Question

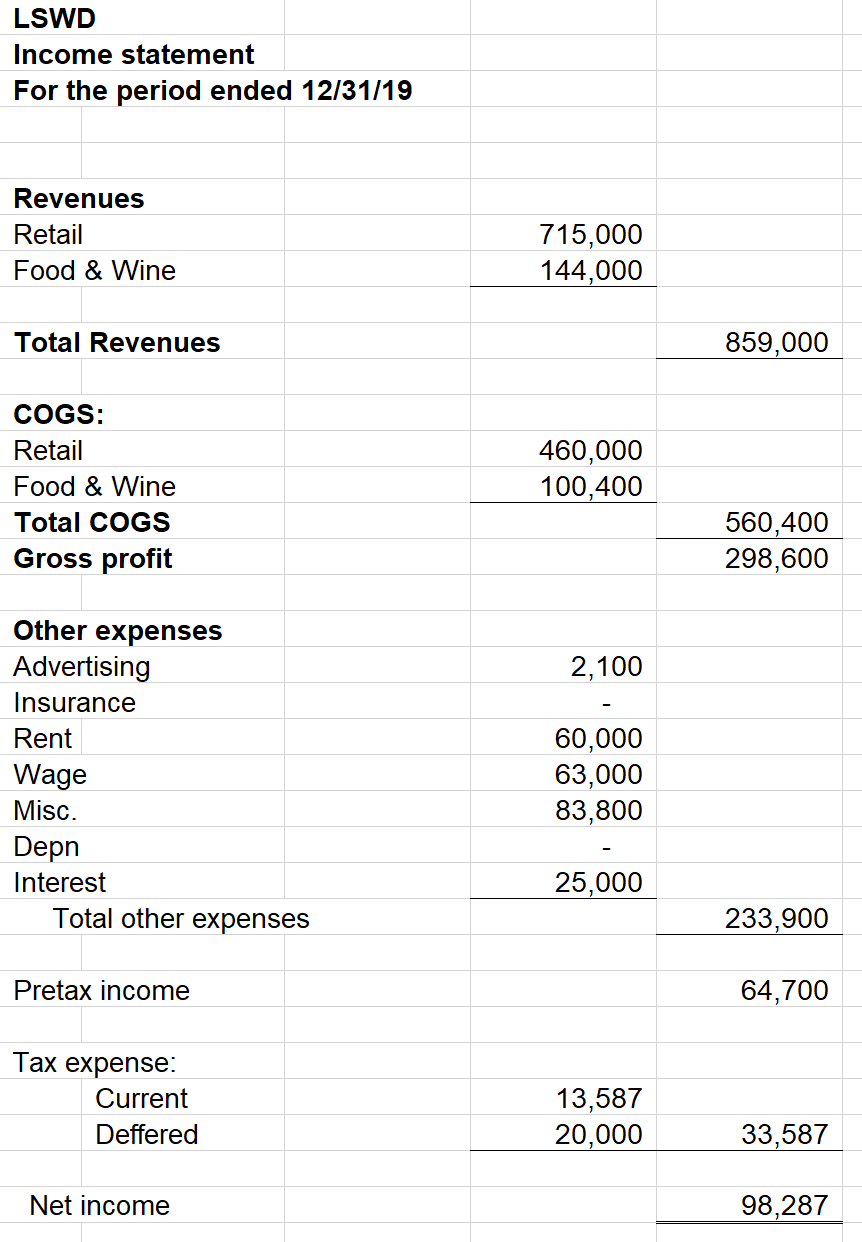

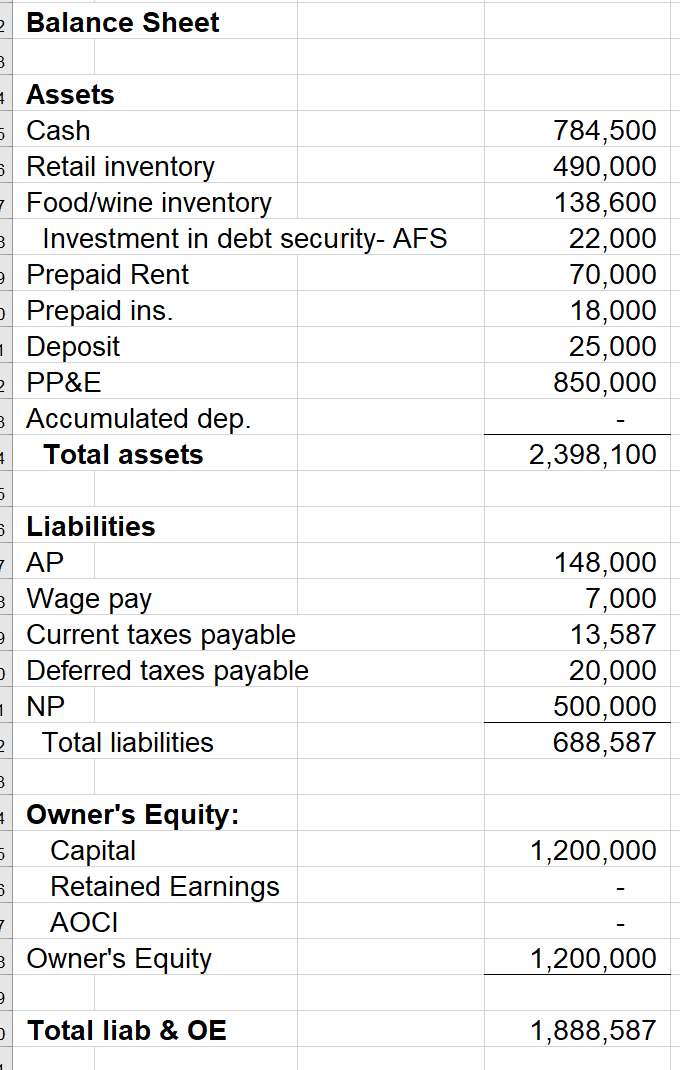

I please would like someone to check my work on the income statement and balance sheet. I started and I'm not sure if I did

I please would like someone to check my work on the income statement and balance sheet. I started and I'm not sure if I did it correctly. I have provided the Journal entries and t accounts I used. I also need help finding other comprehensive income. Your help is greatly appreciated!

Details used for Journal entries and Statements:

In May of 2019, Hayley and Ferdinand Chouinard decided to open a restaurant and wine bar in McCall, Idaho, a resort town about 90 miles north of Boise. The Chouinards had been following the growth in McCall for several years and considered it to be an area with great potential for their business. They were especially encouraged by French developer Jean-Pierre Boes plans to build Tamarack Resort, which will be located approximately 15 miles from McCall. Construction on the $1.5 billion destination ski and golf resort had begun in early 2019. Tamarack plans to target wealthy national and international vacationers, similar to resorts in Whistler, British Columbia and Vail, Colorado.

In addition to a full service restaurant and bar, Hayley and Ferdinand plan to have a small retail area to sell a unique selection of wines, cheeses and other related items. They began their search for a location in March and found what they considered to be an ideal space near the recently renovated Hotel McCall and walking distance to Payette Lake.

Pre-Opening Period

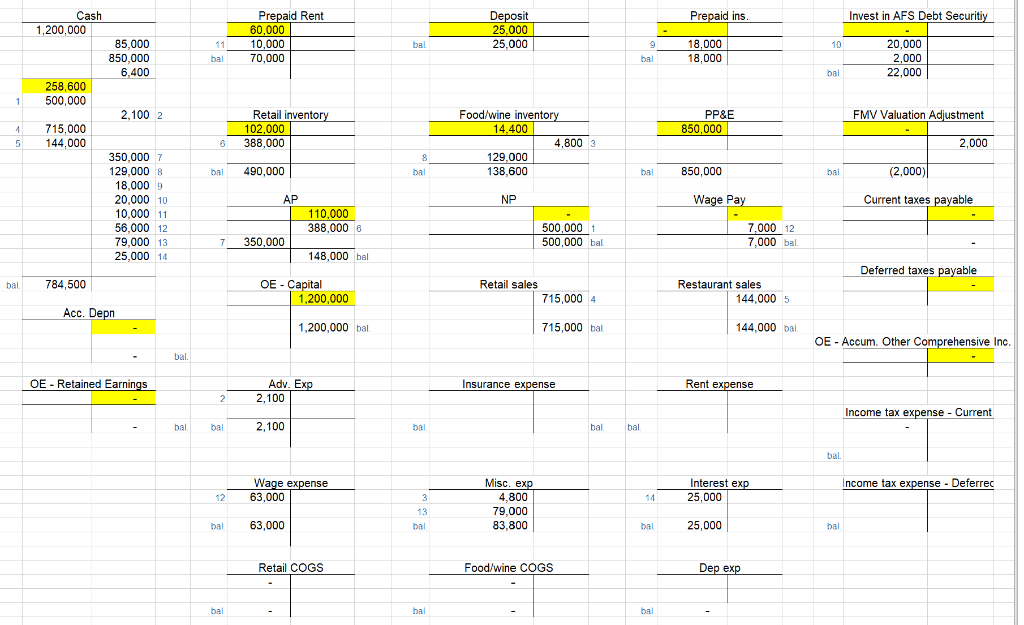

Hayley and Ferdinand invested $1,200,000 of personal funds and decided to call their new business Lake Street Wine and Dine (hereafter LSWD). On May 15, 2019 they signed a renewable 24-month lease for the location they desired. The lease required an up front payment for the first six months (covering July through December 2019) at the rate of $10,000 per month, plus an additional $25,000 damage deposit that was non-refundable if the lease was cancelled. While they were allowed to move in on June 1, consider the rental payment to cover the lease period from July 1 to December 31.

The grand opening was scheduled for July 1st and the month of June was used to prepare the facility and purchase retail merchandise and restaurant supplies. The prior tenant had been a buffet restaurant, so extensive paint and remodeling was necessary in order to create the atmosphere they desired. The cost (all paid in cash) of remodeling the interior space totaled $600,000 and the cost of furnishings was an additional $250,000, including furnishings for the kitchen, bar, and a point of sale computer system. They expected the useful life of the leasehold improvements, furnishings and equipment to be 10 years.

In an effort to attract the Tamarack clientele, Hayley and Ferdinand decided to carry a high-end wine selection along with some northwest favorites, which would differ from those offered in the restaurant. They placed their initial retail wine order with a distributor in early June and their first merchandise arrived June 20th with an invoice for $102,000 payable to the distributor. They also ordered wine that would be served in the restaurant from the same distributor. These shipments of consumable items arrived on the same day with an invoice for $8,000 payable to the distributor. Lastly, they acquired food and supplies for the kitchen from local food distributors for cash payments totaling $6,400.

On June 25th Hayley and Ferdinand reviewed the last minute preparations for opening day as well as where their bank account stood. Hayley was concerned they had two outstanding invoices to suppliers totaling $110,000 and that their cash balance had dwindled down to $258,600. Ferdinand summarized his concerns. In one month, we have gone through $941,400 and that doesnt count the outstanding invoices we still owe. We wont be in business very long at this rate.

On June 30th, Hayley and Ferdinand consulted with Ann Stamey, a local certified public accountant, on setting up accounting records for LSWD and advice about obtaining additional funding. For example, should they seek other investors or should they try to get a loan? Ann explained that, while their bank balance was declining, they were not losing money; rather they were investing in assets. Even so, they were right to be concerned with the amount of cash remaining. After Ann explained the options of seeking equity versus debt financing, Hayley and Ferdinand decided to seek a loan as protection against cash shortages.

The First Six Months of Operations

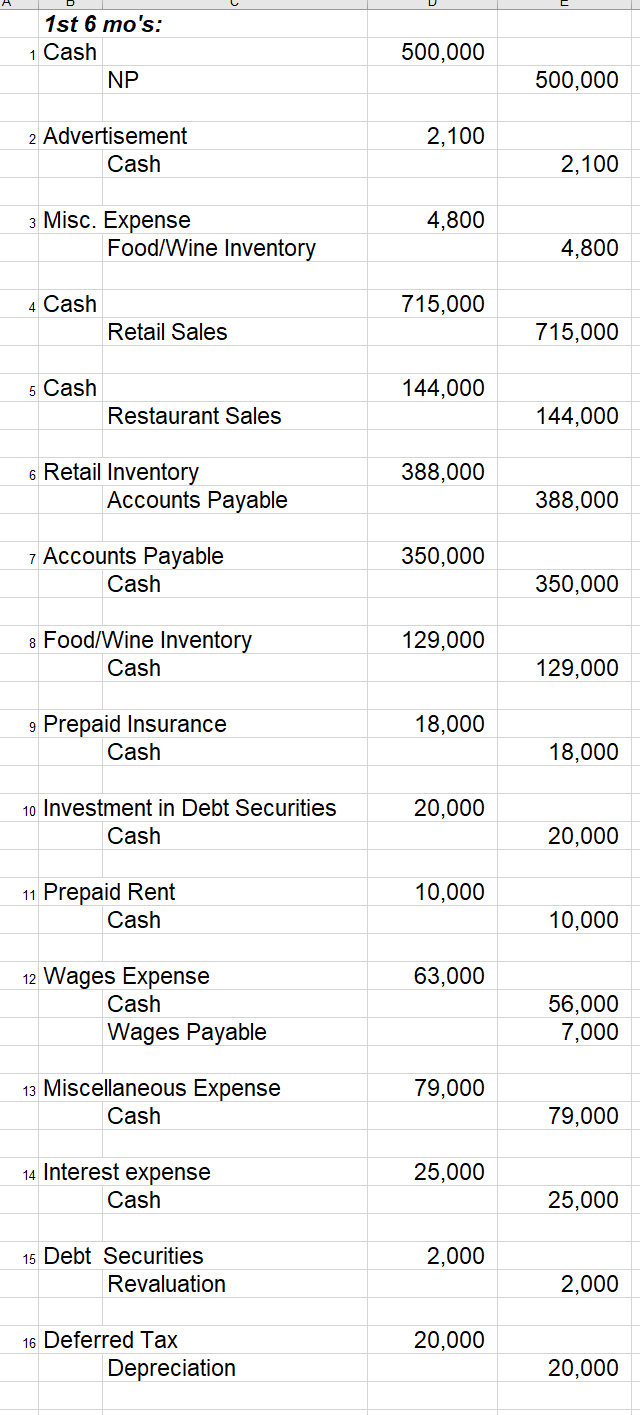

On July 1st, they obtained a loan for $500,000 from a local bank, payable at the end of two years with semi-annual interest payments at an annual rate of 10%. Feeling more comfortable about the companys cash position, Hayley and Ferdinand proceeded with their plans for the grand opening of LSWD.

The Grand Opening event was advertised in the local newspaper and via flyers posted at the other area merchants. The total cost of the advertising for the grand opening was $2,100, which was paid in cash. As planned, on July 1st the doors opened to the public and, as an opening promotion, they had free wine tasting and live music. They estimated the cost of wine for the free tasting to be $4,800. Note that they used wine from the food/wine inventory for the tasting. Friends in a band volunteered to play at the event so no fee was paid for the live music. Given the amount of foot traffic they had received during the day, the opening day seemed like a success. A summary of other events for the first six months of operations follows:

- Retail sales for the first six-month period ending December 31, 2019 totaled $715,000. All sales were for cash.

- Restaurant sales (including food and wine) totaled $144,000 for the first six-month period ending December 31, 2019. All sales were cash sales.

- Between July 1, 2019 and December 31, 2019, LSWD took delivery of retail inventories (i.e., inventories other than food and wine to be served in the restaurant) valued at $388,000. All merchandise was purchased on account. During the six months, LSWD made payments to suppliers in the amount of $350,000.

- Between July 1, 2019 and December 31, 2019, LSWD took delivery of restaurant food and wine inventory valued at $129,000. All were paid in cash.

- A one-year insurance policy to cover miscellaneous liabilities was purchased on September 1, 2019 for $18,000.

- The company purchased Investments in debt securities classified as available-for-sale on September 30, 2019 for $20,000.

- Payment of $10,000 was made on December 20, 2019 to cover Januarys rent.

- Wages for part-time employees during the six-month period ended December 31, 2019 totaled $63,000. Of that amount, $7,000 was unpaid at December 31, 2019.

- Miscellaneous expenses (including Ann Stameys consulting fee) totaling $79,000 were paid in cash.

- Interest for the first six months was paid December 31, 2019.

Other information:

- Inventories on hand at December 31, 2019 for retail merchandise were valued at $30,000 and inventories for restaurant food and wine were valued at $43,000.

- The Investments in debt securities classified as available-for-sale had a fair market value of 22,000 at December 31, 2019.

- The tax rate in 2019 is 21% and no new rate has been enacted for future years. Excess of tax depreciation over book depreciation is $20,000.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started