I really just need help with the December. 31st. Please help me.

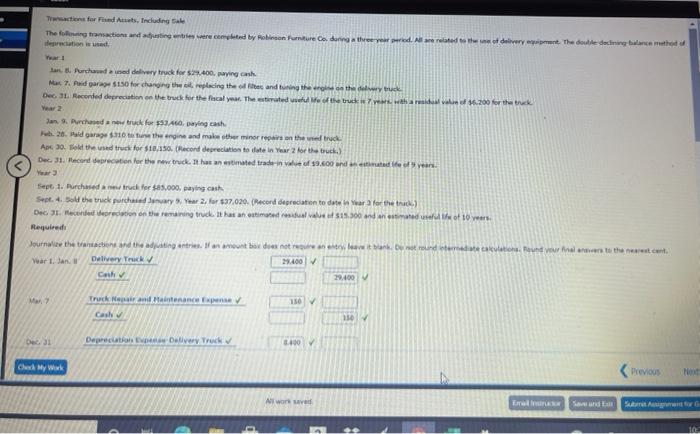

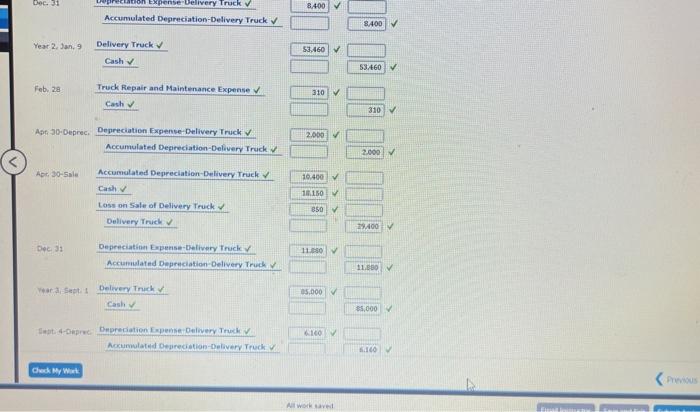

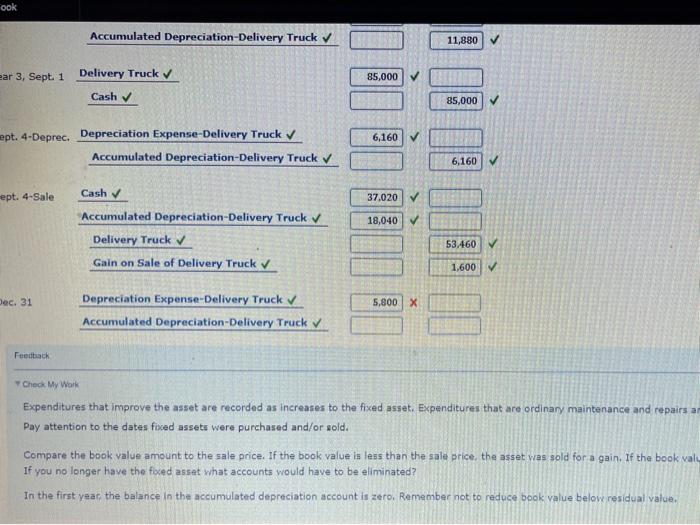

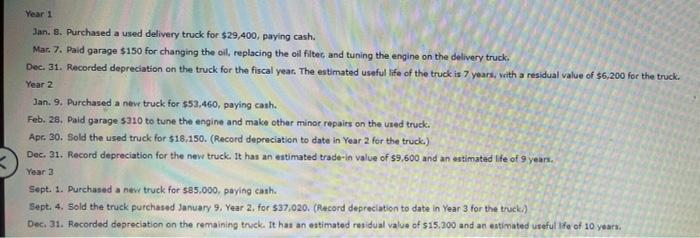

Tractions for Fred As Including Sale The following transactions and acting entries are creted by Robinson Four Co dang three year. related to the of delivery int. The double declining ance method depreciation used tart. . Purchased and delivery truck for 2400, aying at Mac 7. Poid garage $150 for changing the replacing the other and furing there the dewry truck Dec. Recorded depreciation on the back for the fiscal year. The estimated web e of the truck wahamud 16.200 for the truck Year 2 Jan . Perchased truck for $530, Dwying cash Feb 28 Pud garage $10 tore the engine and make other minor repairs on the truck Apr 30 od the used truck for $10.450. record depreciation to date In Year 2 for the truck) Dec. 3. Pecord deprecation for the new truck. It has an estimated trade-on value of $9.500 and an emated te et Year Sept 1. Purchased and trade to as.000, paying cash Sept. 4. Do the truck purchased ar 2 for $37.020. (Record depreciation to date war 2 for the Dec I. confecration on the remaining truck. It has an estimated $15.300 med of 10 years Required Journals the transactions and the adjusting entries. Wanaount bor does not regret it bank. De mest round die Laevisto una veur haal as to the nearest curt Year 1.Jan Delivery 28.400 Cach 29.400 150 Truck Metal and Maintenance Cash 150 Dec 31 Depreciation onlivery Truck 3:40 Cu My Work Previous Net All wort ved Dec. 31 8400 Expense Delivery Truck Accumulated Depreciation-Delivery Truck 8400 Year 2. Jan. 9 Delivery Truck 53,460 Cash 53.460 Feb 28 Truck Repair and Maintenance Expense Cash 310 310 Apr 30-Deprec. Depreciation Expense-Delivery Truck Accumulated Depreciation Delivery Truck 2.000 2.000 A. 30-Sale 10.400 Accumulated Depreciation Delivery Truck Cash Loss on Sale of Delivery Truck Delivery Truck 1.150 V 850 29.400V Dec 3: 11.00 Depreciation Expense-Delivery Truck Accumulated Depreciation Delivery Truck 11.00 Wear Sett Delivery Truck 35.000 $5,000 10 4-Op Depreciation Expense Delivery Truck Accumulated Degrediation-Delivery Truck 160 Check My War AWO ook Accumulated Depreciation-Delivery Truck 11,880 ear 3, Sept. 1 Delivery Truck 85,000 Cash 85,000 6,160 eept. 4-Deprec. Depreciation Expense-Delivery Truck Accumulated Depreciation-Delivery Truck 6,160 ept. 4-Sale Cash 37,020 18,040 Accumulated Depreciation-Delivery Truck Delivery Truck Gain on Sale of Delivery Truck 53.460 1,600 Dec. 31 5,800 x Depreciation Expense-Delivery Truck Accumulated Depreciation-Delivery Truck Feedback Check My Work Expenditures that improve the asset are recorded as increases to the fixed asset. Expenditures that are ordinary maintenance and repairs an Pay attention to the dates focad assets were purchased and/or sold. Compare the book value amount to the sale price. If the book value is less than the sale price, the asset was sold for a gain. If the book value If you no longer have the faced asset what accounts would have to be eliminated? In the first year the balance in the accumulated depreciation account is zero. Remember not to reduce book value below residual value, Year 1 Jan. 8. Purchased a used delivery truck for $29,400, paying cash. Mar. 7. Paid garage $150 for changing the oil, replacing the oil filter, and tuning the engine on the delivery truck. Dec. 31. Recorded depreciation on the truck for the fiscal year. The estimated useful life of the truck is 7 years, with a residual value of $5,200 for the truck. Year 2 Jan. 9. Purchased a new truck for $52,460, paying cash. Feb. 28. Paid garage 5310 to tune the engine and make other minor repaits on the used truck. Apr. 30. Sold the used truck for $18,150. (Record depreciation to date in Year 2 for the truck.) Dec. 31. Record depreciation for the new truck. It has an estimated trade-in value of 59,600 and an estimated life of 9 years. Year 3 Sept. 1. Purchased a new truck for $85.000, paying cash. Sept. 4. Sold the truck purchased January 9, Year 2. for $37,020. (Record depreciation to date in Year 3 for the truck) Dec. 31. Recorded depreciation on the remaining truck. It has an estimated residual value of 515.200 and an estimated useful life of 10 years