Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I. Shown below are selected transaction of Gulf Corp. during the month of December 2011. Dec. 1 Accepted a one-year, 8 percent note receivable

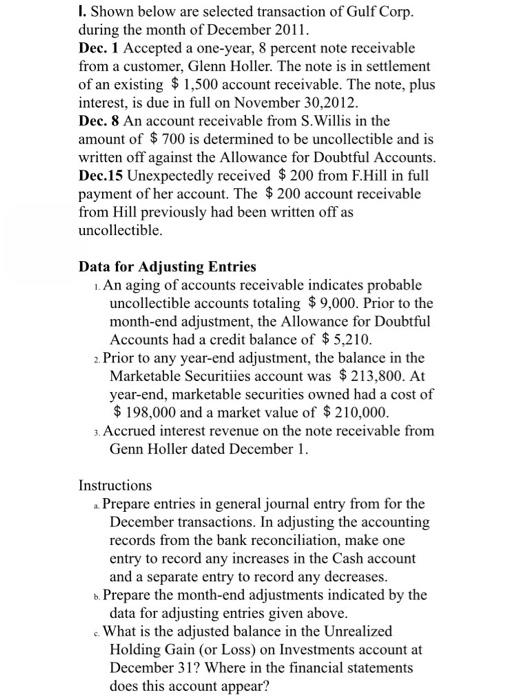

I. Shown below are selected transaction of Gulf Corp. during the month of December 2011. Dec. 1 Accepted a one-year, 8 percent note receivable from a customer, Glenn Holler. The note is in settlement of an existing $ 1,500 account receivable. The note, plus interest, is due in full on November 30,2012. Dec. 8 An account receivable from S.Willis in the amount of $ 700 is determined to be uncollectible and is written off against the Allowance for Doubtful Accounts. Dec.15 Unexpectedly received $ 200 from F.Hill in full payment of her account. The $ 200 account receivable from Hill previously had been written off as uncollectible. Data for Adjusting Entries 1. An aging of accounts receivable indicates probable uncollectible accounts totaling $ 9,000. Prior to the month-end adjustment, the Allowance for Doubtful Accounts had a credit balance of $5,210. 2. Prior to any year-end adjustment, the balance in the Marketable Securitiies account was $213,800. At year-end, marketable securities owned had a cost of $ 198,000 and a market value of $ 210,000. 3. Accrued interest revenue on the note receivable from Genn Holler dated December 1. Instructions . Prepare entries in general journal entry from for the December transactions. In adjusting the accounting records from the bank reconciliation, make one entry to record any increases in the Cash account and a separate entry to record any decreases. &. Prepare the month-end adjustments indicated by the data for adjusting entries given above. - What is the adjusted balance in the Unrealized Holding Gain (or Loss) on Investments account at December 31? Where in the financial statements does this account appear?

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Journal entries in the book of Gulf Corp Date Account title and explanations Debit Credit ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

63615d4ab74e3_234500.pdf

180 KBs PDF File

63615d4ab74e3_234500.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started