Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I shared the case through 3 pictures, but i did not get the full answers for the case study. Client Situation You are a financial

I shared the case through pictures, but i did not get the full answers for the case study. Client Situation

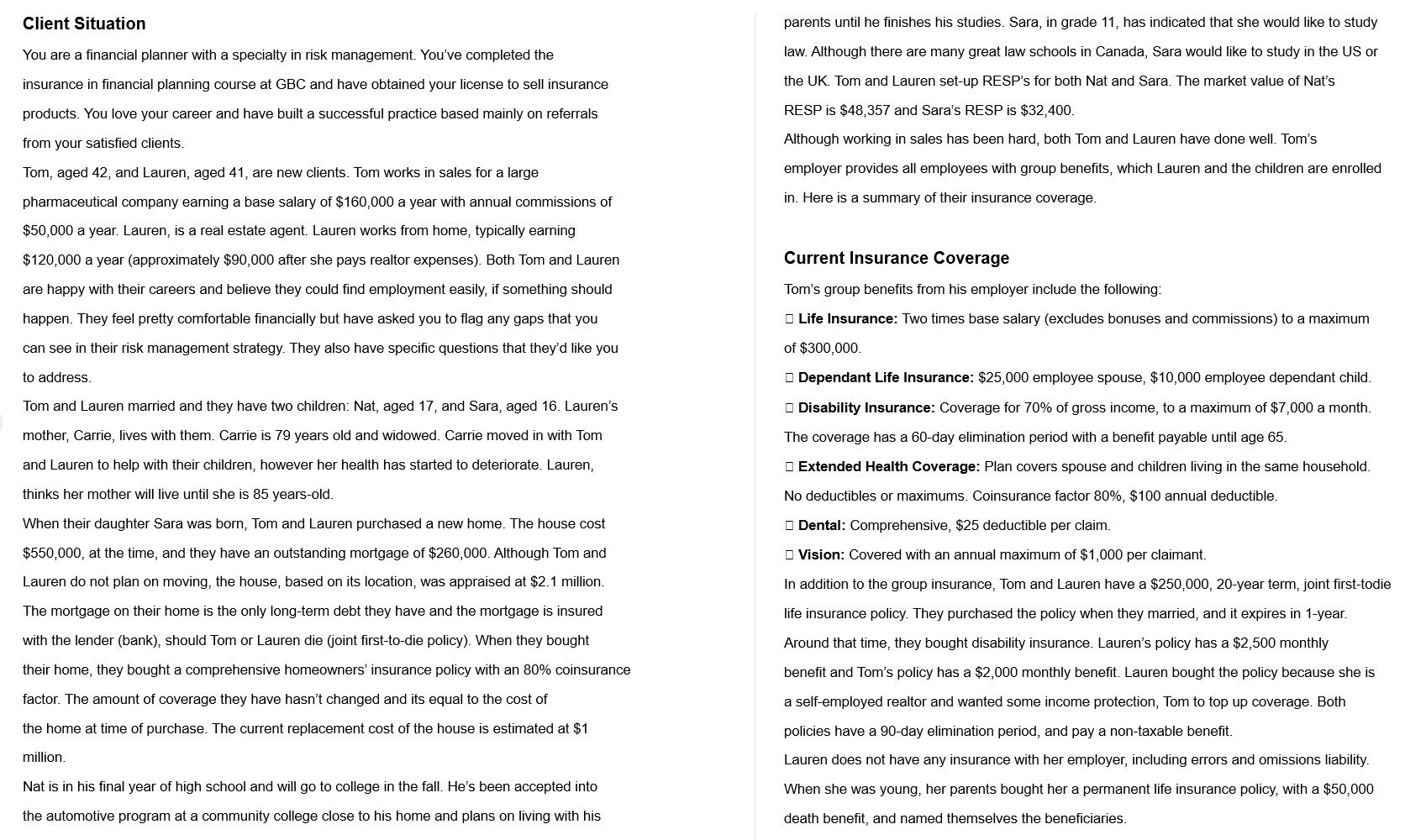

You are a financial planner with a specialty in risk management. You've completed the insurance in financial planning course at GBC and have obtained your license to sell insurance products. You love your career and have built a successful practice based mainly on referrals from your satisfied clients. Tom, aged and Lauren, aged are new clients. Tom works in sales for a large pharmaceutical company earning a base salary of $ a year with annual commissions of $ a year. Lauren, is a real estate agent. Lauren works from home, typically earning $ a year approximately $ after she pays realtor expenses Both Tom and Lauren are happy with their careers and believe they could find employment easily, if something should happen. They feel pretty comfortable financially but have asked you to flag any gaps that you can see in their risk management strategy. They also have specific questions that they'd like you to address.

Tom and Lauren married and they have two children: Nat, aged and Sara, aged Lauren's mother, Carrie, lives with them. Carrie is years old and widowed. Carrie moved in with Tom and Lauren to help with their children, however her health has started to deteriorate. Lauren, thinks her mother will live until she is yearsold.

When their daughter Sara was born, Tom and Lauren purchased a new home. The house cost $ at the time, and they have an outstanding mortgage of $ Although Tom and Lauren do not plan on moving, the house, based on its location, was appraised at $ million. The mortgage on their home is the only longterm debt they have and the mortgage is insured with the lender bank should Tom or Lauren die joint firsttodie policy When they bought their home, they bought a comprehensive homeowners' insurance policy with an coinsurance factor. The amount of coverage they have hasn't changed and its equal to the cost of the home at time of purchase. The current replacement cost of the house is estimated at $ million.

Nat is in his final year of high school and will go to college in the fall. He's been accepted into the automotive program at a community college close to his home and plans on living with his

parents until he finishes his studies. Sara, in grade has indicated that she would like to study law. Although there are many great law schools in Canada, Sara would like to study in the US or the UK Tom and Lauren setup RESP's for both Nat and Sara. The market value of Nat's RESP is $ and Sara's RESP is $

Although working in sales has been hard, both Tom and Lauren have done well. Tom's employer provides all employees with group benefits, which Lauren and the children are enrolled in Here is a summary of their insurance coverage.

Current Insurance Coverage

Tom's group benefits from his employer include the following:

square Life Insurance: Two times base salary excludes bonuses and commissions to a maximum of $

square Dependant Life Insurance: $ employee spouse, $ employee dependant child.

square Disability Insurance: Coverage for of gross income, to a maximum of $ a month. The coverage has a day elimination period with a benefit payable until age

square Extended Health Coverage: Plan covers spouse and children living in the same household.

No deductibles or maximums. Coinsurance factor $ annual deductible.

square Dental: Comprehensive, $ deductible per claim.

square Vision: Covered with an annual maximum of $ per claimant.

In addition to the group insurance, Tom and Lauren have a $year term, joint firsttodie life insurance policy. They purchased the policy when they married, and it expires in year. Around that time, they bought disability insurance. Lauren's policy has a $ monthly benefit and Tom's policy has a $ monthly benefit. Lauren bought the policy because she is a selfemployed realtor and wanted some income protection, Tom to top up coverage. Both policies have a day elimination period, and pay a nontaxable benefit.

Lauren does not have any insurance with her employer, including errors and omissions liability. When she was young, her parents bought her a permanent life insurance policy, with a $ death benefit, and named themselves the beneficiaries. Children

While it has been a challenge for Tom and Lauren to raise their children, they want them to succeed in life. Tom and Lauren want to support their children while they're in school. Sara's education is estimated to cost $ a year, for years. Nat's education is estimated to cost $ a year for years. To make the support equal, Tom and Lauren plan on buying Nat a car $ and giving him $ when he graduates from his program to start a business. At first, Sara thought this was unfair but now understands what her parents are trying to do or at least she says she understands

Current Part I:

A

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started