I only need the ine statement thanks

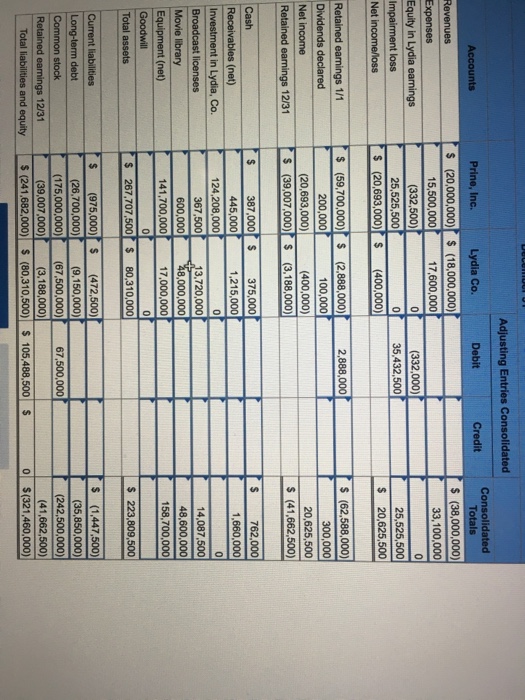

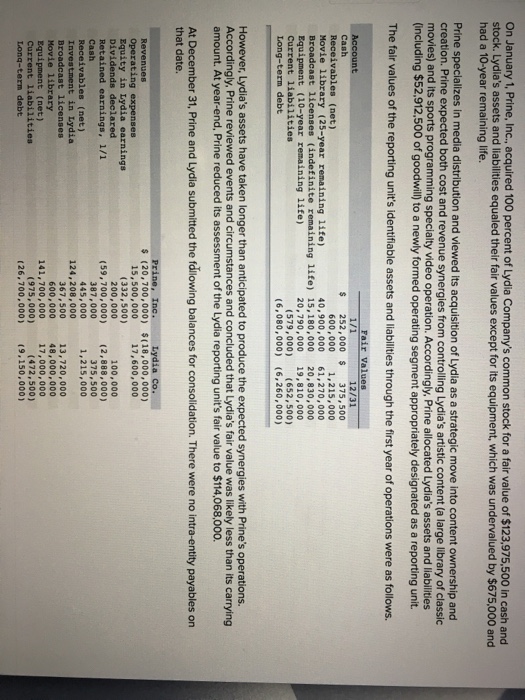

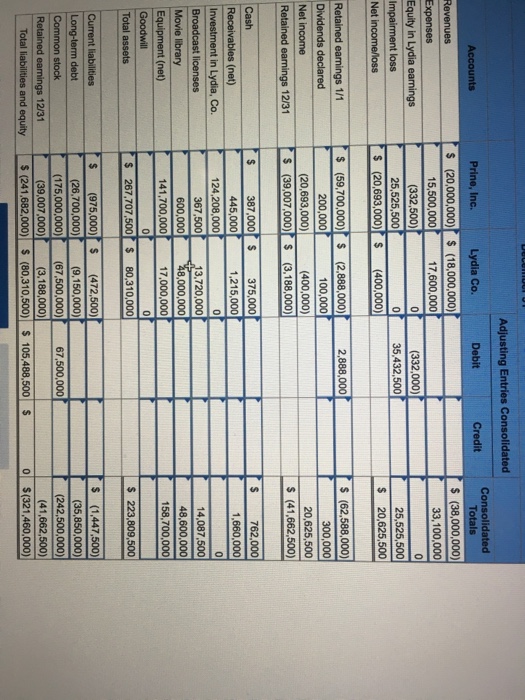

On January 1, Prine, Inc., acquired 100 percent of Lydia Company's common stock for a fair value of $123,975,500 in cash and stock. Lydia's assets and liabilities equaled their fair values except for its equipment, which was undervalued by $675,000 and had a 10-year remaining life. Prine speclalizes in media distribution and viewed its acquisition of Lydia as a strategic move into content ownership and creation. Prine expected both cost and revenue synergies from controlling Lydia's artistic content (a large library of classic movies) and its sports programming specialty video operation. Accordingly, Prine allocated Lydia's assets and liabilities (including $52,912,500 of goodwill) to a newly formed operating segment appropriately designated as a reporting unit The fair values of the reporting unit's identifiable assets and liabilities through the first year of operations were as follows. Fair values Cash Receivables (net) Movie library (25-year remaining life) 252,000 375,500 600,000 1,215,000 40,900,000 61,270,000 Broadcast licenses (indefinite remaining 1ife) 15,180,000 20,830,000 20,790,000 19,810,000 Equipment (10-year remaining life) Current liabilities Long-term debt (579,000) (652,500) (6,080,000) (6,260,000) However, Lydia's assets have taken longer than anticipated to produce the expected synergies with Prine's operations. Accordingly, Prine reviewed events and circumstances and concluded that Lydia's fair value was likely less than its carrying amount. At year-end, Prine reduced its assessment of the Lydia reporting unit's fair value to $114,068,000. At December 31, Prine and Lydia submitted the fdllowing balances for consolidation. There were no intra-entity payables on that date. ia Co. Prine, Inc. 15,500,000 200,000 s (20,700,000) $ (18,000,000) 17,600,000 Operating expenses Equity in Lydia earnings Dividends declared Retained earnings, 1/1 Cash (332,500) 100,000 (59,700,000) (2,888,000) 375,500 1,215,000 387,000 445,000 124,208, 000 367,500 600,000 141,700,000 Receivables (net) Investment in Lydia Broadcast licenses 13,720,000 48,000,000 17,000,000 Movie 1ibrary Equipment (net) Current liabi1ities Long-term debt (472,500) (26,700,000)(9,150,000) (975,000)

I only need the ine statement thanks

I only need the ine statement thanks