Answered step by step

Verified Expert Solution

Question

1 Approved Answer

( i ) Saved Help Save & Exit Submit This question will be sent to your instructor for grading. ( Required information [ The following

i

Saved

Help

Save & Exit

Submit

This question will be sent to your instructor for grading.

Required information

The following information applies to the questions displayed below.

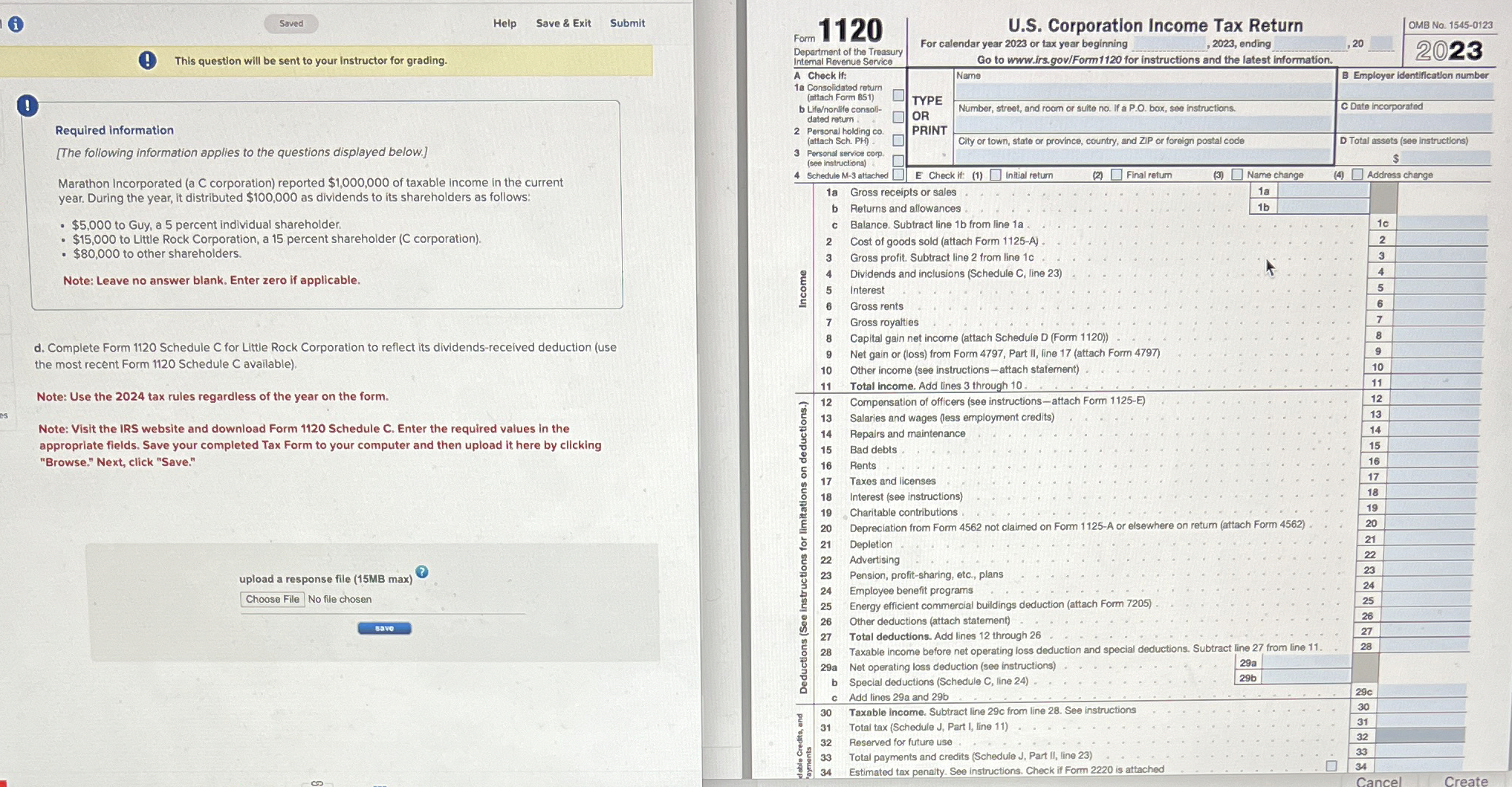

Marathon Incorporated a C corporation reported $ of taxable income in the current year. During the year, It distributed $ as dividends to its shareholders as follows:

$ to Guy, a percent individual shareholder.

$ to Little Rock Corporation, a percent shareholder C corporation

$ to other shareholders.

Note: Leave no answer blank. Enter zero if applicable.

d Complete Form Schedule C for Little Rock Corporation to reflect its dividendsreceived deduction use the most recent Form Schedule available

Note: Use the tax rules regardless of the year on the form.

Note: Visit the IRS website and download Form Schedule C Enter the required values in the appropriate fields. Save your completed Tax Form to your computer and then upload it here by cllcking "Browse." Next, click "Save."

upload a response file MB max

Choose File No file chosen

save

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started