I really need help with this, I'm not very handy with Excel although I'm doing my best to learn properly. It's due on Friday!!! Please!

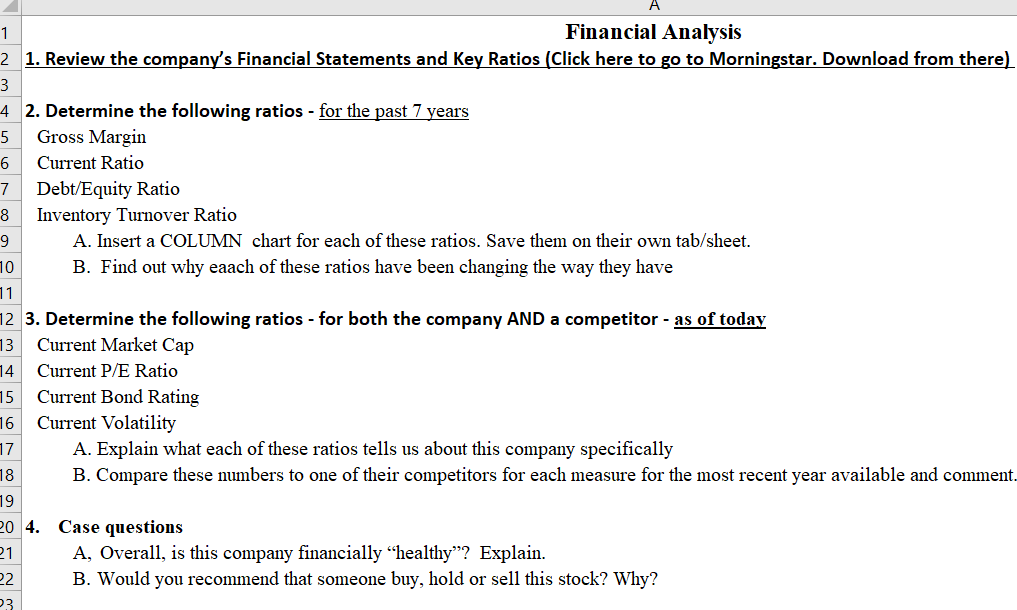

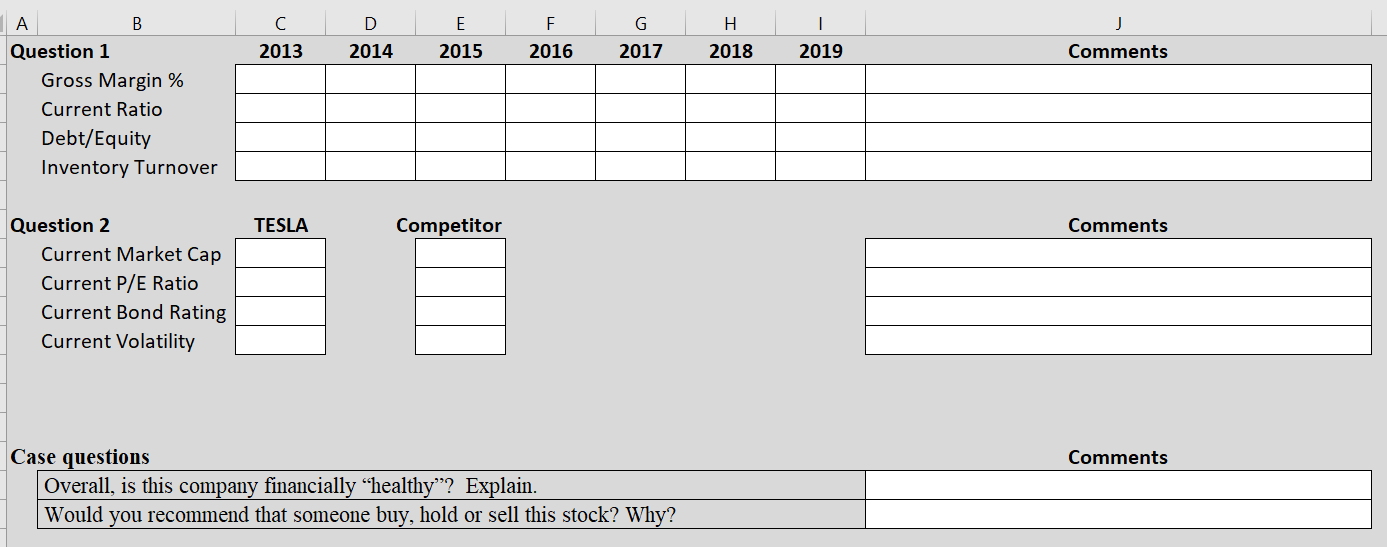

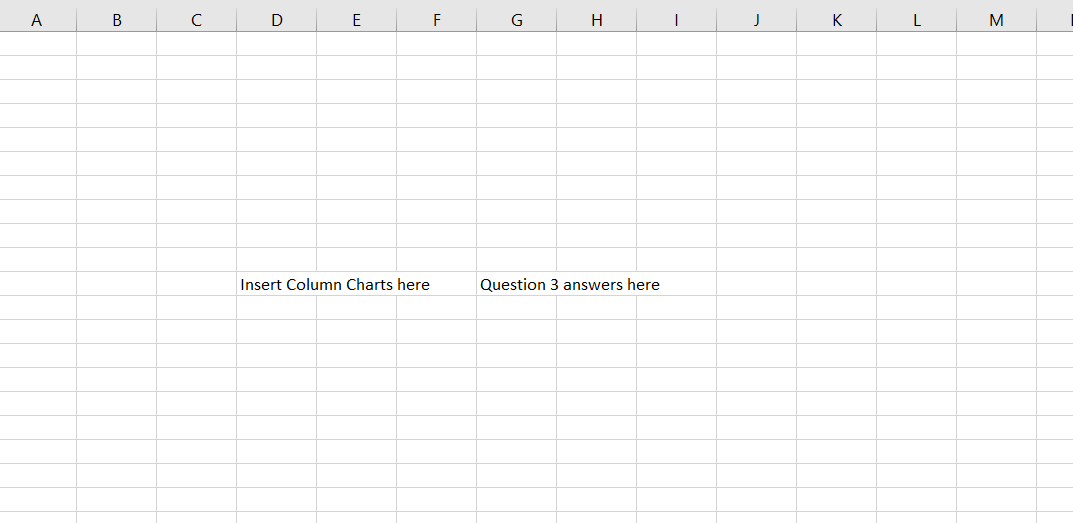

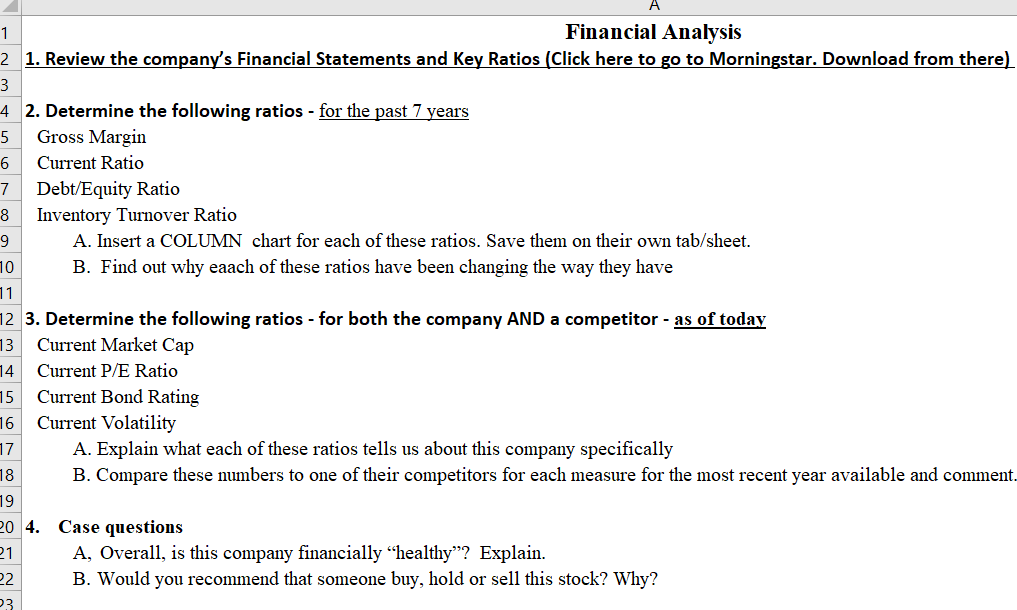

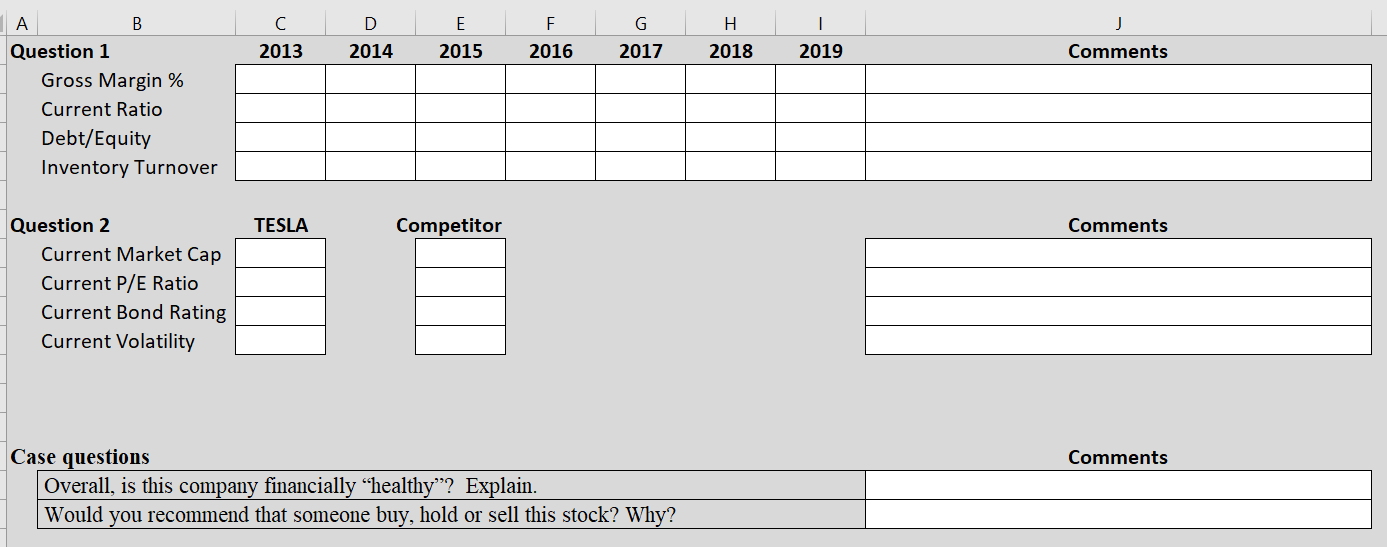

1 Financial Analysis 2 1. Review the company's Financial Statements and Key Ratios (Click here to go to Morningstar. Download from there) 3 4 2. Determine the following ratios - for the past 7 years 5 Gross Margin 6 Current Ratio 7 Debt/Equity Ratio 8 Inventory Turnover Ratio 9 A. Insert a COLUMN chart for each of these ratios. Save them on their own tab/sheet. 10 B. Find out why eaach of these ratios have been changing the way they have 11 12 3. Determine the following ratios - for both the company AND a competitor - as of today 13 Current Market Cap 14 Current P/E Ratio 15 Current Bond Rating 16 Current Volatility 17 A. Explain what each of these ratios tells us about this company specifically 18 B. Compare these numbers to one of their competitors for each measure for the most recent year available and comment. 19 20 4. Case questions 21 A, Overall, is this company financially healthy? Explain. 22 B. Would you recommend that someone buy, hold or sell this stock? Why? 23 D E C 2013 F 2016 G 2017 . 2018 1 2019 2014 2015 Comments A B Question 1 Gross Margin % Current Ratio Debt/Equity Inventory Turnover TESLA Competitor Comments Question 2 Current Market Cap Current P/E Ratio Current Bond Rating Current Volatility Comments Case questions Overall, is this company financially healthy? Explain. Would you recommend that someone buy, hold or sell this stock? Why? B c D E F G I K L M Insert Column Charts here Question 3 answers here 1 Financial Analysis 2 1. Review the company's Financial Statements and Key Ratios (Click here to go to Morningstar. Download from there) 3 4 2. Determine the following ratios - for the past 7 years 5 Gross Margin 6 Current Ratio 7 Debt/Equity Ratio 8 Inventory Turnover Ratio 9 A. Insert a COLUMN chart for each of these ratios. Save them on their own tab/sheet. 10 B. Find out why eaach of these ratios have been changing the way they have 11 12 3. Determine the following ratios - for both the company AND a competitor - as of today 13 Current Market Cap 14 Current P/E Ratio 15 Current Bond Rating 16 Current Volatility 17 A. Explain what each of these ratios tells us about this company specifically 18 B. Compare these numbers to one of their competitors for each measure for the most recent year available and comment. 19 20 4. Case questions 21 A, Overall, is this company financially healthy? Explain. 22 B. Would you recommend that someone buy, hold or sell this stock? Why? 23 D E C 2013 F 2016 G 2017 . 2018 1 2019 2014 2015 Comments A B Question 1 Gross Margin % Current Ratio Debt/Equity Inventory Turnover TESLA Competitor Comments Question 2 Current Market Cap Current P/E Ratio Current Bond Rating Current Volatility Comments Case questions Overall, is this company financially healthy? Explain. Would you recommend that someone buy, hold or sell this stock? Why? B c D E F G I K L M Insert Column Charts here Question 3 answers here