Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I really need help with the formulas Use IF functions to calculate the regular pay and overtime pay in columns E and F based on

I really need help with the formulas

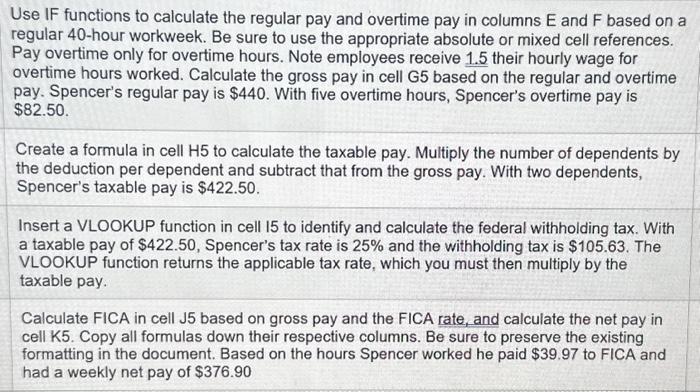

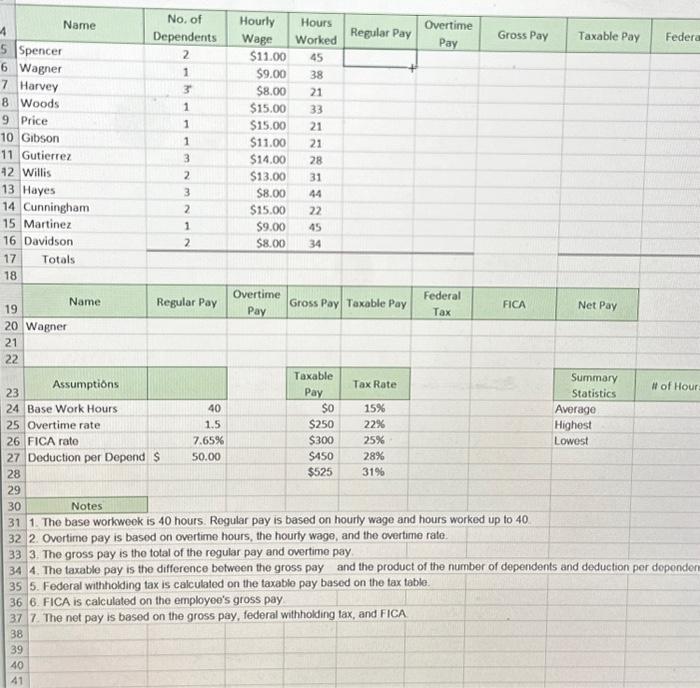

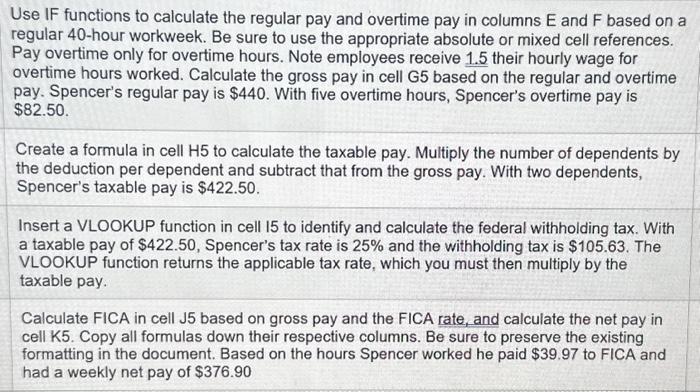

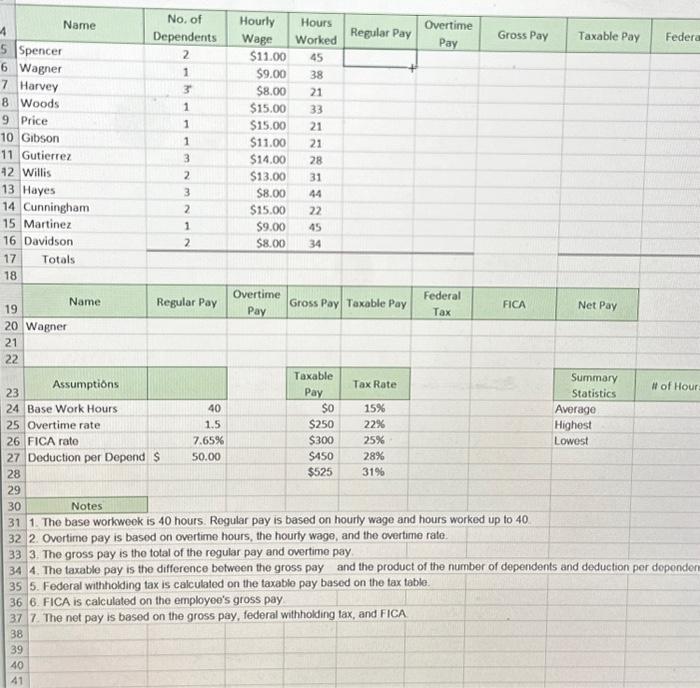

Use IF functions to calculate the regular pay and overtime pay in columns E and F based on a regular 40 -hour workweek. Be sure to use the appropriate absolute or mixed cell references. Pay overtime only for overtime hours. Note employees receive 1.5 their hourly wage for overtime hours worked. Calculate the gross pay in cell G5 based on the regular and overtime pay. Spencer's regular pay is $440. With five overtime hours, Spencer's overtime pay is $82.50. Create a formula in cell H5 to calculate the taxable pay. Multiply the number of dependents by the deduction per dependent and subtract that from the gross pay. With two dependents, Spencer's taxable pay is $422.50. Insert a VLOOKUP function in cell 15 to identify and calculate the federal withholding tax. With a taxable pay of $422.50, Spencer's tax rate is 25% and the withholding tax is $105.63. The VLOOKUP function returns the applicable tax rate, which you must then multiply by the taxable pay. Calculate FICA in cell J5 based on gross pay and the FICA rate, and calculate the net pay in cell K5. Copy all formulas down their respective columns. Be sure to preserve the existing formatting in the document. Based on the hours Spencer worked he paid $39.97 to FICA and had a weekly net pay of $376.90 \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|} \hline & Name & \begin{tabular}{c} No. of \\ Dependents \end{tabular} & \begin{tabular}{l} Hourly \\ Wage \end{tabular} & \begin{tabular}{c} Hours \\ Worked \end{tabular} & Regular Pay & \begin{tabular}{c} Overtime \\ Pay \end{tabular} & Gross Pay & Taxable Pay & Federa \\ \hline 5 & Spencer & 2 & $11.00 & 45 & & & & & \\ \hline 6 & Wagner & 1 & $9.00 & 38 & & & & & \\ \hline 7 & Harvey & 3 & $8.00 & 21 & & & & & \\ \hline 8 & Woods & 1 & $15.00 & 33 & & & & & \\ \hline 9 & Price & 1 & $15.00 & 21 & & & & & \\ \hline 10 & Gibson & 1 & $11.00 & 21 & & & & & \\ \hline 11c & Gutierrez & 3 & $14.00 & 28 & & & & & \\ \hline 42v & Willis & 2 & $13.00 & 31 & & & & & \\ \hline 13 & Hayes & 3 & $8.00 & 44 & & & & & \\ \hline 14 & Cunningham & 2 & $15.00 & 22 & & & & & \\ \hline 15 & Martinez & 1 & $9.00 & 45 & & & & & \\ \hline 16 & Davidson & 2 & $8.00 & 34 & & & & & \\ \hline 17 & Totals & & & & & & & & \\ \hline 18 & & & & & & & & & \\ \hline 19 & Name & Regular Pay & \begin{tabular}{c} Overtime \\ Pay \end{tabular} & Gross Pay & Taxable Pay & \begin{tabular}{c} Federal \\ Tax \end{tabular} & FICA & Net Pay & \\ \hline 20 & Wagner & & & & & & & & \\ \hline 21 & & & & & & & & & \\ \hline 22 & & & & & & & & & \\ \hline 23 & Assumptions & & & \begin{tabular}{c} Taxable \\ Pay \end{tabular} & TaxRate & & & \begin{tabular}{l} Summary \\ Statistics \end{tabular} & H of Hour \\ \hline 24 & Base Work Hours & 40 & & so & 15% & & & Average & \\ \hline 25 & Overtime rate & 1.5 & & $250 & 22% & & & Highest & \\ \hline 26 & FICA rate & 7.65% & & $300 & 25% & & & Lowest & \\ \hline 27 & Deduction per Depend & 50.00 & & \$450 & 28% & & & & \\ \hline 28 & & & & $525 & 31% & & & & \\ \hline 29 & & & & & & & & & \\ \hline 30 & Notes & & & & & & & & \\ \hline 31 & \multicolumn{7}{|c|}{ 1. The base workweek is 40 hours. Regular pay is based on hourly wage and hours worked up to 40.} & & \\ \hline 32 & \multicolumn{9}{|c|}{\begin{tabular}{l} 1. The base workweek is 40 hours. Regular pay is based on hounty wage and hours worked up lo 40 . \\ 2. Overtime pay is based on overtime hours, the hourly wage, and the overtime rate. \end{tabular}} \\ \hline 33 & \multicolumn{9}{|c|}{ 3. The gross pay is the total of the regular pay and overtime pay. } \\ \hline 34 & \multicolumn{9}{|c|}{ 4. The taxable pay is the difference between the gross pay and the product of the number of dependents and deduction per depender } \\ \hline 35 & \multicolumn{9}{|c|}{ 5. Federal withholding tax is calculated on the taxable pay based on the tax table. } \\ \hline 36 & \multirow{2}{*}{\multicolumn{9}{|c|}{\begin{tabular}{l} 6. FICA is calculated on the employee's gross pay \\ 7. The net pay is based on the gross pay, federal withholding tax, and FICA \end{tabular}}} \\ \hline 37 & & & & & & & & & \\ \hline 38 & & & & & & 19 & & & \\ \hline 39 & & & & & & & & & \\ \hline 40 & & & & & & & & & \\ \hline 41 & & & & & & & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started