I only need solutions for a and b. The solutions are given above the question as it appears in the textbook. However, I need to know the steps to get to the solution

I only need solutions for a and b. The solutions are given above the question as it appears in the textbook. However, I need to know the steps to get to the solution

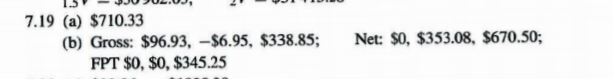

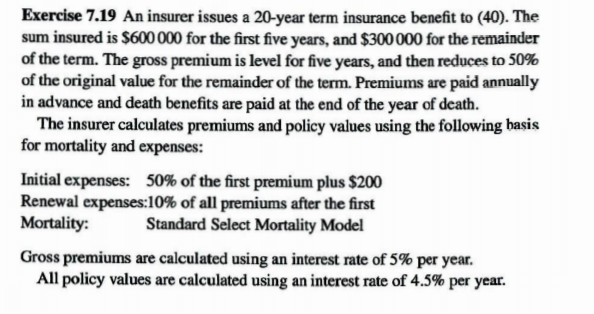

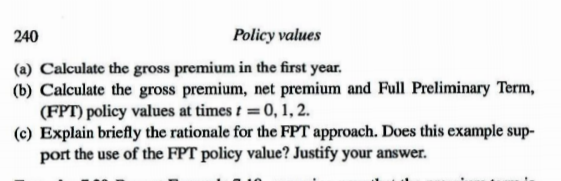

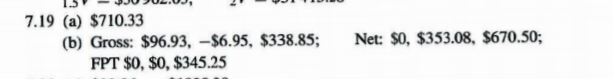

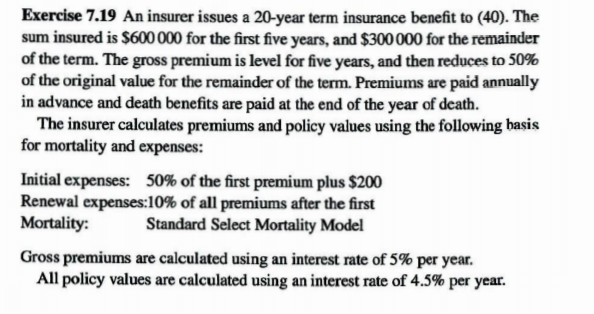

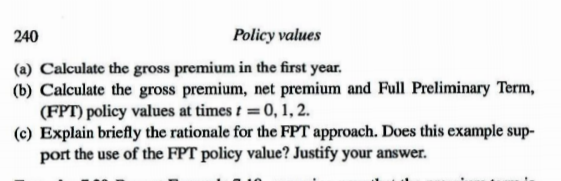

7.19 (a) $710.33 (b) Gross: $96.93,-$6.95, $338.85; FPT $0, $0, $345.25 Net: $0, $353.08, $670.50; Exercise 7.19 An insurer issues a 20-year term insurance benefit to (40). The sum insured is $600 000 for the first five years, and $300 000 for the remainder of the term. The gross premium is level for five years, and then reduces to 50% of the original value for the remainder of the term. Premiums are paid annually in advance and death benefits are paid at the end of the year of death. The insurer calculates premiums and policy values using the following basis for mortality and expenses: Initial expenses: 50% of the first premium plus $200 Renewal expenses:10% of all premiums after the first Mortality: Standard Select Mortality Model Gross premiums are calculated using an interest rate of 5% per year. All policy values are calculated using an interest rate of 4.5% per year. 240 Policy values (a) Calculate the gross premium in the first year, (b) Calculate the gross premium, net premium and Full Preliminary Term, (FPT) policy values at times t = 0, 1, 2. (c) Explain briefly the rationale for the FPT approach. Does this example sup- port the use of the FPT policy value? Justify your answer. 7.19 (a) $710.33 (b) Gross: $96.93,-$6.95, $338.85; FPT $0, $0, $345.25 Net: $0, $353.08, $670.50; Exercise 7.19 An insurer issues a 20-year term insurance benefit to (40). The sum insured is $600 000 for the first five years, and $300 000 for the remainder of the term. The gross premium is level for five years, and then reduces to 50% of the original value for the remainder of the term. Premiums are paid annually in advance and death benefits are paid at the end of the year of death. The insurer calculates premiums and policy values using the following basis for mortality and expenses: Initial expenses: 50% of the first premium plus $200 Renewal expenses:10% of all premiums after the first Mortality: Standard Select Mortality Model Gross premiums are calculated using an interest rate of 5% per year. All policy values are calculated using an interest rate of 4.5% per year. 240 Policy values (a) Calculate the gross premium in the first year, (b) Calculate the gross premium, net premium and Full Preliminary Term, (FPT) policy values at times t = 0, 1, 2. (c) Explain briefly the rationale for the FPT approach. Does this example sup- port the use of the FPT policy value? Justify your

I only need solutions for a and b. The solutions are given above the question as it appears in the textbook. However, I need to know the steps to get to the solution

I only need solutions for a and b. The solutions are given above the question as it appears in the textbook. However, I need to know the steps to get to the solution