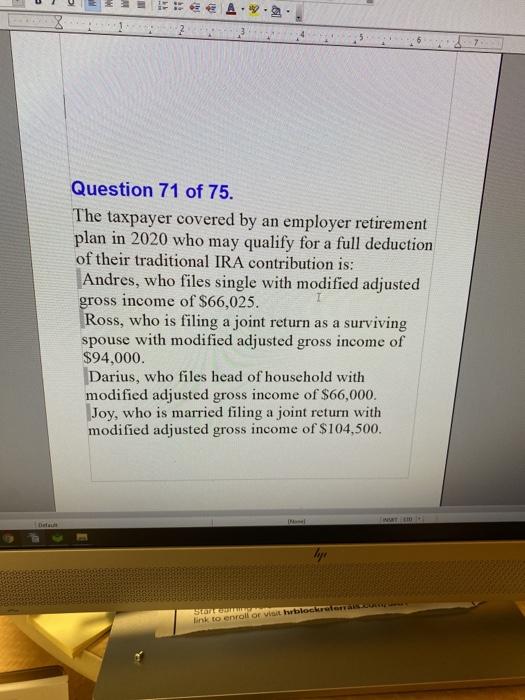

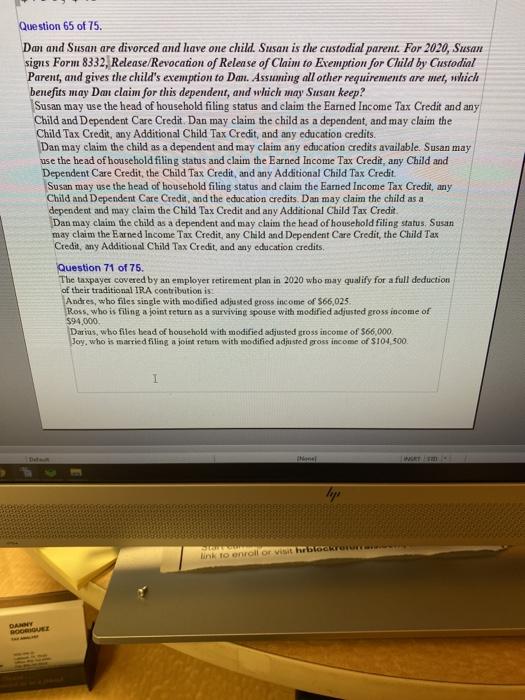

i - Question 71 of 75. The taxpayer covered by an employer retirement plan in 2020 who may qualify for a full deduction of their traditional IRA contribution is: Andres, who files single with modified adjusted gross income of $66,025. Ross, who is filing a joint return as a surviving spouse with modified adjusted gross income of $94.000. Darius, who files head of household with modified adjusted gross income of $66,000. Joy, who is married filing a joint return with modified adjusted gross income of $104,500. lige SISSE link to enroll or visit locktree Question 65 of 75. Dan and Susan are divorced and have one child. Susan is the custodial parent. For 2020, Susan signs Form 8332, Release/Revocation of Release of Claim to Exemption for Child by Custodial Parent, and gives the child's exemption to Dan. Assuming all other requirements are met, which benefits may Dan claim for this dependent, and which may Susan keep? Susan may use the head of household filing status and claim the Eamed Income Tax Credit and any Child and Dependent Care Credit. Dan may claim the child as a dependent, and may claim the Child Tax Credit, any Additional Child Tax Credit, and any education credits. Dan may claim the child as a dependent and may claim any education credits available. Susan may use the head of household filing status and claim the Earned Income Tax Credit, any Child and Dependent Care Credit, the Child Tax Credit, and any Additional Child Tax Credit Susan may use the head of household filing status and claim the Earned Income Tax Credit, any Child and Dependent Care Credit, and the ecacation credits. Dan may claim the child as a dependent and may claim the Child Tax Credit and any Additional Child Tax Credit Dan may claim the child as a dependent and may claim the head of household filing status, Susan may claim the Earned Income Tax Credit, any Child and Dependent Care Credit, the Child Tax Credit, any Additional Child Tax Credit, and any education credits Question 71 of 75 The taxpayer covered by an employer retirement plan in 2020 who may qualify for a full deduction of their traditional IRA contribution is Andres, who files single with modified adjusted gross income of $66,025 Ross, who is filing a joint return as a surviving spouse with modified adjusted gross income of $94.000 Darias, who files head of household with modified adjusted gross income of $66,000 Joy, who is married filing a joint retam with modified adjusted gross income of $104.500 I hy Link to enroll on vist her... DANNY BOOMULE i - Question 71 of 75. The taxpayer covered by an employer retirement plan in 2020 who may qualify for a full deduction of their traditional IRA contribution is: Andres, who files single with modified adjusted gross income of $66,025. Ross, who is filing a joint return as a surviving spouse with modified adjusted gross income of $94.000. Darius, who files head of household with modified adjusted gross income of $66,000. Joy, who is married filing a joint return with modified adjusted gross income of $104,500. lige SISSE link to enroll or visit locktree Question 65 of 75. Dan and Susan are divorced and have one child. Susan is the custodial parent. For 2020, Susan signs Form 8332, Release/Revocation of Release of Claim to Exemption for Child by Custodial Parent, and gives the child's exemption to Dan. Assuming all other requirements are met, which benefits may Dan claim for this dependent, and which may Susan keep? Susan may use the head of household filing status and claim the Eamed Income Tax Credit and any Child and Dependent Care Credit. Dan may claim the child as a dependent, and may claim the Child Tax Credit, any Additional Child Tax Credit, and any education credits. Dan may claim the child as a dependent and may claim any education credits available. Susan may use the head of household filing status and claim the Earned Income Tax Credit, any Child and Dependent Care Credit, the Child Tax Credit, and any Additional Child Tax Credit Susan may use the head of household filing status and claim the Earned Income Tax Credit, any Child and Dependent Care Credit, and the ecacation credits. Dan may claim the child as a dependent and may claim the Child Tax Credit and any Additional Child Tax Credit Dan may claim the child as a dependent and may claim the head of household filing status, Susan may claim the Earned Income Tax Credit, any Child and Dependent Care Credit, the Child Tax Credit, any Additional Child Tax Credit, and any education credits Question 71 of 75 The taxpayer covered by an employer retirement plan in 2020 who may qualify for a full deduction of their traditional IRA contribution is Andres, who files single with modified adjusted gross income of $66,025 Ross, who is filing a joint return as a surviving spouse with modified adjusted gross income of $94.000 Darias, who files head of household with modified adjusted gross income of $66,000 Joy, who is married filing a joint retam with modified adjusted gross income of $104.500 I hy Link to enroll on vist her... DANNY BOOMULE