i only need journal entries from june 9 and on

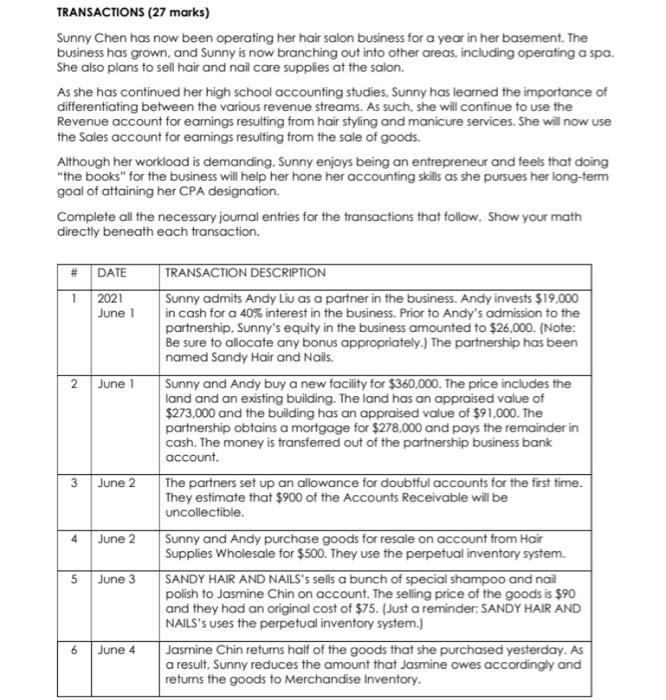

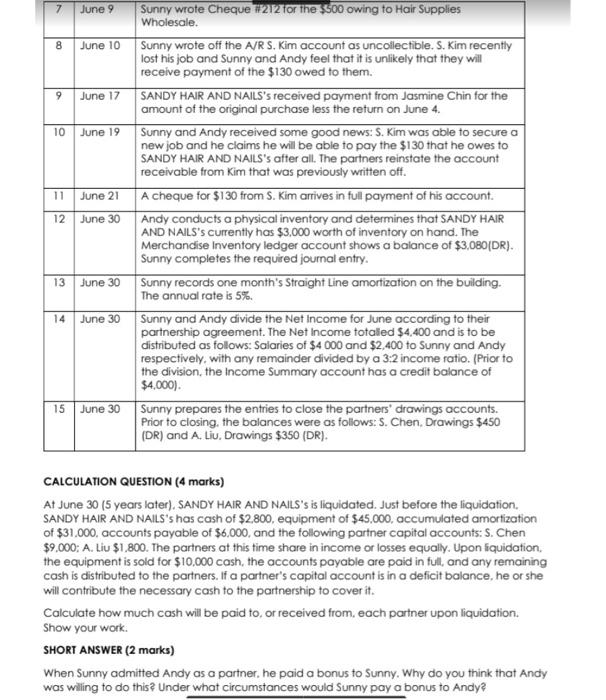

TRANSACTIONS (27 marks) Sunny Chen has now been operating her hair salon business for a year in her basement. The business has grown, and Sunny is now branching out into other areas, including operating a spa. She also plans to sell hair and nail care supplies at the salon. As she has continued her high school accounting studies, Sunny has learned the importance of differentiating between the various revenue streams. As such, she will continue to use the Revenue account for earnings resulting from hair styling and manicure services. She will now use the Sales account for earnings resulting from the sale of goods. Although her workload is demanding, Sunny enjoys being an entrepreneur and feels that doing "the books" for the business will help her hone her accounting skills as she pursues her long-term goal of attaining her CPA designation. Complete all the necessary joumal entries for the transactions that follow. Show your math directly beneath each transaction. # DATE 1 2021 June 1 2 June 1 3 June 2 TRANSACTION DESCRIPTION Sunny admits Andy Liu as a partner in the business. Andy invests $19.000 in cash for a 40% interest in the business. Prior to Andy's admission to the partnership. Sunny's equity in the business amounted to $26,000. (Note: Be sure to allocate any bonus appropriately.) The partnership has been named Sandy Hair and Nails. Sunny and Andy buy a new facility for $360,000. The price includes the land and an existing building. The land has an appraised value of $273,000 and the building has an appraised value of $91,000. The partnership obtains a mortgage for $278.000 and pays the remainder in cash. The money is transferred out of the partnership business bank account. The partners set up an allowance for doubtful accounts for the first time. They estimate that $900 of the Accounts Receivable will be uncollectible. Sunny and Andy purchase goods for resale on account from Hair Supplies Wholesale for $500. They use the perpetual inventory system. SANDY HAIR AND NAILS's sells a bunch of special shampoo and nail polish to Jasmine Chin on account. The selling price of the goods is $90 and they had an original cost of $75. Just a reminder: SANDY HAIR AND NAILS's uses the perpetual inventory system.) Jasmine Chin returns half of the goods that she purchased yesterday. As a result, Sunny reduces the amount that Jasmine owes accordingly and returns the goods to Merchandise Inventory. 4 June 2 5 June 3 6 June 4 7 June 9 8 June 10 9 June 17 10 June 19 11 June 21 12 June 30 Sunny wrote Cheque #272 for the 3500 owing to Hair Supplies Wholesale Sunny wrote off the A/R S. Kim account as uncollectible. S. Kim recently lost his job and Sunny and Andy feel that it is unlikely that they will receive payment of the $130 owed to them. SANDY HAIR AND NAILS's received payment from Jasmine Chin for the amount of the original purchase less the return on June 4. Sunny and Andy received some good news: S. Kim was able to secure a new job and he claims he will be able to pay the $130 that he owes to SANDY HAIR AND NAILS's after all. The partners reinstate the account receivable from Kim that was previously written off. A cheque for $130 from S. Kim arrives in full payment of his account. Andy conducts a physical inventory and determines that SANDY HAIR AND NAILS's currently has $3.000 worth of inventory on hand. The Merchandise Inventory ledger account shows a balance of $3,080(DR). Sunny completes the required journal entry. Sunny records one month's Straight Line amortization on the building. The annual rate is 5%. Sunny and Andy divide the Net Income for June according to their partnership agreement. The Net Income totaled $4,400 and is to be distributed as follows: Salaries of $4 000 and $2,400 to Sunny and Andy respectively, with any remainder divided by a 3:2 income ratio. (Prior to the division, the income Summary account has a credit balance of $4,000). Sunny prepares the entries to close the partners' drawings accounts. Prior to closing, the balances were as follows: S. Chen, Drawings $450 (DR) and A. Liu, Drawings $350 (DR). 13 June 30 14 June 30 15 June 30 CALCULATION QUESTION (4 marks) At June 30 (5 years later), SANDY HAIR AND NAILS's is liquidated. Just before the liquidation SANDY HAIR AND NAILS's has cash of $2,800, equipment of $45,000, accumulated amortization of $31.000, accounts payable of $6,000, and the following partner capital accounts: S. Chen $9.000; A. Liu $1.800. The partners at this time share in income or losses equally. Upon liquidation the equipment is sold for $10,000 cash, the accounts payable are paid in full, and any remaining cash is distributed to the partners. If a partner's capital account is in a deficit balance, he or she will contribute the necessary cash to the partnership to cover it. Calculate how much cash will be paid to, or received from each partner upon liquidation Show your work. SHORT ANSWER (2 marks) When Sunny admitted Andy as a partner, he paid a bonus to Sunny. Why do you think that Andy was willing to do this? Under what circumstances would Sunny pay a bonus to Andy