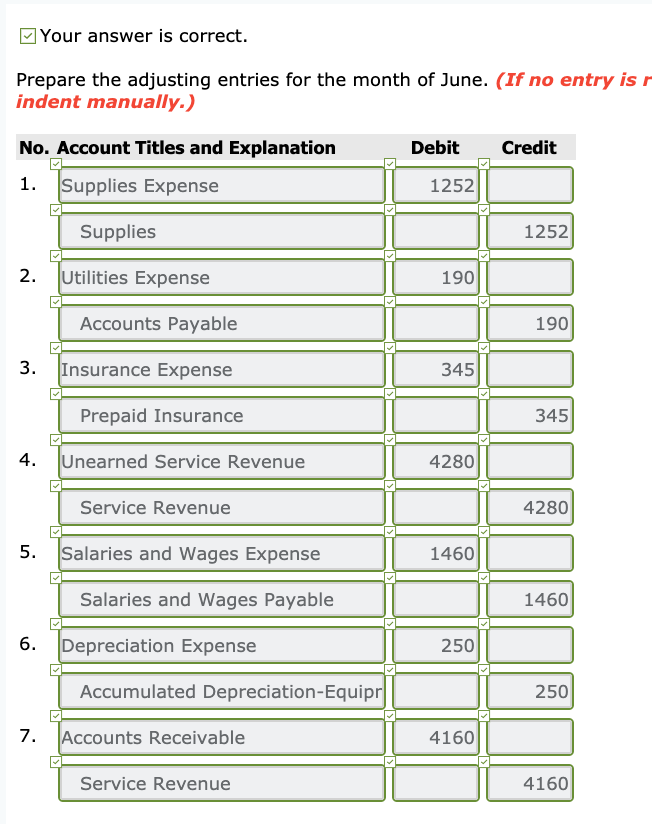

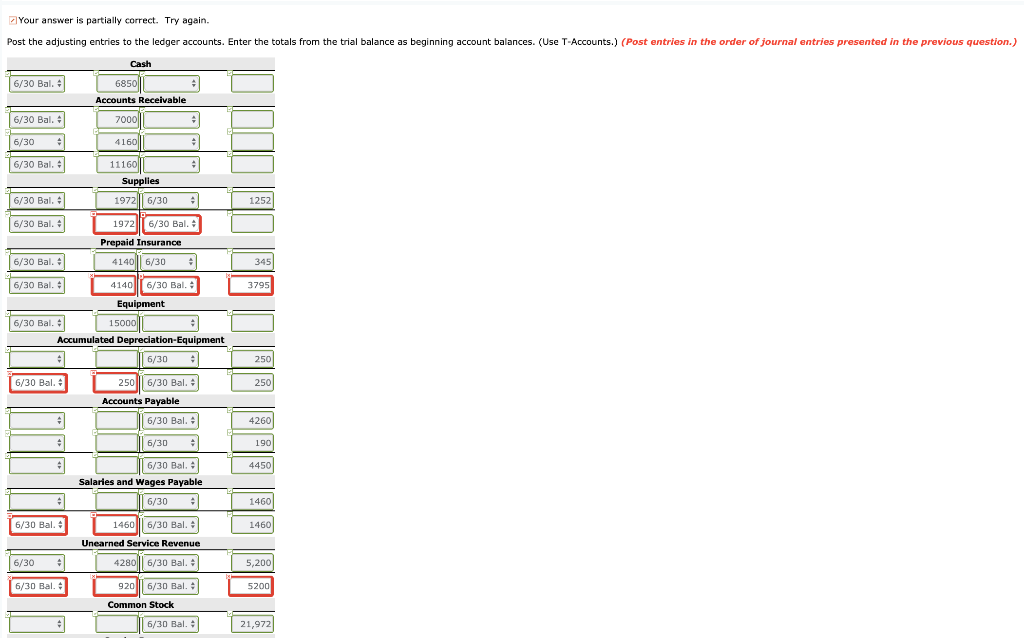

Problem 4-02A Len Jason started his own consulting firm, Jason Consulting, on June 1, 2022. The trial balance at June 30 is as follows. JASON CONSULTING Trial Balance June 30, 2022 Debit Credit Cash $ 6,850 Accounts Receivable 7,000 Supplies 1,972 Prepaid Insurance 4,140 Equipment 15,000 Accounts Payable $ 4,260 Unearned Service Revenue 5,200 Common Stock 21,972 Service Revenue 8,300 Salaries and Wages Expense 4,000 Rent Expense 770 $39,732 $39,732 In addition to those accounts listed on the trial balance, the chart of accounts for Jason also contains the following accounts: Accumulated Depreciation Equipment, Salaries and Wages Payable, Depreciation Expense, Insurance Expense, Utilities Expense, and Supplies Expense. Other data: 1. Supplies on hand at June 30 total $720. 2. A utility bill for $190 has not been recorded and will not be paid until next month. 3. The insurance policy is for a year. 4. Services were performed for $4,280 of unearned service revenue by the end of the month. 5. Salaries of $1,460 are accrued at June 30. 6. The equipment has a 5-year life with no salvage value and is being depreciated at $250 per month for 60 months. 7. Invoices representing $4,160 of services performed by Jason during the month have not been recorded as of June 30. Your answer is correct. Prepare the adjusting entries for the month of June. (If no entry is indent manually.) No. Account Titles and Explanation Debit Credit 1. Supplies Expense 1252 Supplies 1252 DC Utilities Expense Accounts Payable Insurance Expense 1 190 3450 JUL345 Prepaid Insurance 4. Unearned Service Revenue Service Revenue 4280 5. Salaries and Wages Expense Vages Expense Salaries and Wages Payable Payable 1460 | 2500 1460 6. Depreciation Expense Accumulated Depreciation-Equipr 7. Accounts Receivable 4160 Service Revenue L 4 160 60 Your answer is partially correct. Try again. Post the adjusting entries to the ledger accounts. Enter the totals from the trial balance as beginning account balances. (Use T-Accounts.) (Post entries in the order of journal entries presented in the previous question.) 1252 345 3795 Cash 6/30 Bal. 6850 Accounts Receivable 6/30 Bal. 70001 6/30 4160 6/30 Bal. 11160|| Supplies 6/30 Bal. 1972|6/30 6/30 Bal. A 1972 16/30 Bal. A Prepaid Insurance 6/30 Bal. 4 41406/30 6/30 Bal. 4 41406/30 Bal. 4 Equipment 6/30 Bal. 4 15000 ccumulated Depreciation-Equipment 6/30 6/30 Bal. 4 250 6/30 Bal. 4 Accounts Payable 6/30 Bal. 6/30 2 6/30 Bal. Salaries and Wages Payable 6/30 6/30 Bal. 1 1460 | 6/30 Bal. Unearned Service Revenue 6/30 4280|6/30 Bal. 9 5 6/30 Bal. 9206/30 Bal. 9 Common Stock 0 0 6 /30 Bal. $ 250 4260 190 4450 1460 1460 ,200 5200 21,972 Common Stock 6/30 Bal. A T A 21,972 Service Revenue 8,300 D 6/30 Bal. A | 6/30 |6/30 6/30 D T 4280 4160 6/30 Bal. A 16740 6/30 Bal. Salaries and Wages Expense T40001 1460|| 6/30 A 6/30 Bal. T5460 6/30 Bal. A 6/30 9 6/30 Bal. A Rent Expense 770 | Depreciation Expense T 2500 I 250 6/30 Bal. A Insurance Expense 1 345|| A 250 6/30 A 6/30 Bal. A 345 345 || 6/30 Bal. A Utilities Expense 16/30 6/30 Bal. A 1901 6/30 Bal. 190 Supplies Expense 1252 6/30 A 6/30 Bal. A 6/30 Bal. 1972 Your answer is partially correct. Try again. Prepare an adjusted trial balance at June 30, 2022. Cash JASON CONSULTING Adjusted Trial Balance June 30, 2022 Debit Credit 6850 Accounts Receivable 11160 Supplies T 720 L Prepaid Insurance 3795 Equipment 115000 Accumulated Depreciation-Equipme 250 Accounts Payable 4450 Unearned Service Revenue 920 Salaries and Wages Payable 460 Common Stock 21972 Service Revenue Salaries and Wages Expense Rent Expense Supplies Expense Utilities Expense Insurance Expense 345 Depreciation Expense 45792 Click if you would like to Show Work for this question: Open Show WorkStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started