Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I posted this earlier and couldn't get an answer. I redid what i thought was wrong, can anyone help out and explain if i did

I posted this earlier and couldn't get an answer. I redid what i thought was wrong, can anyone help out and explain if i did anything wrong?

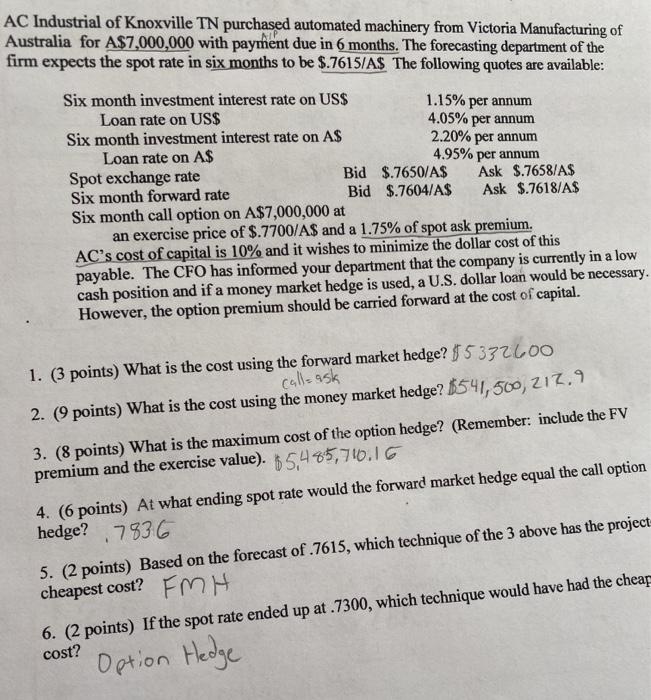

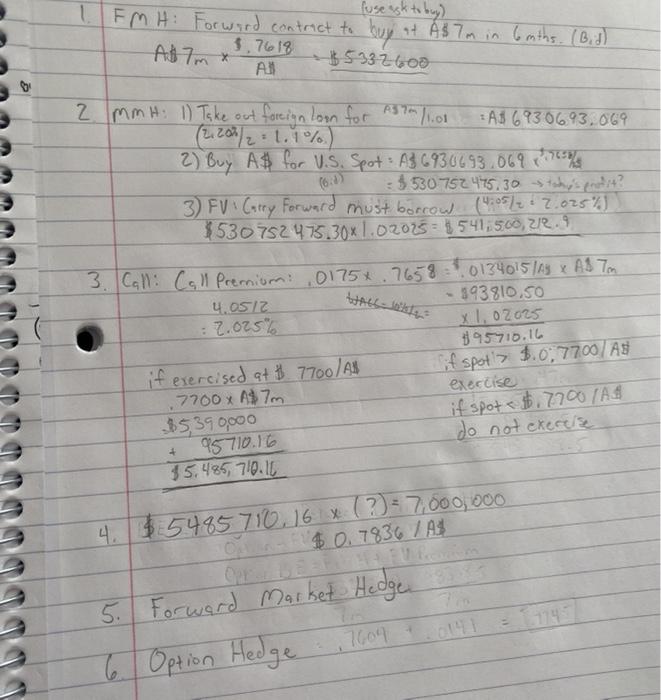

AC Industrial of Knoxville TN purchased automated machinery from Victoria Manufacturing of Australia for A$7,000,000 with payment due in 6 months. The forecasting department of the firm expects the spot rate in six months to be $.7615/A$ The following quotes are available: Six month investment interest rate on US$ 1.15% per annum Loan rate on US$ 4.05% per annum Six month investment interest rate on AS 2.20% per annum Loan rate on A$ 4.95% per annum Spot exchange rate Bid $.7650/A$ Ask $.7658/A$ Six month forward rate Bid $.7604/A$ Ask $.7618/A$ Six month call option on A$7,000,000 at an exercise price of $.7700/A$ and a 1.75% of spot ask premium. AC's cost of capital is 10% and it wishes to minimize the dollar cost of this payable. The CFO has informed your department that the company is currently in a low cash position and if a money market hedge is used, a U.S. dollar loan would be necessary. However, the option premium should be carried forward at the cost of capital. 1. (3 points) What is the cost using the forward market hedge? $5332000 call-ask 2. (9 points) What is the cost using the money market hedge? $541,500, 212.9 3. (8 points) What is the maximum cost of the option hedge? (Remember: include the FV premium and the exercise value). $5,485,710.16 4. (6 points) At what ending spot rate would the forward market hedge equal the call option hedge? 7836 5. (2 points) Based on the forecast of 7615, which technique of the 3 above has the project cheapest cost? FMH 6. (2 points) If the spot rate ended up at 7300, which technique would have had the cheap cost? Option Hedge fuse ask to buy) 1. FM H: Forward contract to buy at A$7m in 6mths. (Bid) A17m x 35337600 A3 3.7618 2. mm H: 1) Take out foreign Loon for A57/100 (2. 202/2.1.1%) = A$ 6930693.069 2) Buy A$ for U.S. Spot: A36930693.069 76% $530752475.30 things dit? 3) FV Catry Forward must borrow (4:05)2 : 2.025%) $530752475.30x1.02025 = 1541, 500, 212.9 3. Call Call Premium: 0175x.7658 10134015 IAS & ASTM 4.0512 393810.50 : 2.025 X 1,02025 $95710.14 if exercised at $ 7700/AS if spots $.0,77.00 / A5 7700x A$7m exercise $5,390,000 95710.16 do not exercise 35.485,710.11 it spot

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started