Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(i) Project cost-benefit analysis (ii) Private cost-benefit analysis (iii) efficiency cost-benefit analysis (iv) Aggregate cost-benefit analysis A firm based in and owned by investors in

(i) Project cost-benefit analysis

(ii) Private cost-benefit analysis

(iii) efficiency cost-benefit analysis

(iv) Aggregate cost-benefit analysis

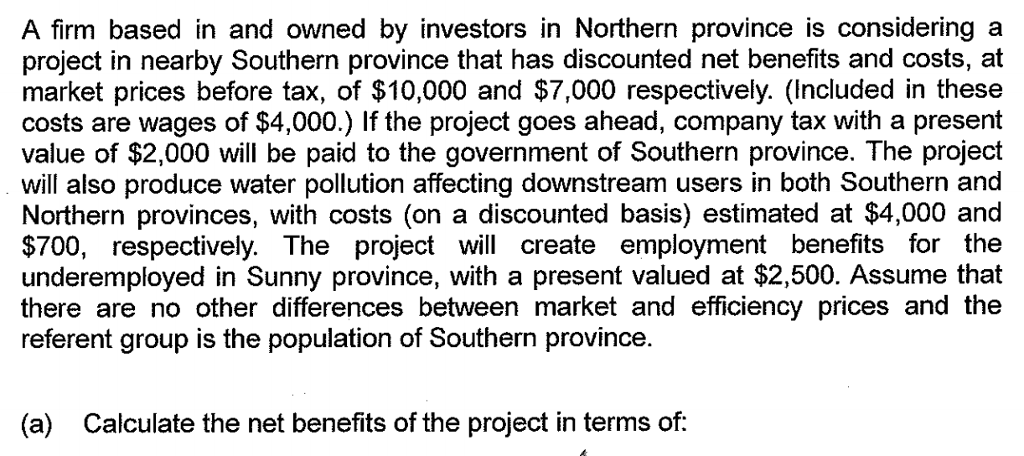

A firm based in and owned by investors in Northern province is considering a project in nearby Southern province that has discounted net benefits and costs, at market prices before tax, of $10,000 and $7,000 respectively. (Included in these costs are wages of $4,000.) If the project goes ahead, company tax with a present value of $2,000 will be paid to the government of Southern province. The project will also produce water pollution affecting downstream users in both Southern and Northern provinces, with costs (on a discounted basis) estimated at $4,000 and $700, respectively. The project will create employment benefits for the underemployed in Sunny province, with a present valued at $2,500. Assume that there are no other differences between market and efficiency prices and the referent group is the population of Southern province. (a) Calculate the net benefits of the project in terms ofStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started