Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I super close but in not sure where I went wrong for the OASDI taxable for Ruiz, Sam. Example 3-1 Example 3-2 Wallington Company has

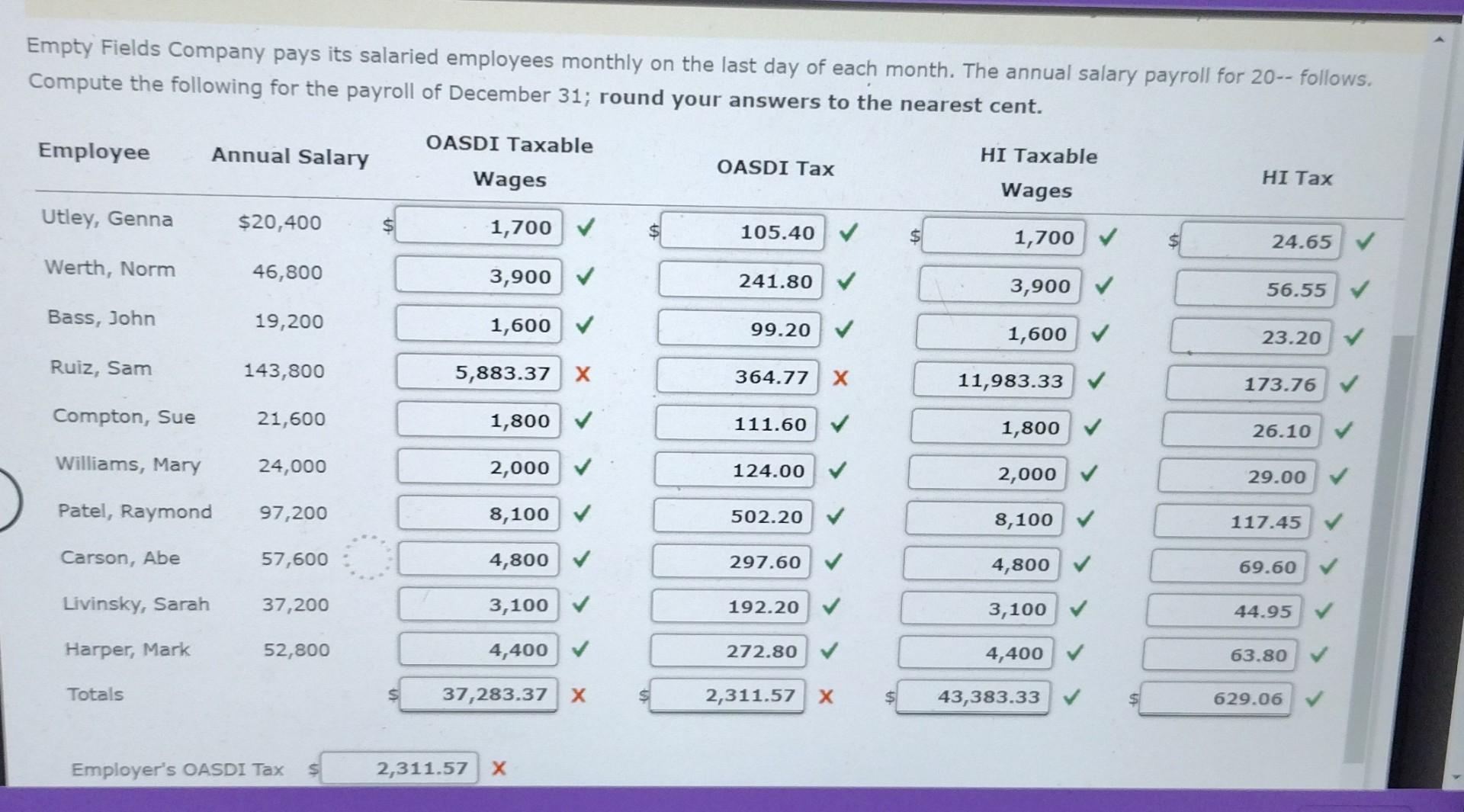

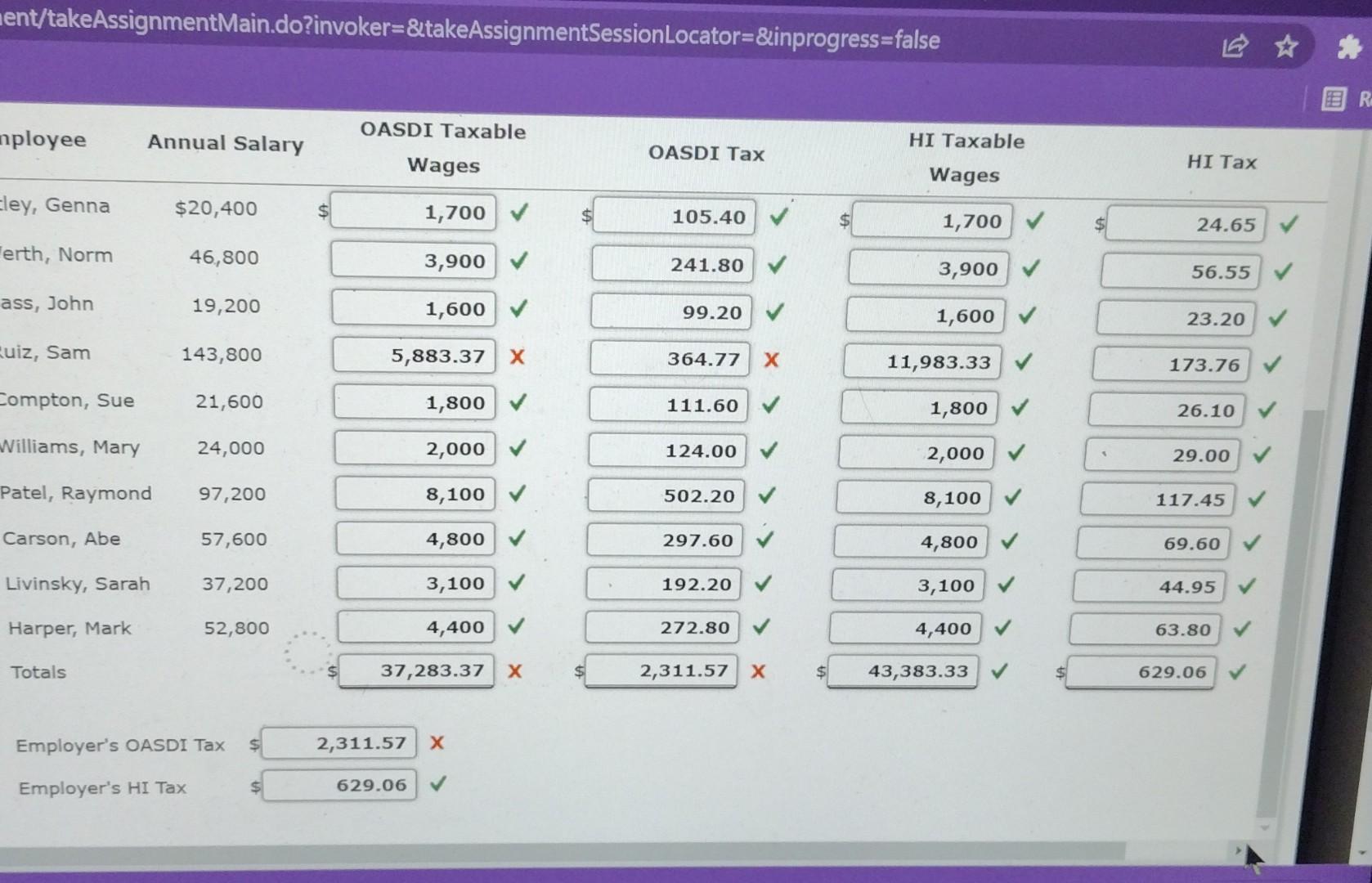

I super close but in not sure where I went wrong for the OASDI taxable for Ruiz, Sam.

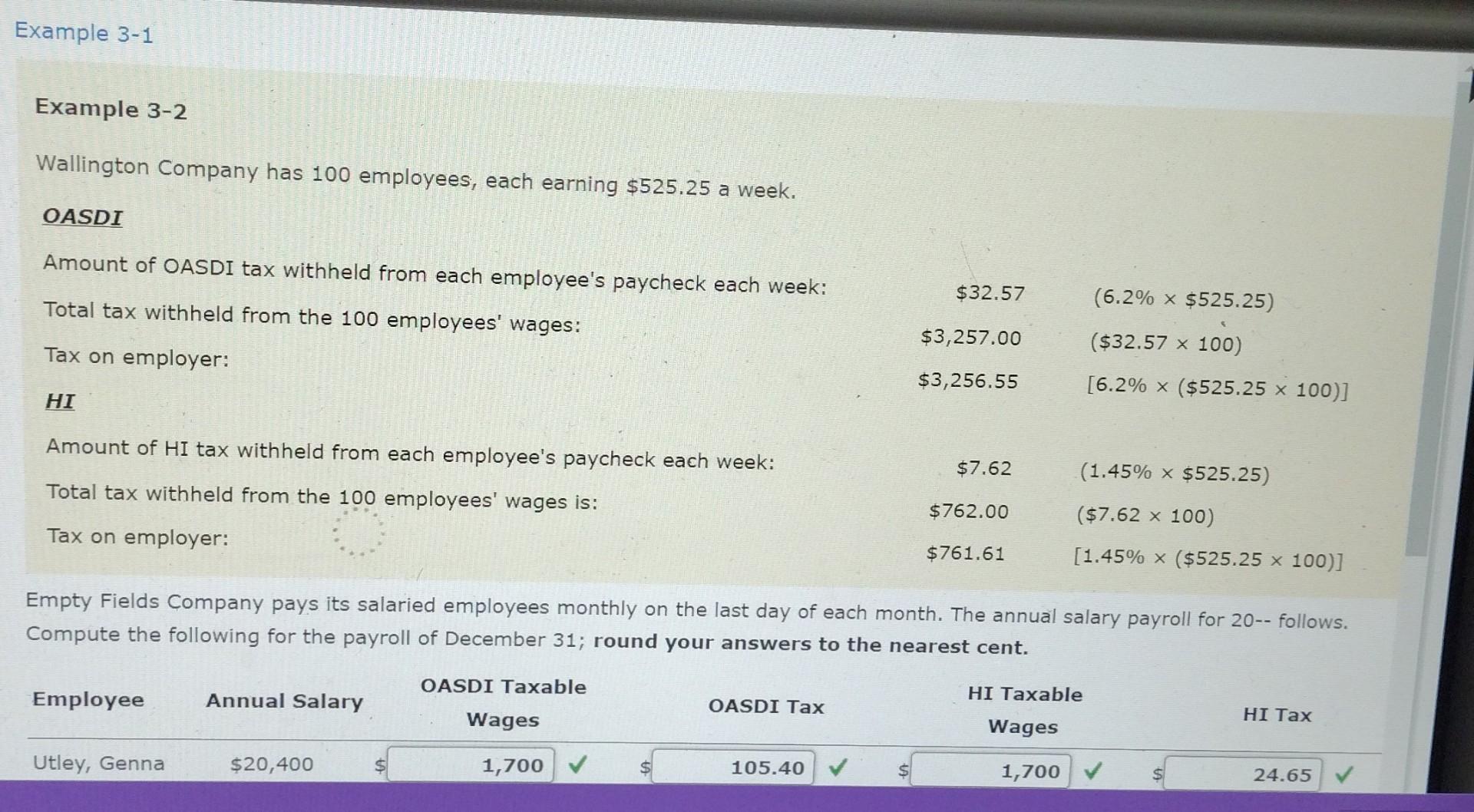

Example 3-1 Example 3-2 Wallington Company has 100 employees, each earning $525.25 a week. OASDI Amount of OASDI tax withheld from each employee's paycheck each week: $32.57 Total tax withheld from the 100 employees' wages: (6.2% x $525.25) $3,257.00 ($32.57 x 100) Tax on employer: $3,256.55 [6.2% x ($525.25 x 100)] Amount of HI tax withheld from each employee's paycheck each week: $7.62 (1.45% x $525.25) Total tax withheld from the 100 employees' wages is: $762.00 ($7.62 x 100) Tax on employer: $761.61 [1.45% x ($525.25 x 100)] Empty Fields Company pays its salaried employees monthly on the last day of each month. The annual salary payroll for 20-- follows. Compute the following for the payroll of December 31; round your answers to the nearest cent. OASDI Taxable Employee Annual Salary HI Taxable OASDI Tax Wages HI Tax Wages Utley, Genna $20,400 1,700 105.40 1,700 $ 24.65 Empty Fields Company pays its salaried employees monthly on the last day of each month. The annual salary payroll for 20-- follows. Compute the following for the payroll of December 31; round your answers to the nearest cent. Employee OASDI Taxable Annual Salary HI Taxable OASDI Tax Wages HI Tax Wages Utley, Genna $20,400 1,700 $ 105.40 1,700 24.65 Werth, Norm 46,800 3,900 241.80 3,900 56.55 Bass, John 19,200 1,600 99.20 1,600 23.20 Ruiz, Sam 143,800 5,883.37 X 364.77 11,983.33 173.76 Compton, Sue 21,600 1,800 111.60 1,800 26.10 Williams, Mary 24,000 2,000 124.00 2,000 29.00 Patel, Raymond 97,200 8,100 502.20 8,100 117.45 Carson, Abe 57,600 4,800 297.60 4,800 ~ 69.60 Livinsky, Sarah 37,200 3,100 192.20 3,100 44.95 Harper, Mark 52,800 4,400 272.80 4,400 63.80 Totals 37,283.37 X 2,311.57 X $ 43,383.33 $ 629.06 Employer's OASDI Tax 2,311.57 X ment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false R OASDI Taxable nployee Annual Salary HI Taxable OASDI Tax Wages HI Tax Wages dley, Genna $20,400 $ 1,700 105.40 $ 1,700 $ 24.65 Ferth, Norm 46,800 3,900 241.80 3,900 56.55 ass, John 19,200 1,600 99.20 1,600 23.20 Euiz, Sam 143,800 5,883.37 364.77 11,983.33 173.76 Compton, Sue 21,600 1,800 111.60 1,800 26.10 Williams, Mary 24,000 2,000 124.00 2,000 29.00 Patel, Raymond 97,200 8,100 502.20 8,100 117.45 Carson, Abe 57,600 4,800 297.60 4,800 69.60 Livinsky, Sarah 37,200 3,100 192.20 3,100 44.95 Harper, Mark 52,800 4,400 272.80 4,400 63.80 Totals 37,283.37 $ 2,311.57 x $ 43,383.33 629.06 Employer's OASDI Tax S 2,311.57 Employer's HI Tax $ 629.06Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started