Answered step by step

Verified Expert Solution

Question

1 Approved Answer

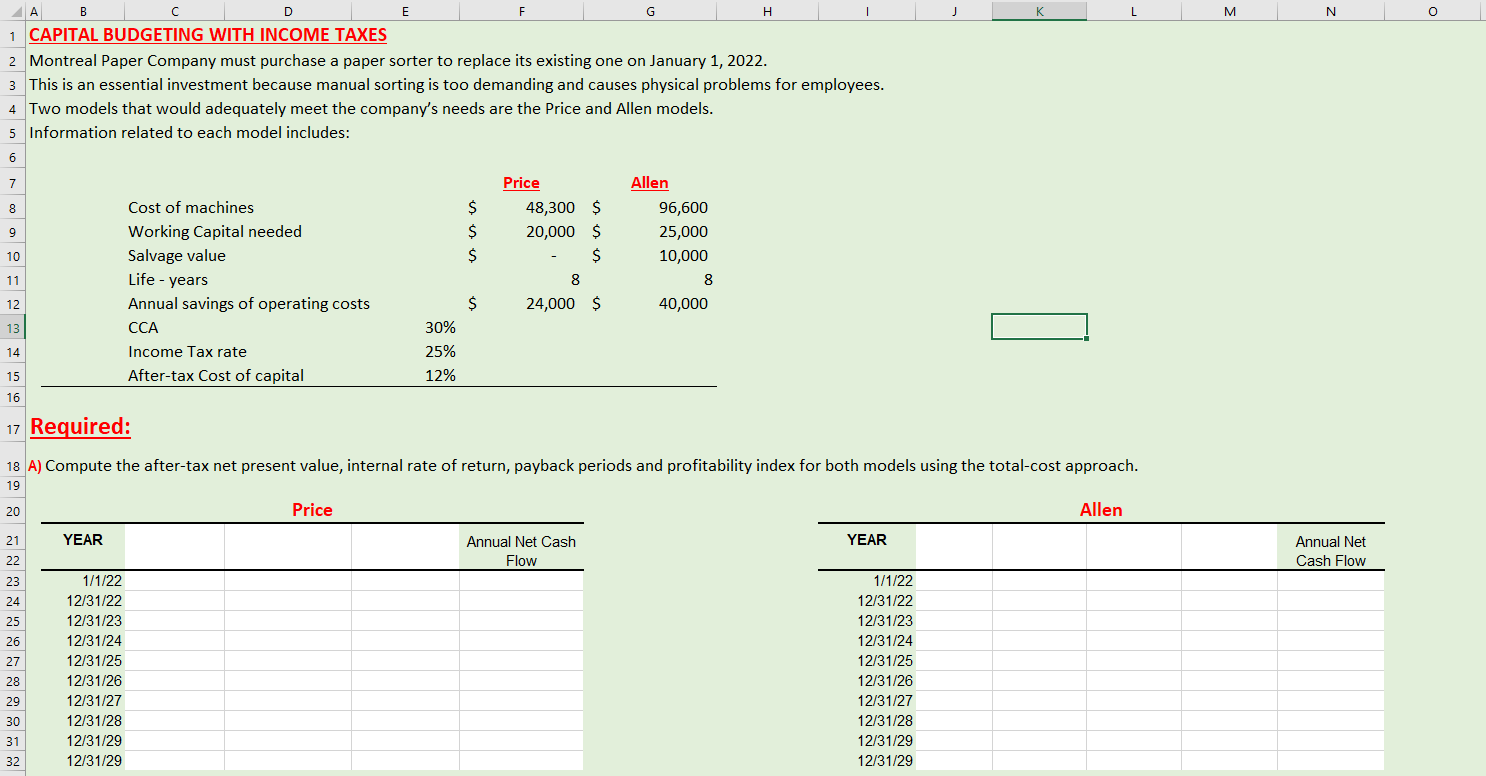

I take more clearer picture. This will not be blurry you can just zoom in the size. A E F G H | J K

I take more clearer picture. This will not be blurry you can just zoom in the size.

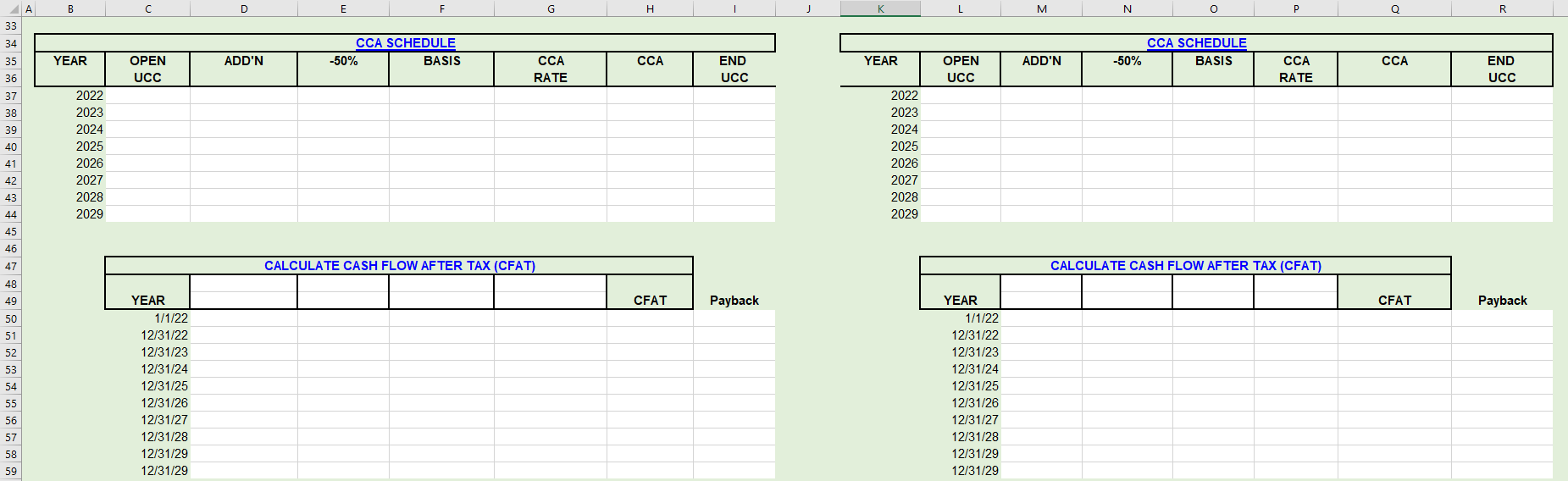

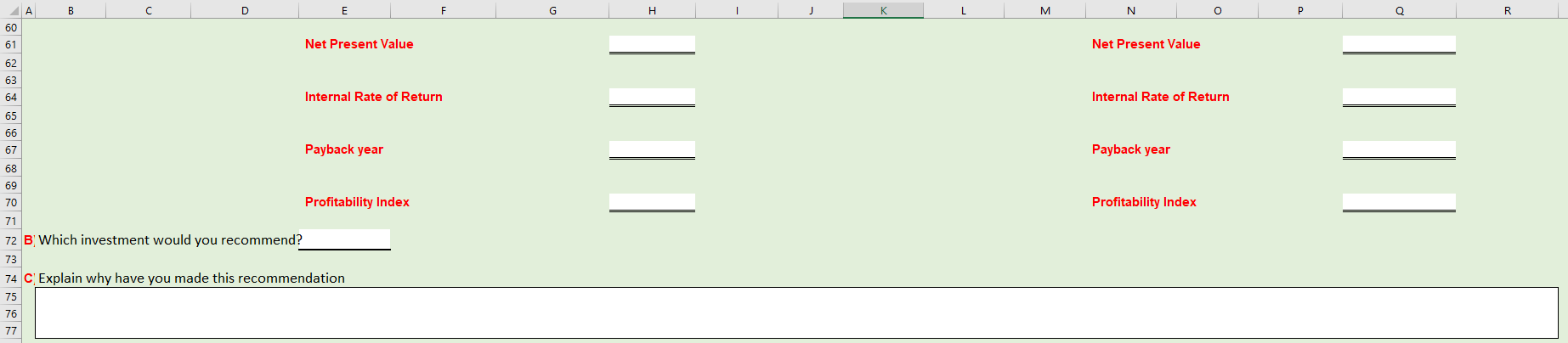

A E F G H | J K L L M N O 4 B D 1 CAPITAL BUDGETING WITH INCOME TAXES 2 Montreal Paper Company must purchase a paper sorter to replace its existing one on January 1, 2022. 3 This is an essential investment because manual sorting is too demanding and causes physical problems for employees. Two models that would adequately meet the company's needs are the price and Allen models. 5 Information related to each model includes: 6 7 Price Allen Cost of machines $ 48,300 $ 96,600 9 9 Working Capital needed $ 20,000 $ 25,000 Salvage value $ 10,000 11 8 8 8 12 Annual savings of operating costs $ 24,000 $ 40,000 30% 14 Income Tax rate 25% After-tax Cost of capital 12% 8 10 $ Life - years 13 CCA 15 16 17 Required: Annual Net Cash Flow 18 A) Compute the after-tax net present value, internal rate of return, payback periods and profitability index for both models using the total-cost approach. 19 20 Price Allen 21 YEAR Annual Net Cash YEAR 22 Flow 23 1/1/22 1/1/22 24 12/31/22 12/31/22 25 12/31/23 12/31/23 26 12/31/24 12/31/24 27 12/31/25 12/31/25 28 12/31/26 12/31/26 29 12/31/27 12/31/27 30 12/31/28 12/31/28 31 12/31/29 12/31/29 32 12/31/29 12/31/29 A B D E F G H J K L M N O P Q R 33 34 35 CCA SCHEDULE -50% BASIS CCA SCHEDULE -50% BASIS YEAR ADD'N CCA YEAR ADD'N CCA OPEN UCC CCA RATE END UCC OPEN UCC CCA RATE END UCC 36 37 38 39 40 2022 2023 2024 2025 2026 2027 2028 2029 2022 2023 2024 2025 2026 2027 2028 2029 41 42 43 44 45 46 47 CALCULATE CASH FLOW AFTER TAX (CFAT) CALCULATE CASH FLOW AFTER TAX (CFAT) 48 49 CFAT Payback CFAT Payback 50 51 52 53 54 YEAR 1/1/22 12/31/22 12/31/23 12/31/24 12/31/25 12/31/26 12/31/27 12/31/28 12/31/29 12/31/29 YEAR 1/1/22 12/31/22 12/31/23 12/31/24 12/31/25 12/31/26 12/31/27 12/31/28 12/31/29 12/31/29 55 56 57 58 59 A B E H L M N O R 60 61 Net Present Value Net Present Value 62 63 64 Internal Rate of Return Internal Rate of Return 65 66 67 Payback year Payback year 68 69 70 Profitability Index Profitability Index 71 72 B Which investment would you recommend? 73 74 C Explain why have you made this recommendation 75 76 77 A E F G H | J K L L M N O 4 B D 1 CAPITAL BUDGETING WITH INCOME TAXES 2 Montreal Paper Company must purchase a paper sorter to replace its existing one on January 1, 2022. 3 This is an essential investment because manual sorting is too demanding and causes physical problems for employees. Two models that would adequately meet the company's needs are the price and Allen models. 5 Information related to each model includes: 6 7 Price Allen Cost of machines $ 48,300 $ 96,600 9 9 Working Capital needed $ 20,000 $ 25,000 Salvage value $ 10,000 11 8 8 8 12 Annual savings of operating costs $ 24,000 $ 40,000 30% 14 Income Tax rate 25% After-tax Cost of capital 12% 8 10 $ Life - years 13 CCA 15 16 17 Required: Annual Net Cash Flow 18 A) Compute the after-tax net present value, internal rate of return, payback periods and profitability index for both models using the total-cost approach. 19 20 Price Allen 21 YEAR Annual Net Cash YEAR 22 Flow 23 1/1/22 1/1/22 24 12/31/22 12/31/22 25 12/31/23 12/31/23 26 12/31/24 12/31/24 27 12/31/25 12/31/25 28 12/31/26 12/31/26 29 12/31/27 12/31/27 30 12/31/28 12/31/28 31 12/31/29 12/31/29 32 12/31/29 12/31/29 A B D E F G H J K L M N O P Q R 33 34 35 CCA SCHEDULE -50% BASIS CCA SCHEDULE -50% BASIS YEAR ADD'N CCA YEAR ADD'N CCA OPEN UCC CCA RATE END UCC OPEN UCC CCA RATE END UCC 36 37 38 39 40 2022 2023 2024 2025 2026 2027 2028 2029 2022 2023 2024 2025 2026 2027 2028 2029 41 42 43 44 45 46 47 CALCULATE CASH FLOW AFTER TAX (CFAT) CALCULATE CASH FLOW AFTER TAX (CFAT) 48 49 CFAT Payback CFAT Payback 50 51 52 53 54 YEAR 1/1/22 12/31/22 12/31/23 12/31/24 12/31/25 12/31/26 12/31/27 12/31/28 12/31/29 12/31/29 YEAR 1/1/22 12/31/22 12/31/23 12/31/24 12/31/25 12/31/26 12/31/27 12/31/28 12/31/29 12/31/29 55 56 57 58 59 A B E H L M N O R 60 61 Net Present Value Net Present Value 62 63 64 Internal Rate of Return Internal Rate of Return 65 66 67 Payback year Payback year 68 69 70 Profitability Index Profitability Index 71 72 B Which investment would you recommend? 73 74 C Explain why have you made this recommendation 75 76 77Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started