i only need those that are incorrect

i only need those that are incorrect

undefined

undefined

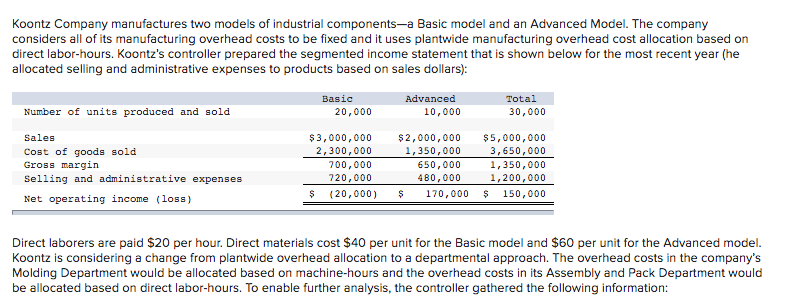

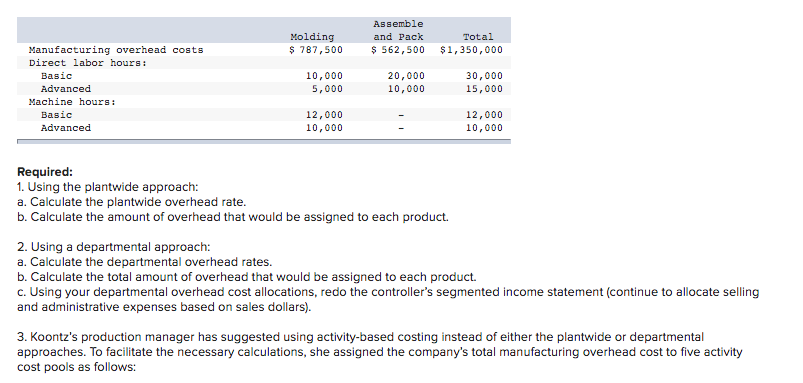

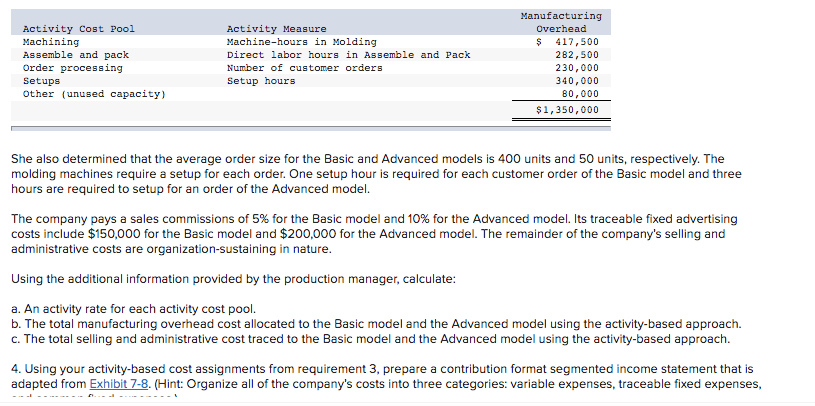

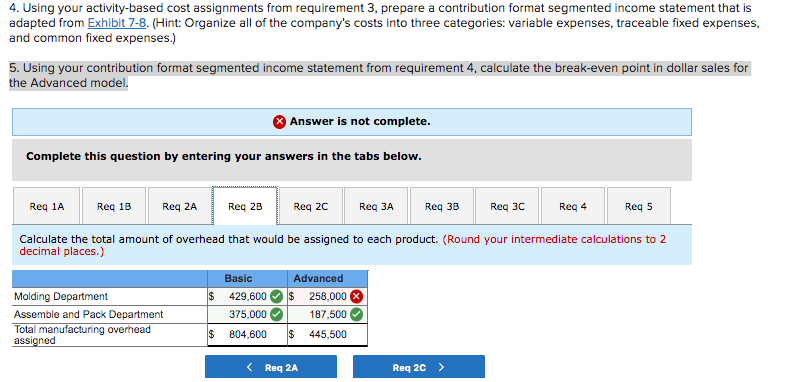

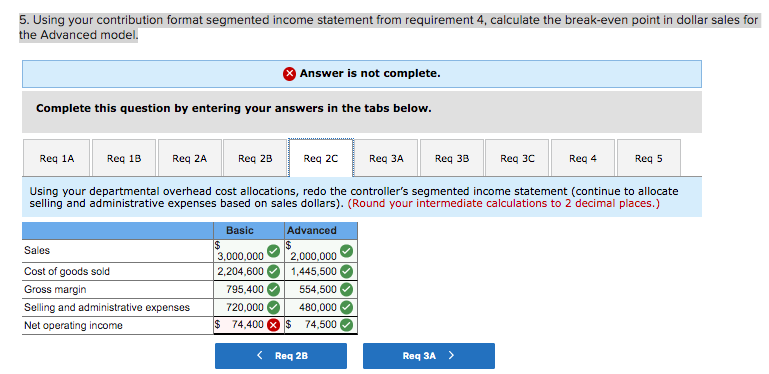

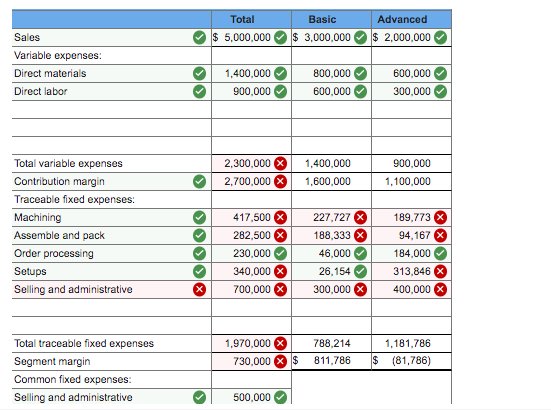

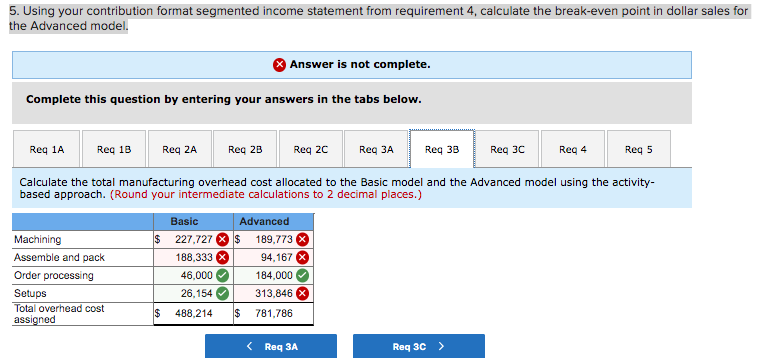

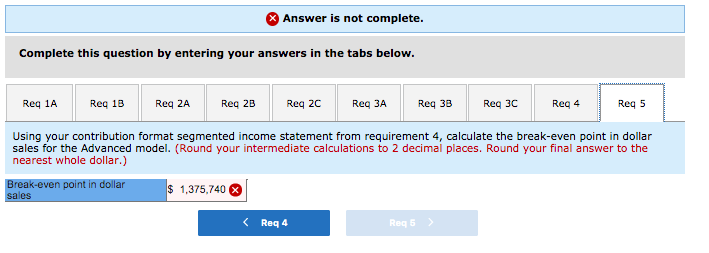

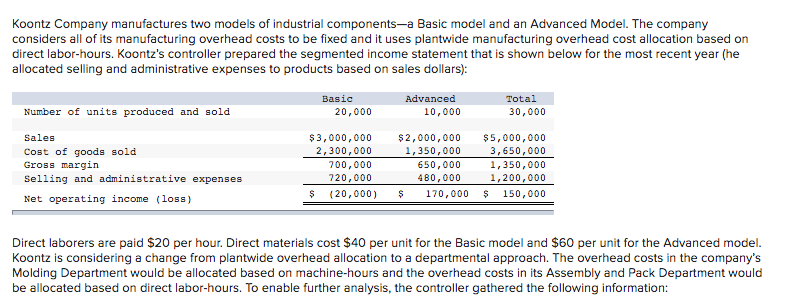

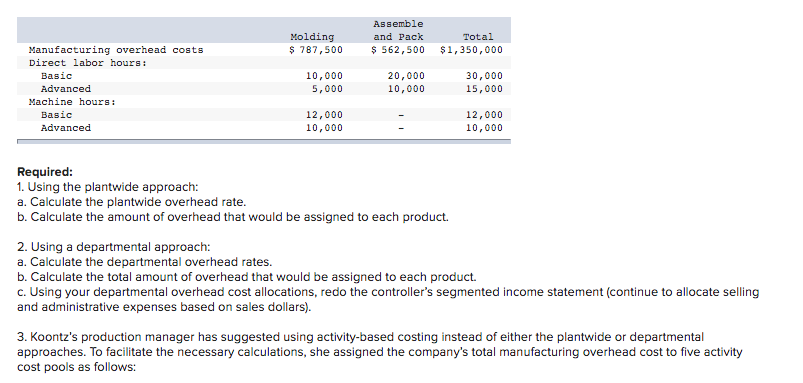

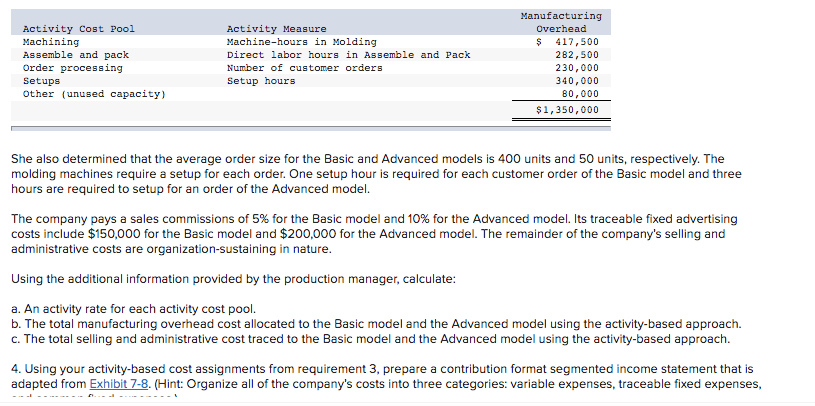

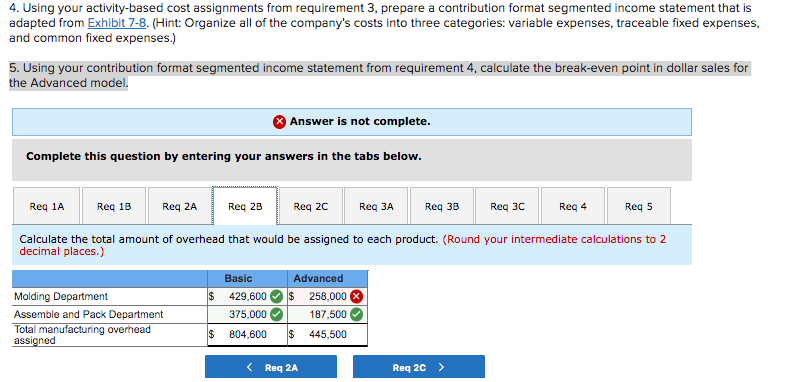

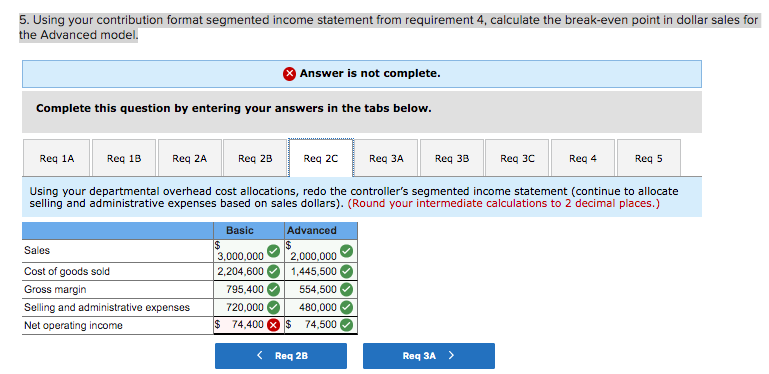

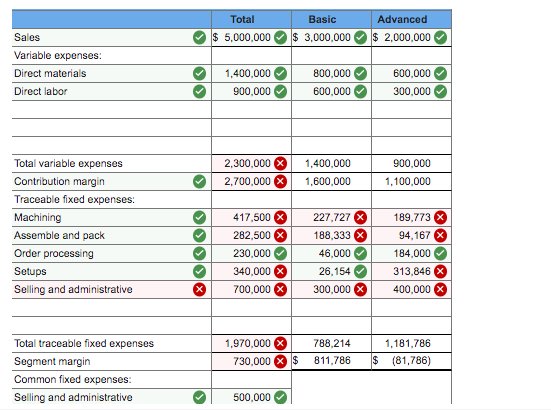

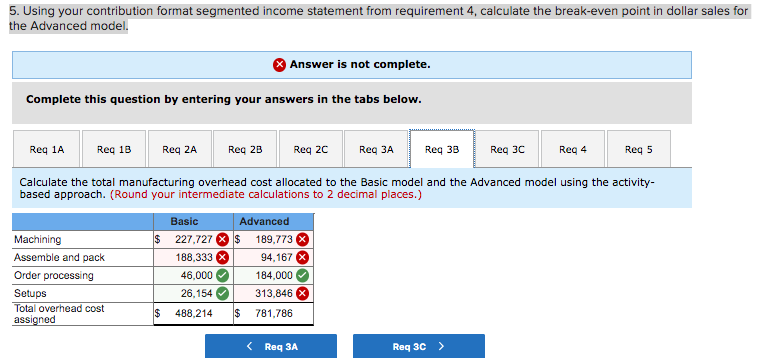

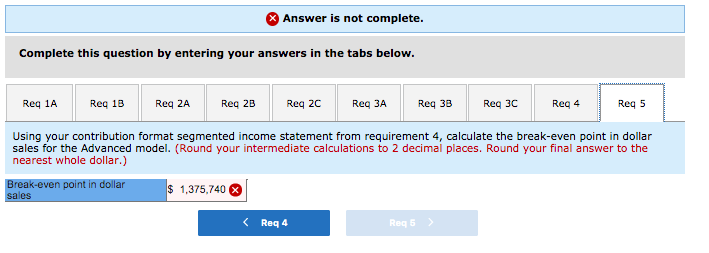

Koontz Company manufactures two models of industrial components-a Basic model and an Advanced Model. The company considers all of its manufacturing overhead costs to be fixed and it uses plantwide manufacturing overhead cost allocation based on direct labor-hours. Koontz's controller prepared the segmented income statement that is shown below for the most recent year (he allocated selling and administrative expenses to products based on sales dollars): Number of units produced and sold Basic 20,000 Advanced 10,000 Total 30,000 Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating income (loss) $3,000,000 2,300,000 700,000 720,000 $ (20,000) $2,000,000 1,350,000 650,000 480,000 $ 170,000 $5,000,000 3,650,000 1,350,000 1,200,000 $ 150,000 Direct laborers are paid $20 per hour. Direct materials cost $40 per unit for the Basic model and $60 per unit for the Advanced model. Koontz is considering a change from plantwide overhead allocation to a departmental approach. The overhead costs in the company's Molding Department would be allocated based on machine-hours and the overhead costs in its Assembly and Pack Department would be allocated based on direct labor-hours. To enable further analysis, the controller gathered the following information: Activity Cost Pool Machining Assemble and pack Order processing Setups Other (unused capacity) Activity Measure Machine-hours in Molding Direct labor hours in Assemble and Pack Number of customer orders Setup hours Manufacturing Overhead S 417,500 282,500 230,000 340,000 80,000 $1,350,000 She also determined that the average order size for the Basic and Advanced models is 400 units and 50 units, respectively. The molding machines require a setup for each order. One setup hour is required for each customer order of the Basic model and three hours are required to setup for an order of the Advanced model. The company pays a sales commissions of 5% for the Basic model and 10% for the Advanced model. Its traceable fixed advertising costs include $150,000 for the Basic model and $200,000 for the Advanced model. The remainder of the company's selling and administrative costs are organization-sustaining in nature. Using the additional information provided by the production manager, calculate: a. An activity rate for each activity cost pool. b. The total manufacturing overhead cost allocated to the Basic model and the Advanced model using the activity-based approach. c. The total selling and administrative cost traced to the Basic model and the Advanced model using the activity-based approach. 4. Using your activity-based cost assignments from requirement 3. prepare a contribution format segmented income statement that is adapted from Exhibit 7-8. (Hint: Organize all of the company's costs into three categories: variable expenses, traceable fixed expenses, 5. Using your contribution format segmented income statement from requirement 4, calculate the break-even point in dollar sales for the Advanced model. Answer is not complete. Complete this question by entering your answers in the tabs below. Reg 1A Reg 13 Req 2A Reg 23 Reg 2C Req 3A Reg 38 Reg 3C Reg 4 Reg 5 Using your departmental overhead cost allocations, redo the controller's segmented income statement (continue to allocate selling and administrative expenses based on sales dollars). (Round your intermediate calculations to 2 decimal places.) Basic Advanced $ Sales $ 3,000,000 2,000,000 Cost of goods sold 2,204,600 1,445,500 Gross margin 795,400 554,500 Selling and administrative expenses 720,000 480,000 Net operating income $ 74,400 X $ 74,500 Answer is not complete. Complete this question by entering your answers in the tabs below. Reg 1A Reg 13 Req ZA Reg 23 Reg 2C Req 3A Reg 33 Reg 3C Reg 4 Reg 5 Using your contribution format segmented income statement from requirement 4, calculate the break-even point in dollar sales for the Advanced model. (Round your intermediate calculations to 2 decimal places. Round your final answer to the nearest whole dollar.) Break-even point in dollar $ 1,375,740 sales Answer is not complete. Complete this question by entering your answers in the tabs below. Reg 1A Reg 13 Req ZA Reg 23 Reg 2C Req 3A Reg 33 Reg 3C Reg 4 Reg 5 Using your contribution format segmented income statement from requirement 4, calculate the break-even point in dollar sales for the Advanced model. (Round your intermediate calculations to 2 decimal places. Round your final answer to the nearest whole dollar.) Break-even point in dollar $ 1,375,740 sales

i only need those that are incorrect

i only need those that are incorrect

undefined

undefined