Question

I. To get your company approved, submit to me by November 10 the names of three companies that meet the following criteria, ranked in order

I. To get your company approved, submit to me by November 10 the names of three

I. To get your company approved, submit to me by November 10 the names of three

companies that meet the following criteria, ranked in order of preference:

- Non-financial U.S. company with positive Operating Cash Flow and Total Debt available in Yahoo Statistics.

- The company has Income Statement and Cash Flow Statement available in Financials as well as Analysis available on Yahoo Finance.

- The companys Trailing Twelve Months (TTM) Operating Cash Flow is at least double the Capital Expenditure in its Cash Flow statement.

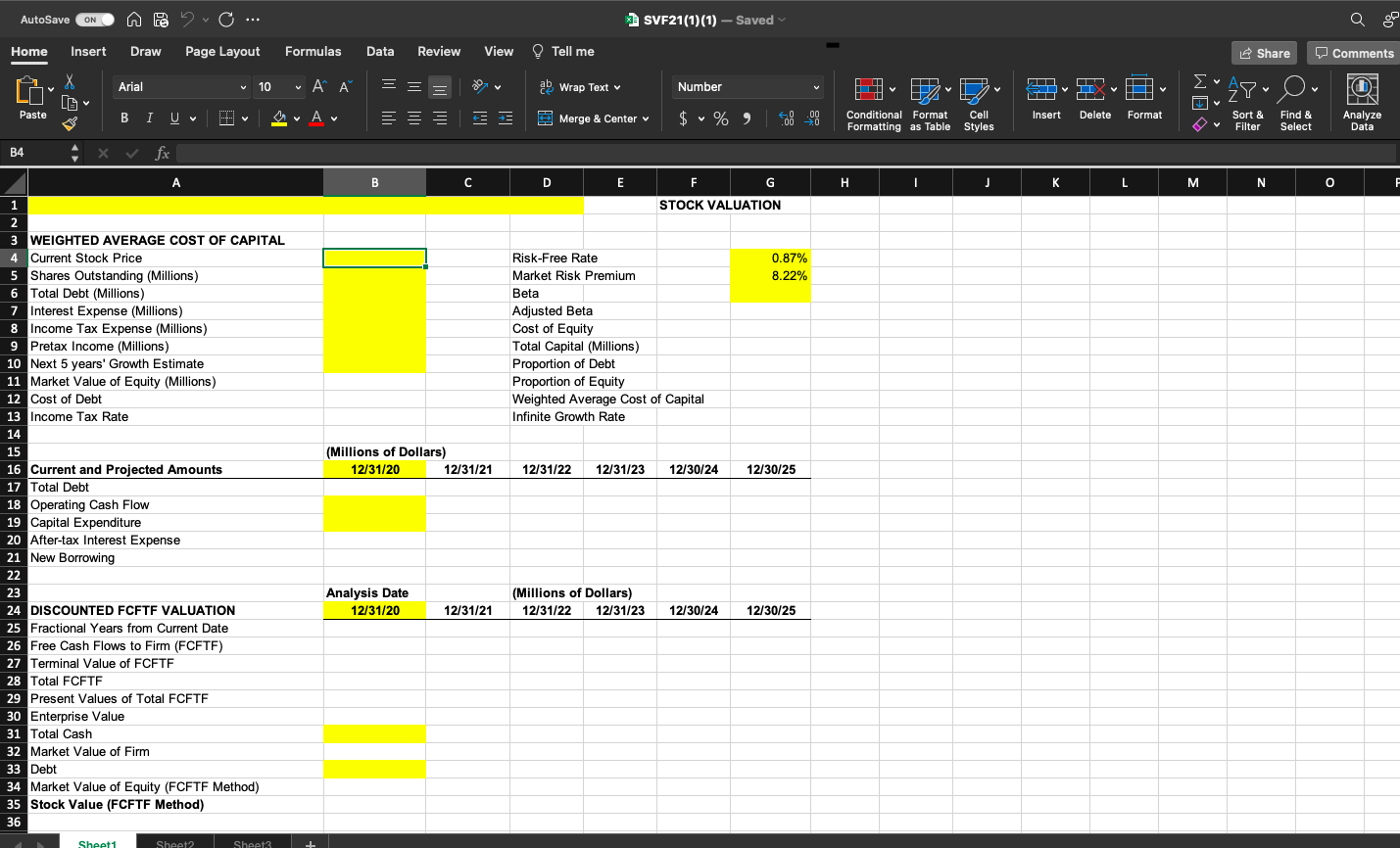

II. Download the stock valuation template (SVF21) from Blackboard (Content tab). Enter

the inputs (blank yellow cells) from your data sources and write efficient Excel

formulas to calculate the outputs, using the guidelines given below and the completed

sample worksheet for Apple provided on the Content tab in Blackboard.

III. Name the Excel sheet with the ticker symbol of your company. Create a custom

footer for your Excel file, showing the file name, sheet name, and date. Save your

completed Excel file with your last name inserted before SVF21 (for example,

ThomasSVF21).

on the due date (December 1):

1. Statistics

2. Profile

3. Income Statement

4. Cash Flow

5. Analysis

[Note: After you have opened each data source, you can click the three dots () on the right of your browsers Search Bar, select Take a Screenshot from the Menu, select Save Full Page on right, and download the Page. Save each of these data sources with your stocks Ticker Symbol and the data name. For example, AAPL Statistics, AAPL Profile, AAPL Income, AAPL Cash Flow, and AAPL Analysis.]

AutoSave ON O... SVF21(1)(1) - Saved Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments Arial 10 - AI = = ab Wrap Text Number 28 Or FO N Analyze Data Paste B I U VA AD Insert E E Merge & Center $ % ) Delete Format Conditional Format Cell Formatting as Table Styles Sort & Filter Find & Select B4 - x fx A B C D E G K L M N O F STOCK VALUATION 0.87% 8.22% Risk-Free Rate Market Risk Premium Beta Adjusted Beta Cost of Equity Total Capital (Millions) Proportion of Debt Proportion of Equity Weighted Average Cost of Capital Infinite Growth Rate (Millions of Dollars) 12/31/20 12/31/21 12/31/22 12/31/23 12/30/24 12/30/25 1 2 3 WEIGHTED AVERAGE COST OF CAPITAL Current Stock Price 5 Shares Outstanding (Millions) 6 Total Debt (Millions) 7 Interest Expense (Millions) 8 Income Tax Expense (Millions) 9 Pretax Income (Millions) 10 Next 5 years' Growth Estimate 11 Market Value of Equity (Millions) 12 Cost of Debt 13 Income Tax Rate 14 15 16 Current and Projected Amounts 17 Total Debt 18 Operating Cash Flow 19 Capital Expenditure 20 After-tax Interest Expense 21 New Borrowing 22 23 24 DISCOUNTED FCFTF VALUATION 25 Fractional Years from Current Date 26 Free Cash Flows to Firm (FCFTF) 27 Terminal Value of FCFTF 28 Total FCFTF 29 Present Values of Total FCFTF 30 Enterprise Value 31 Total Cash 32 Market Value of Firm 33 Debt 34 Market Value of Equity (FCFTF Method) 35 Stock Value (FCFTF Method) 36 Analysis Date 12/31/20 (Millions of Dollars) 12/31/22 12/31/23 12/31/21 12/30/24 12/30/25 Sheet1 Sheet? Sheet3 + AutoSave ON O... SVF21(1)(1) - Saved Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments Arial 10 - AI = = ab Wrap Text Number 28 Or FO N Analyze Data Paste B I U VA AD Insert E E Merge & Center $ % ) Delete Format Conditional Format Cell Formatting as Table Styles Sort & Filter Find & Select B4 - x fx A B C D E G K L M N O F STOCK VALUATION 0.87% 8.22% Risk-Free Rate Market Risk Premium Beta Adjusted Beta Cost of Equity Total Capital (Millions) Proportion of Debt Proportion of Equity Weighted Average Cost of Capital Infinite Growth Rate (Millions of Dollars) 12/31/20 12/31/21 12/31/22 12/31/23 12/30/24 12/30/25 1 2 3 WEIGHTED AVERAGE COST OF CAPITAL Current Stock Price 5 Shares Outstanding (Millions) 6 Total Debt (Millions) 7 Interest Expense (Millions) 8 Income Tax Expense (Millions) 9 Pretax Income (Millions) 10 Next 5 years' Growth Estimate 11 Market Value of Equity (Millions) 12 Cost of Debt 13 Income Tax Rate 14 15 16 Current and Projected Amounts 17 Total Debt 18 Operating Cash Flow 19 Capital Expenditure 20 After-tax Interest Expense 21 New Borrowing 22 23 24 DISCOUNTED FCFTF VALUATION 25 Fractional Years from Current Date 26 Free Cash Flows to Firm (FCFTF) 27 Terminal Value of FCFTF 28 Total FCFTF 29 Present Values of Total FCFTF 30 Enterprise Value 31 Total Cash 32 Market Value of Firm 33 Debt 34 Market Value of Equity (FCFTF Method) 35 Stock Value (FCFTF Method) 36 Analysis Date 12/31/20 (Millions of Dollars) 12/31/22 12/31/23 12/31/21 12/30/24 12/30/25 Sheet1 Sheet? Sheet3 +Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started