Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I. Student tuition and fees were assessed in the amount $21,500,000. Scholarship allowance 5800,000, Unrestricted graduate and assistantship fees $1,500,000. Cash collection was 2. Collected

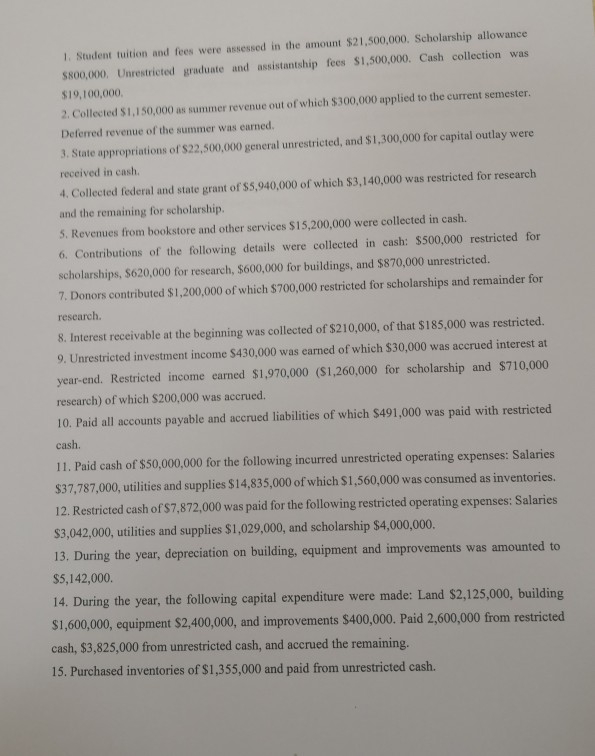

I. Student tuition and fees were assessed in the amount $21,500,000. Scholarship allowance 5800,000, Unrestricted graduate and assistantship fees $1,500,000. Cash collection was 2. Collected $1,150,000 as summer revenue out of which $300,000 applied to the current semester. 3. State appropriations of $22,500,000 general unrestricted, and $1,300,000 for capital outlay were 4. Collected federal and state grant of $5,940,000 of which $3,140,000 was restricted for research $19,100,000. Deferred revenue of the summer was earned. received in cash. and the remaining for scholarship. 5. Revenues from bookstore and other services $15,200,000 were collected in cash. 6. Contributions of the following details were collected in cash: $500,000 restricted for scholarships, $620,000 for research, $600,000 for buildings, and $870,000 unrestricted. 7. Donors contributed $1,200,000 of which $700,000 restricted for scholarships and remainder for research. 8. Interest receivable at the beginning was collected of $210,000, of that $185,000 was restricted. 9. Unrestricted investment income $430,000 was earned of which $30,000 was accrued interest at year-end. Restricted income earned $1,970,000 (S1,260,000 for scholarship and $710,000 research) of which $200,000 was accrued. 10. Paid all accounts payable and accrued liabilities of which $491,000 was paid with restricted cash. 11. Paid cash of $50,000,000 for the following incurred unrestricted operating expenses: Salaries $37,787,000, utilities and supplies $14,835,000 of which $1,560,000 was consumed as inventories. 12. Restricted cash of $7,872,000 was paid for the following restricted operating expenses: Salaries $3,042,000, utilities and supplies S1,029,000, and scholarship $4,000,000. 13. During the year, depreciation on building, equipment and improvements was amounted $5,142,000 to 14. During the year, the following capital expenditure were made: Land $2,125,0, building S1,600,000, equipment $2,400,000, and improvements $400,000. Paid 2,600,000 from restricted cash, $3,825,000 from unrestricted cash, and accrued the remaining. 15. Purchased inventories of $1,355,000 and paid from unrestricted cash. I. Student tuition and fees were assessed in the amount $21,500,000. Scholarship allowance 5800,000, Unrestricted graduate and assistantship fees $1,500,000. Cash collection was 2. Collected $1,150,000 as summer revenue out of which $300,000 applied to the current semester. 3. State appropriations of $22,500,000 general unrestricted, and $1,300,000 for capital outlay were 4. Collected federal and state grant of $5,940,000 of which $3,140,000 was restricted for research $19,100,000. Deferred revenue of the summer was earned. received in cash. and the remaining for scholarship. 5. Revenues from bookstore and other services $15,200,000 were collected in cash. 6. Contributions of the following details were collected in cash: $500,000 restricted for scholarships, $620,000 for research, $600,000 for buildings, and $870,000 unrestricted. 7. Donors contributed $1,200,000 of which $700,000 restricted for scholarships and remainder for research. 8. Interest receivable at the beginning was collected of $210,000, of that $185,000 was restricted. 9. Unrestricted investment income $430,000 was earned of which $30,000 was accrued interest at year-end. Restricted income earned $1,970,000 (S1,260,000 for scholarship and $710,000 research) of which $200,000 was accrued. 10. Paid all accounts payable and accrued liabilities of which $491,000 was paid with restricted cash. 11. Paid cash of $50,000,000 for the following incurred unrestricted operating expenses: Salaries $37,787,000, utilities and supplies $14,835,000 of which $1,560,000 was consumed as inventories. 12. Restricted cash of $7,872,000 was paid for the following restricted operating expenses: Salaries $3,042,000, utilities and supplies S1,029,000, and scholarship $4,000,000. 13. During the year, depreciation on building, equipment and improvements was amounted $5,142,000 to 14. During the year, the following capital expenditure were made: Land $2,125,0, building S1,600,000, equipment $2,400,000, and improvements $400,000. Paid 2,600,000 from restricted cash, $3,825,000 from unrestricted cash, and accrued the remaining. 15. Purchased inventories of $1,355,000 and paid from unrestricted cash

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started