I only need the answer, thank you.

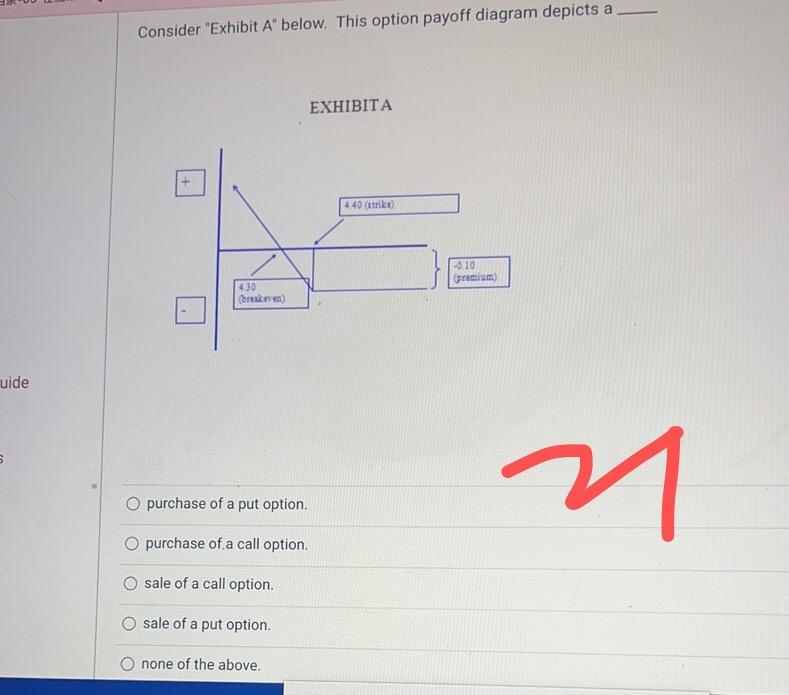

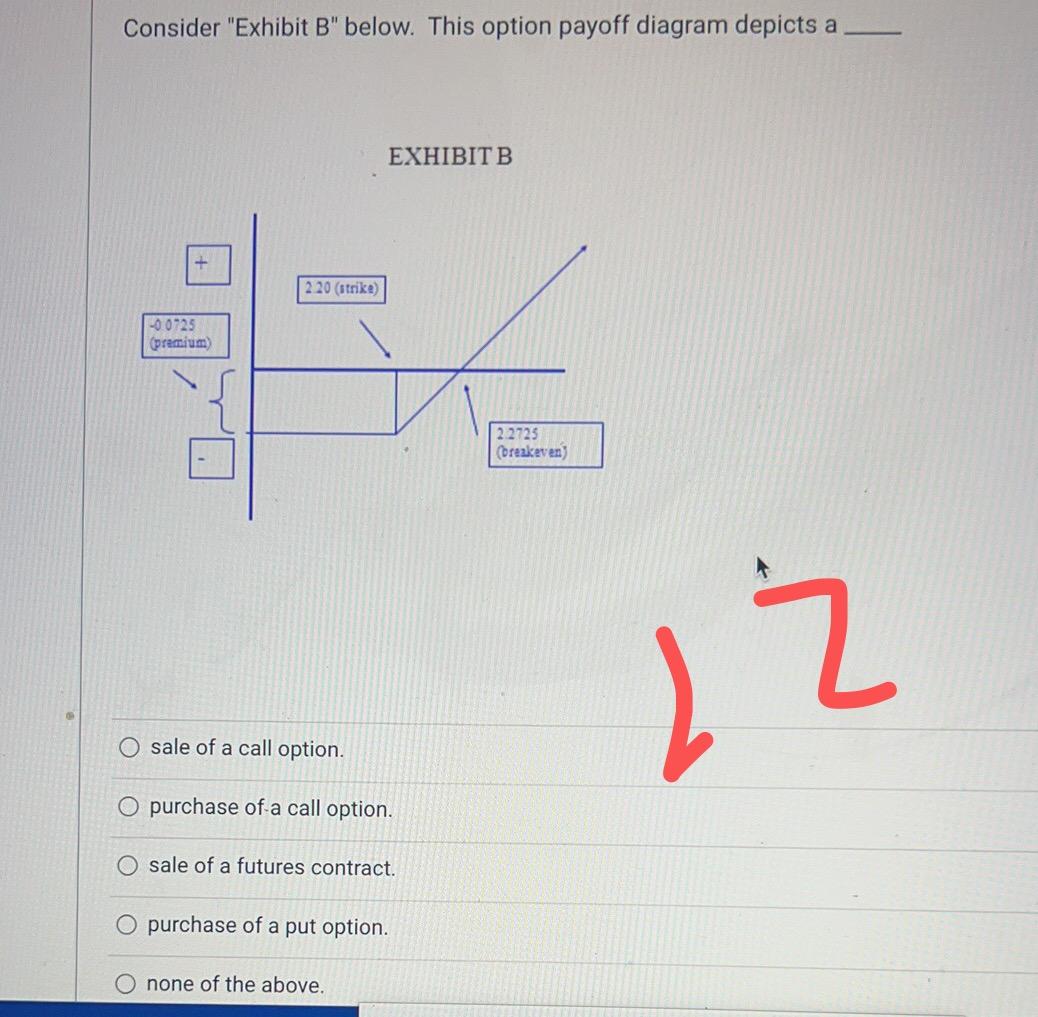

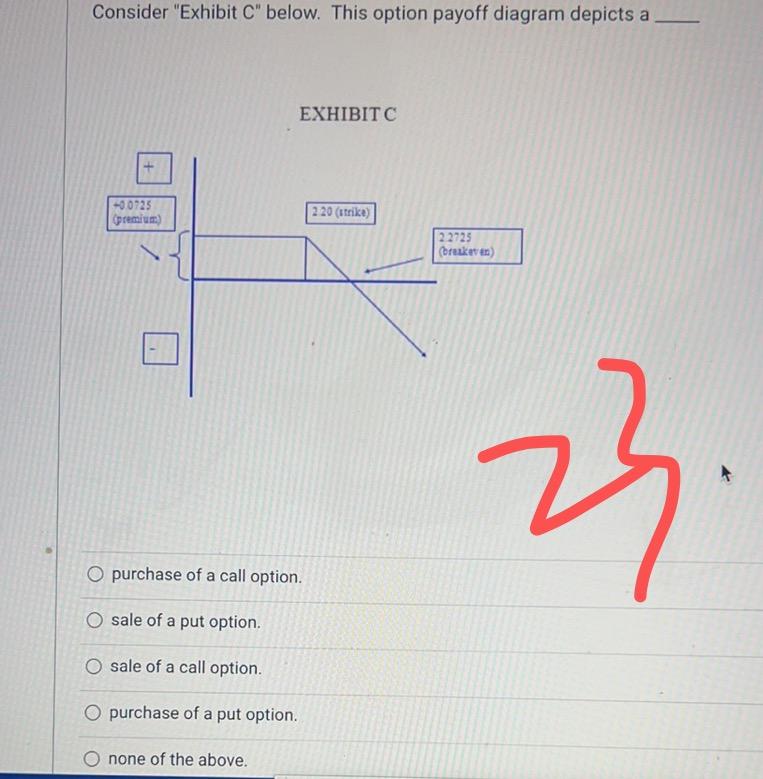

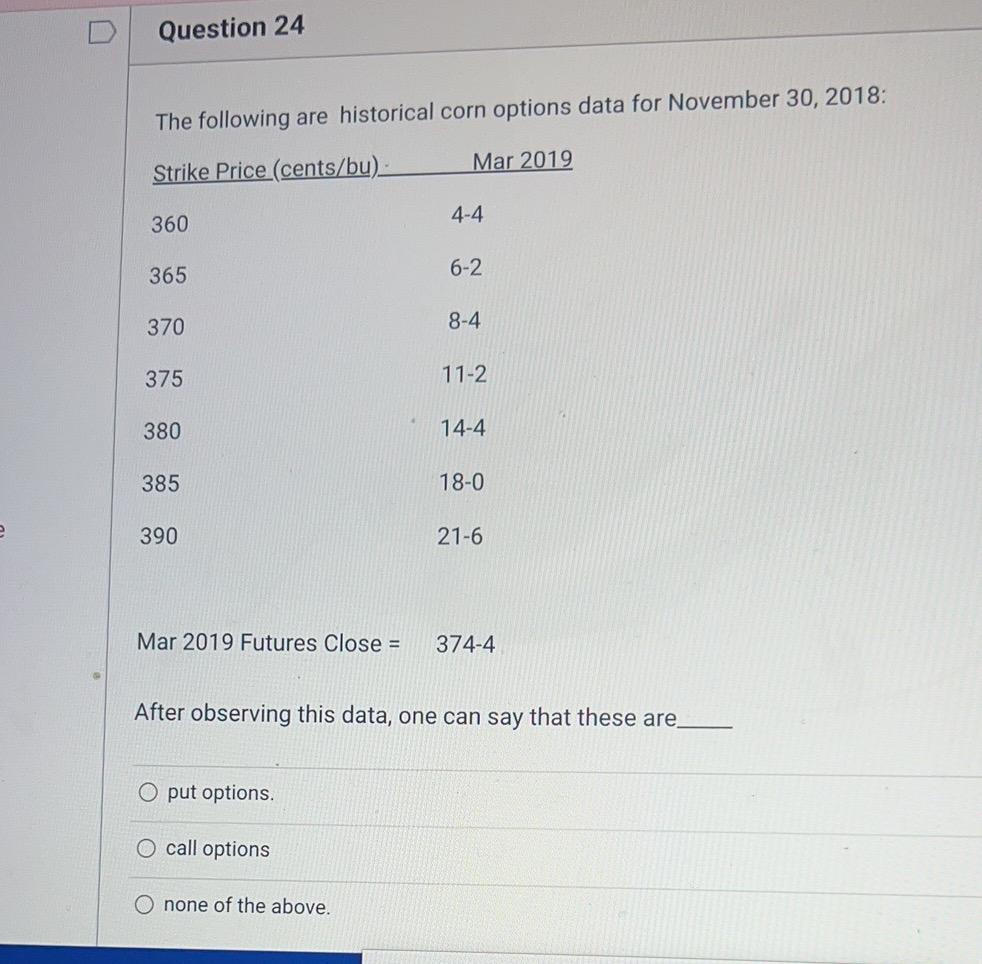

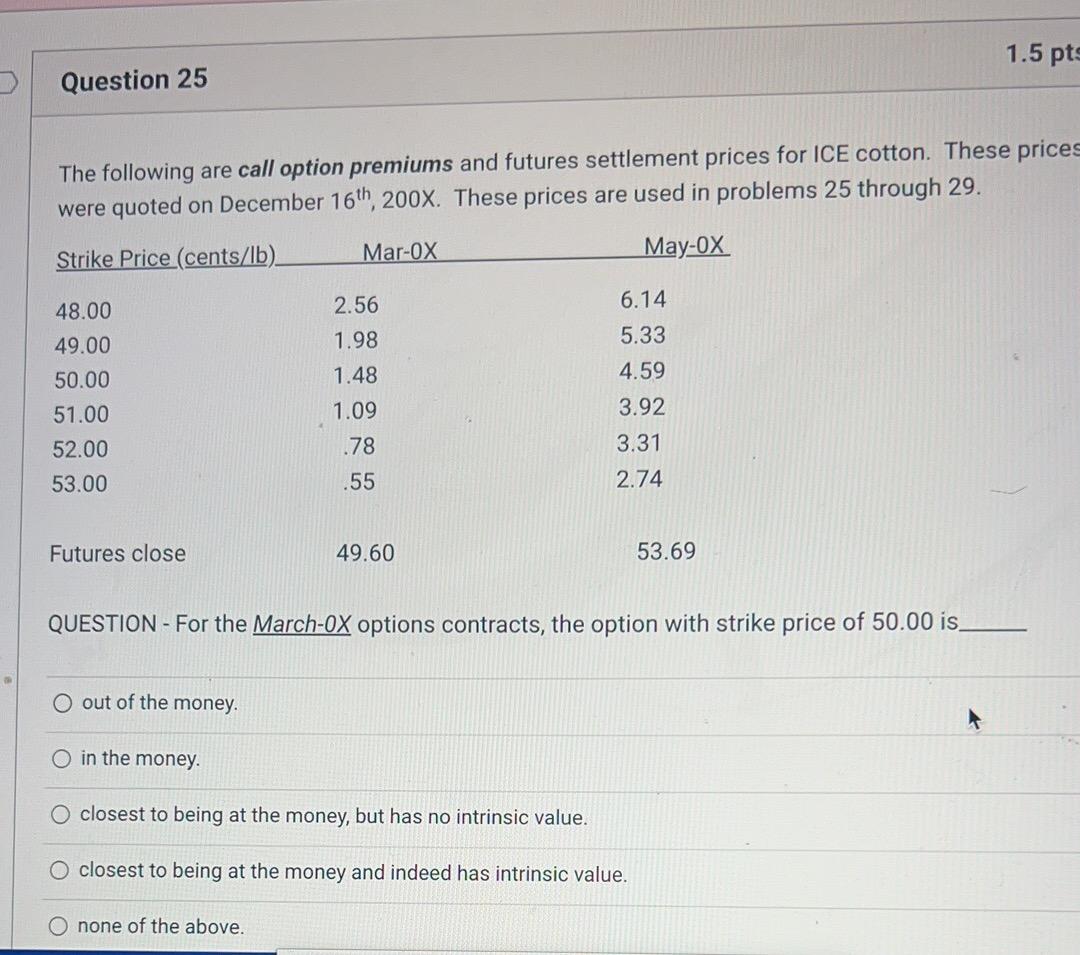

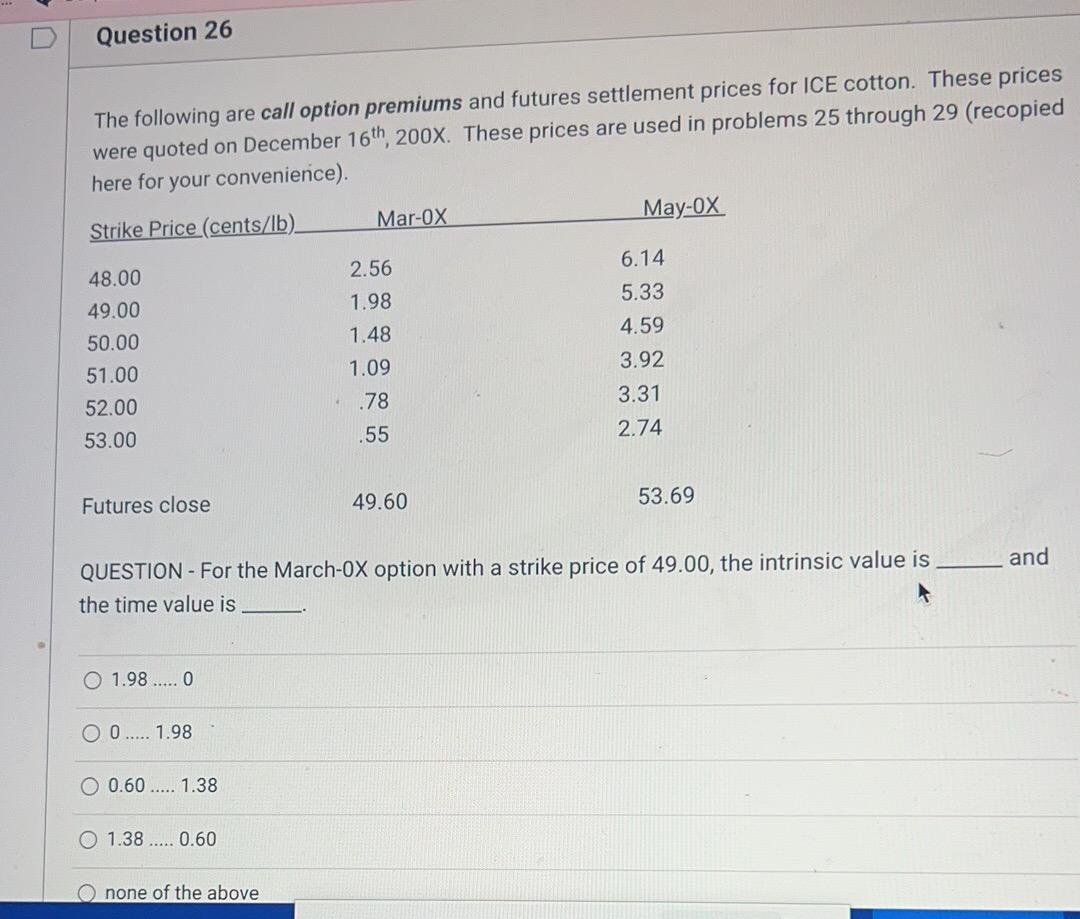

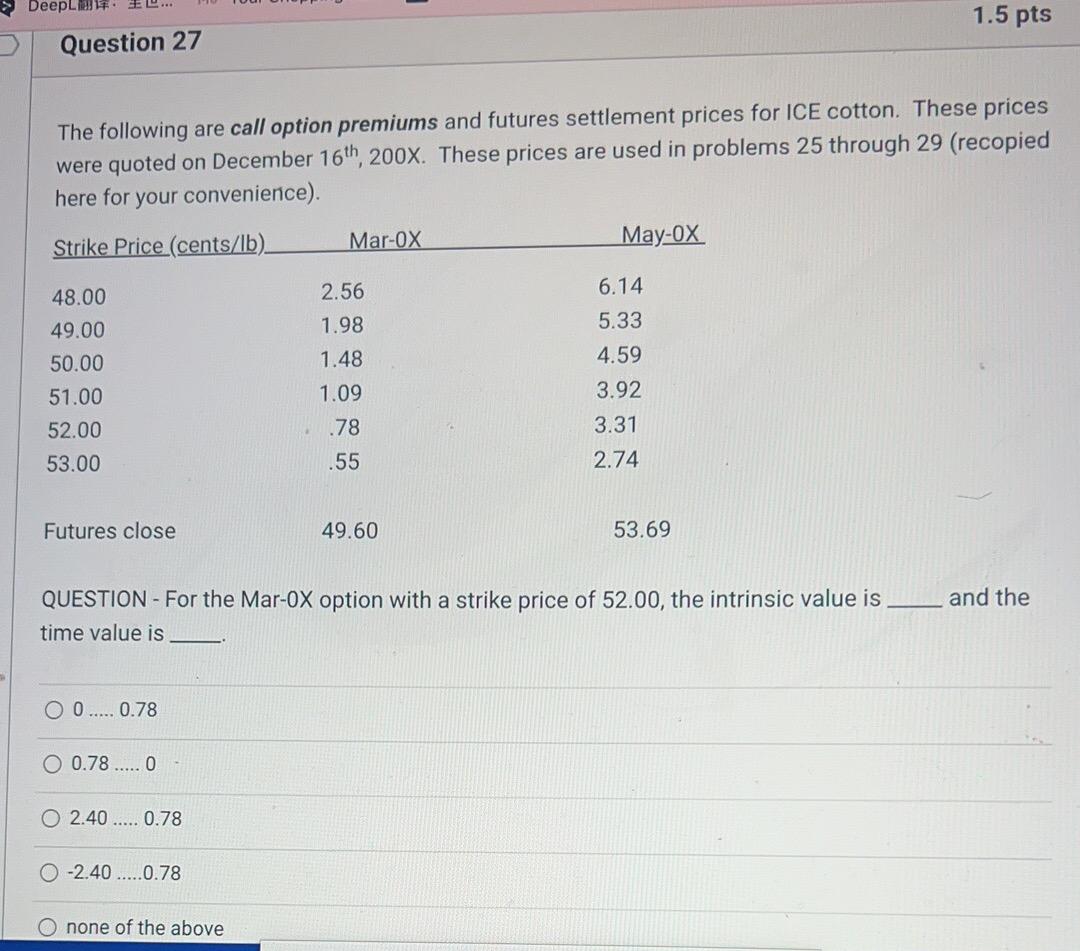

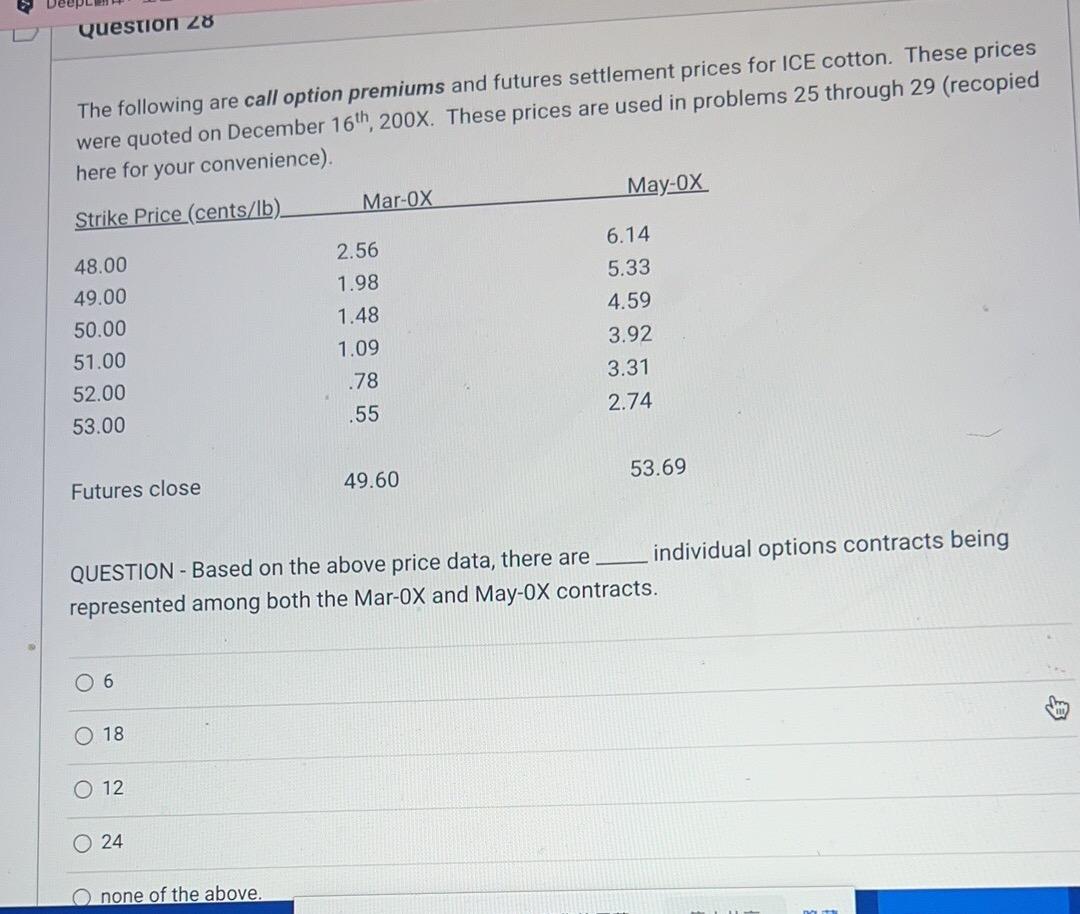

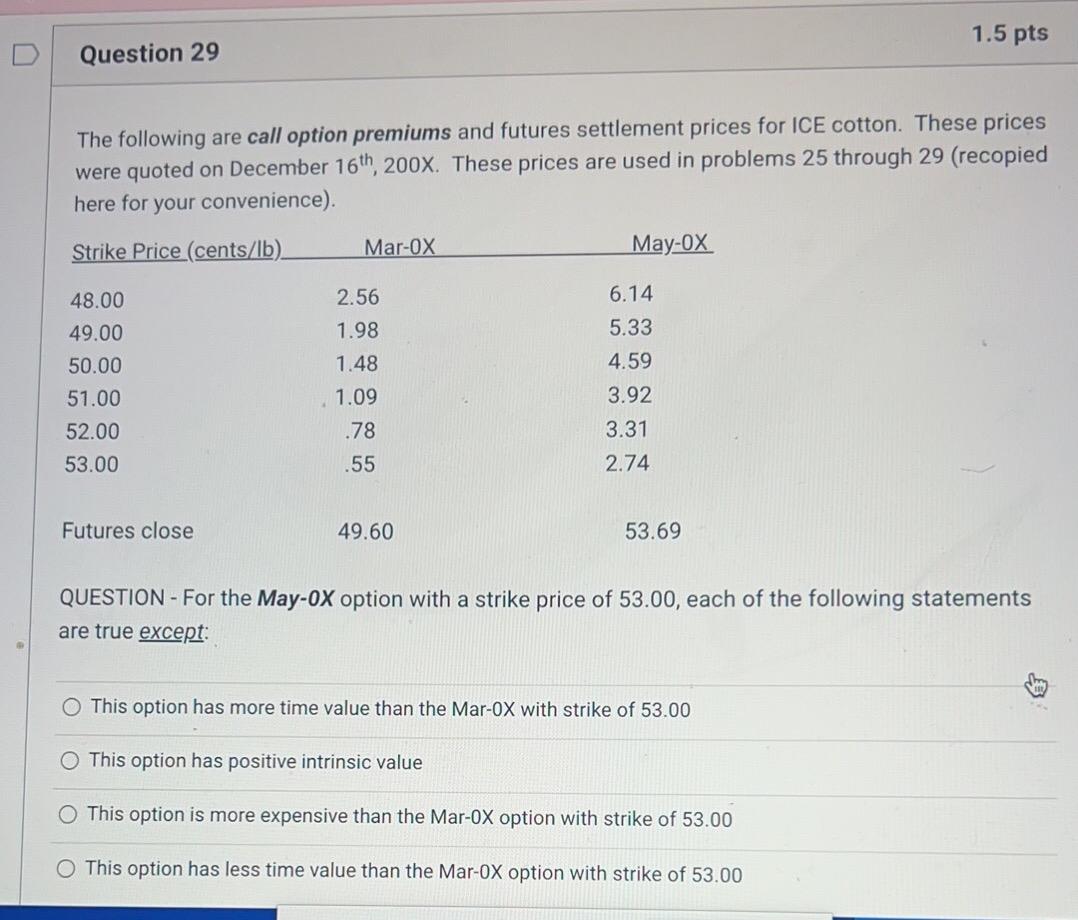

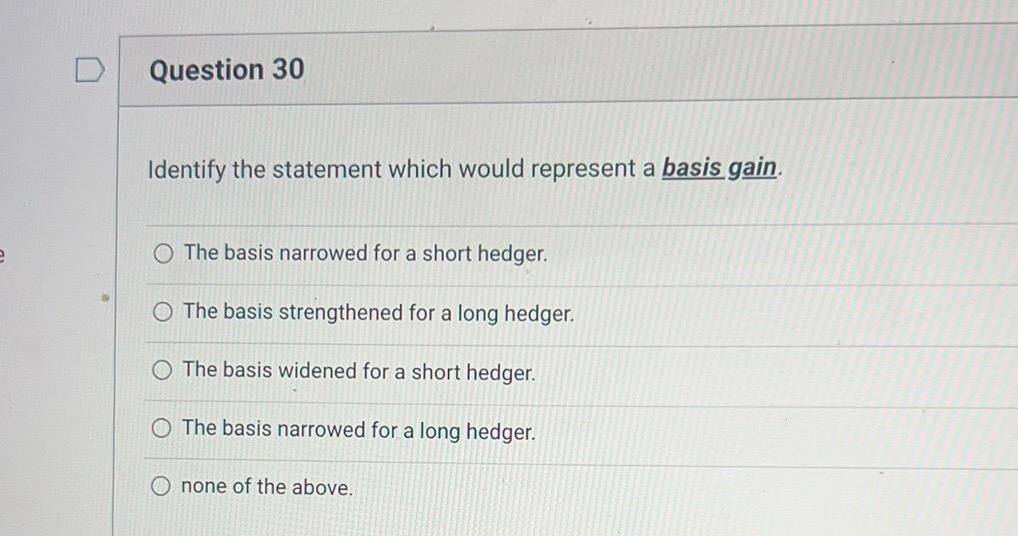

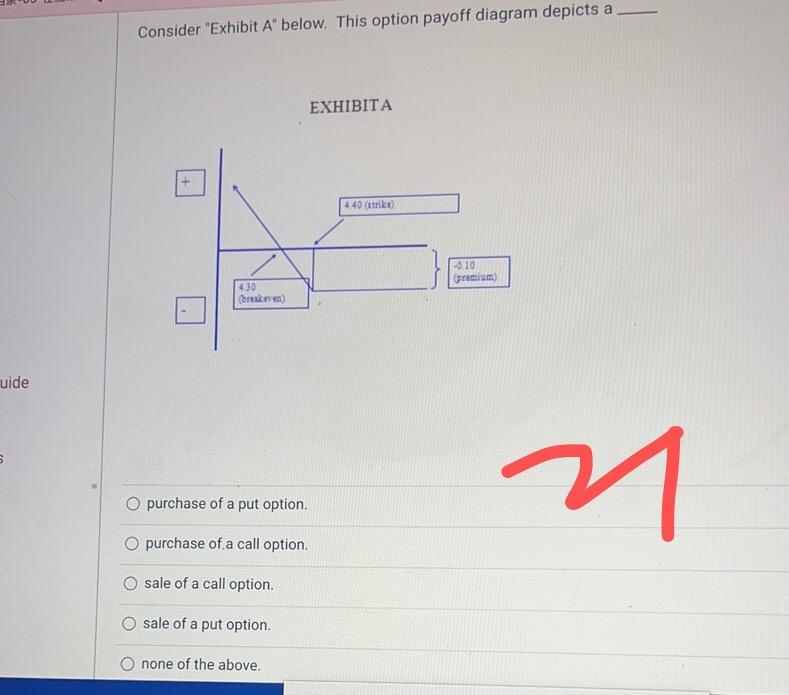

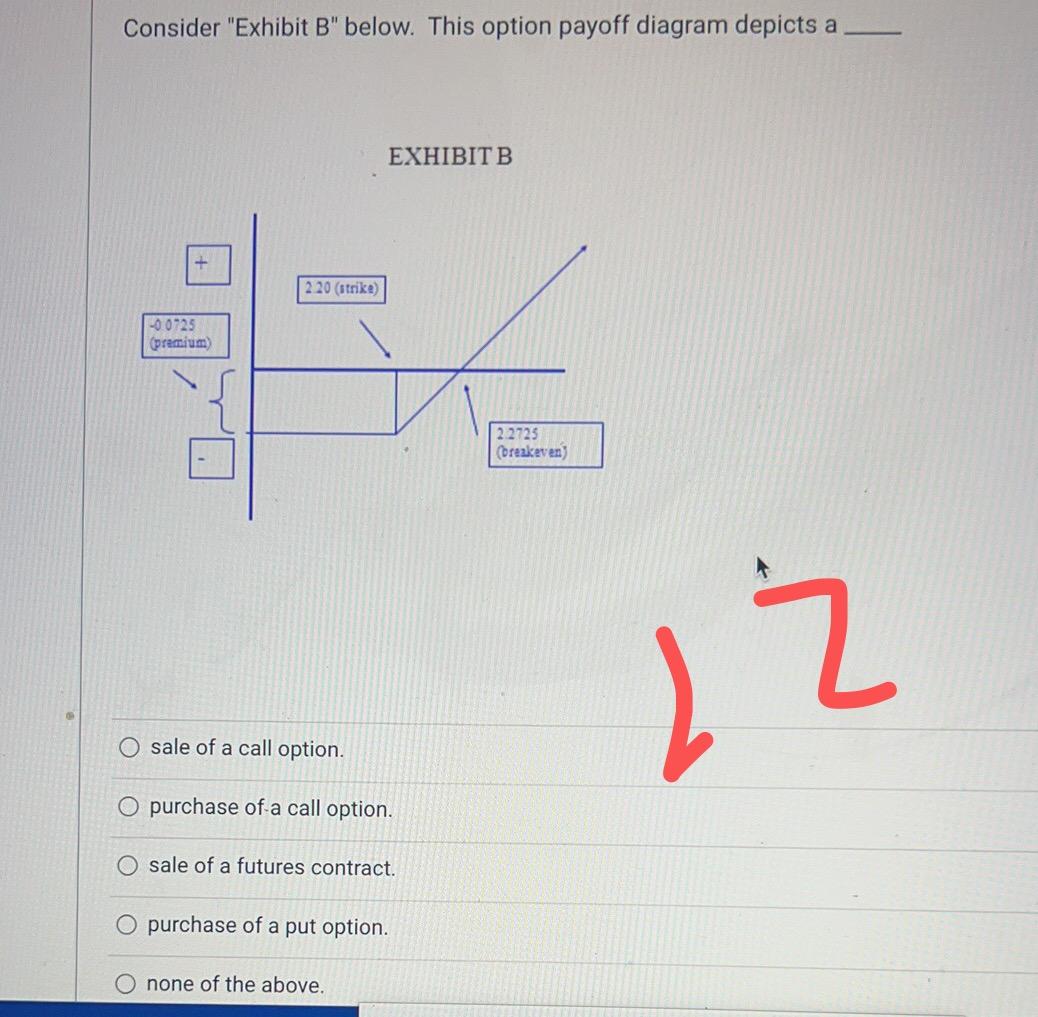

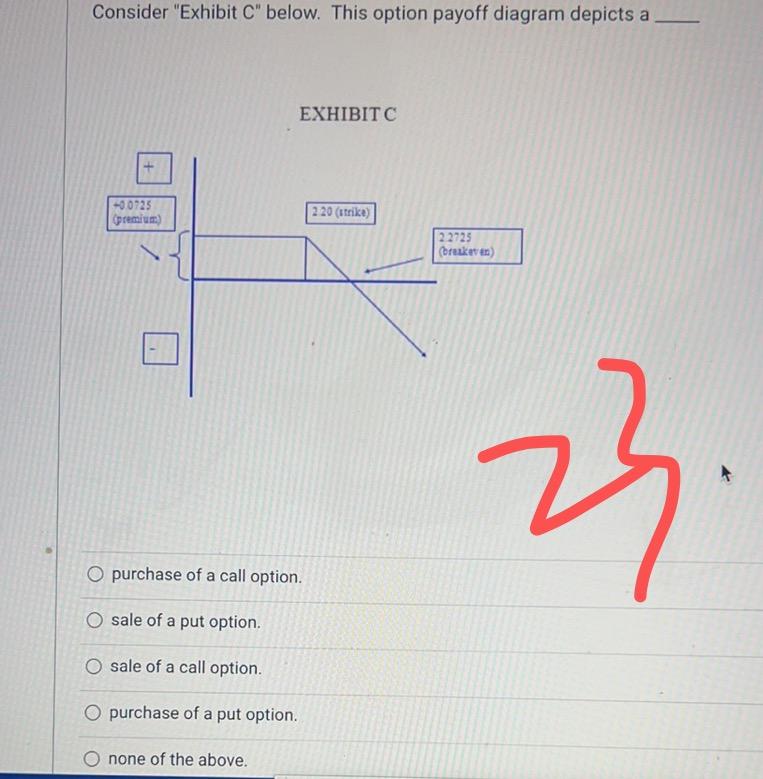

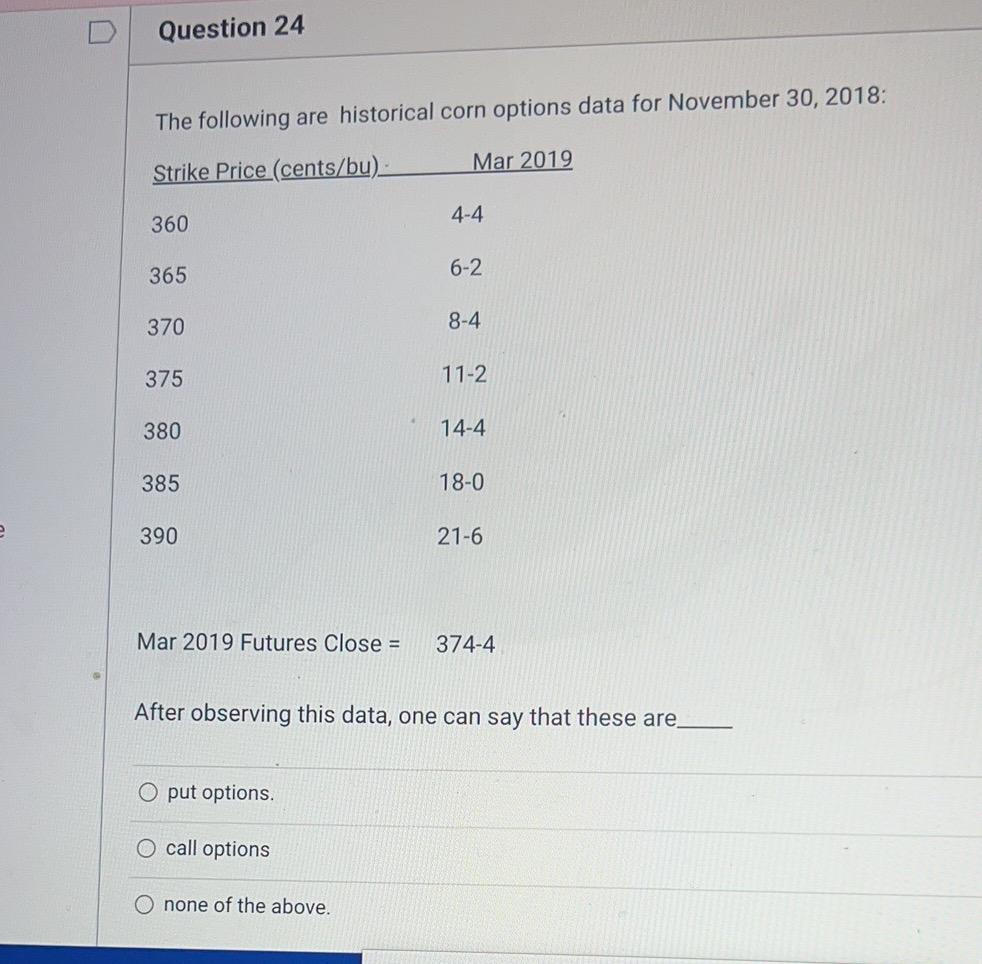

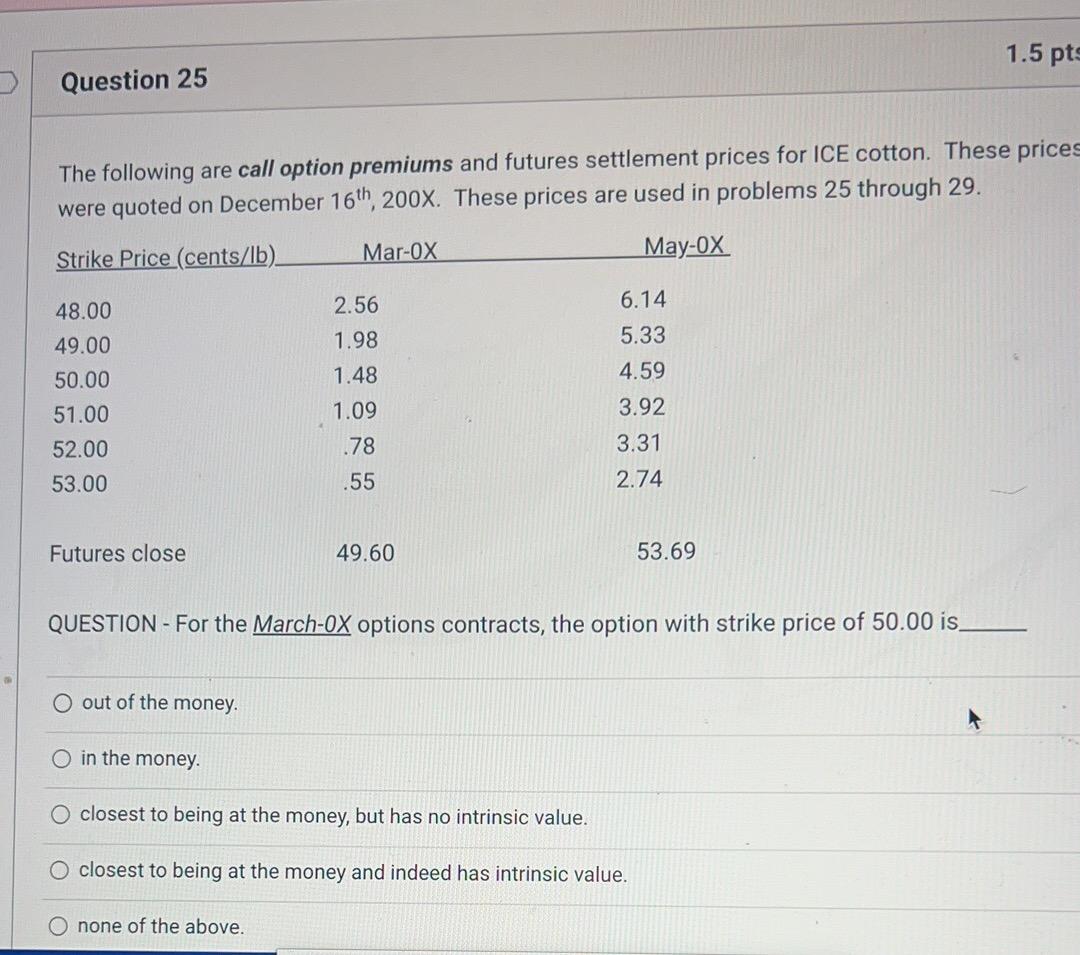

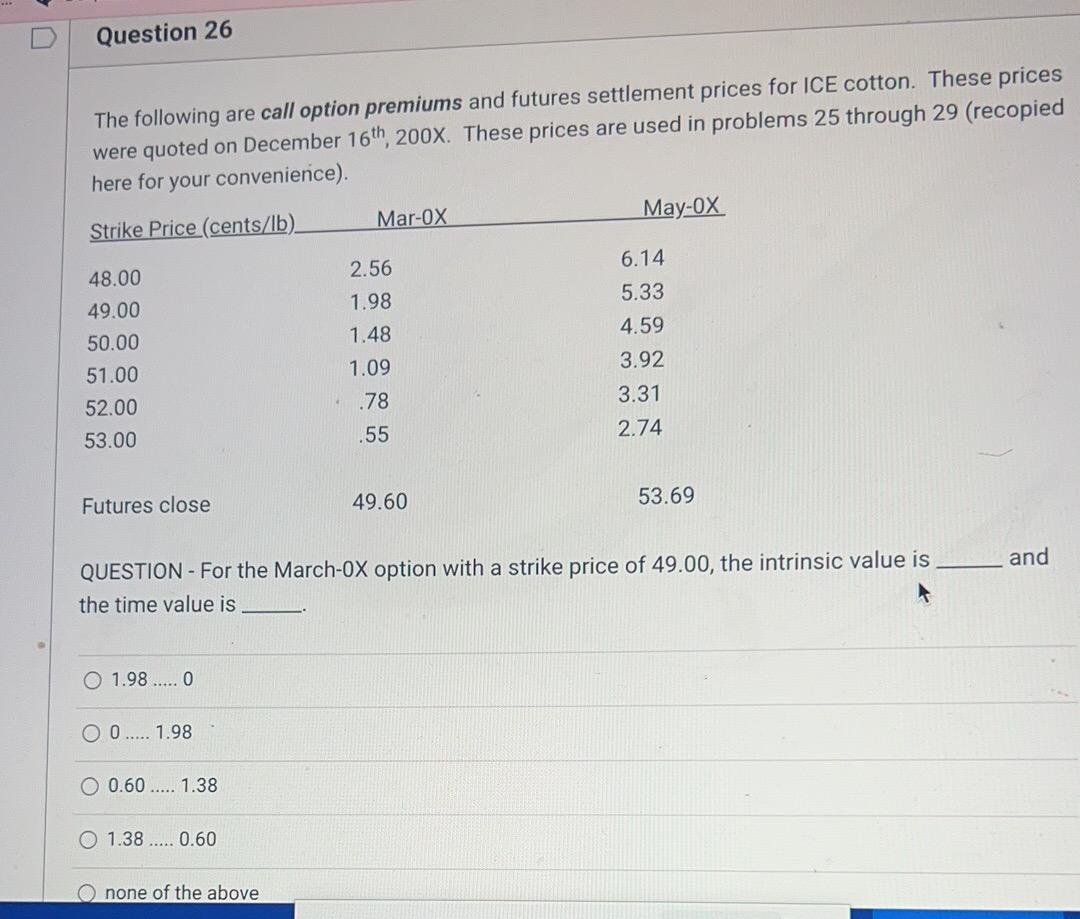

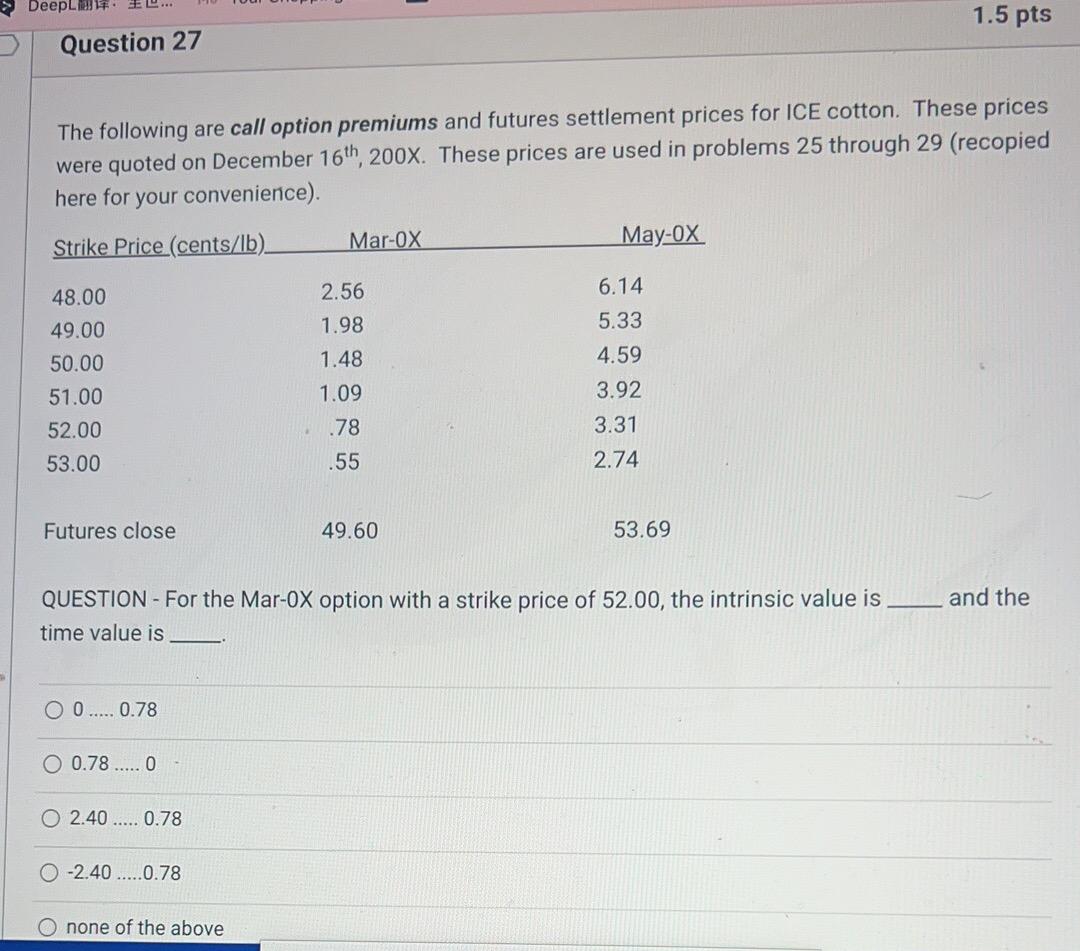

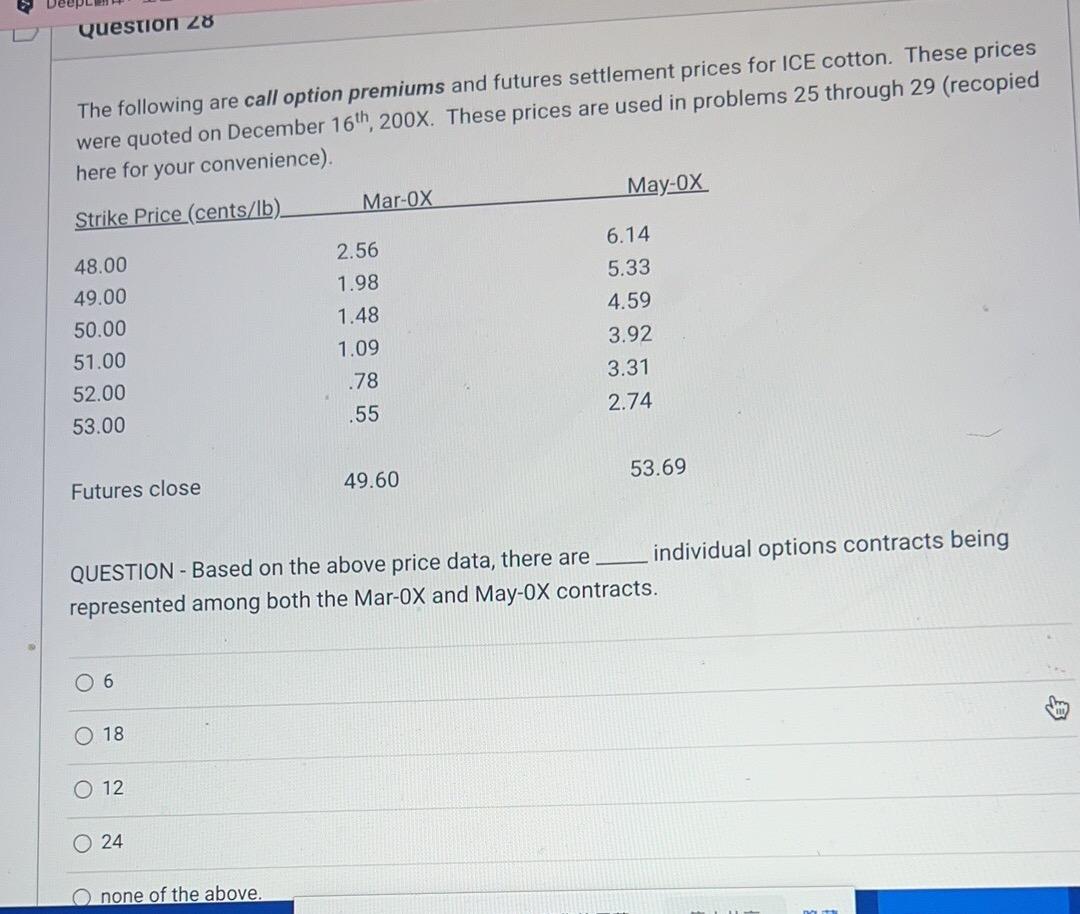

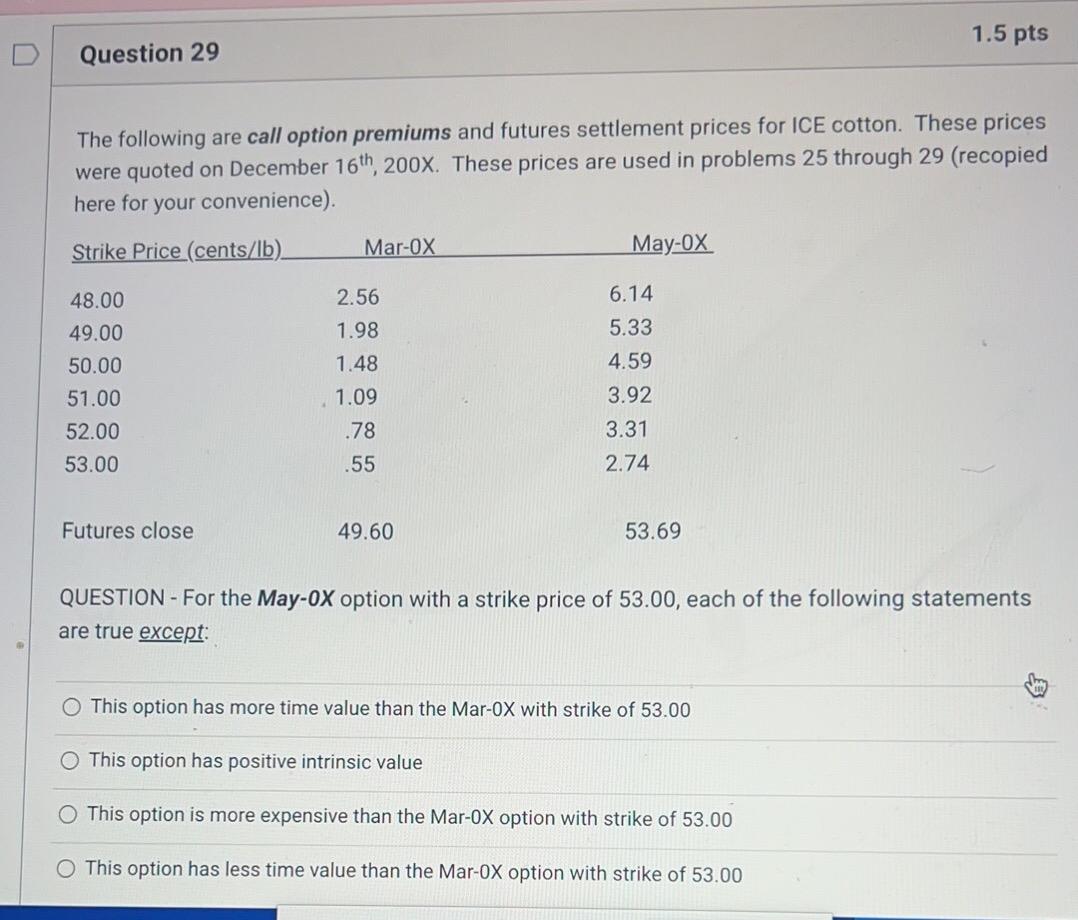

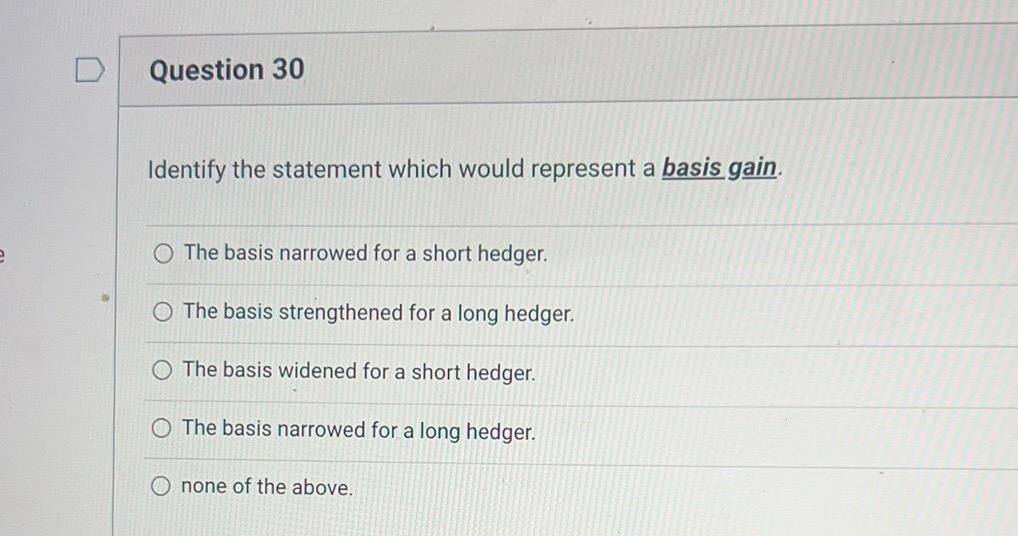

Consider "Exhibit A" below. This option payoff diagram depicts a FXHIRIT A purchase of a put option. purchase of a call option. sale of a call option. sale of a put option. none of the above. Consider "Exhibit B" below. This option payoff diagram depicts a sale of a call option. purchase of a call option. sale of a futures contract. purchase of a put option. none of the above. Consider "Exhibit C" below. This option payoff diagram depicts a purchase of a call option. sale of a put option. sale of a call option. purchase of a put option. none of the above. The following are historical corn options data for November 30, 2018: Mar 2019 Futures Close =3744 After observing this data, one can say that these are put options. call options none of the above. The following are call option premiums and futures settlement prices for ICE cotton. These prices were quoted on December 16th,200X. These prices are used in problems 25 through 29. QUESTION - For the March-OX options contracts, the option with strike price of 50.00 is out of the money. in the money. closest to being at the money, but has no intrinsic value. closest to being at the money and indeed has intrinsic value. none of the above. The following are call option premiums and futures settlement prices for ICE cotton. These prices were quoted on December 16th,200X. These prices are used in problems 25 through 29 (recopied here for your convenience). QUESTION - For the March-0X option with a strike price of 49.00, the intrinsic value is and the time value is 1.98..0 0.1.98 0.60..1.38 1.38..0.60 none of the above The following are call option premiums and futures settlement prices for ICE cotton. These prices were quoted on December 16th,200X. These prices are used in problems 25 through 29 (recopied here for your convenience). QUESTION - For the Mar-0X option with a strike price of 52.00, the intrinsic value is and the time value is 0..0.78 0.78..0 2.40.0.78 2.40.0.78 none of the above The following are call option premiums and futures settlement prices for ICE cotton. These prices were quoted on December 16th,200X. These prices are used in problems 25 through 29 (recopied .... far unur convenience). QUESTION - Based on the above price data, there are individual options contracts being represented among both the Mar- 0X and May-0X contracts. 6 18 12 24 none of the above. The following are call option premiums and futures settlement prices for ICE cotton. These prices were quoted on December 16th,200X. These prices are used in problems 25 through 29 (recopied here for your convenience). QUESTION - For the May-0X option with a strike price of 53.00, each of the following statements are true except: This option has more time value than the Mar-0X with strike of 53.00 This option has positive intrinsic value This option is more expensive than the Mar-0X option with strike of 53.00 This option has less time value than the Mar-0X option with strike of 53.00 Identify the statement which would represent a basis gain. The basis narrowed for a short hedger. The basis strengthened for a long hedger. The basis widened for a short hedger. The basis narrowed for a long hedger. none of the above. Consider "Exhibit A" below. This option payoff diagram depicts a FXHIRIT A purchase of a put option. purchase of a call option. sale of a call option. sale of a put option. none of the above. Consider "Exhibit B" below. This option payoff diagram depicts a sale of a call option. purchase of a call option. sale of a futures contract. purchase of a put option. none of the above. Consider "Exhibit C" below. This option payoff diagram depicts a purchase of a call option. sale of a put option. sale of a call option. purchase of a put option. none of the above. The following are historical corn options data for November 30, 2018: Mar 2019 Futures Close =3744 After observing this data, one can say that these are put options. call options none of the above. The following are call option premiums and futures settlement prices for ICE cotton. These prices were quoted on December 16th,200X. These prices are used in problems 25 through 29. QUESTION - For the March-OX options contracts, the option with strike price of 50.00 is out of the money. in the money. closest to being at the money, but has no intrinsic value. closest to being at the money and indeed has intrinsic value. none of the above. The following are call option premiums and futures settlement prices for ICE cotton. These prices were quoted on December 16th,200X. These prices are used in problems 25 through 29 (recopied here for your convenience). QUESTION - For the March-0X option with a strike price of 49.00, the intrinsic value is and the time value is 1.98..0 0.1.98 0.60..1.38 1.38..0.60 none of the above The following are call option premiums and futures settlement prices for ICE cotton. These prices were quoted on December 16th,200X. These prices are used in problems 25 through 29 (recopied here for your convenience). QUESTION - For the Mar-0X option with a strike price of 52.00, the intrinsic value is and the time value is 0..0.78 0.78..0 2.40.0.78 2.40.0.78 none of the above The following are call option premiums and futures settlement prices for ICE cotton. These prices were quoted on December 16th,200X. These prices are used in problems 25 through 29 (recopied .... far unur convenience). QUESTION - Based on the above price data, there are individual options contracts being represented among both the Mar- 0X and May-0X contracts. 6 18 12 24 none of the above. The following are call option premiums and futures settlement prices for ICE cotton. These prices were quoted on December 16th,200X. These prices are used in problems 25 through 29 (recopied here for your convenience). QUESTION - For the May-0X option with a strike price of 53.00, each of the following statements are true except: This option has more time value than the Mar-0X with strike of 53.00 This option has positive intrinsic value This option is more expensive than the Mar-0X option with strike of 53.00 This option has less time value than the Mar-0X option with strike of 53.00 Identify the statement which would represent a basis gain. The basis narrowed for a short hedger. The basis strengthened for a long hedger. The basis widened for a short hedger. The basis narrowed for a long hedger. none of the above