Answered step by step

Verified Expert Solution

Question

1 Approved Answer

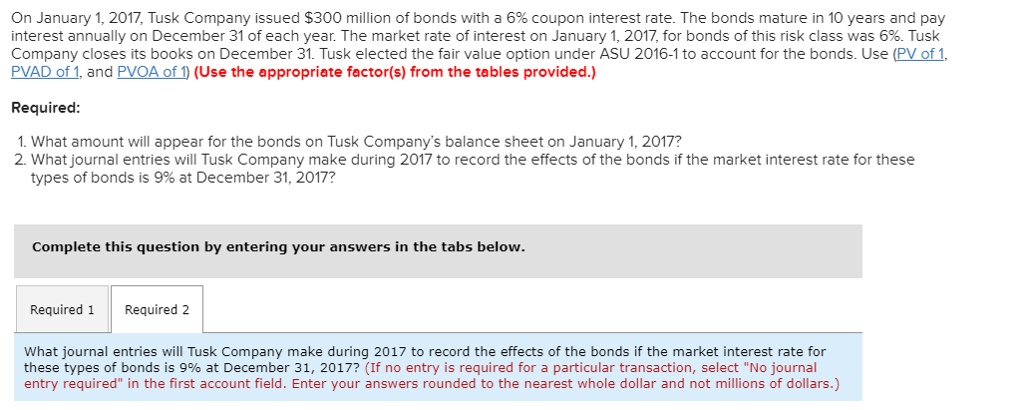

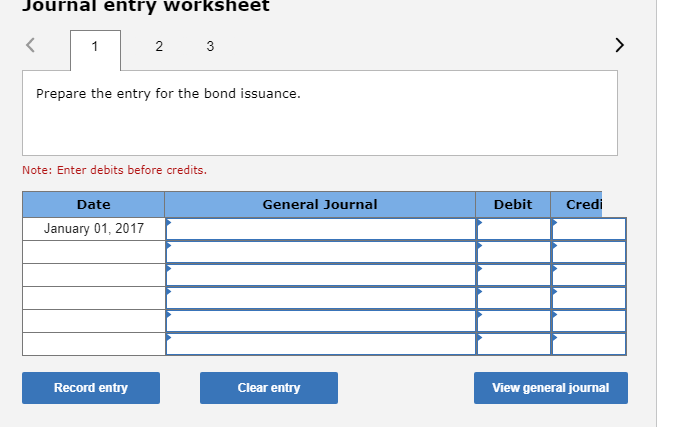

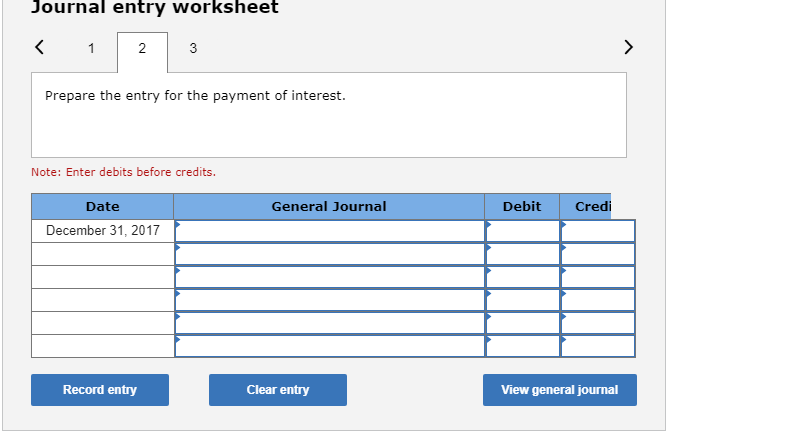

I really need help with this question ASAP if possible. On January 1, 2017, Tusk Company issued $300 million of bonds with a 6% coupon

I really need help with this question ASAP if possible.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started