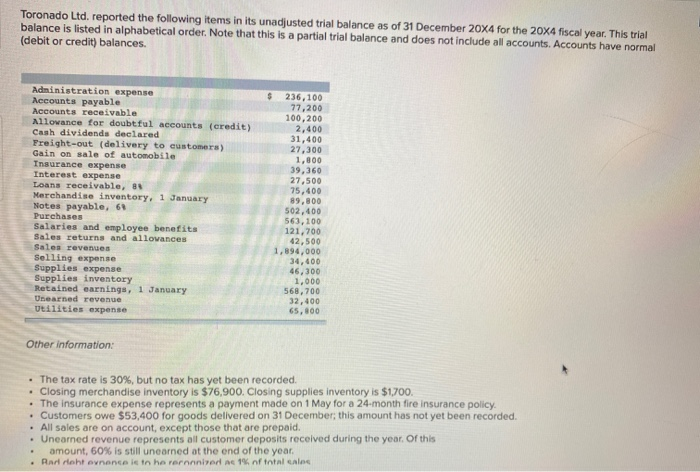

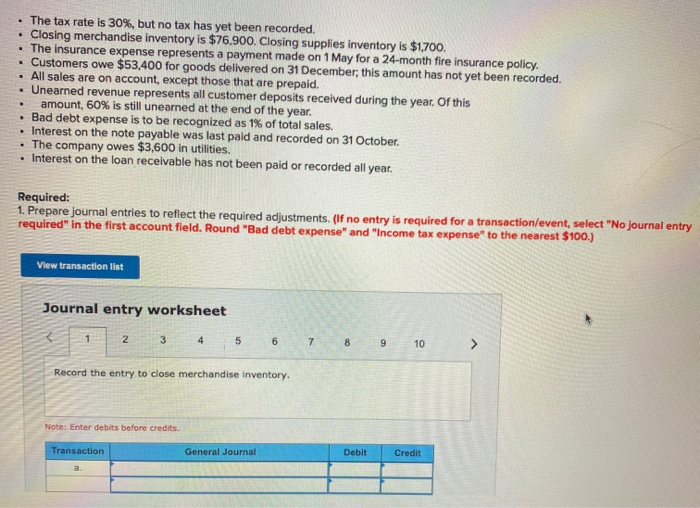

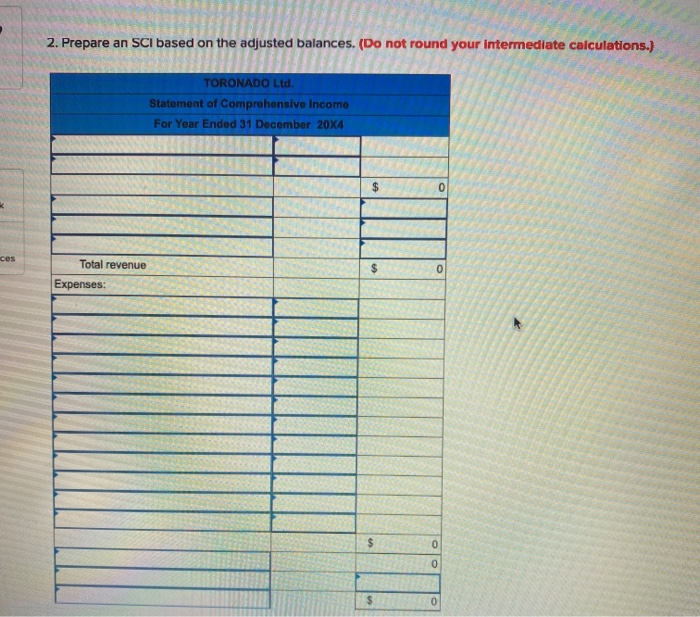

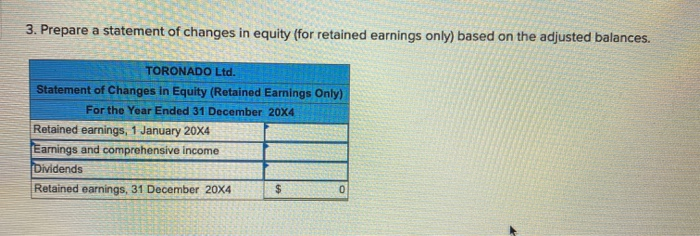

Toronado Ltd. reported the following items in its unadjusted trial balance as of 31 December 20X4 for the 20x4 fiscal year. This trial balance is listed in alphabetical order. Note that this is a partial trial balance and does not include all accounts. Accounts have normal (debit or credit) balances. $ Administration expense Accounts payable Accounts receivable Allowance for doubtful accounts (credit) Cash dividends declared Freight-out (delivery to customers) Gain on sale of automobile Insurance expense Interest expense Loans receivable, 8 Merchandise inventory, 1 January Notes payable, 69 Purchases Salaries and employee benefits Sales returns and allowances Sales revenues Selling expense Supplies expense Supplies inventory Retained earnings, 1 January Unearned revenue Utilities expense 236,100 77,200 100, 200 2,400 31,400 27,300 1,800 39,360 27,500 75,400 89,800 502,400 563,100 121,700 42,500 1,894,000 34,400 46,300 1,000 568,700 32,400 65,800 Other information: The tax rate is 30%, but no tax has yet been recorded Closing merchandise inventory is $76,900. Closing supplies inventory is $1,700. The insurance expense represents a payment made on 1 May for a 24-month fire insurance policy. Customers owe $53,400 for goods delivered on 31 December, this amount has not yet been recorded. . All sales are on account, except those that are prepaid. Unearned revenue represents all customer deposits received during the year. Of this amount, 60% is still unearned at the end of the year. Radroht ovnence is the rernized ac 1% of total cales The tax rate is 30%, but no tax has yet been recorded. Closing merchandise inventory is $76,900. Closing supplies inventory is $1700. The insurance expense represents a payment made on 1 May for a 24-month fire insurance policy. Customers owe $53,400 for goods delivered on 31 December, this amount has not yet been recorded. . All sales are on account, except those that are prepaid. Unearned revenue represents all customer deposits received during the year. Of this amount, 60% is still unearned at the end of the year. Bad debt expense is to be recognized as 1% of total sales. Interest on the note payable was last paid and recorded on 31 October The company owes $3,600 in utilities. Interest on the loan receivable has not been paid or recorded all year. - Required: 1. Prepare journal entries to reflect the required adjustments. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round "Bad debt expense" and "Income tax expense" to the nearest $100.) View transaction list Journal entry worksheet 1 2 3 4 5 6 7 8 9 10 Record the entry to close merchandise inventory. Note: Enter debits before credits Transaction General Journal Debit Credit 2. Prepare an SCI based on the adjusted balances. (Do not round your intermediate calculations.) TORONADO Ltd. Statement of Comprehensive Income For Year Ended 31 December 20X4 $ 0 ces Total revenue 0 Expenses: 0 0 0 3. Prepare a statement of changes in equity (for retained earnings only) based on the adjusted balances. TORONADO Ltd. Statement of Changes in Equity (Retained Earnings Only) For the Year Ended 31 December 20X4 Retained earnings, 1 January 20X4 Earnings and comprehensive income Dividends Retained earnings, 31 December 20X4 $ O