Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I really appreciate for your commitment to reply with full answer but the Schedule 1040 of 2017 is different from the schedule 1040 of 2020.

I really appreciate for your commitment to reply with full answer but the Schedule 1040 of 2017 is different from the schedule 1040 of 2020. You are required to answer with the updated one. I need only the 1040 Schedule of 2020, which is the shorter one. The one you posted, I could find in the System because I am Chegg subscriber. Why I promised to give additional pay because I am asking u additional questions! Please I need Schedule 1040 of 2020 not Schedule 1040 of 2017. Adane

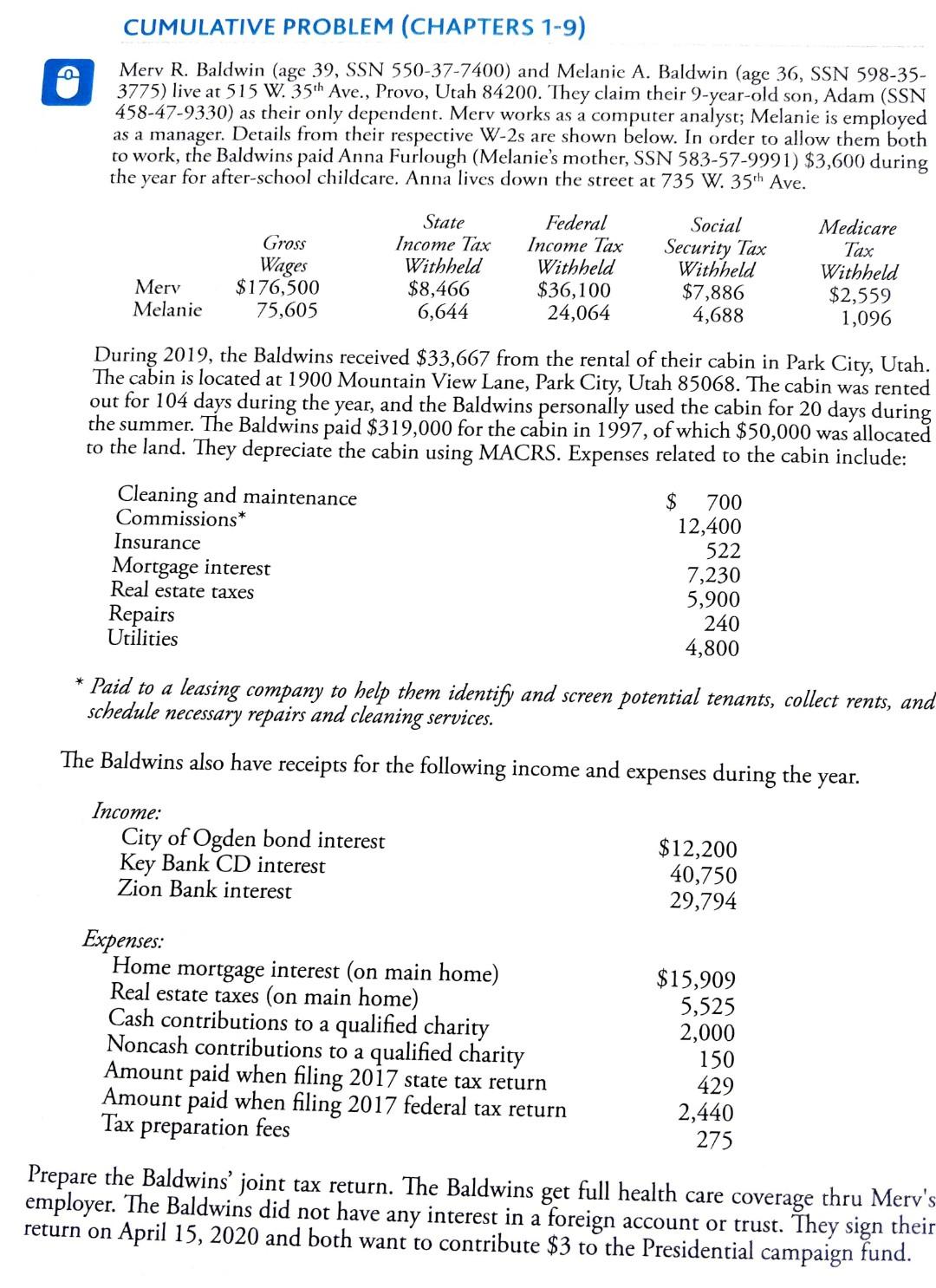

CUMULATIVE PROBLEM (CHAPTERS 1-9) Merv R. Baldwin (age 39, SSN 550-37-7400) and Melanie A. Baldwin (age 36, SSN 598-35- 3775) live at 515 W. 35th Ave., Provo, Utah 84200. They claim their 9-year-old son, Adam (SSN 458-47-9330) as their only dependent. Merv works as a computer analyst; Melanie is employed as a manager. Details from their respective W-2s are shown below. In order to allow them both to work, the Baldwins paid Anna Furlough (Melanie's mother, SSN 583-57-9991) $3,600 during the year for after-school childcare. Anna lives down the street at 735 W. 35th Ave. State Income Tax Withheld $8,466 6,644 Gross Wages $176,500 75,605 Federal Income Tax Withheld $36,100 24,064 Social Security Tax Withheld $7,886 4,688 Medicare Tax Withheld $2,559 1,096 Mery Melanie During 2019, the Baldwins received $33,667 from the rental of their cabin in Park City, Utah. The cabin is located at 1900 Mountain View Lane, Park City, Utah 85068. The cabin was rented out for 104 days during the year, and the Baldwins personally used the cabin for 20 days during the summer. The Baldwins paid $319,000 for the cabin in 1997, of which $50,000 was allocated to the land. They depreciate the cabin using MACRS. Expenses related to the cabin include: Cleaning and maintenance Commissions Insurance Mortgage interest Real estate taxes Repairs Utilities $ 700 12,400 522 7,230 5,900 240 4,800 Paid to a leasing company to help them identify and screen potential tenants, collect rents, and schedule necessary repairs and cleaning services. The Baldwins also have receipts for the following income and expenses during the year. Income: City of Ogden bond interest $12,200 Key Bank CD interest 40,750 Zion Bank interest 29,794 Expenses: Home mortgage interest (on main home) Real estate taxes (on main home) Cash contributions to a qualified charity Noncash contributions to a qualified charity Amount paid when filing 2017 state tax return Amount paid when filing 2017 federal tax return Tax preparation fees $15,909 5,525 2,000 150 429 2,440 275 Prepare the Baldwins' joint tax return. The Baldwins get full health care coverage thru Mery's employer. The Baldwins did not have any interest in a foreign account or trust. They sign their return on April 15, 2020 and both want to contribute $3 to the Presidential campaign fund. CUMULATIVE PROBLEM (CHAPTERS 1-9) Merv R. Baldwin (age 39, SSN 550-37-7400) and Melanie A. Baldwin (age 36, SSN 598-35- 3775) live at 515 W. 35th Ave., Provo, Utah 84200. They claim their 9-year-old son, Adam (SSN 458-47-9330) as their only dependent. Merv works as a computer analyst; Melanie is employed as a manager. Details from their respective W-2s are shown below. In order to allow them both to work, the Baldwins paid Anna Furlough (Melanie's mother, SSN 583-57-9991) $3,600 during the year for after-school childcare. Anna lives down the street at 735 W. 35th Ave. State Income Tax Withheld $8,466 6,644 Gross Wages $176,500 75,605 Federal Income Tax Withheld $36,100 24,064 Social Security Tax Withheld $7,886 4,688 Medicare Tax Withheld $2,559 1,096 Mery Melanie During 2019, the Baldwins received $33,667 from the rental of their cabin in Park City, Utah. The cabin is located at 1900 Mountain View Lane, Park City, Utah 85068. The cabin was rented out for 104 days during the year, and the Baldwins personally used the cabin for 20 days during the summer. The Baldwins paid $319,000 for the cabin in 1997, of which $50,000 was allocated to the land. They depreciate the cabin using MACRS. Expenses related to the cabin include: Cleaning and maintenance Commissions Insurance Mortgage interest Real estate taxes Repairs Utilities $ 700 12,400 522 7,230 5,900 240 4,800 Paid to a leasing company to help them identify and screen potential tenants, collect rents, and schedule necessary repairs and cleaning services. The Baldwins also have receipts for the following income and expenses during the year. Income: City of Ogden bond interest $12,200 Key Bank CD interest 40,750 Zion Bank interest 29,794 Expenses: Home mortgage interest (on main home) Real estate taxes (on main home) Cash contributions to a qualified charity Noncash contributions to a qualified charity Amount paid when filing 2017 state tax return Amount paid when filing 2017 federal tax return Tax preparation fees $15,909 5,525 2,000 150 429 2,440 275 Prepare the Baldwins' joint tax return. The Baldwins get full health care coverage thru Mery's employer. The Baldwins did not have any interest in a foreign account or trust. They sign their return on April 15, 2020 and both want to contribute $3 to the Presidential campaign fundStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started