Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I really need the answer for the 3 questions in detail, many thanks!! The mini case name Brexit and Roll-Royce in the text book named

I really need the answer for the 3 questions in detail, many thanks!!

The mini case name "Brexit and Roll-Royce" in the text book named "Multinational Business Finance, 15th edition" (Pg. 389, chapter 12)

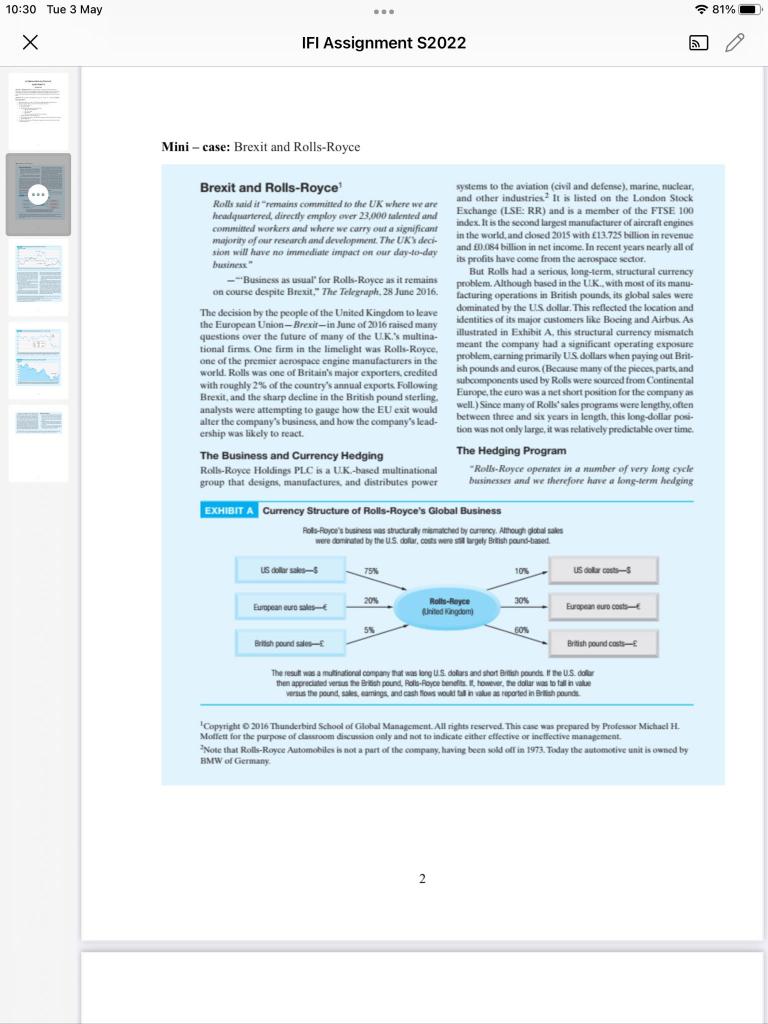

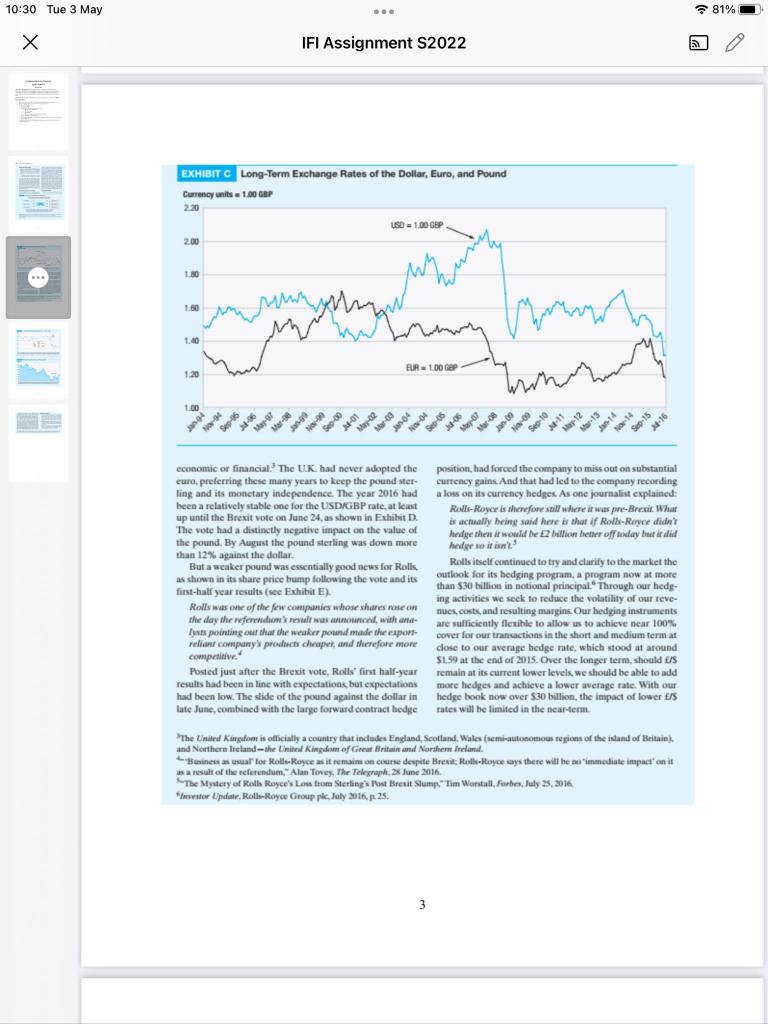

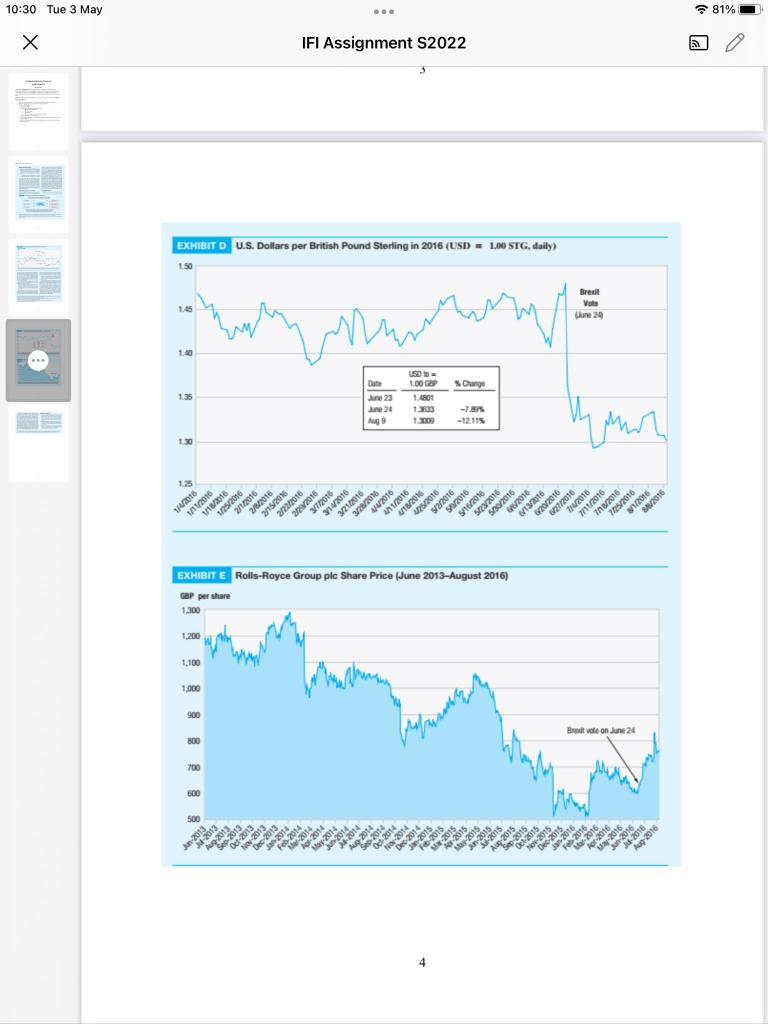

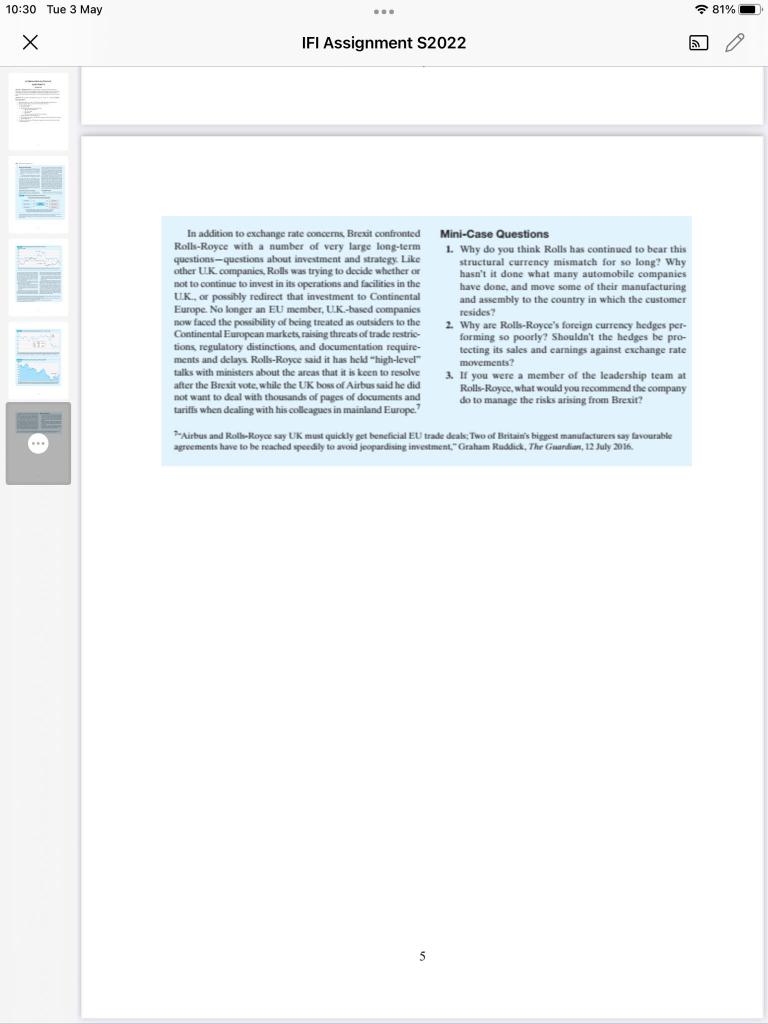

10:30 Tue 3 May . 81% IFI Assignment S2022 Mini-case: Brexit and Rolls-Royce Brexit and Rolls-Royce Rolls said it remains committed to the UK where we are headquartered directly employ over 23,000 talented and Committed workers and where we carry out a significant majority of our research and development. The UK deci sion will have no immediate impact on our day-to-day business --Business as usual for Rolls-Royce as it remains on course despite Brexit." The Telegraph. 28 June 2016 The decision by the people of the United Kingdom to leave the European Union-Brexit-in Jure of 2016 raised many questions over the future of many of the U.K.) multina- tional firms. One firm in the limelight was Rolls-Royce. one of the premier aerospace engine manufacturers in the world. Rolls was one of Britain's major exporters, credited with roughly 2% of the country's annual exports Following Brexit, and the sharp decline in the British pound sterling analysts were attempting to gauge how the EU exit would alter the company's business, and how the company's lead- ership was likely to react. The Business and Currency Hedging Rolls-Royce Holdings PLC is a UK-based multinational group that designs, manufactures and distributes power , systems to the aviation (civil and defense), marine, nuclear, and other industries. It is listed on the London Stock Exchange (LSE: RR) and is a member of the FTSE 100 index. It is the second largest manufacturer of aircraft engines in the world, and closed 2015 with 13.725 billion in revenue and 8,084 billion in net income. In recent years nearly all of its profits have come from the aerospace sedor. But Rolls had a serious, long-term, structural currency problem. Although based in the UK., with most of its manu- facturing operations in British pounds its global sales were dominated by the US dollar. This reflected the location and identities of its major customers like Bocing and Airbus. As illustrated in Exhibit A, this structural currency mismatch meant the company had a significant operating exposure problem carning primarily US dollars when paying out Brit- ish pounds and curos (Because many of the pieces parts and subscomponents used by Rolls were sourced from Continental Europe, the euro was a not short position for the company as well.) Since many of Rolls sales programs were lengthy.often between three and six years in length, this long-dollar pos. tion was not only large, it was relatively predictable over time. The Hedging Program "Rolls-Royce operates in a number of very long cycle businesses and we therefore have a long-term hedging EXHIBIT A Currency Structure of Rolls-Royce's Global Business Polls Royce's business was structurally mismatched by currency. Althoughal sales were dominated by the US dollar costs were still gey British pound-based US dollar 75% 10% US dollars 20 30% European auto Rolls-Royce United Kingdom European cuoco 5 BON British pounds saken British pound cost The result was a multinational company that was long US dollars and short Brah pounds of the US dollar then appreciated vers the British pound. Rolls-Royce bends how the dollar was to fill in alle vers the pound, sales, camings, and cash flows would take as reported in British pounds Copyright 2016 Thunderbird School of Global Management. All rights reserved. This case was prepared by Professor Michael H Moffett for the purpose of dustoom discussion only and not to indicate either effective or ineffective management Note that Rolls-Royce Automobiles is not a part of the company having been sold off in 1973. Today the automotive unit is owned by BMW of Germany 2 10:30 Tue 3 May .. 81% % IFI Assignment S2022 EXHIBIT D U.S. Dollars per British Pound Sterling in 2016 (USD - 1.00 STG, daily) = ) 150 Vote une 29 mammor 1.00 0 100 CP Change 1.35 Date June 23 June 24 Aug 1.4801 - -12.11% 1.3000 4 1 . 1.30 15 910 1/11/2016 1/10/2016 211.2016 2/6/2016 2015/2016 328/2010 2016 620/2016 27/2016 2016 13/2016 /2016 016 530/2016 16/2016 529/2016 18/2016 52/2016 11/2016 7/2016 81/2016 SESSA 2018 12/2016 11/2016 2016 29/2016 . T5/2016 1/2010 27222016 222016 72015 142016 212016 EXHIBIT E Rolls-Royce Group plc Share Price (June 2013-August 2016) GBP per share 1.300 1.200 1.100 1.000 900 Breivole on June 24 800 700 500 500 1-2013 A 2015 201 SD 2013 CLORO 2016 4 10:30 Tue 3 May . 81% IFI Assignment S2022 Mini-case: Brexit and Rolls-Royce Brexit and Rolls-Royce Rolls said it remains committed to the UK where we are headquartered directly employ over 23,000 talented and Committed workers and where we carry out a significant majority of our research and development. The UK deci sion will have no immediate impact on our day-to-day business --Business as usual for Rolls-Royce as it remains on course despite Brexit." The Telegraph. 28 June 2016 The decision by the people of the United Kingdom to leave the European Union-Brexit-in Jure of 2016 raised many questions over the future of many of the U.K.) multina- tional firms. One firm in the limelight was Rolls-Royce. one of the premier aerospace engine manufacturers in the world. Rolls was one of Britain's major exporters, credited with roughly 2% of the country's annual exports Following Brexit, and the sharp decline in the British pound sterling analysts were attempting to gauge how the EU exit would alter the company's business, and how the company's lead- ership was likely to react. The Business and Currency Hedging Rolls-Royce Holdings PLC is a UK-based multinational group that designs, manufactures and distributes power , systems to the aviation (civil and defense), marine, nuclear, and other industries. It is listed on the London Stock Exchange (LSE: RR) and is a member of the FTSE 100 index. It is the second largest manufacturer of aircraft engines in the world, and closed 2015 with 13.725 billion in revenue and 8,084 billion in net income. In recent years nearly all of its profits have come from the aerospace sedor. But Rolls had a serious, long-term, structural currency problem. Although based in the UK., with most of its manu- facturing operations in British pounds its global sales were dominated by the US dollar. This reflected the location and identities of its major customers like Bocing and Airbus. As illustrated in Exhibit A, this structural currency mismatch meant the company had a significant operating exposure problem carning primarily US dollars when paying out Brit- ish pounds and curos (Because many of the pieces parts and subscomponents used by Rolls were sourced from Continental Europe, the euro was a not short position for the company as well.) Since many of Rolls sales programs were lengthy.often between three and six years in length, this long-dollar pos. tion was not only large, it was relatively predictable over time. The Hedging Program "Rolls-Royce operates in a number of very long cycle businesses and we therefore have a long-term hedging EXHIBIT A Currency Structure of Rolls-Royce's Global Business Polls Royce's business was structurally mismatched by currency. Althoughal sales were dominated by the US dollar costs were still gey British pound-based US dollar 75% 10% US dollars 20 30% European auto Rolls-Royce United Kingdom European cuoco 5 BON British pounds saken British pound cost The result was a multinational company that was long US dollars and short Brah pounds of the US dollar then appreciated vers the British pound. Rolls-Royce bends how the dollar was to fill in alle vers the pound, sales, camings, and cash flows would take as reported in British pounds Copyright 2016 Thunderbird School of Global Management. All rights reserved. This case was prepared by Professor Michael H Moffett for the purpose of dustoom discussion only and not to indicate either effective or ineffective management Note that Rolls-Royce Automobiles is not a part of the company having been sold off in 1973. Today the automotive unit is owned by BMW of Germany 2 10:30 Tue 3 May .. 81% % IFI Assignment S2022 EXHIBIT D U.S. Dollars per British Pound Sterling in 2016 (USD - 1.00 STG, daily) = ) 150 Vote une 29 mammor 1.00 0 100 CP Change 1.35 Date June 23 June 24 Aug 1.4801 - -12.11% 1.3000 4 1 . 1.30 15 910 1/11/2016 1/10/2016 211.2016 2/6/2016 2015/2016 328/2010 2016 620/2016 27/2016 2016 13/2016 /2016 016 530/2016 16/2016 529/2016 18/2016 52/2016 11/2016 7/2016 81/2016 SESSA 2018 12/2016 11/2016 2016 29/2016 . T5/2016 1/2010 27222016 222016 72015 142016 212016 EXHIBIT E Rolls-Royce Group plc Share Price (June 2013-August 2016) GBP per share 1.300 1.200 1.100 1.000 900 Breivole on June 24 800 700 500 500 1-2013 A 2015 201 SD 2013 CLORO 2016 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started