Answered step by step

Verified Expert Solution

Question

1 Approved Answer

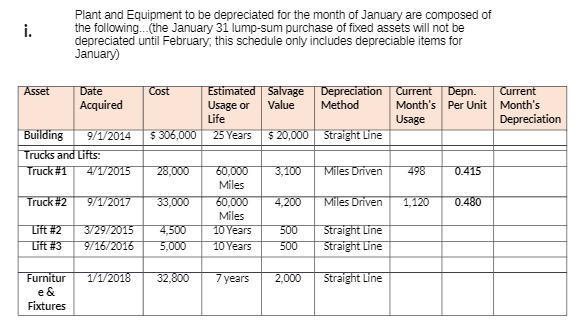

i. Plant and Equipment to be depreciated for the month of January are composed of the following...(the January 31 lump-sum purchase of fixed assets

i. Plant and Equipment to be depreciated for the month of January are composed of the following...(the January 31 lump-sum purchase of fixed assets will not be depreciated until February; this schedule only includes depreciable items for January) Asset Date Acquired Cost Estimated | Salvage Usage or Value Depreciation Current Method Depn. Month's Per Unit Current Building 9/1/2014 $306,000 Life 25 Years Usage Month's Depreciation $20,000 Straight Line Trucks and Lifts: Truck #1 4/1/2015 28,000 60,000 Miles 3,100 Miles Driven 498 0.415 Truck #2 9/1/2017 33,000 60,000 4,200 Miles Driven 1,120 0.480 Miles Lift #2 3/29/2015 Lift #3 9/16/2016 4,500 10 Years 500 Straight Line 5,000 10 Years 500 Straight Line Furnitur e & 1/1/2018 32,800 7 years 2,000 Straight Line Fixtures

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To calculate the depreciation for the month of January for the plant and equipment provided we need to determine the depreciation expense for e...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6642ac15d2329_976331.pdf

180 KBs PDF File

6642ac15d2329_976331.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started