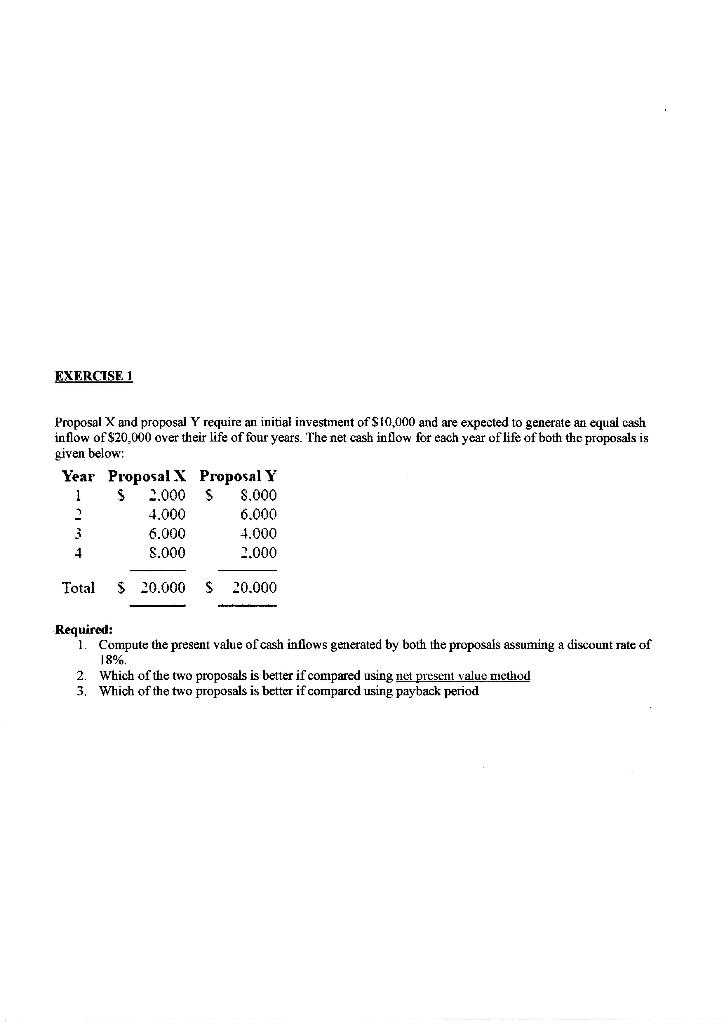

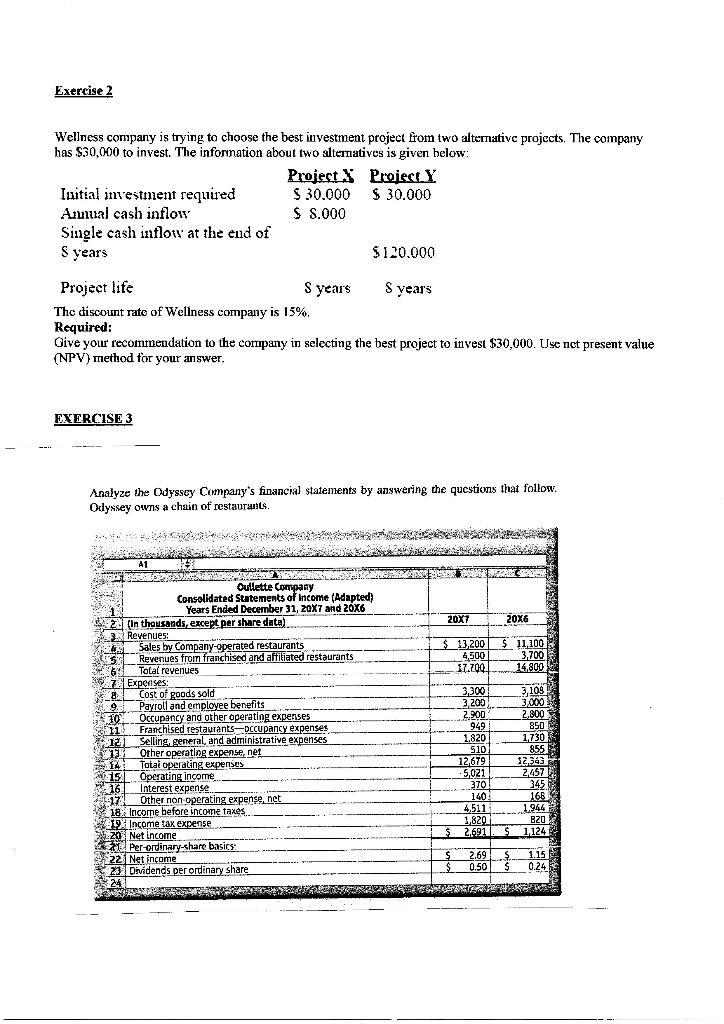

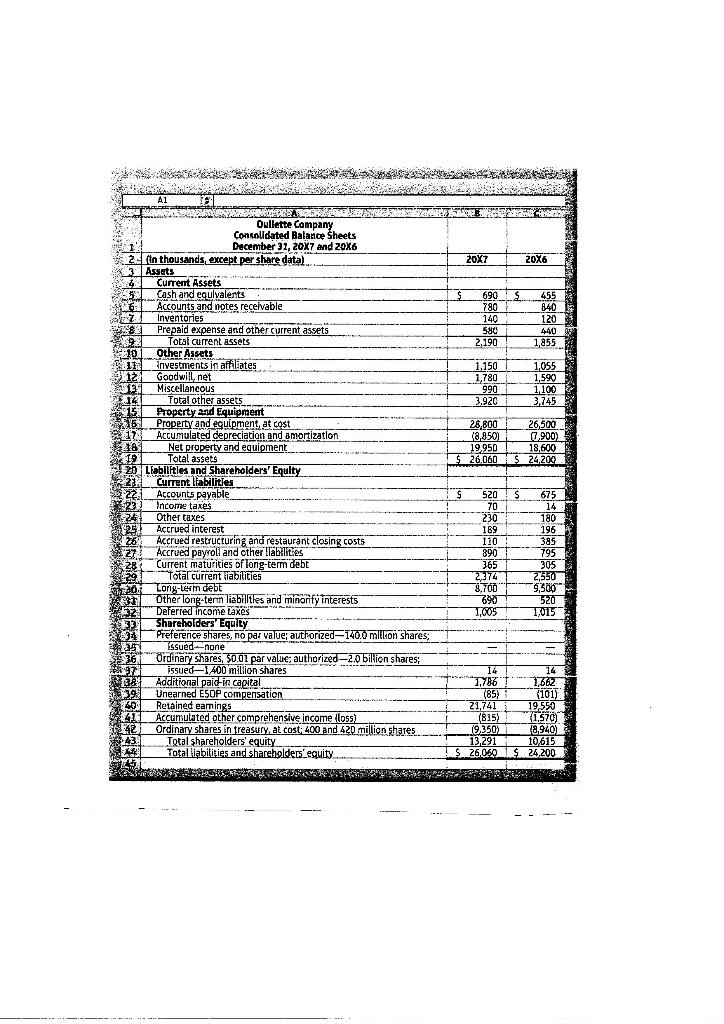

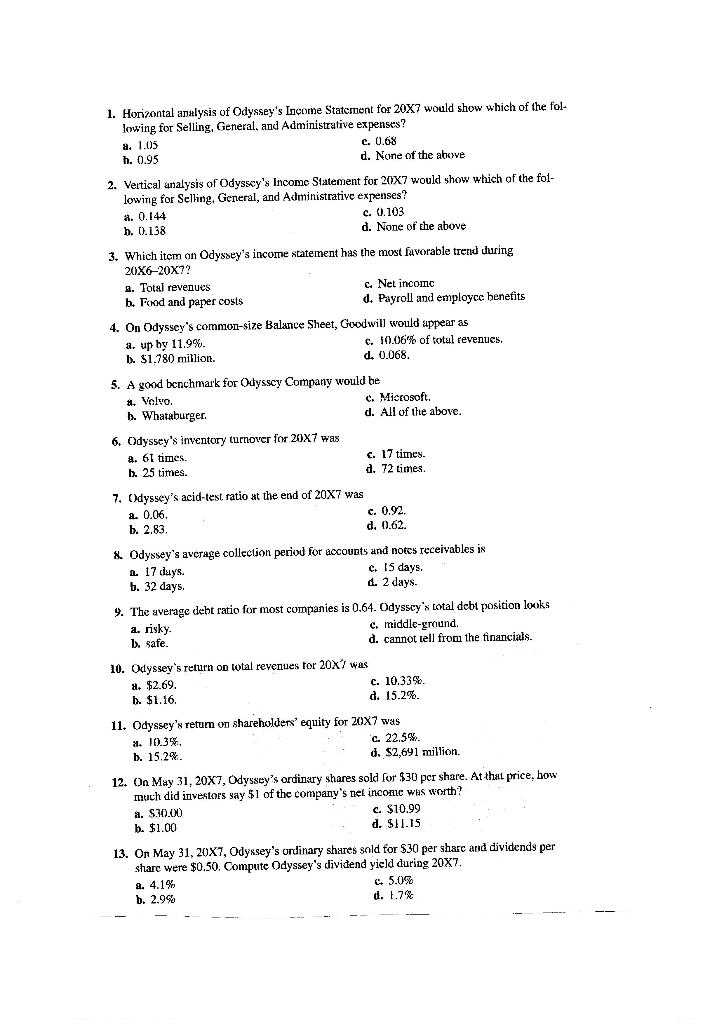

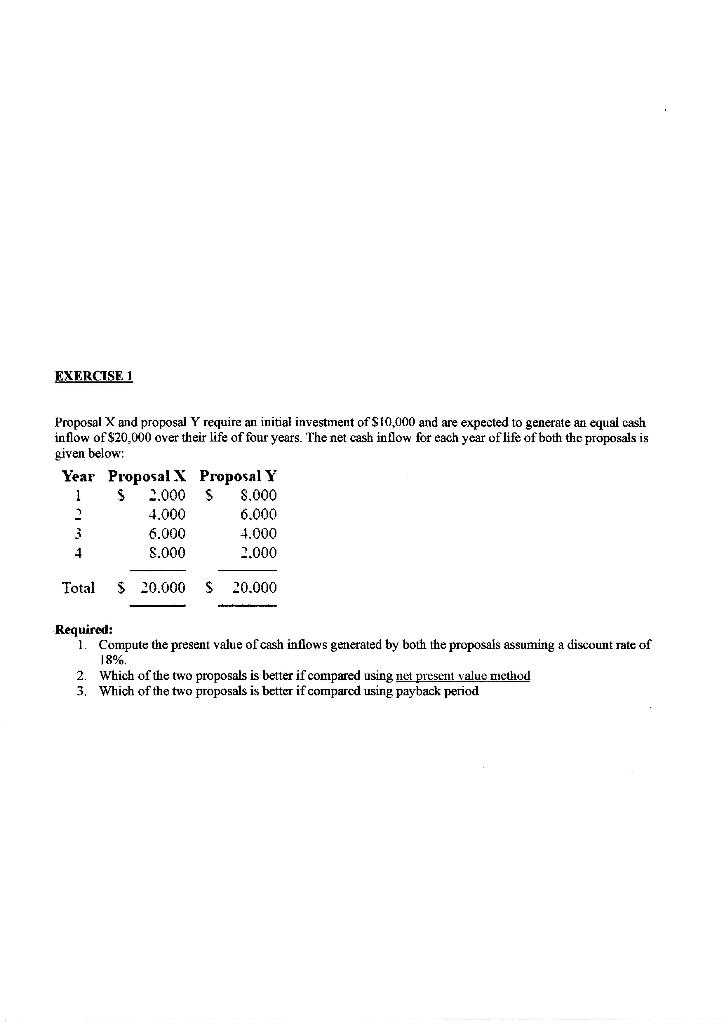

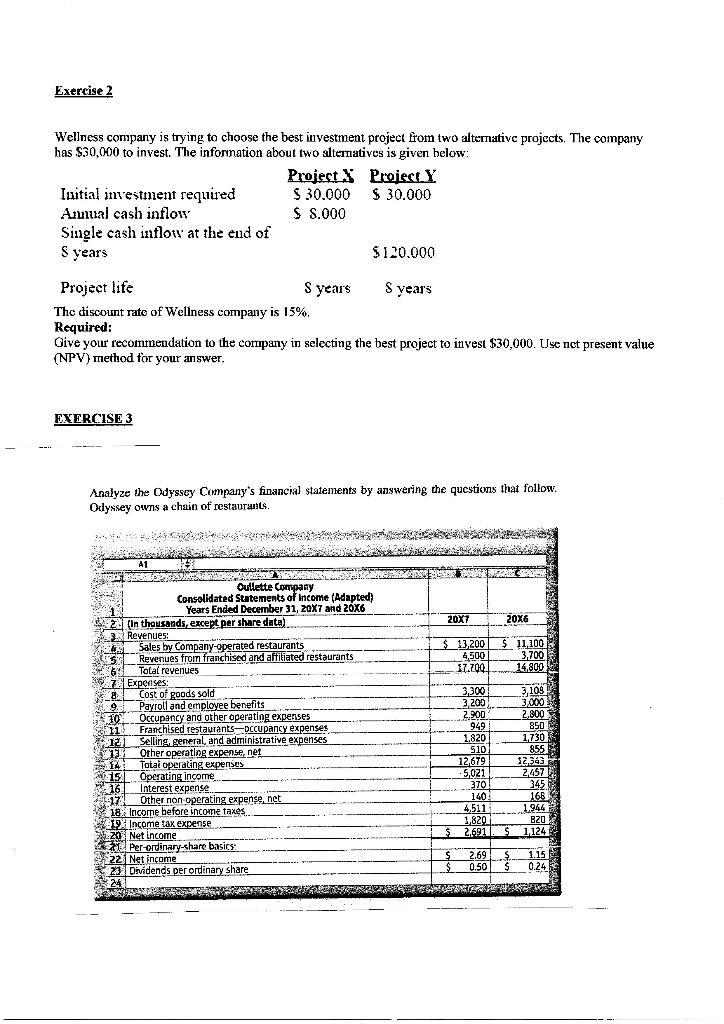

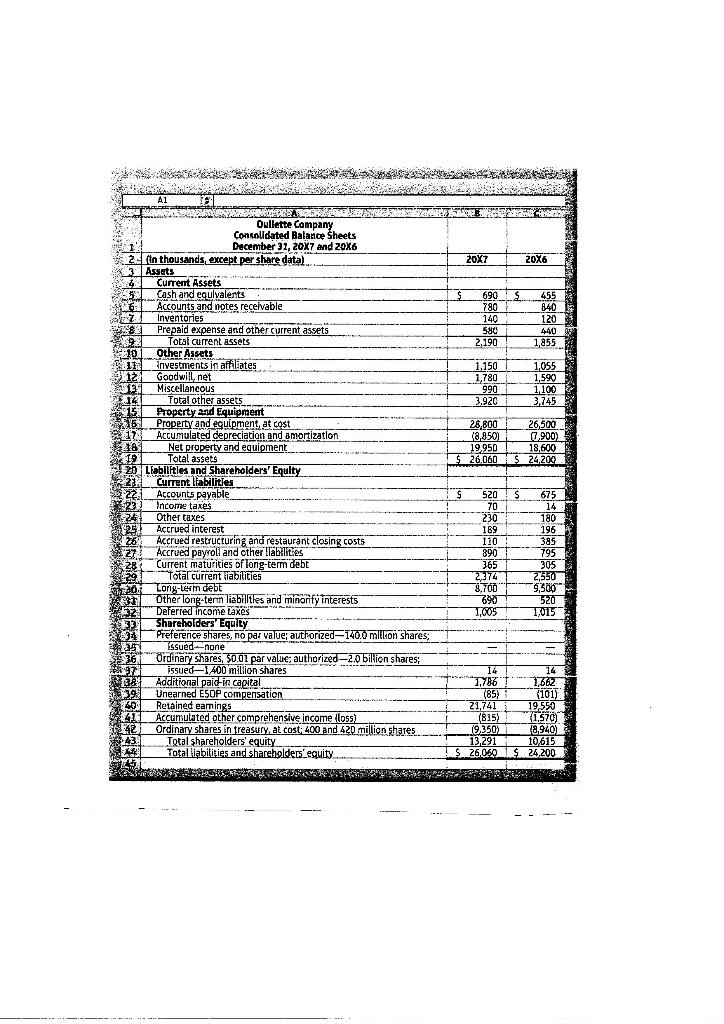

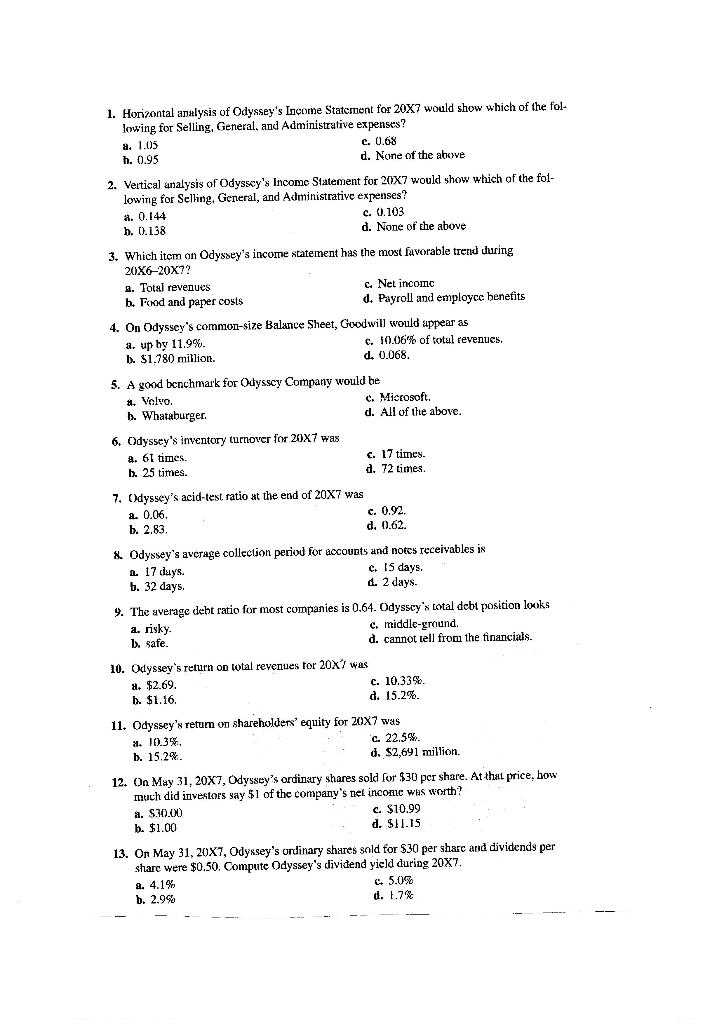

EXERCISE 1 Proposal X and proposal Y require an initial investment of $10,000 and are expected to generate an equal cash inflow of $20,000 over their life of four years. The net cash inflow for each year of life of both the proposals is given below: Year Proposal .X Proposal Y 1 $ 2.000 $ 8.000 2 4.000 6.000 6.000 4.000 1 8.000 2.000 Total $20.000 S 20.000 Required: 1. Compute the present value of cash inflows generated by both the proposals assuming a discount rate of 18%. 2. Which of the two proposals is better if compared using 11ct preserit value Dictiod 3. Which of the two proposals is better if compared using payback period Exercise 2 Wellness company is trying to choose the best investment project from two alternative projects. The company has $30,000 to invest. The information about two alternatives is given below: Projects Project. Y Initial investment required S 30.000 $ 30.000 Annual cash inflow $ 8.000 Single cash inflow at the end of S years $120.000 Project life S years S years The discount rate of Wellness company is 15%, Required: Give your recommendation to the company in selecting the best project to invest $30,000. Use net present value (NPV) method for your answer. EXERCISE 3 Analyze the Odyssey Company's financial statements by answering the questions that follow. Odyssey owns a chain of restaurants A1 TASSEN 20X7 20X6 $ 13,200 $ 11,100 $ 4,500 3.700 17.200 14.800 --- Oullette Company Consolidated Statements of income (Adapted) Years Ended December 31, 20X7 and 20X6 2. (In thousands, except per share data) Revenues: Sales by Company-operated restaurants $ 52 Revenues from franchised and affiliated restaurants 63 Total revenues 16.Expenses: 8 8 Cost of goods sold 9 Payroll and employee benefits 10 Occupancy and other operating expenses Franchised restaurants occupancy expenses Selling, general, and administrative expenses 19 Other operating expense, net 14 Total operating expenses 15.1. Operating income 16 Interest expense 2:17 Other non operating expense.net 18. Income before income taxes 19 Income tax expense 20 Net Income Per ordinary-share basics: 22 Net Income 23 Dividends per ordinary share 24 12 3300 3200 2200 949 1.820 510 12.679 5,021 370 140 4,511 1.820 $ 2.691 3,109 30001 2.800 850 1.730 855 12.343. 2457 345 16B 1.944 BZO 1124 $ $ $ 2.69 0.50 $. $ 1.15 0.24 LEVERBAALSTRY PORCE Oullette Company Consolidated Balance Sheets 1 December 31, 20X7 and 20X6 2. (en thousands, except per share data) 20X7 20X6 3 Assets 4 Current Assets 52 Cash and equivalents $ 690 IS 455 63 Accounts and notes receivable 780 840 22 7 Inventories 140 120 8 Prepaid expense and other current assets 580 4401 $92 Total current assets 2,190 1,855 10. Other Assets 11_ investments in affiliates 1.150 1,055 9112 Goodwil, net 1,780 1,590 VET Miscellancous 990 1100 14 Total other assets 3.920 3.745 815 Property and Equipment 161 Property and equipment, at cost 28,800 26,500 17. Accumulated depreciation and amortization 18,850) 6.900) 163 Net property and equipment 19.950 18,600 19 Total assets $ 26,0605 24200 $ 20 Liabilitles and Shareholders' Equity 21 Current liabilities -22 Accounts payable $ 520 SZOS $ 675 $23 Income taxes 70 14 24 Other taxes 230 180 1252 Accrued interest 189 196 26 Accrued restructuring and restaurant closing costs 110 385 27 Accrued payroli and other labilities 890 795 28 Current maturities of long-term debt 365 305 29 Total current liabilities 2,374 2,550 30 Long-term debe 8.700 9.300 Other long-tern liabiltles and minority interests 690 520 132 Deferred income taxes 1,005 1,015 33 Shareholders' Equity 34 Preference shares, no pat value; authorized-140.0 million shares; 31 issued none ---- - 5.36 Ordinary shares, $0.01 par value; authorized 2.0 billion shares; 1997 issued-1,400 milion shares 14 14 1378 Additional paid-in capital 1,736 1,662 39 Unearned ESOP compensation (85) (101) ( 1492 40 Retained earnings 21,741 19,550 41 Accumulated other comprehensive income 1055) (815) (1.570) AL Ordinary shares in treasury, at cost: 400 and 420 milion shares 19,350) 18,940 ) 23 Total shareholders equity 13,291 10,615 Total Habilities and shareholders equity $26.050 1 $ 24,200 3 CHU 1. Horizontal analysis of Odyssey's Income Statement for 20X7 would show which of the fol- lowing for Selling, General, and Administrative expenses? a. 1.05 e. 0.68 h. 0.95 d. None of the above d 2. Vertical analysis of Odyssey's Income Statement for 20X7 would show which of the fol- lowing for Selling, General, and Administrative expenses? a. 0.144 c. 0.103 h. 0.138 d. None of the above 3. Which item on Odyssey's income statement has the most favorable trend during 20X6-20X7? 2. Total revenues c. Net incomc b. Food and paper costs d. Payroll and employce benefits 4. On Odyssey's common-size Balance Sheet, Goodwill would appear as a. up by 11.9%. c. 10.06% of total revenues. b. $1.780 million. d. 0.068. 5. A good benchmark for Odyssey Company would be a. Volvo. c. Microsoft. 1. Whataburger. d. All of the above. 6. Odyssey's inventory turnover for 20X7 was a. 61 times. b. 25 times. c. 17 times. d. 72 times. 7. Odyssey's acid-test ratio at the end of 20X7 was a. 0.06. c. 0.92 b. 2.83 d. 0.62. & Odyssey's average collection period for accounts and notes receivables is 2. 17 duys. c. Is days. b. 32 days. d. 2 days. 9. The average debt ratio for most companies is 0.64. Odysscy's total debt position looks a. risky. c. middle-ground b. safe. d. cannot tell from the financials. 10. Odyssey's return on total revenues for 20X7 was 2. $2.69. c. 10.338 1. $1.16. d. 15.2% 11. Odyssey's retum on shareholders' equity for 20X7 was 2. 10.3%. c. 22.5%. b. 15.2%. d. $2,691 million. 12. On May 31, 20X7, Odyssey's ordinary shares sold for $30 per share. At that price, how much did investors say $1 of the company's nel income was worth? a. S30.00 c. $10.99 b. $1.00 . $ d. $11.15 13. On May 31, 20X7, Odyssey's ordinary shares sold for $30 per share and dividends per share were $0.50. Compute Odyssey's dividend yield during 20x7. a. 4.1% 6 5.09 b. 2.990 d. 1.74