1. 14. Calculating NPV [LO 26.3] BQ Ltd is considering making an offer to purchase iReport Publications....

Question:

1. 14.

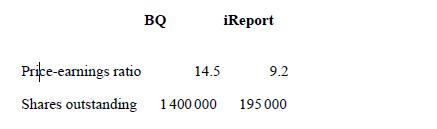

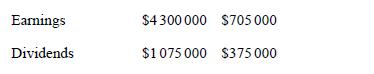

Calculating NPV [LO 26.3] BQ Ltd is considering making an offer to purchase iReport Publications. The chief financial officer has collected the following information:

1.

BQ also knows that securities analysts expect the earnings and dividends of iReport to grow at a constant rate of 5 per cent each year.

BQ management believes that the acquisition of iReport will provide the firm with some economies of scale that will increase this growth rate to 7 per cent per year.

1. What is the value of iReport to BQ?

2. What would BQ’s gain be from this acquisition?

3. If BQ were to offer $38 in cash for each share of iReport, what would the NPV of the acquisition be?

4. What is the most BQ should be willing to pay in cash per share for the shares of iReport?

5. If BQ were to offer 205 000 of its shares in exchange for the outstanding shares of iReport, what would the NPV be?

6. Should the acquisition be attempted? If so, should it be as in (c)

or as in (e)?

7. BQ’s outside financial consultants think that the 7 per cent growth rate is too optimistic and a 6 per cent rate is more realistic. How does this change your previous answers?

Step by Step Answer:

Fundamentals Of Corporate Finance

ISBN: 9781743768051

8th Edition

Authors: Stephen A. Ross, Rowan Trayler, Charles Koh, Gerhard Hambusch, Kristoffer Glover, Randolph W. Westerfield, Bradford D. Jordan