Answered step by step

Verified Expert Solution

Question

1 Approved Answer

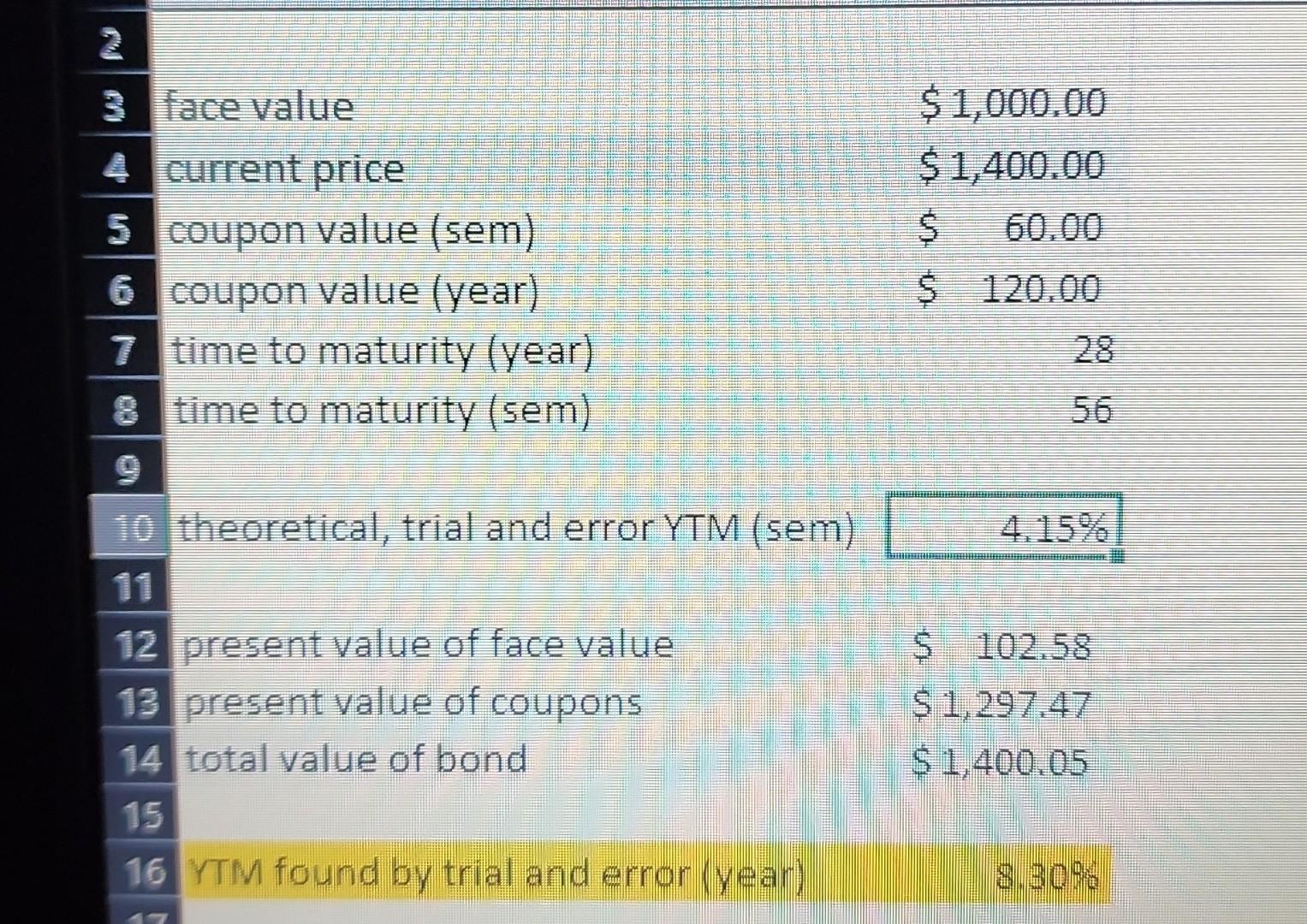

I posted the problem and the solution, can anyone explain me How we got 4.15%- by trial and error, what it is trial and error

I posted the problem and the solution, can anyone explain me How we got "4.15%"- by trial and error, what it is trial and error formula, I just need the formula and explanation how to get "4.15%" here, please.

al h. Leveraged Corporation has bonds with face value $1,000 at the current price of $1,400. If the semiannual coupon value is $60 ($60 every six months), maturing in exactly 28 years from now, calculate the YTM of this bond. i. Company RS's bonds outstanding have coupon rate of 6% and semiannual payments. If the YTM 2 $1,000.00 $1,400.00 S 60.00 $ 120.00 3 face value 4 current price 5 coupon value (sem) 6 coupon value (year) 7 time to maturity (year) 8 time to maturity (sem) 9 10 theoretical, trial and error YTM (sem) 28 4.15% $ 102.58 12 present value of face value 13 present value of coupons 14 total value of bond S1,297.47 $ 1.400.05 15 16 YTM found by trial and error year)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started