I provide all the information as well as question 1 memo I WANT YOU TO DO QUESTION 2

I provide all the information as well as question 1 memo I WANT YOU TO DO QUESTION 2

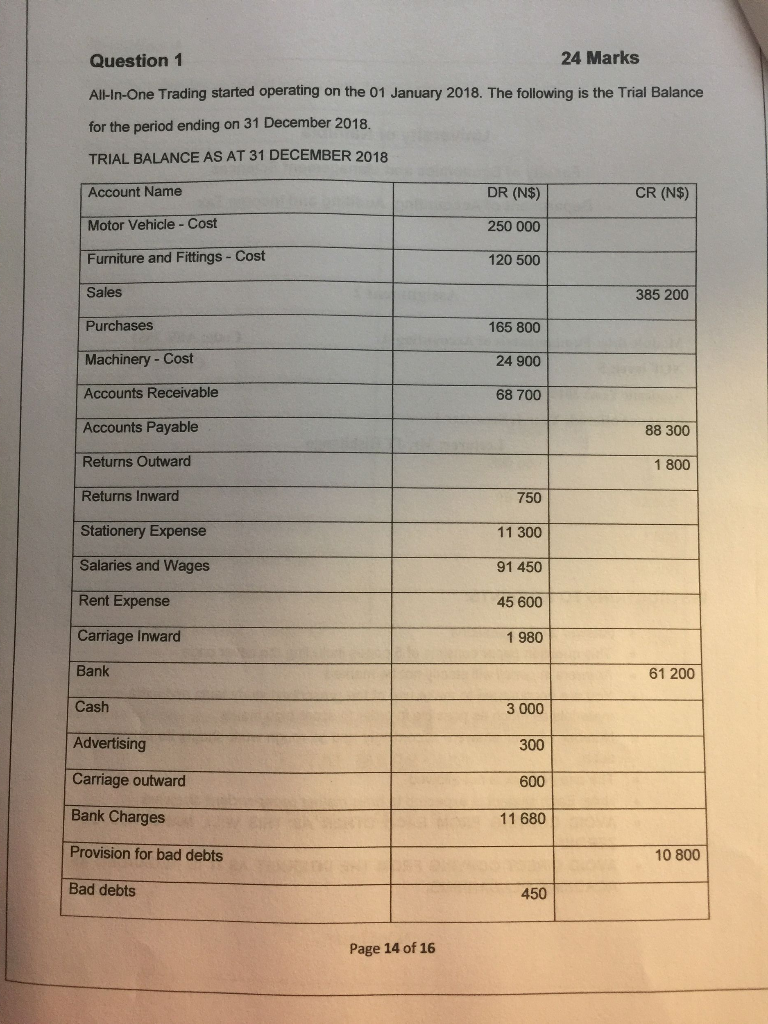

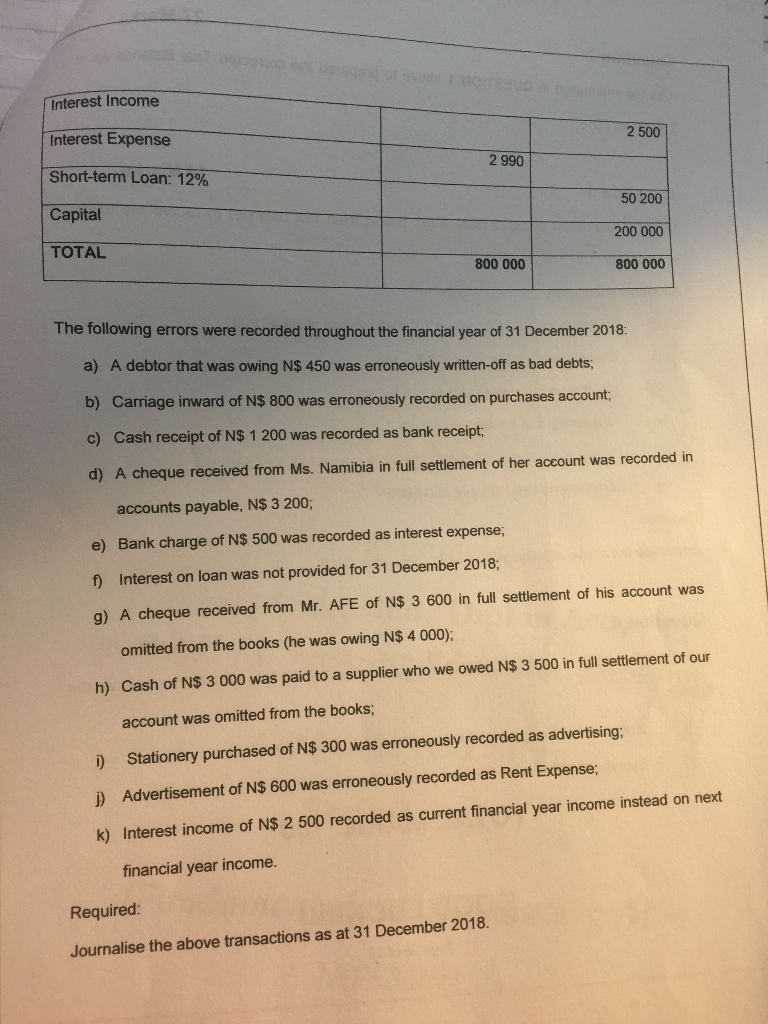

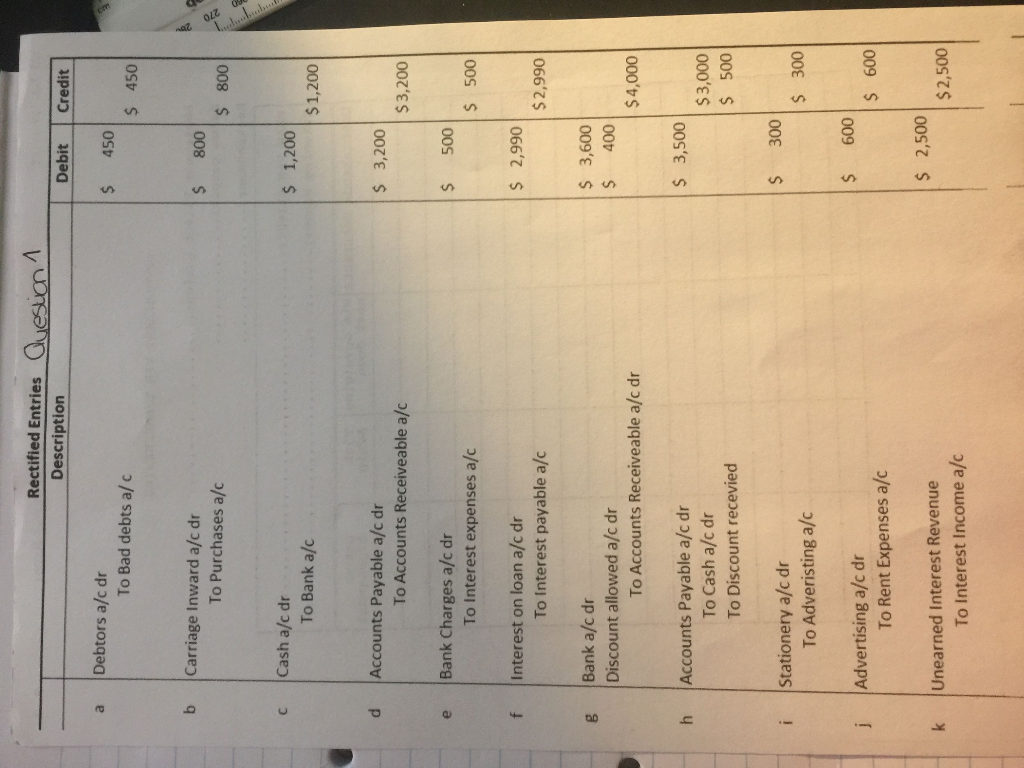

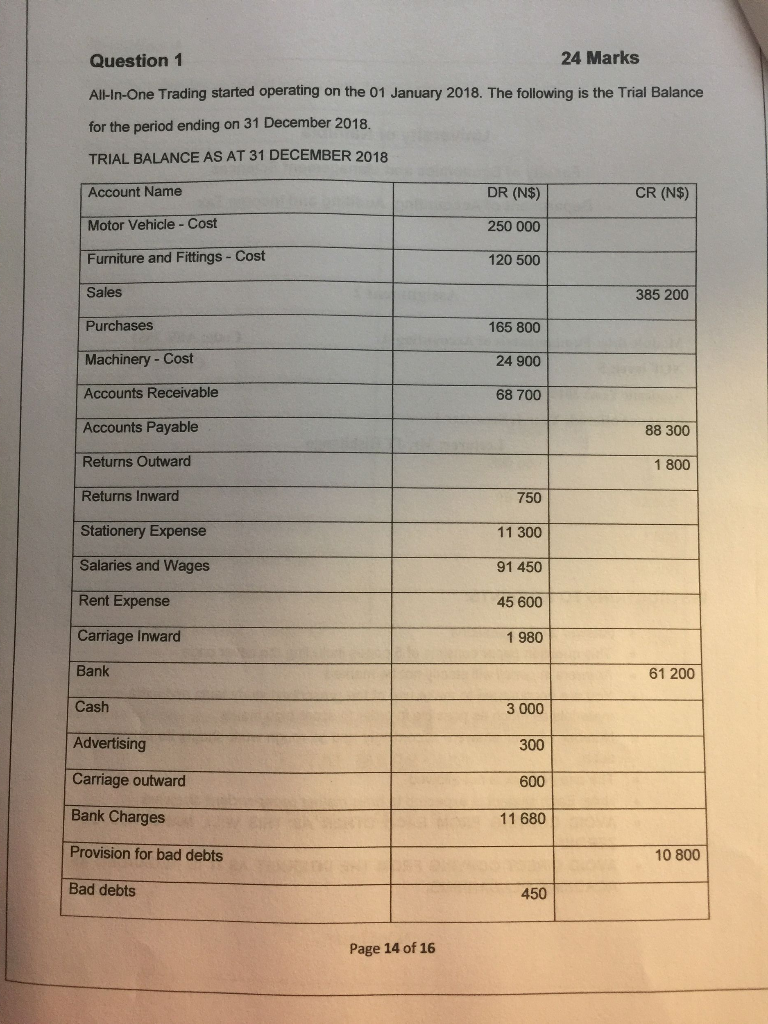

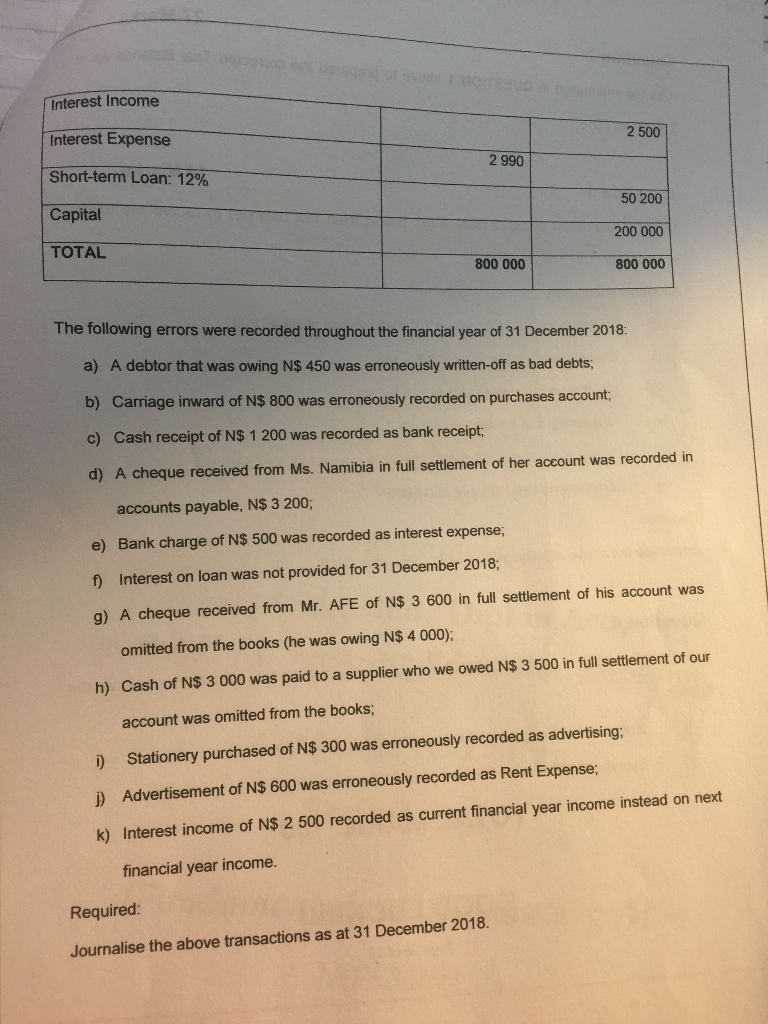

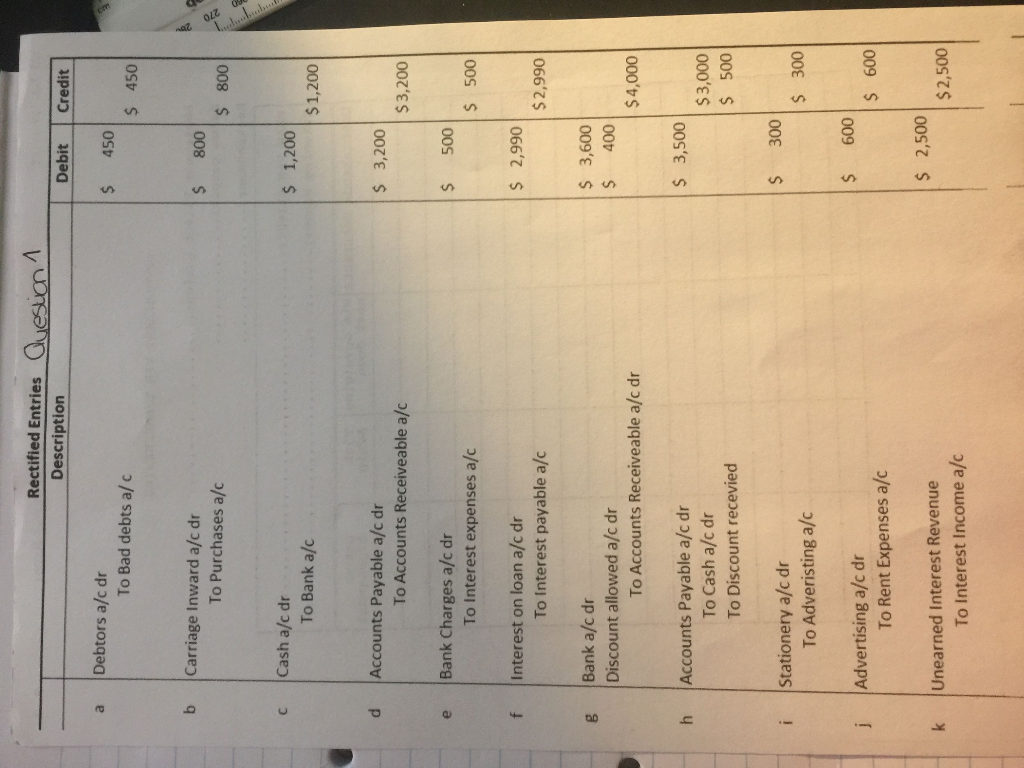

Question 1 Al-In-One Trading started operating on the 01 January 2018. The following is the Trial Balance for the period ending on 31 December 2018. TRIAL BALANCE AS AT 31 DECEMBER 2018 Account Name 24 Marks DR (N$) 250 000 120 500 CR (N$) Motor Vehicle Cost Furniture and Fittings Cost Sales 385 200 Purchases 165 800 24 900 68 700 Machinery Cost Accounts Receivable Accounts Payable Returns Outward Returns Inward Stationery Expense Salaries and Wages Rent Expense Carriage Inward Bank Cash Advertising 88 300 1 800 750 11 300 91 450 45 600 1 980 61 200 3 000 300 600 11680 Carriage outward Bank Charges Provision for bad debts 10 800 Bad debts 450 Page 14 of 16 Interest Income Interest Expense Short-term Loan: 12% Capital TOTAL 2 500 2 990 50 200 200 000 800 000 800 000 The following errors were recorded throughout the financial year of 31 December 2018: a) A debtor that was owing N$ 450 was erroneously written-off as bad debts b) Carriage inward of N$ 800 was erroneously recorded on purchases account c) Cash receipt of N$ 1 200 was recorded as bank receipt d) A cheque received from Ms. Namibia in full settlement of her account was recorded in accounts payable, N$ 3 200; e) Bank charge of N$ 500 was recorded as interest expense; f) Interest on loan was not provided for 31 December 2018; g) A cheque received from Mr. AFE of N$ 3 600 in full settlement of his account was omitted from the books (he was owing N$ 4 000) h) Cash of NS 3 000 was paid to a supplier who we owed NS 3 500 in full settlement of our account was omitted from the books; ) Stationery purchased of N$ 300 was erroneously recorded as advertising: ) Advertisement of N$ 600 was erroneously recorded as Rent Expense; k) Interest income of N$ 2 500 recorded as current financial year income instead on next financial year income. Required: Journalise the above transactions as at 31 December 2018. Rectified Entries Quesion Description Debit Credit a Debtors a/c dr $ 450 To Bad debts a/ c s 450 b Carriage Inward a/c dr s 800 To Purchases a/c $ 800 c Cash a/c dr s 1,200 To Bank a/c $1,200 d Accounts Payable a/c dr s 3,200 To Accounts Receiveable a/c $ 3,200 e Bank Charges a/c dr $ 500 To Interest expenses a/c S 500 f Interest on loan a/c dr s 2,990 To Interest payable a/c $2,990 g Bank a/c dr Discount allowed a/c dr S 3,600 S 400 To Accounts Receiveable a/c dr $4,000 h Accounts Payable a/c dr 3,500 To Cash a/c dr To Discount recevied $3,000 S 500 s 300 i Stationery a/c dr s 300 To Adveristing a/c Advertising a/c dr Unearned Interest Revenue $ 600 s 600 To Rent Expenses a/c $2,500 $ 2,500 To Interest Income a/c Question 2 Use the information in QUESTION 1 above to prepared the corrected Trial Balance as at 31 December 2018. 27 Marks

I provide all the information as well as question 1 memo I WANT YOU TO DO QUESTION 2

I provide all the information as well as question 1 memo I WANT YOU TO DO QUESTION 2