i uploaded sheet to help. its the indirect method. i already asked question but the other person who answered didnt seem to have all the answers right.

i uploaded sheet to help. its the indirect method. i already asked question but the other person who answered didnt seem to have all the answers right.

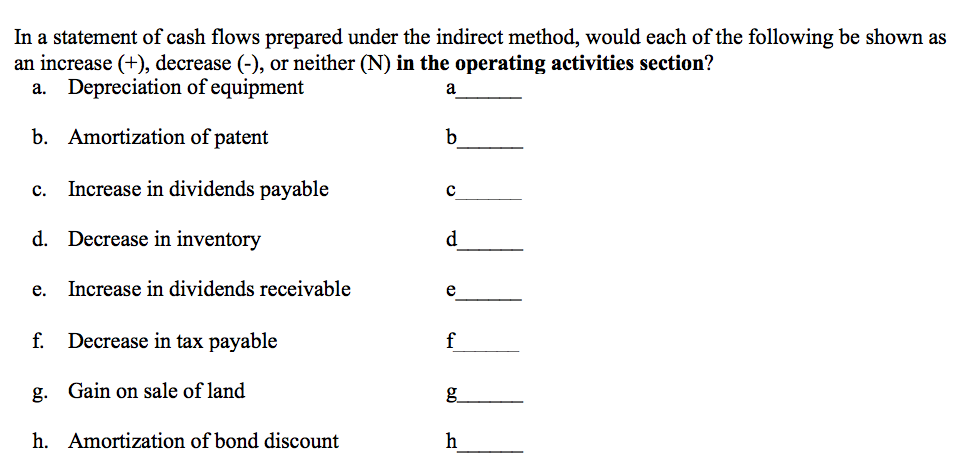

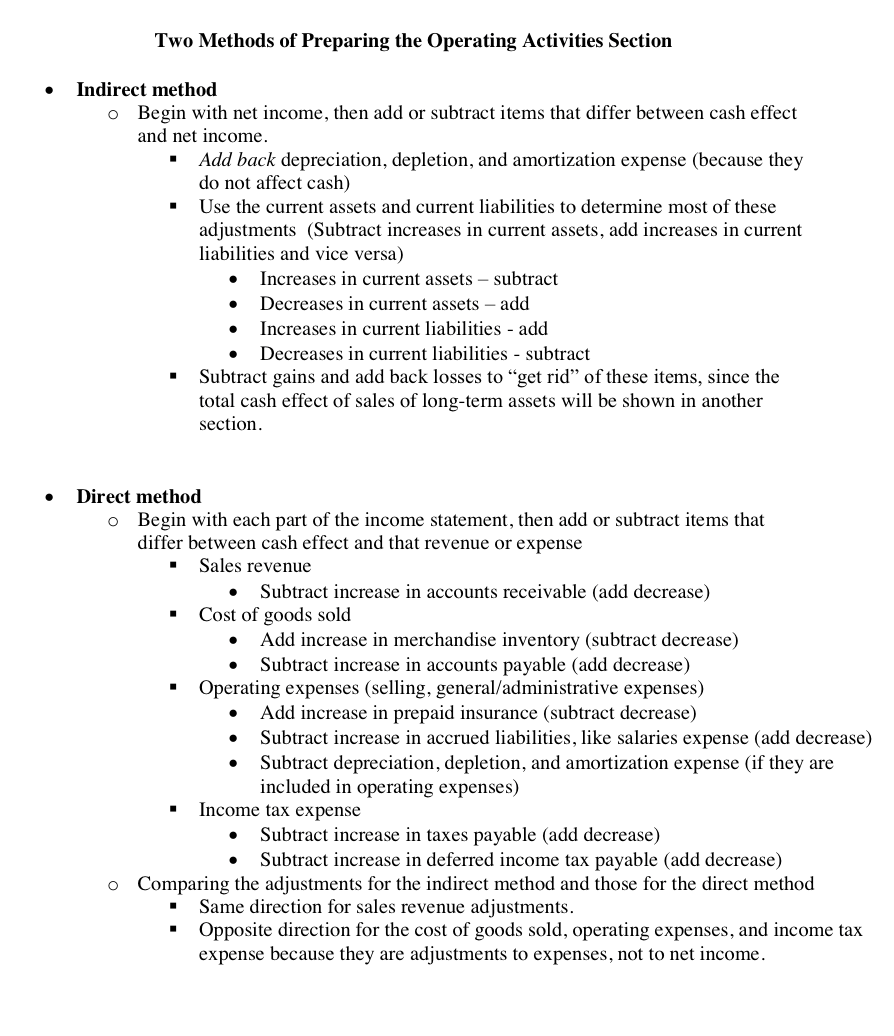

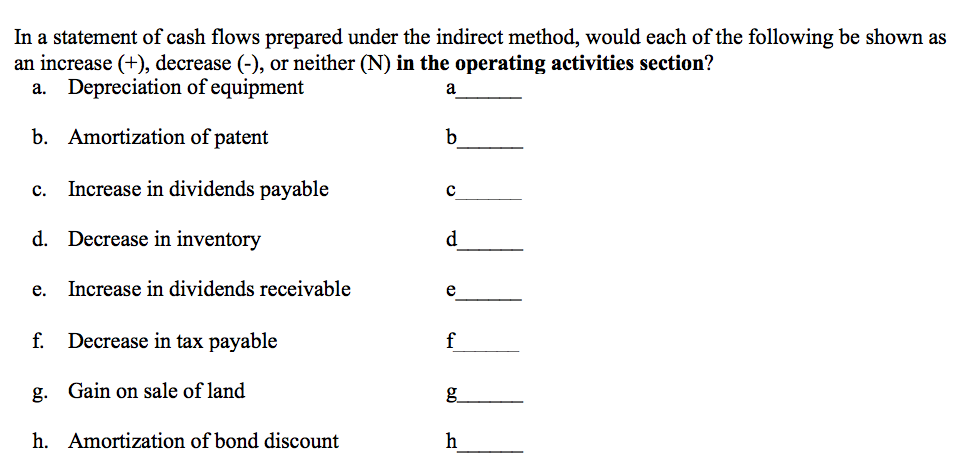

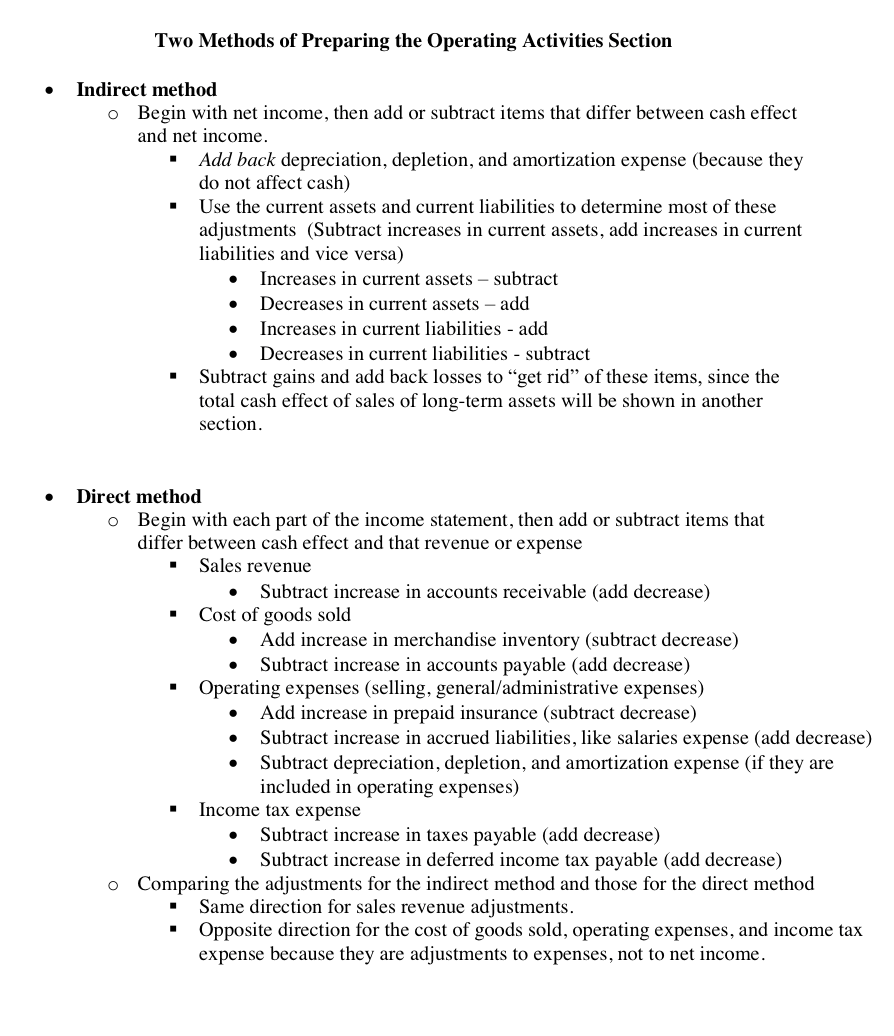

In a statement of cash flows prepared under the indirect method, would each of the following be shown as an increase (+), decrease (-), or neither (N) in the operating activities section? a. Depreciation of equipment b. Amortization of patent c. Increase in dividends payable d. Decrease in inventory e. Increase in dividends receivable f. Decrease in tax payable g. Gain on sale of land h. Amortization of bond discount Two Methods of Preparing the Operating Activities Section Indirect method o Begin with net income, then add or subtract items that differ between cash effect and net income. Add back depreciation, depletion, and amortization expense (because they do not affect cash) Use the current assets and current liabilities to determine most of these adjustments (Subtract increases in current assets, add increases in current liabilities and vice versa) Increases in current assets - subtract Decreases in current assets - add Increases in current liabilities - add Decreases in current liabilities - subtract Subtract gains and add back losses to get rid" of these items, since the total cash effect of sales of long-term assets will be shown in another section. Direct method o Begin with each part of the income statement, then add or subtract items that differ between cash effect and that revenue or expense Sales revenue Subtract increase in accounts receivable (add decrease) Cost of goods sold Add increase in merchandise inventory (subtract decrease) Subtract increase in accounts payable (add decrease) Operating expenses (selling, general/administrative expenses) Add increase in prepaid insurance (subtract decrease) Subtract increase in accrued liabilities, like salaries expense (add decrease) Subtract depreciation, depletion, and amortization expense (if they are included in operating expenses) Income tax expense Subtract increase in taxes payable (add decrease) Subtract increase in deferred income tax payable (add decrease) o Comparing the adjustments for the indirect method and those for the direct method . Same direction for sales revenue adjustments Opposite direction for the cost of goods sold, operating expenses, and income tax expense because they are adjustments to expenses, not to net income

i uploaded sheet to help. its the indirect method. i already asked question but the other person who answered didnt seem to have all the answers right.

i uploaded sheet to help. its the indirect method. i already asked question but the other person who answered didnt seem to have all the answers right.