i think i did it right but im not sure

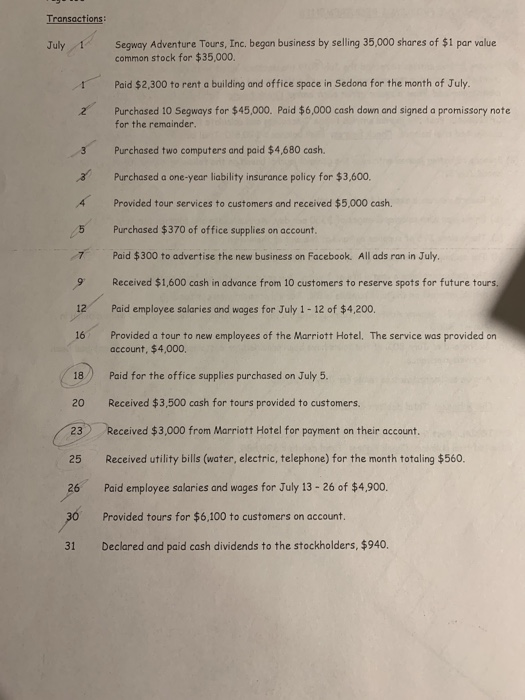

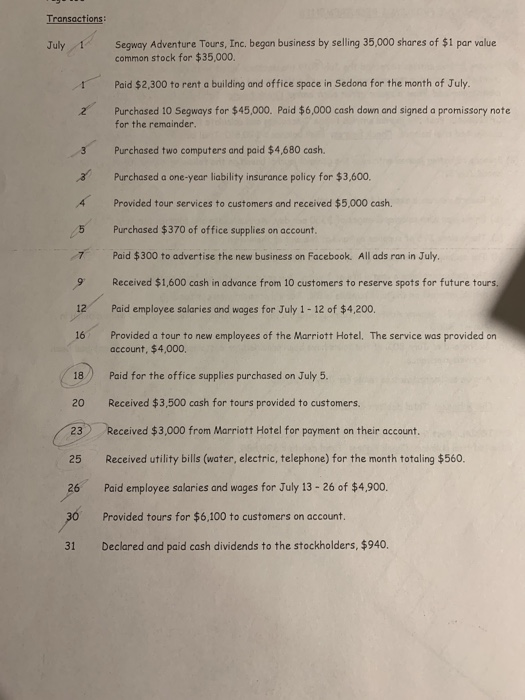

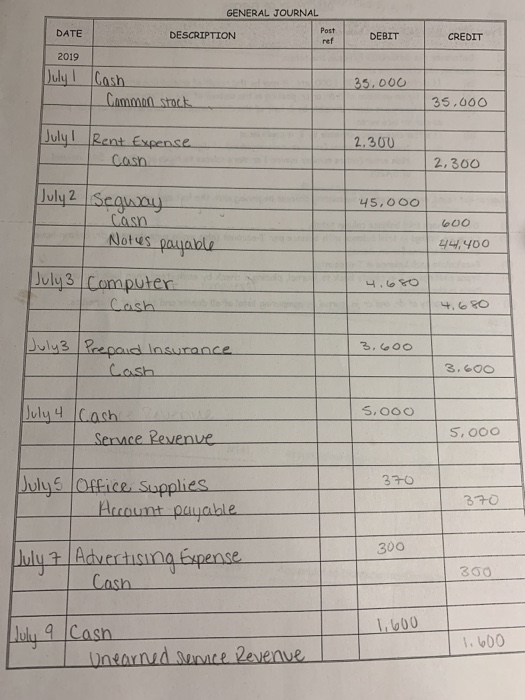

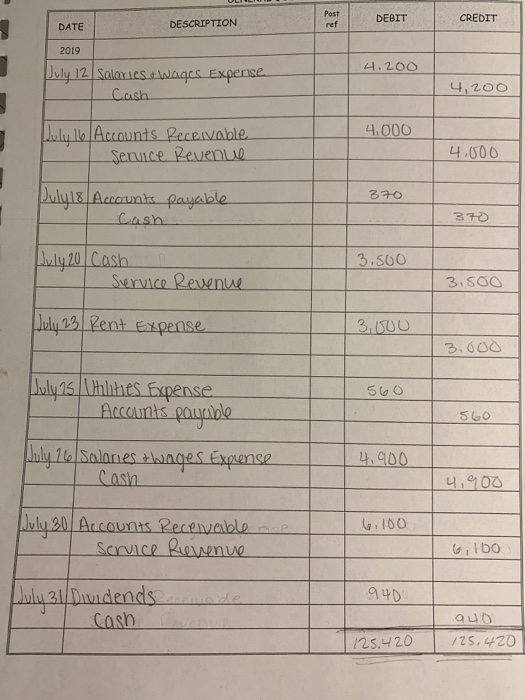

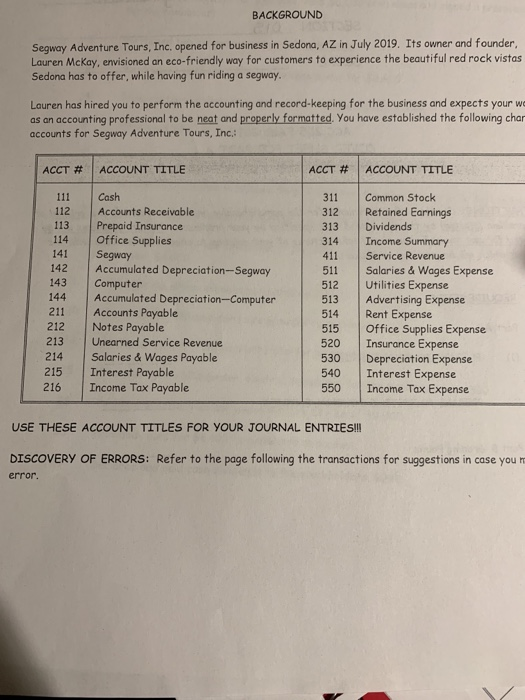

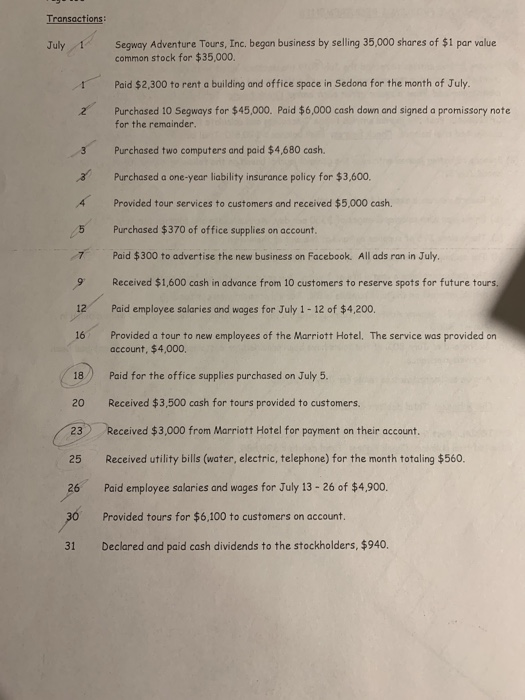

Transactions: July 1 Segway Adventure Tours, Inc, began business by selling 35,000 shares of $1 par value common stock for $35,000. Paid $2,300 to rent a building and office space in Sedona for the month of July. Purchased 10 Segways for $45,000. Paid $6,000 cash down and signed a promissory note for the remainder. Purchased two computers and paid $4,680 cash. Purchased a one-year liability insurance policy for $3,600, Provided tour services to customers and received $5,000 cash. Purchased $370 of office supplies on account. Paid $300 to advertise the new business on Facebook. All ads ran in July Received $1,600 cash in advance from 10 customers to reserve spots for future tours. Paid employee salaries and wages for July 1 - 12 of $4,200. Provided a tour to new employees of the Marriott Hotel. The service was provided on account, $4,000 18 Paid for the office supplies purchased on July 5. 20 Received $3,500 cash for tours provided to customers. Received $3,000 from Marriott Hotel for payment on their account. Received utility bills (water, electric, telephone) for the month totaling $560. Paid employee salaries and wages for July 13 - 26 of $4,900. 30 Provided tours for $6,100 to customers on account. 31 Declared and paid cash dividends to the stockholders, $940. GENERAL JOURNAL DATE Post DESCRIPTION DEBIT CREDIT 2019 July 1 Cash Common stock 35.000 35.000 2.300 July! Rent Expense - Cash 2,300 45,000 July 2 Segway Cash Notus payable 600 44,400 July 3 Computer Cash July3 3. OO Prepaid Insurance Cash 3.600 July 4 5.000 Cash ne Service Revenue 5,000 370 Julys Office Supplies Account payable 370 300 July 7 Advertising Expense Cash 300 1,600 July 9 Cash Unearned sevice Revenue 1.600 Post DATE DEBIT DATE DESCRIPTION CREDIT 2019 4.200 July 12 Saloxiest wages Expense. I Cash 4,200 4.000 July 16 Accounts Receivable service Revenue 4.000 370 Dukung Accounts payable Cash 3.500 July 20 Cash I Service Revenue 1 3.500 July 23 Rent Expense 3,000 3.000 July 25 Whites Expense Accounts payable - 560 560 July 26 Salones thages Expense Cash 4,900 4.900 6.100 | July 30 Accounts Receivable noe I service Revenue 6,160 I 940 July 31/ Dividends I Cash unde au quo 725,420 125.420 BACKGROUND Segway Adventure Tours, Inc, opened for business in Sedona, AZ in July 2019. Its owner and founder, Lauren McKay, envisioned an eco-friendly way for customers to experience the beautiful red rock vistas Sedona has to offer, while having fun riding a segway. Lauren has hired you to perform the accounting and record-keeping for the business and expects your we as an accounting professional to be neat and properly formatted. You have established the following char accounts for Segway Adventure Tours, Inc.: ACCT # ACCOUNT TITLE ACCT # ACCOUNT TITLE 111 112 311 312 313 314 114 141 142 143 144 211 212 213 214 215 216 Cash Accounts Receivable Prepaid Insurance Office Supplies Segway Accumulated Depreciation --Segway Computer Accumulated Depreciation-Computer Accounts Payable Notes Payable Unearned Service Revenue Salaries & Wages Payable Interest Payable Income Tax Payable 512 513 514 515 520 530 540 550 Common Stock Retained Earnings Dividends Income Summary Service Revenue Salaries & Wages Expense Utilities Expense Advertising Expense Rent Expense Office Supplies Expense Insurance Expense Depreciation Expense Interest Expense Income Tax Expense USE THESE ACCOUNT TITLES FOR YOUR JOURNAL ENTRIES!!! DISCOVERY OF ERRORS: Refer to the page following the transactions for suggestions in case you m error