Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I tried to fill some spaces already, not sure if it is right. Please help The following list of accounts was prepared for Tile, Etc.,

I tried to fill some spaces already, not sure if it is right. Please help

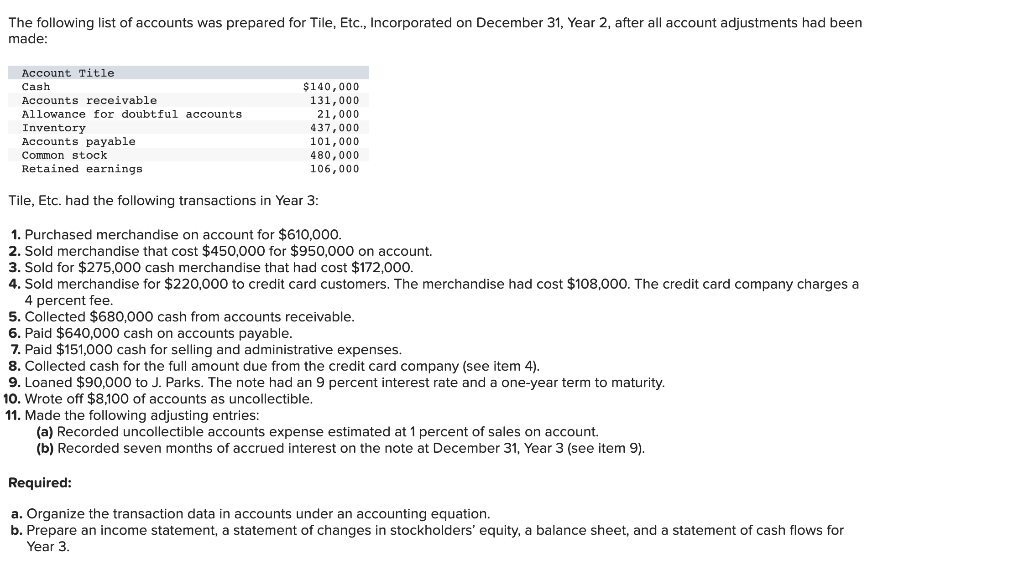

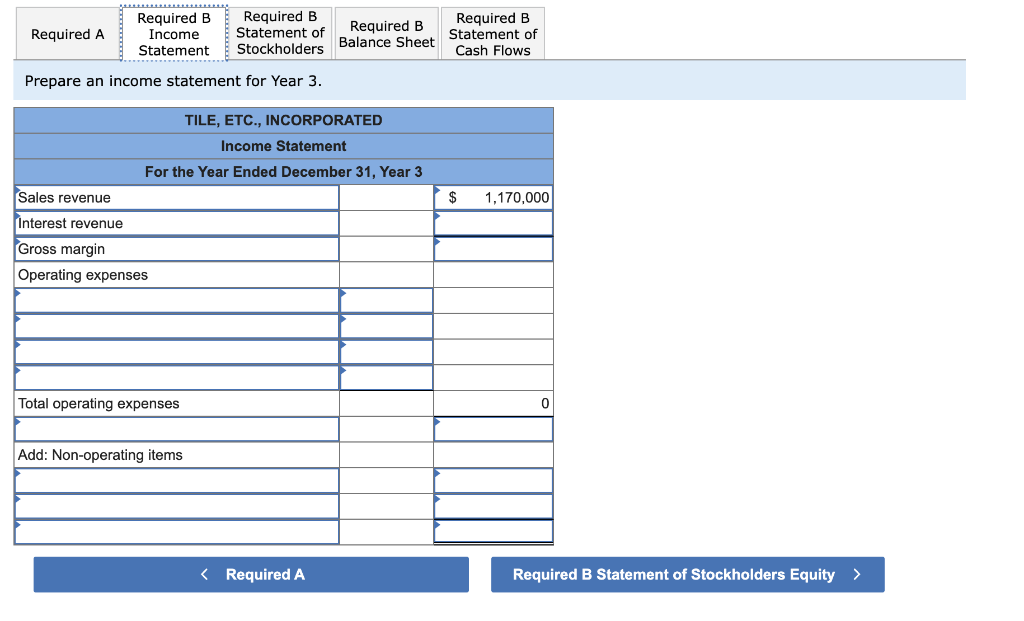

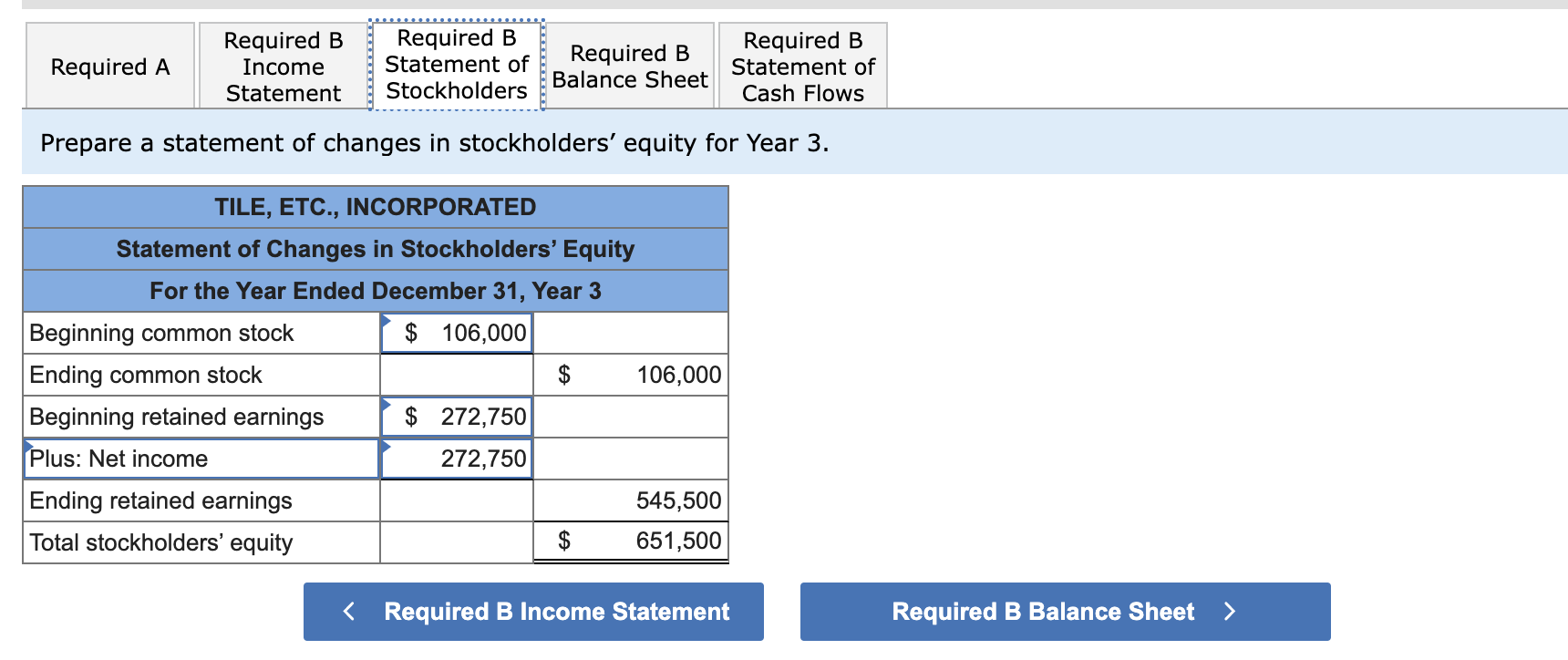

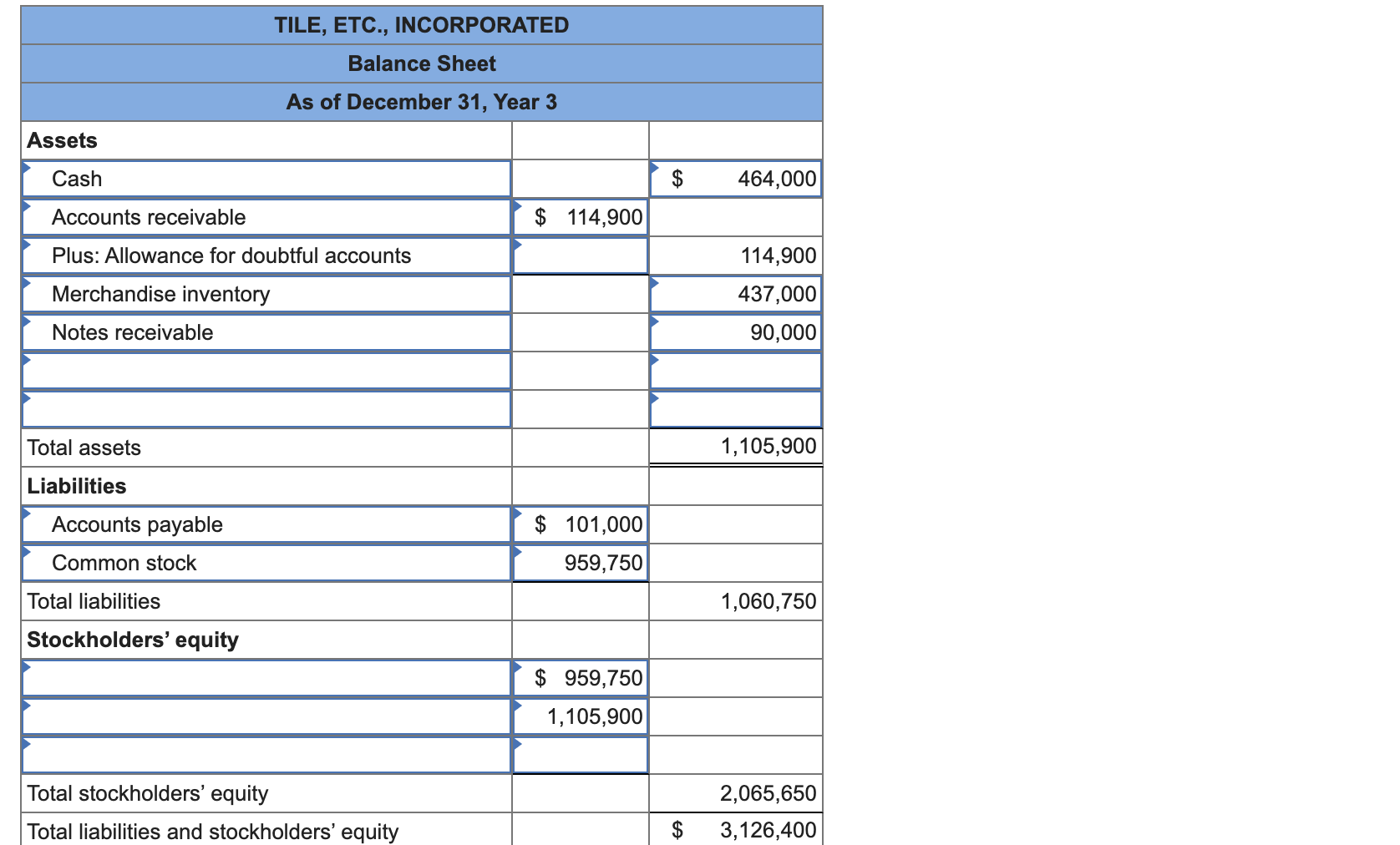

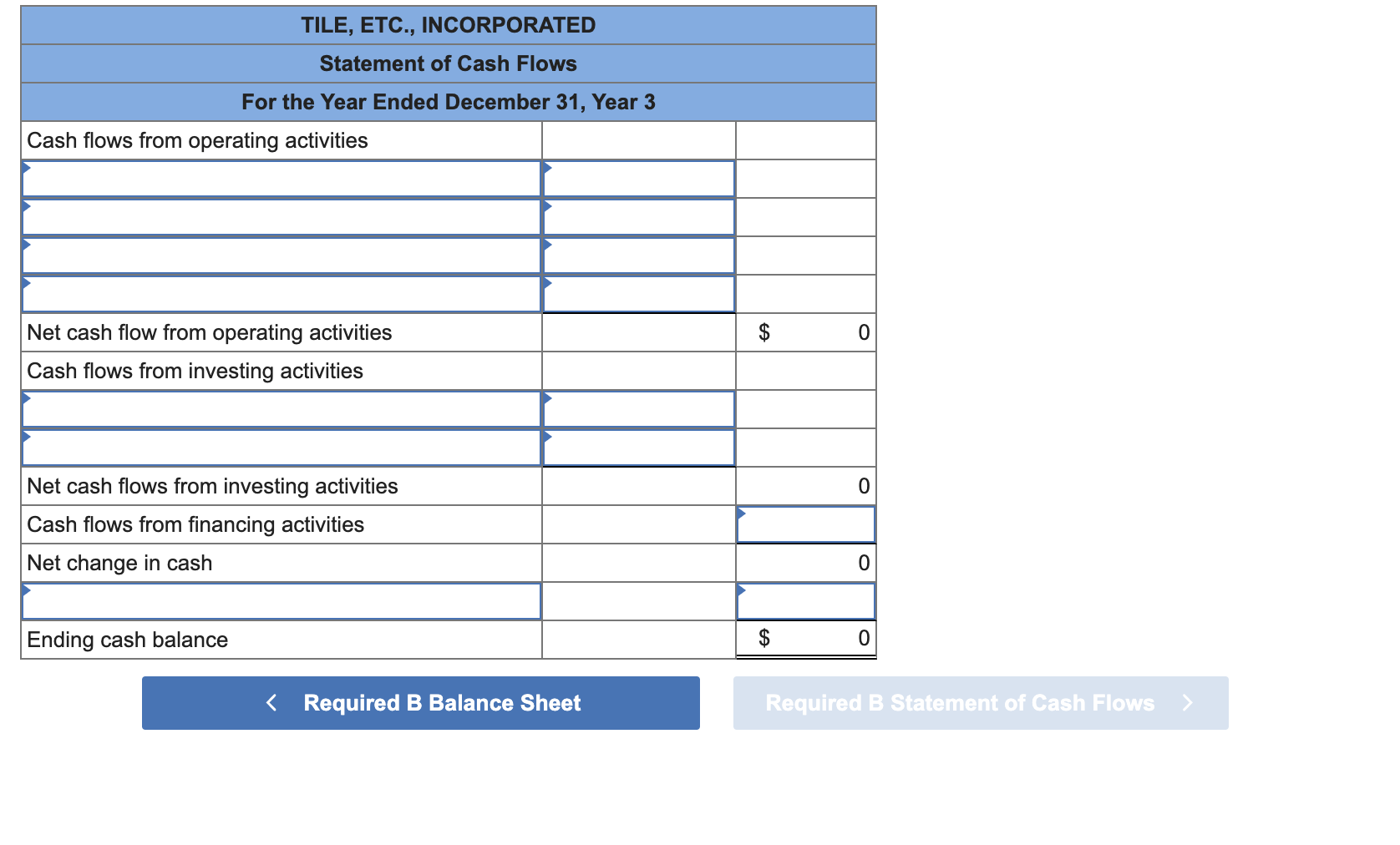

The following list of accounts was prepared for Tile, Etc., Incorporated on December 31, Year 2, after all account adjustments had been made: Tile, Etc. had the following transactions in Year 3: 1. Purchased merchandise on account for $610,000. 2. Sold merchandise that cost $450,000 for $950,000 on account. 3. Sold for $275,000 cash merchandise that had cost $172,000. 4. Sold merchandise for $220,000 to credit card customers. The merchandise had cost $108,000. The credit card company charges a 4 percent fee. 5. Collected $680,000 cash from accounts receivable. 6. Paid $640,000 cash on accounts payable. 7. Paid $151,000 cash for selling and administrative expenses. 8. Collected cash for the full amount due from the credit card company (see item 4). 9. Loaned $90,000 to J. Parks. The note had an 9 percent interest rate and a one-year term to maturity. 10. Wrote off $8,100 of accounts as uncollectible. 11. Made the following adjusting entries: (a) Recorded uncollectible accounts expense estimated at 1 percent of sales on account. (b) Recorded seven months of accrued interest on the note at December 31, Year 3 (see item 9). Required: a. Organize the transaction data in accounts under an accounting equation. b. Prepare an income statement, a statement of changes in stockholders' equity, a balance sheet, and a statement of cash flows for Year 3. Prepare an income statement for Year 3. Prepare a statement of changes in stockholders' equity for Year 3. TILE, ETC., INCORPORATED Balance Sheet As of December 31, Year 3 \begin{tabular}{|l|r|r|} \hline Assets & & \\ \hline Cash & & $ \\ \hline Accounts receivable & $114,900 & \\ \hline Plus: Allowance for doubtful accounts & & 464,000 \\ \hline Merchandise inventory & & 114,900 \\ \hline Notes receivable & & 437,000 \\ \hline & & 90,000 \\ \hline & & \\ \hline Total assets & & 1,105,900 \\ \hline Liabilities & & \\ \hline Accounts payable & $101,000 & \\ \hline Common stock & 959,750 & \\ \hline Total liabilities & & 1,060,750 \\ \hline Stockholders' equity & & \\ \hline & $959,750 & \\ \hline & 1,105,900 & \\ \hline & & \\ \hline Total stockholders' equity & & \\ \hline Total liabilities and stockholders' equity & & $,065,650 \\ \hline & & 3,126,400 \\ \hline \end{tabular} TILE, ETC., INCORPORATED Statement of Cash Flows For the Year Ended December 31, Year 3Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started