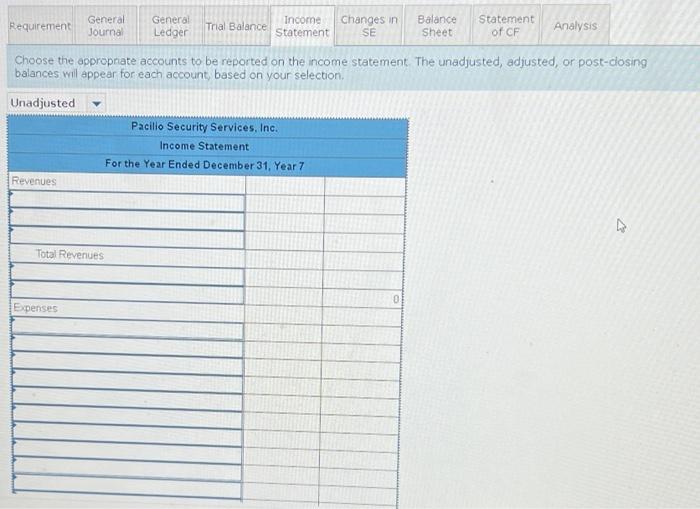

I understand this is alot, the main part is completing numbers 1-22 into the general journal. After that is complete, numbers should autofill. For things like the statement of CF or Balance Sheet, the correct name of the transaction is the most important, the numbers will autofill. Thank you

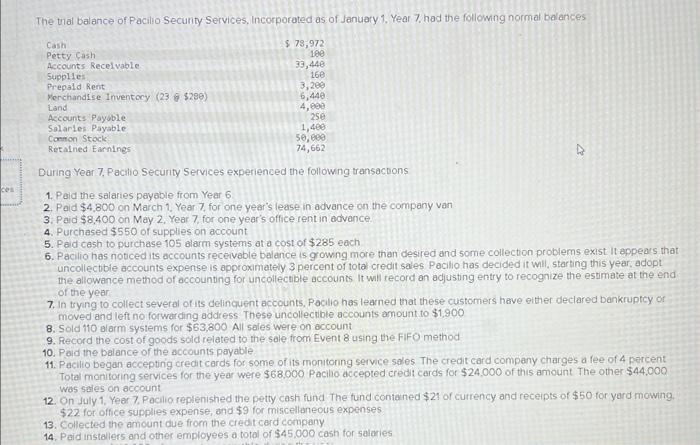

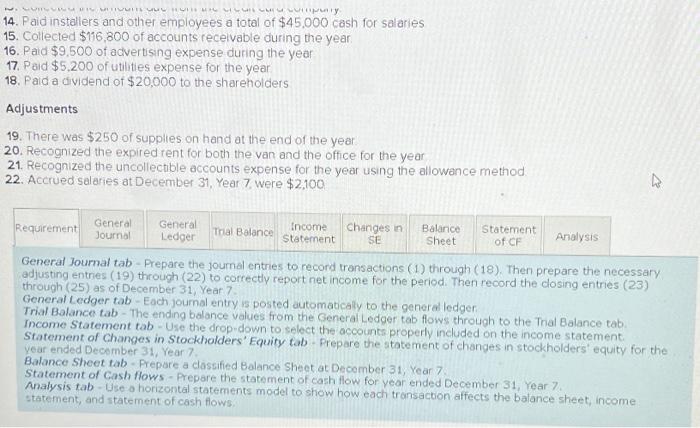

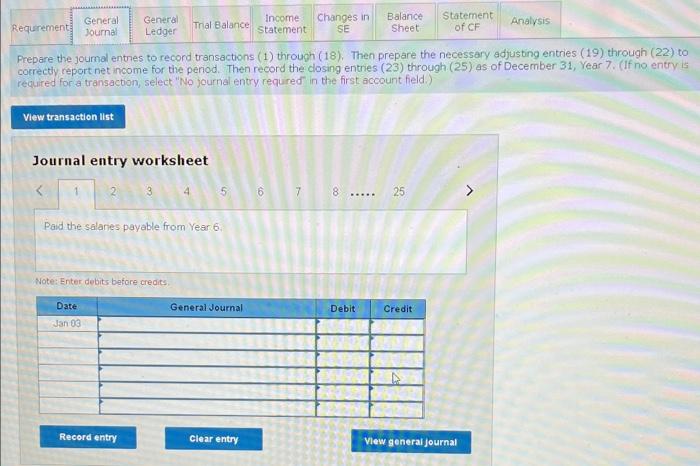

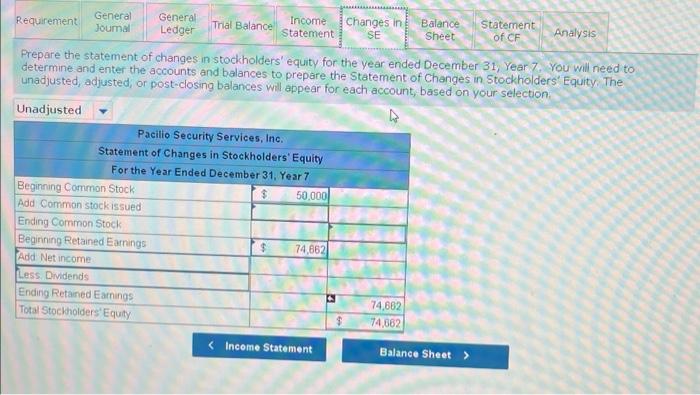

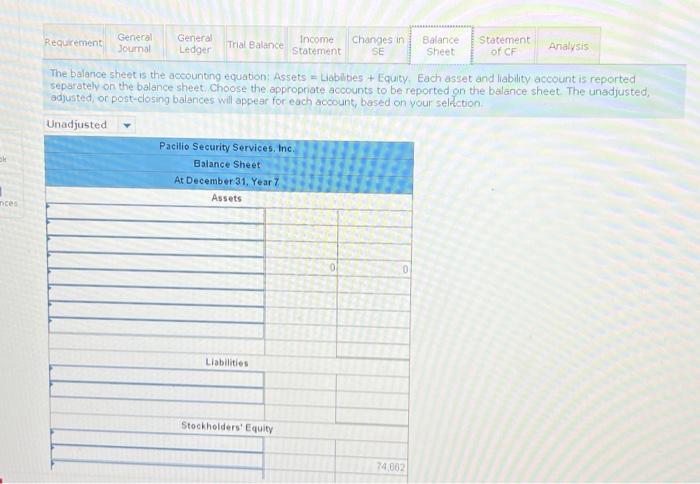

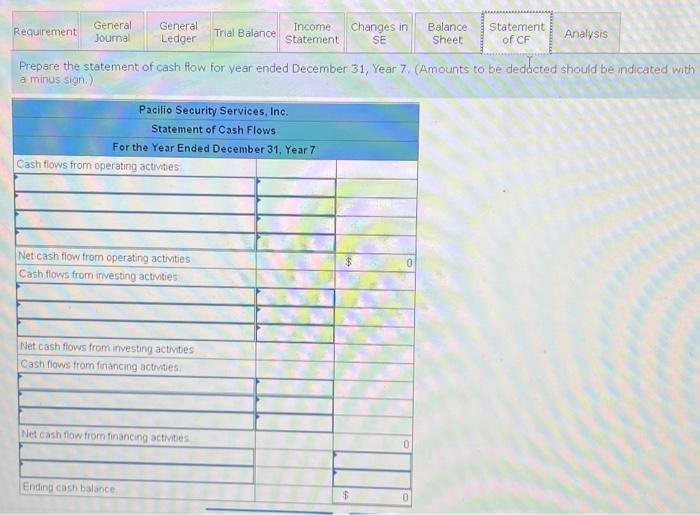

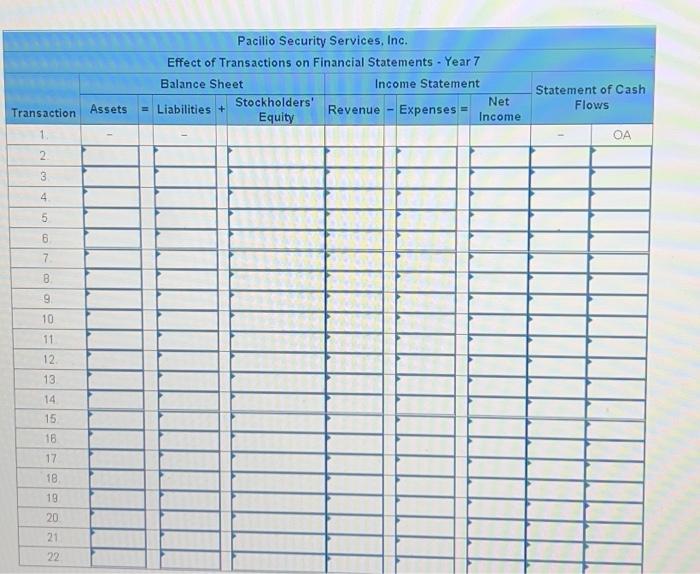

The tial balance of Pacilio. Security Services, Incorporated as of January 1, Year 7, had the followng normal balances During Year 7, Pacilio Secunty Services experienced the following transactions 1. Paid the salaries payable from Year 6 2. Paid $4,800 on March 1, Year 7, for one year's lease in advance on the company van 3. Paid $8,400 on May 2, Year 7 , for one year's office rent in edvance. 4. Purchased $550 of supplies on account 5. Paid cash to purchase 105 alarm systems at a cost of $285 each 6. Pacilia has noticed its accounts receivable balance is growng more than desired and some collection problems exist It appears that uncollectible accounts expense is approximateiy 3 percent of tota credit sales. Pacilio has decided it will, starting this year, adopt the allowance method of accounting for uncollectible accounts It will record an adjusting entry to recognize the estimate at the end of the year 7. In tryng to collect several of its delincuent accounts, Pocilio has learned that these customers have etther declared bankruptcy of moved and left no forwarding address These uncollectible accounts amount to $1,900 8. Sold 110 alarm systems for $63,800 All sales were on account 9. Record the cost of goods soid related to the sale from Event 8 using the FiFO method 10. Poid the balance of the accounts payable 11. Pacilto began accepting credit cards for some of its monitoring service sales. The credit card company charges a fee of 4 percent Total monitoring services for the year were $68,000 Pacitio accepted credit cards for $24,000 of this amount The other $44,000 Was sates on account 12. On July 1, Year 7. Pecilia replenished the petty cash fund The fund contaned $21 of cutrency and receipts of $50 for yerd mowing. $22 for offce supplies expense, and $9 for miscellaneous expenses 13. Collected the amount due from the creditcerd company 14. Paid instaliers and other employees a total of $45,000 cash for salaries General Journal tab - Prepare the journal entries to record transactions (1) through (18). Then prepare the necessary adjusting entnes (19) through (22) to correctly report net income for the period. Then record the dosing entries (23) through (25) as of December 31 , Year 7 General Ledger tab - Each joumal entry is posted automaticaly to the general ledger: Trial Balance tab - The ending balance values from the General Ledger tab flows through to the Tral Balance tab Income Statement tab - Use the drop-down to select the accounts properly included on the income statement. Statement of Changes in Stockholders' Equity tab. Prepare the statement of changes in stockholders' equity for the year ended Decomber 31, Year 7. Balance Sheet tab - Prepare a classified Balance Sheet at Decomber 31, Year 7. Statement of Cosh flows - Prepare the statement of cash flow for year ended December 31, Year 7. Analysis tab - Use a horizontal statements model to show how each transaction affects the balance sheet, income statement, and statement of cash flows. Prepare the journal enthes to record transactions (1) through (18). Then prepare the necessary adjusting entries (19) through (22) to coerectiy report net income for the period. Then record the dosing entries (23) through. (25) as of December 31 , Year 7 . (If no entry is required for a transaction, select "No journal entry required" in the first account field.) Journal entry worksheet Choose the appropnate accounts to be reported on the income statement. The unadjusted, adjusted, or post-dosing balances will eppear for each account, based on your selection. Prepare the statement of changes in stodkholders' equity for the year ended December 31 , Year 7 . You will need to determine and enter the accounts and balances to prepare the Statement of Changes in Stockholders'. Equity. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. The balance sheet is the accouning equation: Assets = Liablibes + Equity. Each asset and liability account is reported separately on the balance sheet. Choose the appropriate accounts to be reported gn the balance sheet. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selfuction Prepare the statement of cash flow for year ended December 31 , year 7 . (Amounts to be deddcted should be indicated with a minus sign.) Pacilio Security Services, Inc