Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I tried to answer but I did something wrong. please help The following information was taken from the accounting records of Chicoutimi Lte. and Jonquire

I tried to answer but I did something wrong. please help

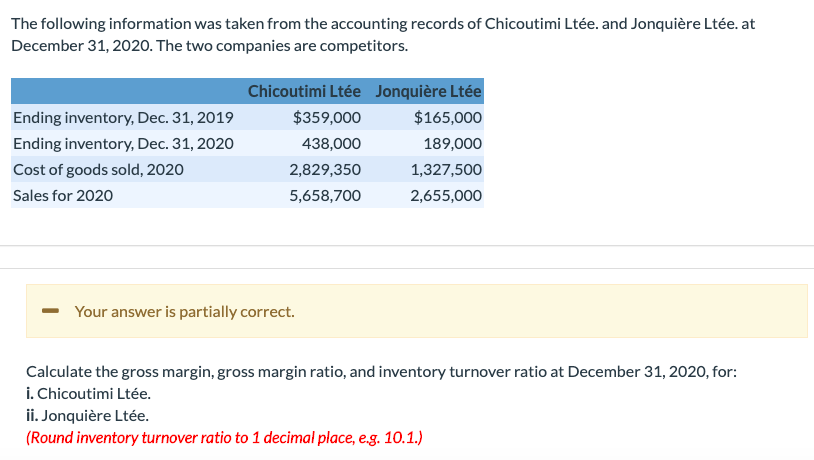

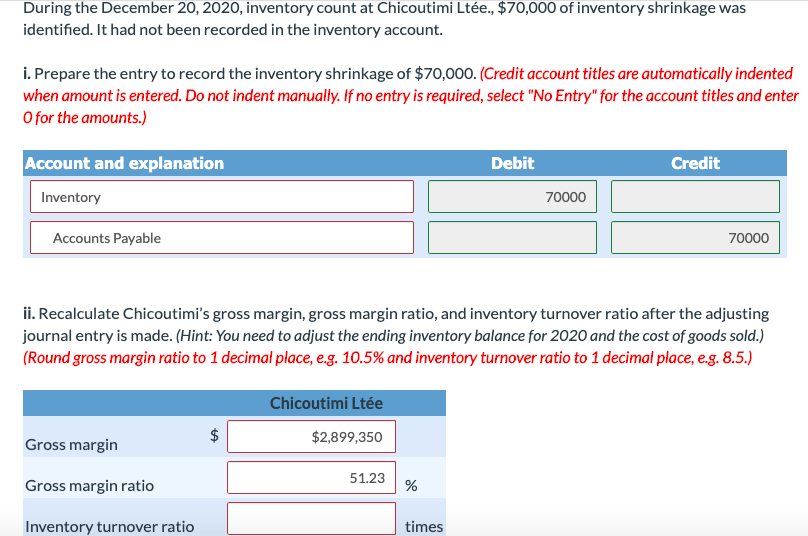

The following information was taken from the accounting records of Chicoutimi Lte. and Jonquire Lte. at December 31, 2020. The two companies are competitors. Ending inventory, Dec. 31, 2019 Ending inventory, Dec. 31, 2020 Cost of goods sold, 2020 Sales for 2020 Chicoutimi Lte Jonquire Lte $359,000 $165,000 438,000 189,000 2,829,350 1,327,500 5,658,700 2,655,000 Your answer is partially correct. Calculate the gross margin, gross margin ratio, and inventory turnover ratio at December 31, 2020, for: i. Chicoutimi Lte. ii. Jonquire Lte. (Round inventory turnover ratio to 1 decimal place, e.g. 10.1.) During the December 20, 2020, inventory count at Chicoutimi Lte., $70,000 of inventory shrinkage was identified. It had not been recorded in the inventory account. i. Prepare the entry to record the inventory shrinkage of $70,000. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account and explanation Debit Credit Inventory 70000 Accounts Payable 70000 ii. Recalculate Chicoutimi's gross margin, gross margin ratio, and inventory turnover ratio after the adjusting journal entry is made. (Hint: You need to adjust the ending inventory balance for 2020 and the cost of goods sold.) (Round gross margin ratio to 1 decimal place, e.g. 10.5% and inventory turnover ratio to 1 decimal place, e.g. 8.5.) Chicoutimi Lte $ Gross margin $2,899,350 51.23 Gross margin ratio % Inventory turnover ratio timesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started