Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I tried to upload these in another question submitted but gor some reason whole both were clear on my end the upload was blurry and

I tried to upload these in another question submitted but gor some reason whole both were clear on my end the upload was blurry and illegible. Can you please help ne to solve these step by step using excel? or I have a TI-84 Plus CE I purchased to help me learn? Can you put what formula you entered in excel if you used one?

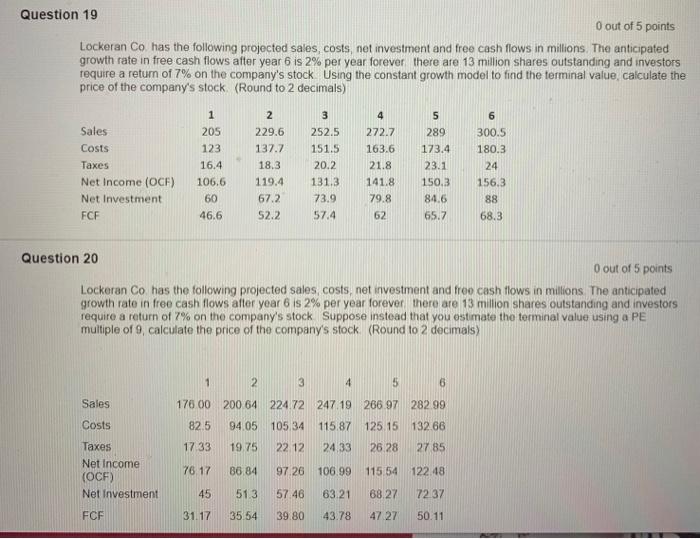

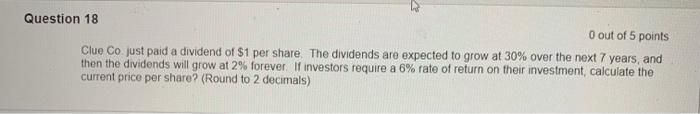

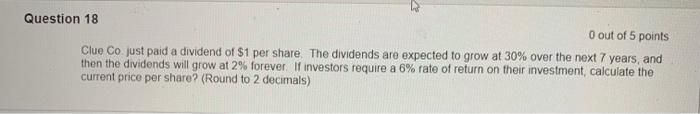

Question 19 O out of 5 points Lockeran Co has the following projected sales, costs, net investment and free cash flows in millions. The anticipated growth rate in free cash flows after year 6 is 2% per year forever there are 13 million shares outstanding and investors require a retum of 7% on the company's stock Using the constant growth model to find the terminal value, calculate the price of the company's stock (Round to 2 decimals) 6 Sales Costs Taxes Net Income (OCF) Net Investment FCF 1 205 123 16.4 106.6 60 46.6 2 229.6 137.7 18.3 119.4 67.2 52.2 3 252.5 151.5 20.2 131.3 73.9 57.4 4 272.7 163.6 21.8 141.8 79.8 62 5 289 173.4 23.1 150,3 84.6 65.7 300.5 180.3 24 156.3 88 68.3 Question 20 O out of 5 points Lockeran Co has the following projected sales, costs, net investment and treo cash flows in millions The anticipated growth rate in free cash flows after year 6 is 2% per year forever there are 13 million shares outstanding and investors require a return of 7% on the company's stock Suppose instead that you estimate the terminal value using a PE multiple of 9, calculate the price of the company's stock (Round to 2 decimals) 1 2 3 4 5 6 Sales Costs 176 00 200 64 224.72 247.19 266.97 282.99 82.5 94.05 105.34 115.87 125.15 132.66 17.33 19.75 22 12 24.33 26.28 27 85 Taxes Net Income (OCF) Net investment 76 17 86.84 97 26 106.99 115.54 122.48 45 51.3 5746 63.21 68.27 72 37 FCF 31.17 35.54 39.80 43.78 47 27 50.11 Question 18 O out of 5 points Clue Co. just paid a dividend of $1 per share. The dividends are expected to grow at 30% over the next 7 years, and then the dividends will grow at 2% forever. If investors require a 6% rate of return on their investment, calculate the current price per share? (Round to 2 decimals)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started