I really need help with all of these problems before 2:00 PM eastern standard time tomorrow, 5/01/2019. Thank you!

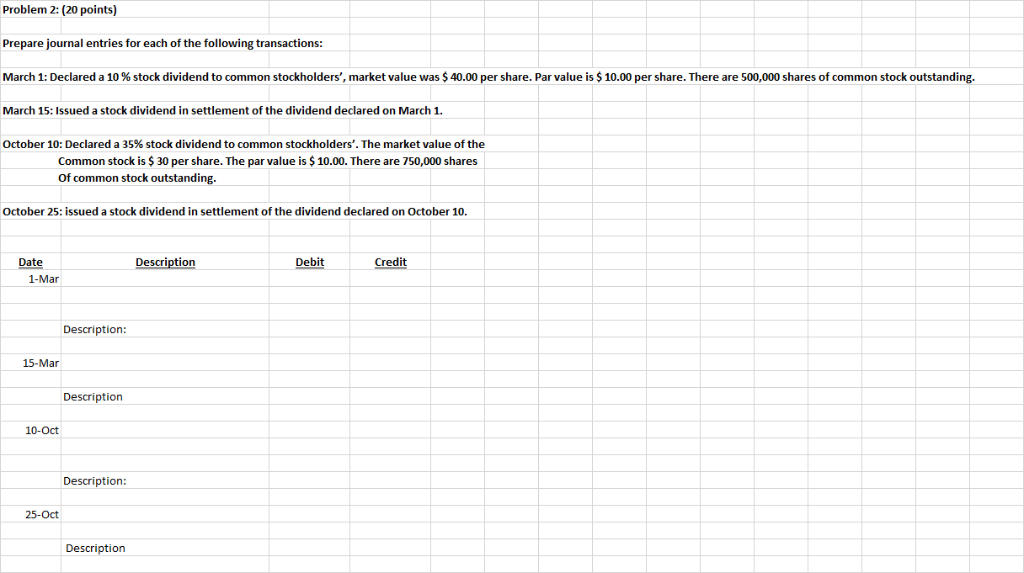

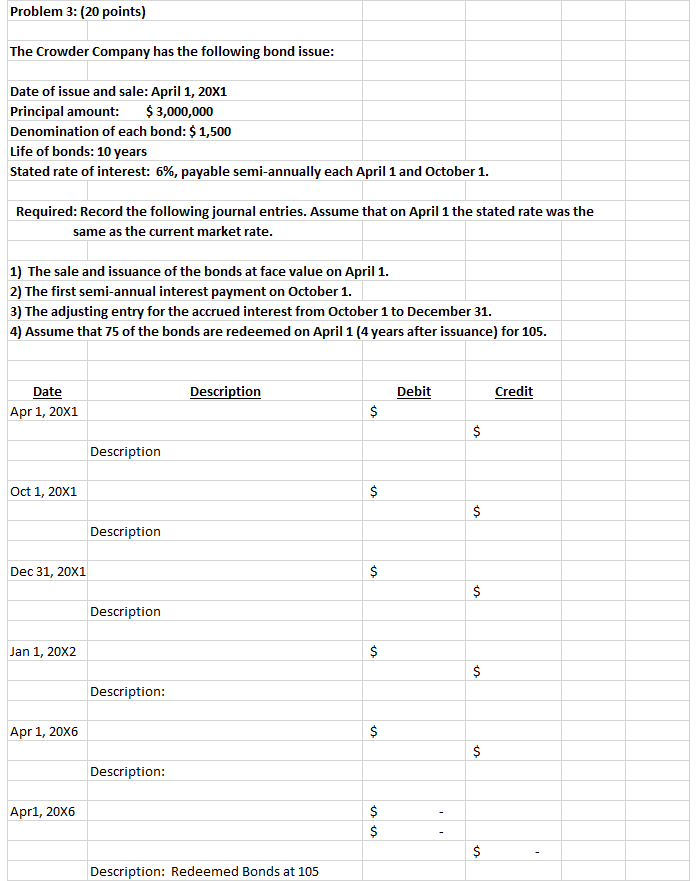

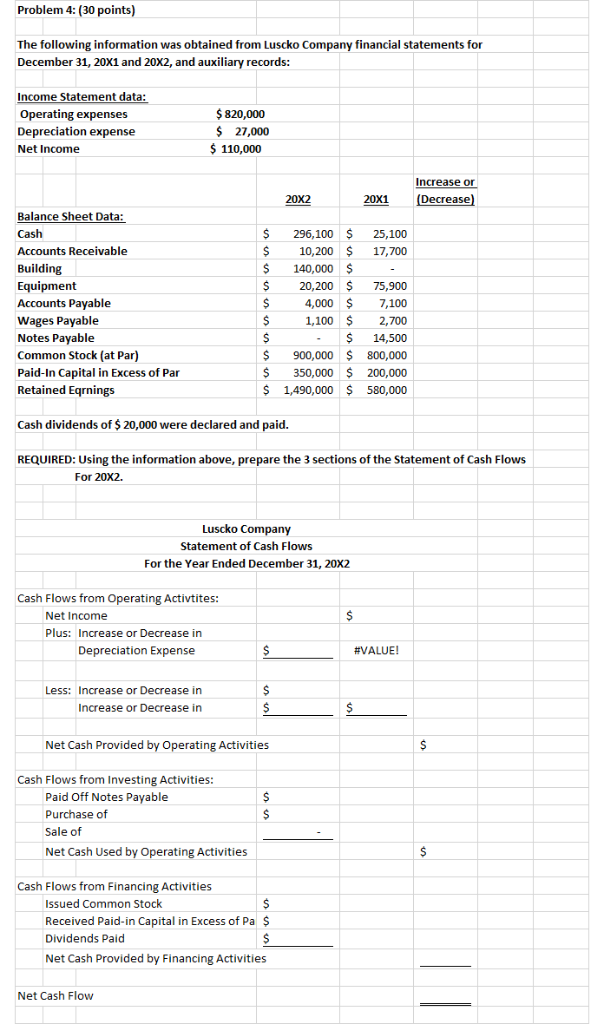

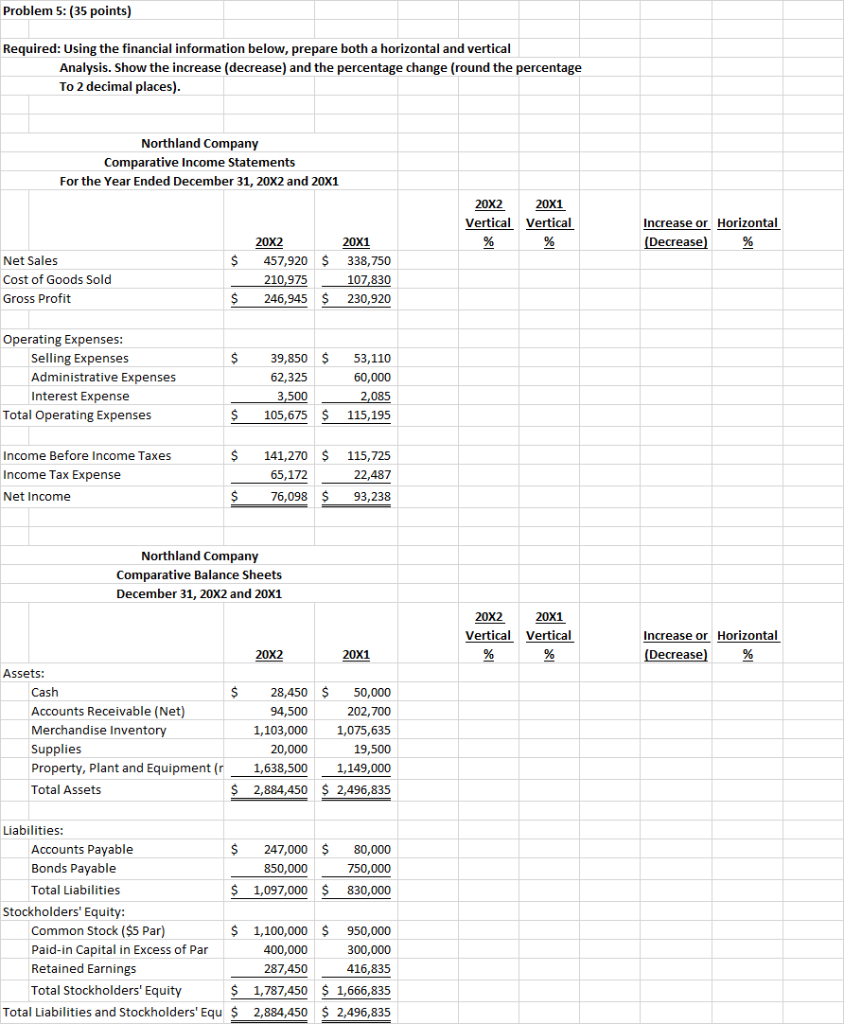

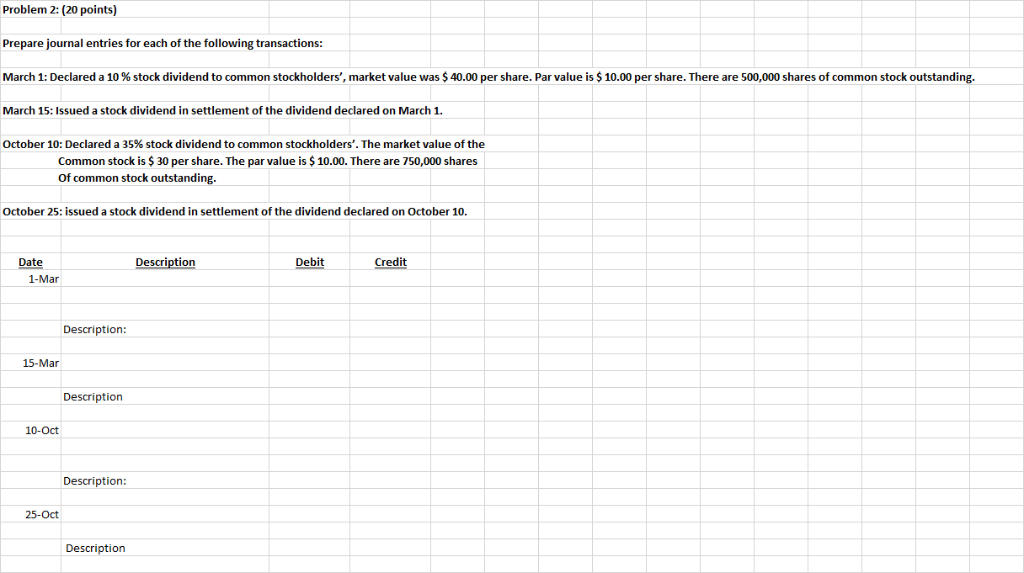

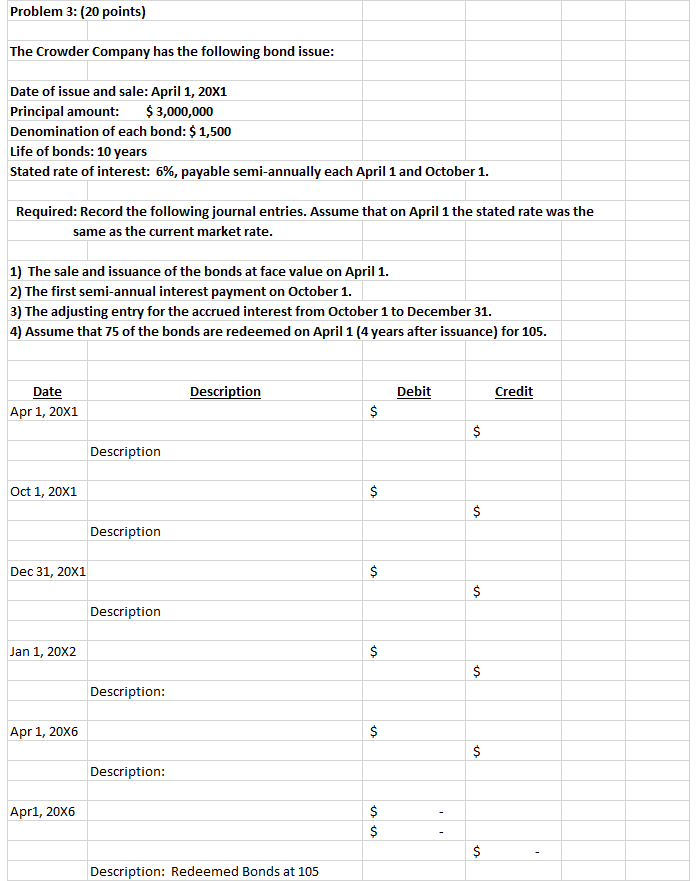

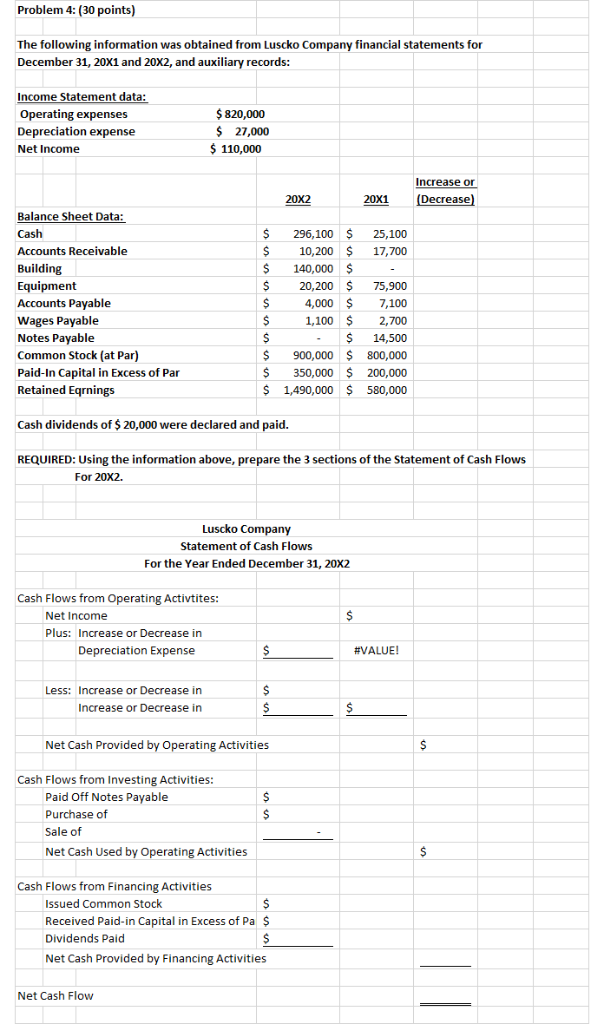

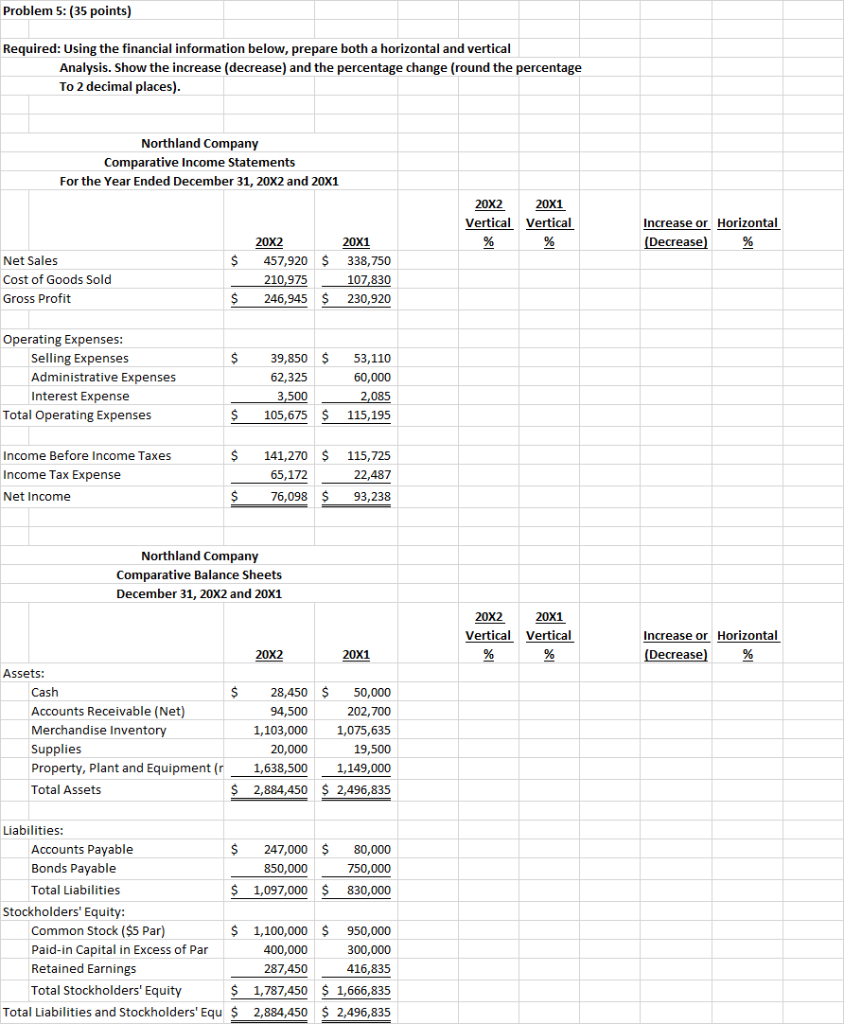

Problem 2: (20 points) Prepare journal entries for each of the following transactions: March 1: Declared a 10% stock dividend to common stockholders market value was $ 40.00 per share. Par value is $ 10.00 per share. There are 500,000 shares of common stock outstanding. March 15: Issued a stock dividend in settlement of the dividend declared on March 1. October 10: Declared a 35% stock dividend to common stockholders. The market value of the Common stock is $ 30 per share. The par value is $10.00. There are 750,000 shares Of common stock outstanding. October 25: issued a stock dividend in settlement of the dividend declared on October 10 Debit Credit Date 1-Mar Description: 15-Mar 10-Oct Description: 25-Oct Description Problem 3: (20 points) The Crowder Company has the following bond issue: Date of issue and sale: April 1, 20X1 Principal amount: $ 3,000 Denomination of each bond: $1,500 Life of bonds: 10 years stated rate of interest 6%, payable semi-annually each April 1 and October 1. Required: Record the following journal entries. Assume that on April 1 the stated rate was the same as the current market rate 1) The sale and issuance of the bonds at face value on April 1. 2) The first semi-annual interest payment on October 1. 3) The adjusting entry for the accrued interest from October 1 to December 31. 4) Assume that 75 of the bonds are redeemed on April 1 (4 years after issuance) for 105 Date Description Debit Credit Apr 1, 20X1 Description Oct 1, 20X1 Description Dec 31, 20X1 Description Jan 1, 20X2 Description: Apr 1, 20X6 Description: Apr1, 20X6 Description: Redeemed Bonds at 105 Problem 4: (30 points) The following information was obtained from Luscko Company financial statements for December 31, 20X1 and 20X2, and auxiliary records: Income Statement data: Operating expenses Depreciation expense Net Income 820,000 27,000 $110,000 Increase or 20X1 (Decrease) Balance Sheet Data $296,100 25,100 $10,200 17,700 Accounts Receivable Building Equipment Accounts Payable Wages Payable Notes Payable Common Stock (at Par) Paid-In Capital in Excess of Par Retained Eqrnings $140,000 20,200 $ 75,900 4,0007,100 1,100 $2,700 S14,500 $900,000 $800,000 350,000 200,000 S 1,490,000580,000 Cash dividends of $ 20,000 were declared and paid. REQUIRED: Using the information above, prepare the 3 sections of the Statement of Cash Flows For 20X2. Luscko Company Statement of Cash Flows For the Year Ended December 31, 20X2 Cash Flows from Operating Activtites Net Income Plus: Increase or Decrease in Depreciation Expense #VALUE! Less: Increase or Decrease in Increase or Decrease in Net Cash Provided by Operating Activities Cash Flows from Investing Activities: Paid Off Notes Payable Purchase of Sale of Net Cash Used by Operating Activities Cash Flows from Financing Activities Issued Common Stock Received Paid-in Capital in Excess of Pa $ Dividends Paid Net Cash Provided by Financing Activities Net Cash Flow Problem 5: (35 points) Required: Using the financial information below, prepare both a horizontal and vertical Analysis. Show the increase (decrease) and the percentage change (round the percentage To 2 decimal places) Northland Company Comparative Income Statements For the Year Ended December 31, 20X2 and 20X1 20X2 Vertica Vertical 20X1 Increase or Horizontal (Decrease) % 20X1 20X2 s 457,920 338 Net Sales Cost of Goods Sold Gross Profit 338,750 210,975107,830 107,830 6,945 230,920 Operating Expenses: $39,850 $53,110 60,000 2,085 $105,675$115,195 Selling Expenses Administrative Expenses Interest Expense 62,325 Total Operating Expenses Income Before Income Taxes Income Tax Expense Net Income 141,270 S 115,725 22,487 $ 76,098 $ 93,238 65,172 Northland Company Comparative Balance Sheets December 31, 20X2 and 20X1 20X2 20X1 Increase or Horizontal (Decrease) % Vertical Vertical 20X2 20X1 Assets: Cash Accounts Receivable (Net) Merchandise Inventory Supplies $28,45050,000 202,700 1,103,000 1,075,635 19,500 Property, Plant and Equipment (r1,638,500 1,149,000 $ 2,884,450 $ 2,496,835 94,500 20,000 Total Assets Liabilities: 247,000$80,000 750,000 $ 1,097,000$830,000 Accounts Payable Bonds Payable Total Liabilities 850,000 Stockholders' Equity: $ 1,100,000 $950,000 300,000 416,835 $ 1,787,450 1,666,835 Total Liabilities and Stockholders' Equ S 2,884,450 S 2,496,835 Common Stock($5 Par) Paid-in Capital in Excess of Par Retained Earnings Total Stockholders' Equity 400,000 287,450