Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I only need the answers, no need for working . Correct answers will be liked, thank you! The following trial balance was extracted from the

I only need the answers, no need for working . Correct answers will be liked, thank you!

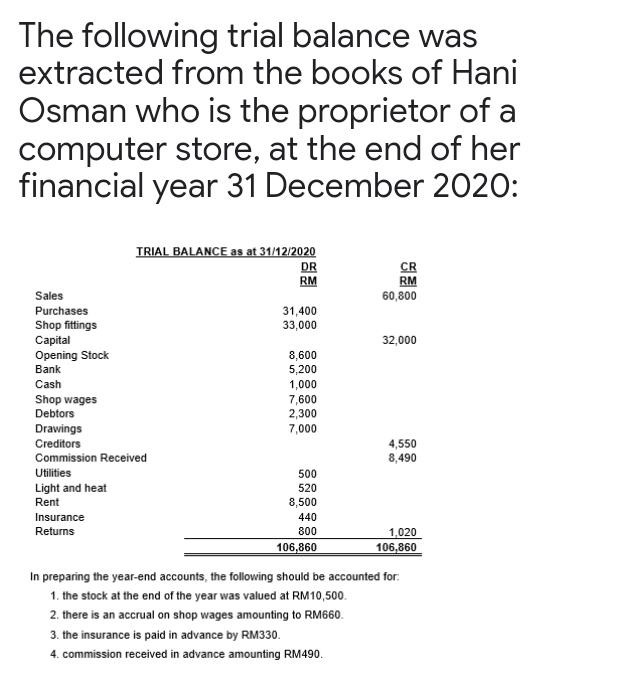

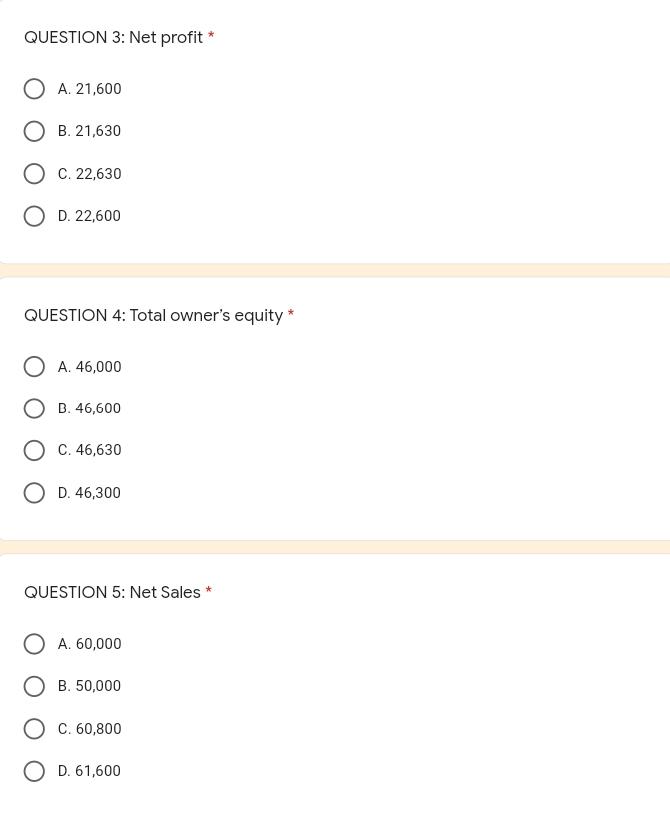

The following trial balance was extracted from the books of Hani Osman who is the proprietor of a computer store, at the end of her financial year 31 December 2020: TRIAL BALANCE as at 31/12/2020 DR CR RM RM Sales 60,800 Purchases 31,400 Shop fittings 33,000 Capital 32,000 Opening Stock 8,600 Bank 5,200 Cash 1,000 Shop wages 7,600 Debtors 2,300 Drawings 7,000 Creditors 4,550 Commission Received 8,490 Utilities 500 Light and heat 520 Rent 8,500 Insurance 440 Returns 800 1,020 106,860 106,860 In preparing the year-end accounts, the following should be accounted for 1. the stock at the end of the year was valued at RM10,500 2. there is an accrual on shop wages amounting to RM660. 3. the insurance is paid in advance by RM330. 4. commission received in advance amounting RM490 QUESTION 3: Net profit* A. 21,600 O B. 21,630 O C. 22,630 D. 22,600 QUESTION 4: Total owner's equity * A. 46,000 B. 46,600 O C. 46,630 D. 46,300 QUESTION 5: Net Sales O A. 60,000 B. 50,000 O C. 60,800 D. 61,600

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started