Question

I received an answer on my Cadh Flow problem. the answer that I received was Equipment was (5300). i was reading the answer and I

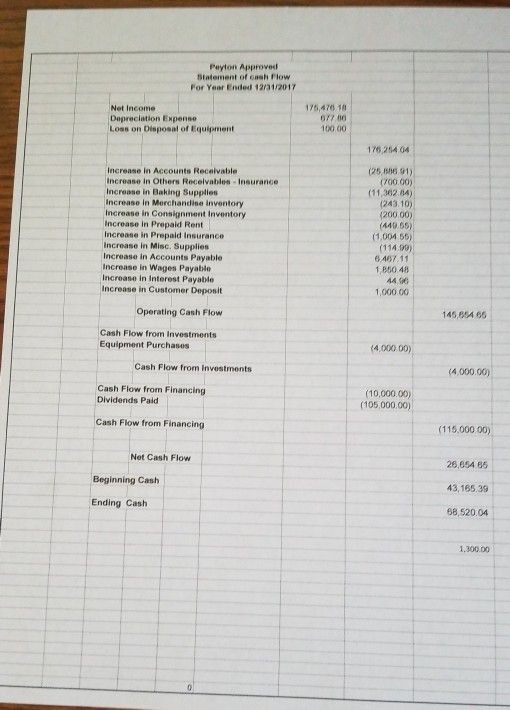

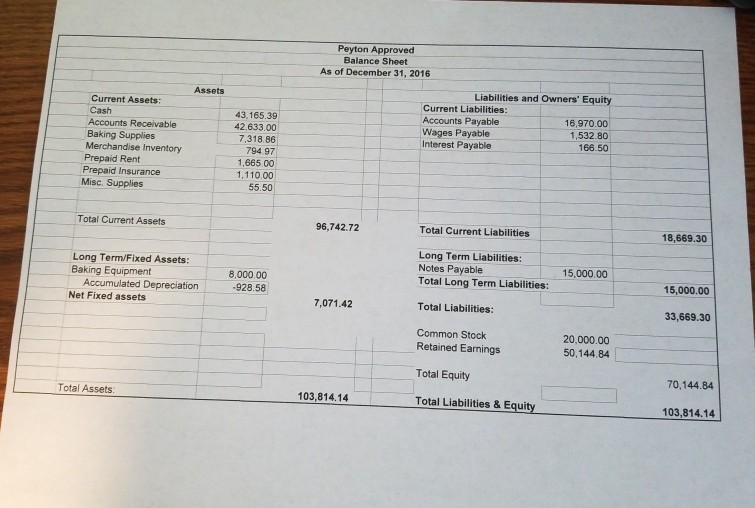

I received an answer on my Cadh Flow problem. the answer that I received was Equipment was (5300). i was reading the answer and I was confused. It said that the opening balance for Equipment was $8,000. That was the closing balance for 2016. In 2017 their was a purchase of $6,000 making the opening balance for 2017 as $14,000. There was a loss of equipment for $2,000. Accumulated Dep. for $1.200, Other Receivable -Insurance $700 from the insurance which will be paid in January and a $100 loss. If the

adjusted Trial Balance shows $12,000. Why was the 2016 balance of $8,000 use

d instead of the 2017 balance of $12,000.

I hope I got all.of the Statements.

i see from the previous response that the equipment on the Cash Flow sheet is ($5,300). Can you explain how they got this answer.

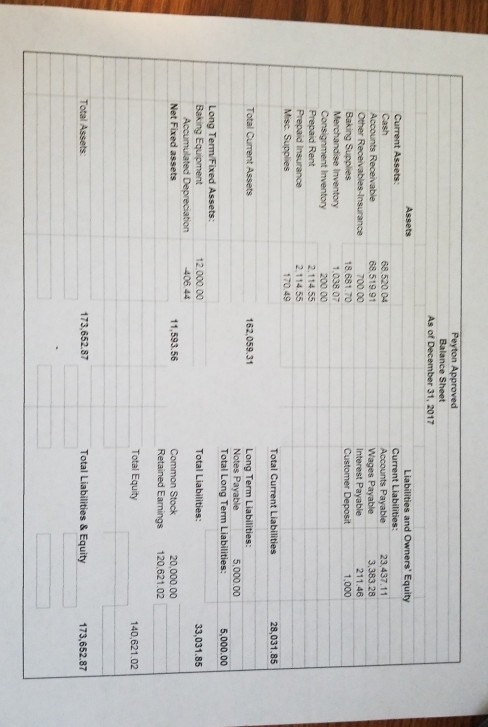

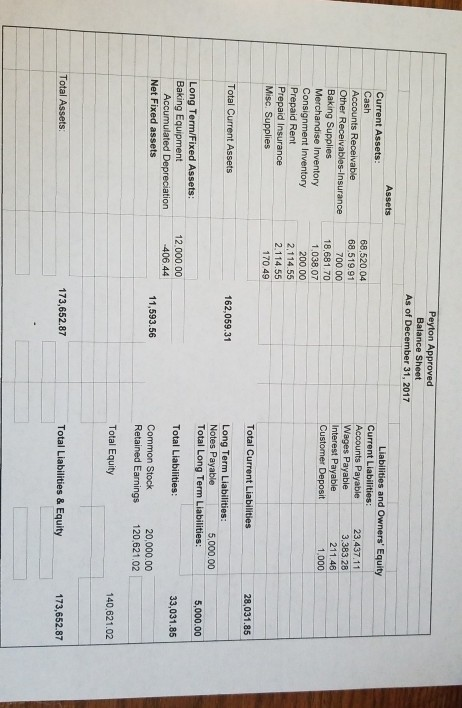

Payton Approved Statement of cash flow For Year Ended 12/31/2017 Net Income Depreciation Expense Loss on Disposal of Equipment 176,476 10 077.00 100.00 17025404 Increase in Accounts Receivable Increase in Others Receivables Insurance Increase in Baking Supplies Increase in Merchandise inventory Increase in Consignment Inventory Increase in Prepaid Rent Increase in Prepaid Insurance Increase in Misc. Supplies Increase in Accounts Payable Increase in Wages Payable Increase in Interest Payable Increase in Customer Deposit (25.0691) (700.00) (11,362.14) (243.10) (200.00) (440.55) (1,004 65) (114.90) 6.467.11 1,850 48 44 66 1,000.00 Operating Cash Flow 146,654 65 Cash Flow from Investments Equipment Purchases (4,000.00) Cash Flow from Investments (4,000.00) Cash Flow from Financing Dividends Paid (10,000.00) (105,000,00) Cash Flow from Financing (115,000 00) Net Cash Flow 26,654 85 Beginning Cash 43,165.39 Ending Cash 88,520.04 1.300.00 0 Peyton Approved Balance Sheet As of December 31, 2017 Assets Current Assets: Liabilities and Owners' Equity Current Liabilities: Accounts Payable 23.437.11 Wages Payable 3.383.28 Interest Payable 211.46 Customer Deposit 1.000 Accounts Receivable Other Receivables Insurance Baking Supplies Merchandise Inventory Consignment Inventory Prepaid Rent Prepaid Insurance Misc. Supplies 68.520.04 68.519.91 700.00 18.681.70 1.038 07 200.00 2.114.55 2.114.55 170.49 Total Current Liabilities 28,031.85 Total Current Assets 162,059.31 Long Term Liabilities: Notes Payable 5,000.00 Total Long Term Liabilities: 5,000.00 Long Term Fixed Assets: Baking Equipment Accumulated Depreciation Net Fixed assets 12.000.00 408 44 Total Liabilities: 33,031.85 11,593.56 Common Stock Retained Earnings 20.000.00 120.621.02 Total Equity 140.621.02 Total Assets 173,652.87 Total Liabilities & Equity 173,652.87 Peyton Approved Balance Sheet As of December 31, 2016 Assets Current Assets: Cash Accounts Receivable Baking Supplies Merchandise Inventory Prepaid Rent Prepaid Insurance Misc. Supplies Liabilities and Owners' Equity Current Liabilities: Accounts Payable 16,970.00 Wages Payable 1,532.80 Interest Payable 166.50 43.165.39 42.633.00 7,318.86 794 97 1.665.00 1.110.00 55.50 Total Current Assets 96,742.72 Total Current Liabilities 18,669.30 Long Term/Fixed Assets: Baking Equipment Accumulated Depreciation Net Fixed assets Long Term Liabilities: Notes Payable Total Long Term Liabilities: 8,000.00 -928.58 15,000.00 15,000.00 7,071.42 Total Liabilities: 33,669.30 Common Stock Retained Earnings 20.000.00 50,144.84 Total Equity Total Assets 70,144.84 103,814.14 Total Liabilities & Equity 103,814.14 Peyton Approved Balance Sheet As of December 31, 2017 Assets Current Assets: Cash Accounts Receivable Other Receivables-Insurance Baking Supplies Merchandise Inventory Consignment Inventory Prepaid Rent Prepaid Insurance Misc. Supplies Liabilities and Owners' Equity Current Liabilities: Accounts Payable 23,437.11 Wages Payable 3.383.28 Interest Payable 21146 Customer Deposit 1.000 68,520.04 68.519.91 700.00 18,681.70 1.038.07 200.00 2.114.55 2.114.55 170.49 Total Current Liabilities 28,031.85 Total Current Assets 162,059.31 Long Term Liabilities: Notes Payable 5,000.00 Total Long Term Liabilities: 5,000.00 Long Term/Fixed Assets: Baking Equipment Accumulated Depreciation Net Fixed assets 12 000.00 -406.44 Total Liabilities: 33,031.85 11,593.56 Common Stock Retained Earnings 20,000.00 120.621.02 Total Equity 140.621.02 Total Assets 173,652.87 Total Liabilities & Equity 173,652.87Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started